TIDMKMK

RNS Number : 7360Y

Kromek Group PLC

18 January 2022

18 January 2022

Kromek Group plc

("Kromek" or the "Group")

Interim Results

On track to deliver significant revenue growth for full year

with over 90% visibility of forecasts

Kromek (AIM: KMK), a leading developer of radiation and

bio-detection technology solutions for the advanced imaging and

CBRN detection segments, announces its interim results for the six

months ended 31 October 2021.

Financial Highlights

-- Revenue was GBP4.7m (H1 2021: GBP4.6m)

-- Gross margin was 47% (H1 2021: 54%; FY 2021: 48%)

-- Adjusted EBITDA* improved to GBP0.6m loss (H1 2021: GBP0.9m loss)

-- Loss before tax reduced to GBP3.1m (H1 2021: GBP3.4m loss)

-- Gross cash and cash equivalents at 31 October 2021 were

GBP10.2m (30 April 2021: GBP15.6m; 31 October 2020: GBP5.8m)

* Adjusted EBITDA is defined as earnings before interest,

taxation, depreciation, amortisation, exceptional items, early

settlement discounts and share-based payments. For further details,

see the Financial Review below.

Operational Highlights

-- The Group delivered on existing contracts, won new orders and

experienced greater customer engagement regarding future projects

in both of its advanced imaging and CBRN detection segments

-- Growth and, partly, margin were impacted by supply chain

related challenges for components, with certain deliveries being

delayed into the second half that are now being recovered. The

Group took steps to increase the surety of its supply, resulting in

increased inventory and working capital, and, accordingly, does not

expect revenue to be impacted by similar issues in the second

half

-- Delivery continued on the Group's existing advanced imaging

contracts and new business activity increased, significantly

strengthening the pipeline for the second half and beyond:

o Significant increase in medical imaging new business activity

as the impact of the pandemic continued to recede - strengthening

the pipeline for H2 2022 and beyond

o Ramp up in delivery under the Group's significant multi-year medical imaging contract

o Entered commercial development engagement with three new

strategic OEMs for key medical imaging applications

o Signed a seven-year supply agreement, worth up to $17m, to

provide a CZT detector solution for industrial screening

o Received a $250,000 repeat order in industrial screening from

a US-based aerospace and defence technology customer

o Entered commercial development engagement with two new security screening OEMs

-- New and repeat orders won in the CBRN detection segment along

with the Group participating in an increasing number of nuclear

security tenders and making significant progress in its

bio-security development programmes:

o Awarded a two-year contract worth up to $1.6m by a US federal

entity for the D3S-ID wearable nuclear radiation detector

o Received a GBP173,000 order for the D5 RIID high-performance

handheld radiation detector from a UK government-related

customer

o Awarded a $6m contract extension from the Defense Advanced

Research Projects Agency ("DARPA"), an agency of the US Department

of Defense, to advance the development of a mobile wide-area

bio-security system capable of detecting and identifying airborne

pathogens

o Successfully completed piloting in schools, airports and other

locations of an airborne COVID-19 detection system under a project

funded by Innovate UK and commenced productisation phase

o 15 new customers won in the civil nuclear market

-- Three new patents were filed and three were granted during the period

Dr Arnab Basu, CEO of Kromek, said: " During the first half of

the 2022 financial year, we continued to deliver on our existing

contracts as well as win new and repeat orders in both our advanced

imaging and CBRN detection segments. We also made substantial

progress with our existing development programmes and initiated new

programmes with a number of strategic partners. While our growth

and margin during the period were impacted by challenges related to

the supply chain for components, this is being recovered in the

second half and we remain on track to deliver a significant

increase in revenue for full year 2022, in line with market

expectations, with visibility of over 90% of full year forecasts.

This would represent our highest ever full year revenue with growth

in both segments.

"Looking further ahead, we have significantly strengthened our

pipeline in the multiple substantial markets in which we operate.

We offer our customers a differentiating technology that supports

early medical diagnosis to improve patient outcomes and government

vigilance to the threat of terrorism - which are long-term growth

drivers. As a result, the Board continues to look to the future

with great confidence ."

For further information, please contact:

Kromek Group plc

Arnab Basu, CEO

Paul Farquhar, CFO +44 (0)1740 626 060

Cenkos Securities plc (Nominated Adviser

and Broker)

Giles Balleny/Camilla Hume (NOMAD)

Julian Morse (Sales) +44 (0)20 7397 8900

Luther Pendragon Ltd (Financial PR)

Harry Chathli/Claire Norbury +44 (0)20 7618 9100

Analyst Presentation

Arnab Basu, CEO, and Paul Farquhar, CFO, will be hosting a

presentation for analysts and investors at 9.30am GMT today via

webcast. To register to participate, please contact

amysmart@luther.co.uk at Luther Pendragon.

About Kromek Group plc

Kromek Group plc is a leading developer of radiation detection

and bio-detection technology solutions for the advanced imaging and

CBRN detection segments. Headquartered in County Durham, UK, Kromek

has manufacturing operations in the UK and US, delivering on the

vision of enhancing the quality of life through innovative

detection technology solutions.

The advanced imaging segment comprises the medical (including CT

and SPECT), security and industrial markets. Kromek provides its

OEM customers with detector components, based on its core cadmium

zinc telluride (CZT) platform, to enable better detection of

diseases such as cancer and Alzheimer's, contamination in

industrial manufacture and explosives in aviation settings.

In CBRN detection, the Group provides nuclear radiation

detection solutions to the global homeland defence and security

market. Kromek's compact, handheld, high-performance radiation

detectors, based on advanced scintillation technology, are

primarily used to protect critical infrastructure and urban

environments from the threat of 'dirty bombs'.

The Group is also developing bio-security solutions in the CBRN

detection segment. These consist of fully automated and autonomous

systems to detect a wide range of airborne pathogens.

Kromek is listed on AIM, a market of the London Stock Exchange,

under the trading symbol 'KMK'.

Further information is available at www.kromek.com .

Operational Review

During the six months to 31 October 2021, the Group delivered on

existing contracts and development programmes, won new and repeat

orders and experienced greater customer engagement regarding future

projects in both the advanced imaging and chemical, biological,

radiological and nuclear (CBRN) detection segments of the business.

This resulted in a slight increase in revenue over the same period

of the prior year and a significantly strengthened pipeline for the

second half of the year and beyond. Whilst the Group's growth

during the first half was impeded by supply chain pressures,

particularly global electronic component shortages, which meant

certain deliveries were postponed into early in the second half,

the Group has taken steps during the period to increase the surety

of its supply and, as such, revenue in the second half of the year

is not expected to be similarly impacted. The Group also continued

to strengthen its manufacturing capabilities with the ongoing

rollout of the capacity expansion projects that it had commenced in

the prior year.

Advanced Imaging Segment

The advanced imaging segment comprises the medical imaging,

security screening and industrial screening markets. Kromek

provides its OEM customers with detector components, based on its

core cadmium zinc telluride (CZT) platform, to enable better

detection of diseases such as cancer and cardiac conditions,

contamination in industrial manufacture and explosives in aviation

settings.

In this segment, commercial engagement with customers consists

of an initial design phase followed by incorporation of the Group's

detectors and technologies into a customer's system and then the

award to the Group of a multi-year supply contract, which provides

long-term revenue visibility. Kromek has an established track

record of winning orders for development purposes that transition

to multi-year supply contracts from customers in gamma probes, bone

mineral densitometry ("BMD") and single photon emission computed

tomography ("SPECT") in medical imaging as well as in security and

industrial screening. In particular, this success is evidenced by

the significant contracts awarded in H2 2019 in medical imaging and

the period under review in industrial imaging, which are expected

to be worth approximately $58.1m and $17m respectively. As the

Group continues to win such contracts, the Group's revenue base

expands and the revenue profile becomes increasingly

predictable.

During the period, the Group continued to deliver detector

components to its customers under orders for development purposes

and multi-year supply contracts. It has also experienced greater

customer engagement regarding future projects as normal business

increasingly resumes following the temporary redirection of

resources due to the COVID-19 pandemic. Kromek remains on track to

deliver strong growth in this segment compared with the 2021

financial year.

Medical Imaging

In recent years, leading OEMs in medical imaging have been

increasingly adopting CZT detector platforms as the enabling

technology for their product roadmaps. CZT detector platforms

enable OEMs to significantly improve the quality of imaging, which

leads to earlier and more reliable diagnosis of diseases such as

cancer. Kromek's CZT detector solutions are increasingly being

commercially adopted for SPECT, molecular breast imaging ("MBI")

and BMD applications. These, along with computed tomography ("CT"),

are key target areas for future growth as they address diseases

particularly associated with an ageing population such as cancer,

Alzheimer's, Parkinson's, cardiovascular illnesses and

osteoporosis. Kromek also serves the gamma probes market in medical

imaging, which are used during surgeries for the removal of lymph

nodes.

During the period, Kromek continued to fulfil its existing

supply orders in medical imaging and progress its development

programmes. In particular, delivery continued to ramp up as planned

to the Group's significant OEM customer that, in H2 2019, awarded

the Group a contract expected to be worth a minimum of $58.1m over

an approximately seven-year period. In addition, the Group

continued delivery of a $600k order received in H2 2021 from a

different customer for the supply of detectors to be used in niche

SPECT applications. This delivery was completed by the end of the

2021 calendar year as planned and the Group expects to receive

further repeat orders under the ongoing supply relationship with

this customer.

There was a significant increase in new business activity as the

impact of the pandemic - which had caused a temporary redirection

of resources in healthcare settings - continued to recede. This

applied particularly in the Group's key target areas of CT and

SPECT, supported by the growing industry adoption of new techniques

and rollout of new systems. Kromek commenced commercial development

engagement with three new strategic OEM customers in this market.

These initial orders are for the supply of CZT-based detectors for

use by the OEM customers in their commercial development

programmes.

During the period, one of the Group's US medical imaging

customers received FDA approval for its system for a niche nuclear

medical application, which is using Kromek's detectors. The Group

has received several orders from this customer, which it expects to

continue on an ongoing basis.

Security Screening

In security screening, Kromek's technologies are used in travel,

primarily aviation, settings to enable the Group's customers to

meet the high-performance standards they require, and as demanded

by regulatory bodies, to ensure passenger safety while increasing

the convenience and efficiency of the security process. The Group

provides OEM and government customers with components and systems

for cabin and hold luggage scanning.

During the period, the Group continued to deliver under its

existing component supply agreements in the security screening

market. In its development work, Kromek completed a two-year $1.6m

project funded by the US Department of Homeland Security for a CZT

detector platform for threat resolution for hold baggage, hand

baggage and cargo screening systems. The Group expects commercial

adoption and integration of this platform in multiple commercial

advanced baggage screening products. The Group also entered two new

commercial development engagements during the period where Kromek

is customising its detector solutions for incorporation into its

OEM customers' systems.

Industrial Screening

In industrial screening , Kromek provides OEM customers with

detector components for incorporating into scanning systems used

during manufacturing processes to identify potential

contaminants.

In October 2021, the Group signed a seven-year supply agreement,

worth up to $17m, to provide CZT-based detector components for

incorporation into systems for identifying contaminants for the

purpose of product quality inspection. The contract, which was

awarded following the completion of a two-year development

programme, is expected to commence in the current financial year

and is with a US based, sector-leading industrial OEM with a global

customer base.

Also during the period, the Group was awarded a $250,000 repeat

order from a US-based customer that is a global leader in aerospace

and defence technologies. The customer's system, which incorporates

Kromek detectors, is used for in-line quality control in

manufacturing processes.

CBRN Detection Segment

In CBRN detection, the Group provides nuclear radiation

detection solutions to the global homeland defence and security

market. Kromek's compact, handheld, high-performance radiation

detectors, based on advanced scintillation technology, are

primarily used to protect critical infrastructure and urban

environments from the threat of 'dirty bombs'. Kromek's portfolio

also includes a range of high-resolution detectors and measurement

systems used for civil nuclear applications, primarily in nuclear

power plants and research establishments. In addition, t he Group

is developing bio-security solutions to detect a wide range of

airborne pathogens, including SARS-CoV-2 (COVID-19).

The Group won new and repeat orders in the nuclear security and

civil nuclear markets during the first half of the year and

participated in an increasing number of tenders reflecting the

growth in global government defence spending. The outcomes of these

tenders are expected to be known during 2022 and the Group expects

that the procurement activity in this market will remain high

throughout the year. T he Group also made significant progress with

its development programmes in bio-security and anticipates

commercial deployment of this technology in the next financial

year.

Nuclear Security

Kromek's nuclear security platforms - D3S and D5 - consist of a

family of products designed to cater for the varying demands of

homeland security and defence markets. In particular, the D3S

platform is widely deployed as a networked solution to protect

cities, buildings or critical infrastructure against the threat of

use of 'nuclear dirty bombs' by terrorists.

Kromek was awarded a contract by a US federal entity for the

Group's D3S-ID wearable nuclear radiation detector that is designed

to enable first responders, armed forces, border security and other

CBRN experts to detect radiological threats. The contract will be

delivered over two years and is worth up to $1.6m. The Group also

continued to receive repeat orders from the European Commission for

the D3S-ID portable radiation detector.

During the first half of the year, Kromek received an order

worth GBP173,000 from its UK government-related customer for the

Group's D5 RIID high-performance radiation detector designed for

challenging environments. This represents the first major order for

the D5 RIID following its launch last year. In addition, post

period, the Group received orders from two new customers for D5

detectors.

Civil Nuclear

In the civil nuclear market, Kromek won 15 new customers during

the period. The Group continued its development work under a

development and supply contract awarded in the previous financial

year, worth a minimum of $960,000, which is for a product with both

nuclear security and civil nuclear applications. The project is

progressing on schedule, with the development work being completed

by the end of calendar year 2021 and the product now in the

validation phase ahead of the commencement of supply.

Biological-Threat Detection

Kromek is developing bio-security solutions consisting of fully

automated and autonomous systems to detect a wide range of airborne

pathogens for the purposes of national security and protecting

public health. Since H2 2019, the Group has been working with the

Defense Advanced Research Projects Agency ("DARPA"), an agency of

the US Department of Defense, to develop a biological-threat

detection system that autonomously senses, analyses and identifies

airborne pathogens. The programme was established to combat

bioterrorism and is now also aimed at providing an early warning

system in the event of a virus outbreak to enable action to be

taken to localise the spread and prevent it from becoming an

epidemic or global pandemic. The Group is also working under a

programme funded by Innovate UK, which commenced in 2021, to

develop a bio-security solution to support end-use cases

specifically for COVID-19 detection.

During the period, the Group continued to deliver on the

development milestones under its programme with DARPA and received

a $6m contract for the next phase. The programme is for the

development of a completely automated wide spectrum airborne

pathogen detection system that is fully mobile and runs

autonomously. It is being designed to be networkable and provide

wide-area monitoring capability in near real-time. To date, the

Group has been awarded a total of over $13m by DARPA under this

programme.

Under its programme funded by Innovate UK to develop a solution

for airborne COVID-19 detection, the Group successfully completed

piloting of the system at a number of schools, airports and other

locations. The solution is now in the productisation phase, with a

manufacturing partner having been identified and a number of

pre-production models also having been produced. Further, the Group

also engaged in validation of the technology in third party

laboratories with very positive results on both the detection

levels, sensitivity and false alarm rates.

R&D, IP and Manufacturing

During the period, the Group continued to ramp up several

projects, which had commenced in the prior year, for the expansion

of production capacity and increased process automation. These

programmes are resulting in greater productivity and cost

efficiency in the manufacture of CZT and non-CZT products in both

the Group's UK and US facilities.

Kromek is focused on developing the next generation of products

for commercial application in its core markets. As noted, during

the period the Group continued to advance development programmes

with a number of partners and, in particular, significantly

progressed the development of its biological-threat detection

solution.

In H1 2022, Kromek applied for three new patents and had three

patents granted across three patent families, bringing the total

number of patents held by the Group to in excess of 275. The new

applications cover innovations in both of the Group's segments.

Financial Review

Revenue for the six-month period ended 31 October 2021 increased

slightly to GBP4.7m (H1 2021: GBP4.6m). The Group's growth was

impacted during the period by supply chain pressures, particularly

global electronic component shortages, which resulted in the

delivery of some contracts being delayed into the second half of

the year. As described further below, the Group took steps to

increase the surety of its supply during the period. Accordingly,

the Group does not expect revenue to be impacted by supply chain

issues in the second half and remains on track to deliver

significant growth for the full year, with visibility of over 90%

of forecast revenue.

Gross profit was GBP2.2m (H1 2021: GBP2.5m) due to gross margin

for the period being 46.8% compared with 54.5% for H1 2021 and

43.5% for H2 2021. The reduction compared with the first half of

the prior year is due to product mix and component price inflation

driven by supply chain pressures.

The Group generated other operating income of GBP1.3m (H1 2021:

GBP0.3m), which predominantly comprises forgiveness of Paycheck

Protection Programme (PPP) loans in the US. The Group had been

granted PPP loans totalling $1.8m in the prior year and, during the

period under review, applied for, and received, forgiveness for

repayment from the US Government. In the prior year period, the

GBP0.3m of other operating income comprised UK Government grants in

response to COVID-19.

Administrative expenses and distribution costs increased to

GBP6.4m (H1 2021: GBP5.9m), which is largely due to a combination

of increased depreciation and amortisation expense, staff costs,

travel and consultancy fees.

The forgiveness of PPP loans offset the decline in gross profit

and the increased administrative and distribution costs to enable a

reduction in operating loss to GBP2.9m (H1 2021: GBP3.1m loss).

The Group recognised an exceptional income of GBP0.1m relating

to the impairment reversal of a specific trade receivable that was

impaired in the full year 2020 financial statements and

subsequently classified as an exceptional item.

Loss before tax reduced to GBP3.1m (H1 2021: GBP3.4m loss).

The adjusted EBITDA loss for the period was reduced to GBP0.6m

(H1 2021: GBP0.9m loss). Adjusted EBITDA is calculated as per the

following table:

H1 2022 H1 2021 FY 2021

(Unaudited) (Unaudited) (Audited)

------------

GBP'000 GBP'000 GBP'000

------------- ------------

Loss before tax (3,056) (3,399) (6,331)

------------- ------------

EBITDA adjustments:-

------------- ------------

Net interest 276 306 546

------------- ------------

Depreciation 854 821 1,685

------------- ------------

Amortisation 1,265 1,279 2,359

------------- ------------

Share-based payments 120 120 106

------------- ------------

COVID-19 related

items

------------- ------------

Exceptional items (89) - (52)

------------- ------------

Adjusted EBITDA* (630) (873) (1,687)

------------- ------------

*Adjusted EBITDA is defined as earnings before interest,

taxation, depreciation, amortisation, exceptional items and

share-based payments. The exceptional item in H1 2022 and FY 2021

relates to the reversal of items impaired in the FY 2020 Annual

Report. Share-based payments are added back when calculating the

Group's adjusted EBITDA as this is currently an expense with a zero

direct cash impact on financial performance. Adjusted EBITDA is

considered a key metric to the users of the financial statements as

it represents a useful milestone that is reflective of the

performance of the business resulting from movements in revenue,

gross margin, and the costs of the business.

Investment in product development was GBP3.1m for the six-month

period ended 31 October 2021 (H1 2021: GBP2.7m). The expenditure in

H1 2022 was in technology and product developments, reflecting the

continuing investment and commitment in new and enhanced products,

applications and platforms that can be commercially marketed.

Amortisation of such development activity in the period was GBP1.0m

(H1 2021: GBP1.0m).

Cash and cash equivalents at 31 October 2021 were GBP10.2m (30

April 2021: GBP15.6m; 31 October 2020: GBP5.8m). The decrease over

the six-month period primarily reflects i nvestment in product

development and other intangibles, with capitalised development

costs of GBP3.1m and IP additions of GBP0.1m, and a GBP1.7m

reduction in working capital.

Inventories increased by GBP1.1m in the period from GBP6.2m to

GBP7.3m. This increase was primarily in order to secure surety of

critical electronic components for both H2 2022 and, in certain

instances, H1 2023, in response to the supply chain pressures

experienced during the first half. As such, the Group sourced

component inventory when available, rather than in accordance with

normal supply lead times. As noted above, there was significant

component price inflation caused by the constrained market supply,

which also contributed to the increased spend on inventories.

Outlook

Kromek entered the second half of FY 2022 in a stronger position

than when it started the year and, the Board believes, than at any

point in the Group's history. The Group has continued to deliver on

its existing contracts as well as increase its contracted orderbook

and pipeline. The Group has made significant progress under

development programmes that are in areas that the Board believes

will be key drivers of future growth, in particular, SPECT, CT and

bio-security. In addition, due to the mitigating actions and

significant forward planning that Kromek implemented during the

first half of the year, and which remain in place, the Group does

not expect revenue to be impacted by supply chain challenges in the

second half of the year.

The Group currently has visibility in excess of 90% of expected

full year revenue based on orders already delivered and won and

this is further supported by a strong and increasing pipeline. As a

result, Kromek is on track to deliver an increase in revenue of

approximately 45% for full year 2022, in line with market

expectations, which would represent the Group's highest ever full

year revenue and reflect growth in both the advanced imaging and

CBRN detection segments.

Looking further ahead, Kromek is operating in multiple

substantial markets where its technology enables its advanced

imaging customers to differentiate their products - forming an

important part of the roadmap of major OEMs - and its CBRN

detection customers to enhance national defence. The demand for

technology that enables early medical diagnosis to improve patient

outcomes and government vigilance to the threat of terrorism will

continue. In addition, Kromek's strategic position in the advanced

imaging segment has been significantly strengthened this year with

the Group becoming the only commercial independent global supplier

of CZT. As a result, the Board continues to look to the future with

great confidence.

Consolidated condensed income statement

For the six months ended 31 October 2021

Six months Six months Year

ended 31 ended 31 ended

October October 30 April

2021 2020 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Note

Continuing operations

Revenue 4 4,707 4,576 10,352

Cost of sales (2,503) (2,083) (5,346)

Gross profit 2,204 2,493 5,006

Other operating income 5 1,343 300 379

Distribution costs (273) (128) (287)

Administrative expenses (including

operating expenses) (6,143) (5,758) (10,935)

Operating loss (2,869) (3,093) (5,837)

Exceptional impairment reversal

on trade receivables and amounts

recoverable on contract 6 89 - 52

Operating results (post exceptional

items) (2,780) (3,093) (5,785)

----------- ----------- ---------

Finance income 6 1 2

Finance costs (282) (307) (548)

Loss before tax (3,056) (3,399) (6,331)

Tax 7 707 385 978

Loss from continuing operations (2,349) (3,014) (5,353)

Losses per share

-basic (p) 9 (0.5) (0.9) (1.5)

- diluted (p) (0.5) (0.9) (1.5)

Consolidated condensed statement of comprehensive income

For the six months ended 31 October 2021

Six months

ended Year

Six months

ended 31

October 31 October ended

30 April

2021 2020 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Loss for the period (2,349) (3,014) (5,353)

------------- ------------- -----------

Items that may be recycled to the

income statement

Exchange gains/(losses) on translation

of foreign operations 1,154 (640) (1,981)

------------- ------------- -----------

Total comprehensive loss for the

period (1,195) (3,654) (7,334)

============= ============= ===========

Consolidated condensed statement of financial position

31 October 31 October 30 April

2021 2020 2021

GBP'000 GBP'000 GBP'000

Note (Unaudited) (Unaudited) (Audited)

Non-current assets

Goodwill 1,275 1,275 1,275

Other intangible assets 26,240 23,048 24,144

Property, plant and equipment 10 10,884 12,052 11,200

Right-of-use asset 3,884 3,597 4,076

42,283 39,972 40,695

Current assets

Inventories 7,336 6,579 6,202

Trade and other receivables 7,166 6,282 6,644

Current tax assets 422 1,415 1,015

Cash and bank balances 10,243 5,810 15,602

25,167 20,086 29,463

----------- ----------- ---------

Total assets 67,450 60,058 70,158

=========== =========== =========

Current liabilities

Trade and other payables (5,959) (5,966) (6,174)

Lease obligation (389) (328) (399)

Borrowings (4,813) (3,654) (5,387)

Provisions for liabilities - - -

(11,161) (9,948) (11,960)

Net current assets 14,006 10,138 17,503

Non-current liabilities

Deferred income (1,221) (1,068) (1,071)

Lease obligation (4,111) (3,575) (4,256)

Borrowings (1,977) (3,928) (2,816)

Total liabilities (18,470) (18,519) (20,103)

Net assets 48,980 41,539 50,055

As at 31 October 2021

Equity

Share capital 12 4,319 3,449 4,319

Share premium account 72,943 61,603 72,943

Merger reserve 21,853 21,853 21,853

Translation reserve 1,154 1,341 -

Accumulated losses (51,289) (46,707) (49,060)

Total equity 48,980 41,539 50,055

Consolidated condensed statement of changes in equity

For the six months ended 31 October 2021

Equity attributable to equity holders of the

Group

Share

Share Premium Merger Translation Accumulated

Capital Account Reserve Reserve Losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 May 2021 4,319 72,943 21,853 - (49,060) 50,055

Loss for the period - - - - (2,349) (2,394)

Other comprehensive

income for the period - - - 1,154 - 1,154

Total comprehensive

loss for the period - - - 1,154 (2,349) (1,195)

Transactions with

shareholders

recorded in equity

Issue of share capital - - - - - -

net of expenses

Premium on shares issued

less expenses - - - - - -

Credit to equity for

equity-settled

share-based

payments - - - - 120 120

Balance at 31 October

2021 4,319 72,943 21,853 1,154 (51,289) 48,980

Balance at 1 May 2020 3,446 61,600 21,853 1,981 (43,813) 45,067

Loss for the period - - - - (3,014) (3,014)

Other comprehensive

loss for the period - - - (640) - (640)

Total comprehensive

loss for the period - - - (640) (3,014) (3,654)

Transactions with

shareholders

recorded in equity

Issue of share capital

net of expenses 3 - - - - 3

Premium on shares issued

less expenses - 3 - - - 3

Credit to equity for

equity-settled

share-based

payments - - - - 120 120

Balance at 31 October

2020 3,449 61,603 21,853 1,341 (46,707) 41,539

Balance at 1 May 2020 3,446 61,600 21,853 1,981 (43,813) 45,067

Loss for the year - - - - (5,353) (5,353)

Other comprehensive

loss for the year - - - (1,981) - (1,981)

Total comprehensive

loss for the year - - - (1,981) (5,353) (7,334)

Transactions with

shareholders

recorded in equity

Issue of share capital

net of expenses 873 - - - - 873

Premium on shares issued

less expenses - 11,343 - - - 11,343

Credit to equity for

equity-settled

share-based

payments - - - - 106 106

Balance at 30 April

2021 4,319 72,943 21,853 - (49,060) 50,055

Consolidated condensed statement of cash flows

For the six months ended 31 October 2021

Six months Six months Year

ended 31 ended 31 ended 30

October October April

2021 2020 2021

Note GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Net cash used in operating activities 11 (2,213) (1,890) (1,309)

Investing activities

Interest received 6 1 2

Purchases of property, plant and

equipment (260) (295) (454)

Purchases of patents and trademarks (96) (114) (156)

Capitalisation of research and

development costs (3,125) (2,667) (5,463)

Net cash used in investing activities (3,475) (3,075) (6,071)

Financing activities

New borrowings 560 2,283 3,215

Net proceeds on issue of shares - 3 12,216

Interest paid (162) (189) (309)

Payment of loan and borrowings (704) (307) (595)

Finance lease repayments (322) (272) (395)

Net cash (used in) / generated

from financing activities (628) 1,518 14,132

Net (decrease) / increase in cash

and cash equivalents (6,316) (3,447) 6,752

Cash and cash equivalents at beginning

of period 15,602 9,444 9,444

Effect of foreign exchange rate

changes 957 (187) (594)

Cash and cash equivalents at end

of period 10,243 5,810 15,602

=========== =========== =========

Notes to the unaudited interim statements

For the six months ended 31 October 2021

1. Basis of preparation

This interim financial report does not constitute statutory

accounts as defined in section 434 of the Companies Act 2006. The

auditors reported on the Kromek Group plc financial statements for

the year ended 30 April 2021, their report was unqualified and did

not contain a statement under section 498(2) or (3) of the

Companies Act 2006. The Group's consolidated annual financial

statements for the year ended 30 April 2021 have been filed with

the Registrar of Companies and are available on the Group's

website: www.kromek.com .

2. Going concern

The Directors have a reasonable expectation that the going

concern basis of accounting remains appropriate and that the Group

has adequate resources and facilities to continue in operation for

the next 12 months based on its cash flow forecasts prepared.

Accordingly, the Group's unaudited interim statements for the six

months ended 31 October 2021 have been prepared on a going concern

basis which contemplates the realisation of assets and the

settlement of liabilities and commitments in the normal course of

operations.

3. Interim report

This interim financial report will be available from the Group's

website at www.kromek.com .

4. Business and geographical segments

Products and services from which reportable segments derive

their revenues

For management purposes, the Group is organised into two

business units (UK and USA) and it is on these operating segments

that the Group is providing disclosure.

The chief operating decision maker is the Board of Directors who

assess performance of the segments using the following key

performance indicators; revenue, gross profit, operating profit and

EBITDA. The amounts provided to the Board with respect to assets

and liabilities are measured in a way consistent with the Financial

Statements.

The turnover, profit on ordinary activities and net assets of

the Group are attributable to one business segment, i.e. the

development of digital colour x-ray imaging enabling direct

materials identification, as well as developing a number of

detection products in the industrial market. Whilst results are not

measured by end market, the Group currently categorises its

customers as belonging to the advanced imaging and CBRN detection

markets.

Analysis by geographical area

A geographical analysis of the Group's revenue by destination is

as follows:

Six months Six months Year

ended 31 ended 31 ended

October October 30 April

2021 2020 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

United Kingdom 928 683 1,627

North America 1,916 3,055 5,693

Asia 125 197 610

Europe 1,695 630 2,387

Australasia 43 11 3

Africa - - 32

Total revenue 4,707 4,576 10,352

4. Business and geographical segments (continued)

A geographical analysis of the Group's revenue by origin is as

follows:

Six months ended 31 October 2021

UK Operations USA Operations Total for

GBP'000 GBP'000 Group

GBP'000

Revenue from sales

Revenue by segment:

-Sale of goods and services 3,487 3,813 7,300

-Revenue from grants 409 - 409

-Revenue from contract customers 374 142 516

Total sales by segment 4,270 3,955 8,225

Removal of inter-segment sales (2,459) (1,059) (3,518)

-------------- --------------- ----------

Total external sales 1,811 2,896 4,707

============== =============== ==========

Segment result - operating loss (2,382) (398) (2,780)

Net interest (162) (114) (276)

Loss before tax (2,544) (512) (3,056)

Tax credit 707 - 707

-------------- --------------- ----------

Loss for the period (1,837) (512) (2,349)

============== =============== ==========

Other information

Property, plant and equipment additions 65 195 260

Depreciation of property, plant

and equipment 506 348 854

Intangible asset additions 2,627 594 3,221

Amortisation of intangible assets 751 514 1,265

-------------- --------------- ----------

Balance Sheet

Total assets 41,942 25,508 67,450

-------------- --------------- ----------

Total liabilities (11,911) (6,559) (18,470)

-------------- --------------- ----------

Inter-segment sales are charged at prevailing market prices.

No impairment losses were recognised in respect of property,

plant and equipment and goodwill.

4. Business and geographical segments (continued)

Six months ended 31 October 2020

Total for

UK Operations USA Operations Group

GBP'000 GBP'000 GBP'000

Revenue from sales

Revenue by segment:

-Sale of goods and services 2,255 1,615 3,870

-Revenue from grants 8 - 8

-Revenue from contract customers 2,266 320 2,586

Total sales by segment 4,529 1,935 6,464

Removal of inter-segment sales (1,317) (571) (1,888)

-------------- --------------- ----------

Total external sales 3,212 1,364 4,576

============== =============== ==========

Segment result - operating loss (537) (2,556) (3,093)

Net interest (179) (127) (306)

Loss before tax (716) (2,683) (3,399)

Tax credit 385 - 385

-------------- --------------- ----------

Loss for the period (331) (2,683) (3,014)

============== =============== ==========

Other information

Property, plant and equipment additions 229 66 295

Depreciation of property, plant

and equipment 483 338 821

Intangible asset additions 2,172 609 2,781

Amortisation of intangible assets 777 502 1,279

-------------- --------------- ----------

Balance Sheet

Total assets 35,203 24,855 60,058

-------------- --------------- ----------

Total liabilities (11,887) (6,632) (18,519)

-------------- --------------- ----------

The accounting policies of the reportable segments are the same

as the Group's accounting policies. Segment profit or loss

represents the profit or loss earned by each segment without

allocation of the share of profits or losses of associates, central

administration costs including Directors' salaries, investment

revenue and finance costs, and income tax expense. This is the

measure reported to the Group's Chief Executive for the purpose of

resource allocation and assessment of segment performance.

5. Other Operating Income

In the period to 31 October 2021, other operating income

comprised the forgiveness of PPP loans granted by the US Government

and grants received from the Coronavirus Job Retention Scheme

provided by the UK Government in response to COVID-19's economic

impact on businesses. In the prior year period, the GBP0.3m of

other operating income comprised UK Government grants in response

to COVID-19.

6. Exceptional Items

The Group has reversed GBP89k in relation to an item impaired in

the full year 2020 financial statements.

7. Tax

The Group has recognised R&D tax credits of GBP707k for the

six months ended 31 October 2021 (six months ended 31 October 2020:

GBP385k).

8. Dividends

The Directors do not recommend the payment of a dividend (six

months ended 31 October 2020: GBPnil).

9. Losses per share

The calculation of the basic and diluted loss per share is based

on the following data:

Losses

Six months Six months Year

ended 31 ended 31 ended

October October 30 April

2021 2020 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Losses for the purposes of basic loss

per share being net loss attributable

to owners of the Group (2,349) (3,014) (5,353)

Six months Six months Year

ended 31 ended 31 ended

October October 30 April

2021 2020 2021

'000 '000 '000

(Unaudited) (Unaudited) (Audited)

Number of shares

Weighted average number of ordinary

shares for the purposes of basic loss

per share 431,852 344,751 358,912

Effect of dilutive potential ordinary

shares:

Share options and warrants 618 340 373

Weighted average number of ordinary

shares for the purposes of diluted loss

per share 432,470 345,745 359,285

Basic (p) (0.5) (0.9) (1.5)

Diluted (p) (0.5) (0.9) (1.5)

Due to the Group having losses in each of the periods, the fully

diluted loss per share for disclosure purposes, as shown in the

income statement, is the same as for the basic loss per share.

10. Property, plant and equipment

During the six months ended 31 October 2021, the Group acquired

property, plant and equipment with a cost of GBP260k (six months

ended 31 October 2020: GBP295k).

11. Notes to the cash flow statement

Six months Six months Year

ended 31 ended 31 ended

October October 30 April

2021 2020 2021

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Loss for the period (2,349) (3,014) (5,353)

Adjustments for:

Finance income (6) (1) (2)

Finance costs 282 307 548

Income tax credit (707) (385) (978)

Depreciation of property, plant and

equipment 854 821 1,685

Amortisation of intangible assets 1,265 1,279 2,359

Share-based payment expense 120 120 106

PPP loan forgiveness (1,253) - -

Impairment of intangible asset - - 30

Loss on disposal - - 82

Operating cash flows before movements

in working capital (1,794) (873) (1,523)

(Increase) / decrease in inventories (1,134) (163) 214

(Increase) / decrease in receivables (524) 1,928 1,566

(Decrease) in payables (61) (2,782) (2,571)

Cash used in operations (3,513) (1,890) (2,314)

Income taxes received 1,300 - 1,005

Net cash used in operating activities (2,213) (1,890) (1,309)

12. Share capital

During the period, no ordinary shares (six months ended 31

October 2020: 250,000) were issued to satisfy the exercise of

employee share options.

13. Events after the balance sheet date

There are no significant or disclosable post-balance sheet

events.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKOBPFBKDPDD

(END) Dow Jones Newswires

January 18, 2022 02:00 ET (07:00 GMT)

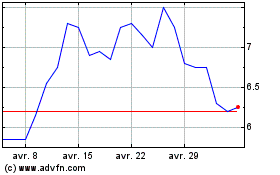

Kromek (LSE:KMK)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Kromek (LSE:KMK)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024