TIDMKYGA

RNS Number : 6086J

Kerry Group PLC

28 April 2022

Date: 28 April 2022

LEI: 635400TLVVBNXLFHWC59

KERRY GROUP

Q1 INTERIM MANAGEMENT STATEMENT 2022

Continued strong business growth through the first quarter

OVERVIEW

* Group volume growth 5.6% (6.3%(1) LFL volume growth)

* Taste & Nutrition 6.8 %

* Dairy Ireland 0.7%(1)

* Group pricing 5.8% (6.6%(1) LFL pricing)

* Group organic growth 11.4% (12.9%(1) LFL organic

growth)

* Group EBITDA margin +10bps

* Full year EPS guidance reaffirmed

(1) Like-for-like (LFL) growth rates exclude the Consumer Foods Meats

& Meals business disposal

Edmond Scanlon, Chief Executive Officer

"We were pleased with our start to the year despite challenging conditions

in a number of markets. Taste & Nutrition achieved continued strong

growth, particularly in developed markets. This growth was led by

the Meat, Snacks and Bakery end use markets. Growth in the retail

channel remained strong while foodservice continued its excellent

overall growth in the period.

We also made good progress on the strategic front, enhancing our

biotechnology portfolio with the acquisition of c-LEcta(2), while

expanding our local presence in emerging markets with the acquisition

of Almer(2) in Southeast Asia and further enhancing our footprint

in the Middle East and Africa.

As overall market conditions remain highly dynamic, we are actively

managing the inflationary environment in close collaboration with

our customers. As previously announced, we have taken the decision

to suspend our operations in Russia and Belarus and we continue to

work through the challenges presented in China since the introduction

of localised restrictions.

As we commence a new strategic cycle, the progress we've made positions

us strongly for growth. We are reaffirming our full year earnings

guidance."

Markets and Performance

The overall demand environment remained positive through the

period, as consumers moved to more normalised work environments and

increased their social engagement. Overall mobility approached

pre-pandemic levels, with travel and out-of-home eating occasions

continuing to increase. As consumer preferences continue to evolve

with increased demand for new food and beverage experiences,

sustainability remains a key factor in purchasing decisions, while

overall price inflation has now moved into the consciousness of

many consumers.

These dynamics are leading to challenges for customers who

continue to pursue more focused innovation strategies to meet these

evolving needs, while they seek to ensure continuity of supply and

navigate the current inflationary environment.

Group reported revenue increased by 8.1% in the period. This

comprised of business volume growth of 5.6%, increased pricing of

5.8%, a translation currency tailwind of 5.4% and contribution from

business acquisitions of 4.0%, partially offset by the impact of

the business disposal of the Consumer Foods Meats & Meals

business of 12.7%.

Group EBITDA margin increased by 10bps primarily driven by

accretion from recent portfolio developments, operating leverage

and mix, offset by the impact of passing through input cost

inflation.

Business Reviews

Taste & Nutrition

Continued good growth in the retail channel and excellent growth

in foodservice

> Overall volume growth of 6.8% with strong growth across many developed markets

> Food EUMs of Meat, Bakery and Snacks achieved excellent growth

> Pricing of 4.6% reflected the pass through of increases in raw material input costs

Taste & Nutrition delivered strong overall growth in the

period, driven by performance across many developed markets. The

foodservice channel achieved strong double digit volume growth,

reflective of continued business momentum and lower comparatives at

the beginning of the prior year. The retail channel delivered good

growth levels driven by Meat, Snacks and Bakery markets. This

growth was supported by continued strong demand for Kerry's food

waste solutions as customers continue to evaluate the

sustainability credentials of their offerings, while good growth

was achieved within authentic taste with a number of new business

wins.

Business volumes in emerging markets increased by 7.9%, as

strong growth in LATAM, the Middle East and Southeast Asia was

partially offset by challenging conditions in China.

Americas Region

> Overall volume growth of 6.7% led by Meat, Bakery and Meals

> Retail channel delivered good growth, with continued momentum in the foodservice channel

> LATAM delivered strong growth led by Mexico and Brazil

North America delivered a very good performance led by Meat and

Meat Alternatives, as strong growth was achieved through taste

innovations and increased demand for Kerry's food protection and

preservation solutions. This growth was supported by the Group's

new manufacturing facility in Rome, Georgia.

Bakery delivered strong growth through customer launches with

cleaner labels and added functionality, together with a step-up in

LTOs within the foodservice channel. Meals achieved very strong

growth through new taste solutions with quick service and fast

casual foodservice restaurant customers. Overall growth in

foodservice was strong in the period, underpinned by innovations to

reduce complexity in back of house operations, targeted menu

development and increased seasonal menu offerings. The previously

announced acquisition of Natreon, Inc.(2) also completed in the

period.

Within LATAM, Brazil and Mexico delivered strong growth. Volume

growth in Brazil was driven by performance in Meat and ice cream,

while growth in Mexico was led by new launches in Meat and within

the Snacks category with regional leaders.

Within the global Pharma EUM, good volume growth was achieved in

cell nutrition.

Europe Region

> Volume growth of 8.5% led by Meat, Dairy and Beverage

> Retail channel delivered good growth, with strong growth in

foodservice against lower prior year comparatives

> Growth in the region was led by the UK, Central Europe and Southern Europe

The region achieved strong growth across food and beverage

markets in the period. Within the Food EUM, growth was strong in

Meat through new launch activity in healthier coatings, authentic

taste innovations and clean smoke solutions. Growth in Dairy was

supported by recent dairy alternative launches in the foodservice

channel, while good growth in Snacks was achieved through new

savoury taste solutions and healthier snacking. Within the Beverage

EUM, growth was driven by innovations in nutritional beverages with

functional claims and through low/non-alcohol launches

incorporating Kerry's botanicals, natural extracts and sugar

reduction technologies.

Growth in the region was strongest in developed markets in the

period, led by growth in the UK, followed by Central and Southern

Europe, while performance in Russia and Eastern Europe was impacted

by the war in the region.

In the period the Group completed the acquisition of c-LEcta

GmbH(2), which is a leading biotechnology innovation company based

in Leipzig, Germany.

APMEA Region

> Volume growth of 6.2% driven by strong growth in the Middle East and Southeast Asia

> Growth led by Snacks, Meat and Bakery

> Foodservice achieved good overall growth and retail performed well

Growth in the region was primarily driven by strong growth in

the Middle East and a very good overall performance across

Southeast Asia, partially offset by challenges resulting from the

localised restrictions in China.

Overall growth was strong across Food EUMs. Excellent growth was

achieved in Snacks with regional leaders across the Middle East and

Southeast Asia. Growth in Meat was led by local authentic taste and

texture solutions, while growth in Bakery was supported by new

launch activity and increased demand for functional systems.

Kerry continued its expansion in the region with the acquisition

of Almer Malaysia Sdn Bhd(2) and the opening of its Jeddah, Saudi

Arabia operation, which enhances the Group's capability to deliver

sustainable taste and nutrition solutions for local customers and

consumers.

Dairy Ireland

Solid growth as business saw significant price inflation across

the period

> Overall volume growth of 0.7%(1) with increases across both

Dairy Consumer Products and Dairy Ingredients

> Pricing of 18.7%(1) reflected significant increases in dairy prices and raw material costs

In the Dairy Ireland segment, solid overall volume growth was

achieved as the business saw significant price increases across the

period.

Within Dairy Consumer Products, good volume growth was achieved

right across the dairy snacking range, led by Cheestrings with

increased out-of-home consumption. Volumes in spreadable butter

were lower due to reduced promotional activity, while the cheese

category had strong comparatives due to a higher level of at-home

consumption in the prior year.

Dairy Ingredients performance reflected significant higher

prices as a result of constrained global supply dynamics.

(2) In March 2022, Kerry completed the following

acquisitions:

-- 100% of the share capital of the company Almer Malaysia sdn

Bhd "Almer"

-- 100% of the issued share capital of the company Natreon Inc.

"Natreon"

-- c.93% of the issued share capital of the company c-LEcta GMBH

"c-LEcta"

Financial Review

At the end of March, the Group's net debt of EUR2.3 billion

reflected overall acquisition spend. The Group's consolidated

balance sheet remains strong which will facilitate the continued

organic and acquisitive growth of Group businesses. As announced on

16 February, the Group has proposed a final dividend of 66.7 cent

per share for approval at the Annual General Meeting.

Future Prospects

Our markets remain highly dynamic with a good overall demand

environment, despite current uncertain market conditions in places.

While our industry is experiencing a period of heightened

inflation, we remain confident in our ability to manage through

this current cycle with our well-established pricing model and cost

initiatives. Kerry remains strongly positioned for growth with a

good innovation pipeline. We expect to achieve adjusted earnings

per share growth in 2022 of 5% to 9% on a constant currency

basis.

Disclaimer: Forward Looking Statements

This Announcement contains forward looking statements which

reflect management expectations based on currently available data.

However actual results may differ materially from those expressed

or implied by these forward looking statements. These forward

looking statements speak only as of the date they were made, and

the Company undertakes no obligation to publicly update any forward

looking statement, whether as a result of new information, future

events or otherwise.

CONTACT INFORMATION

=============================================

Investor Relations

Marguerite Larkin , Chief Financial

Officer

+353 66 7182292 | investorrelations@kerry.ie

William Lynch , Head of Investor

Relations

+353 66 7182292 | investorrelations@kerry.ie

Media

Catherine Keogh , Chief Corporate

Affairs & Brand Officer

+353 45 930188 | corpaffairs@kerry.com

Website

www.kerrygroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUBAWRUVUSUAR

(END) Dow Jones Newswires

April 28, 2022 02:01 ET (06:01 GMT)

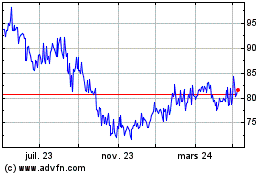

Kerry (LSE:KYGA)

Graphique Historique de l'Action

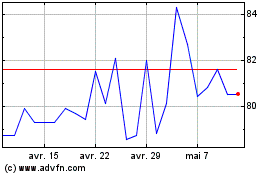

De Mar 2024 à Avr 2024

Kerry (LSE:KYGA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024