Kazera Global PLC Continued progress and momentum into 2022 (6582B)

15 Février 2022 - 8:00AM

UK Regulatory

TIDMKZG

RNS Number : 6582B

Kazera Global PLC

15 February 2022

February 2022

Kazera Global plc

("Kazera" or the "Company")

Continued progress and momentum into 2022

Kazera Global plc, the AIM quoted investment company, is pleased

to announce that diamond production for the current production

cycle (December 2021/January 2022) has achieved a record number of

over 1,000 carats, the largest of which is a high value stone of 13

ct. In addition, as per Company projections at year end, the

Tantalite Valley mine is expected to become operational shortly,

after which the Company will begin exporting commercial quantities

of Tantalum to its offtake partner.

Highlights

-- Diamond production during current production cycle (December

2021/January 2022) in excess of 1,000 carats, comfortably beating

previous highest diamond production of 242 carats.

-- The batch contains a number of larger diamonds, the largest being 13 carats.

-- The processing plant at Tantalite Valley in Namibia is now nearing completion.

-- Water recycling at Tantalite Valley has averaged 95% meaning

that projected production can now be achieved without the cost and

technical risk of a pipeline from the Orange River.

Background

Diamond production within the Company has been restricted

historically due to Deep Blue Minerals not having control over the

gravel separation process. This problem has been resolved by the

Company, together with MV5, taking over the running of the Muisvlak

plant. Due to existing stockpiles this has led to record breaking

diamond production. By continuing to control the separation

process, the Company is now confident of being able to produce a

regular and profitable number of diamonds in each cycle.

The size of the diamonds in the current batch has also been

record breaking. The biggest diamond is 13 carats, as opposed to 3

previously. Given our experience in the most productive gravel

areas, the Company will continue to focus on areas where it

anticipates achieving the best returns.

In Namibia, the works undertaken by the Company's wholly owned

subsidiary, African Tantalum, in conjunction with DJ Drilling, has

led to the entire refurbishment and redesign of the plant. The

heavy seasonal rains which had previously caused the plant to be

covered in a deep layer of silt caused no operational delays this

year. In addition, the Company's water recycling techniques, which

were designed to achieve a minimum of 65% water reusage, have

surpassed expectations with 95% of water being recovered. The

Company is now confident that it can achieve the levels of

production anticipated without the capital cost and engineering

risk associated with building a pipeline to the Orange River.

The plant is now in test operation and the Company anticipates

being able to shortly begin exporting commercial volumes of

Tantalum to its Chinese offtake partner.

Forward Strategy

With regards to our diamond operations, the Company will

continue to focus on controlling the production process and on

identifying the most profitable areas for mining activity. The

Company is confident that diamonds will be a consistent source of

revenue and profit generation during the forthcoming year.

In Namibia, the plant has been significantly upgraded and the

water recycling techniques implemented by the Company have been

shown to work. Various potential improvements to the plant have

been identified and will be implemented over time so as to minimize

down time in the plant. The Company remains confident of

maintaining a steady increase in production volumes of Tantalum as

2022 progresses and remains confident of this being a major

contributor to the Company's bottom line during 2022.

The grant of the Mining Permit for Heavy Mineral Sands is still

awaited. The only objection received to the application is regarded

by the Company's consultants as without merit and the expectation

is that the Permit will be received shortly. Upon receipt of this,

as previously announced, we anticipate that within 6 months the

Company will begin the profitable, and potentially transformative,

production of mineral sands.

It is our expectation that profitability will be improved even

further by introducing a third party to build and operate a

separation plant for which discussions are already underway with a

number of interested entities. Simultaneously, the Company's

application for a Prospecting Right over an area which is

approximately 34 times larger than the current site is

progressing.

Dennis Edmonds, Kazera Chief Executive Officer, commented:

"With our diamond operation now contributing directly to the

Company's bottom line, Tantalum profits soon to be generated and

HMS to come, we can look forward with ever more confidence to a

secure economic future in 2022. Adding our Lithium opportunity,

which we expect to feature prominently as we progress through 2022

and additional Tantalum and HMS possibilities, it becomes ever more

apparent that we are sitting on very valuable resources. The

continued electrification of the global economy and end demand for

Tantalum and Lithium support our development plans. On the HMS side

the supply/demand dynamics in the near- and medium-term work

strongly in our favour. In addition, the Board is constantly

evaluating new opportunities."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No. 596/2014 ('MAR').

For further information on the Company, visit: www. kazeraglobal

.com

Kazera Global plc (c/o Camarco) Tel: +44 (0)203 757 4980

Dennis Edmonds (CEO)

finnCap (Nominated Adviser and Joint Broker) Tel: +44 (0)207 220 0500

Christopher Raggett / Tim Harper (Corporate

Finance)

Camarco (PR)

Gordon Poole / James Crothers / Hugo Liddy Tel: +44 (0)20 3781 8331

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLGPUUWPUPPPWC

(END) Dow Jones Newswires

February 15, 2022 02:00 ET (07:00 GMT)

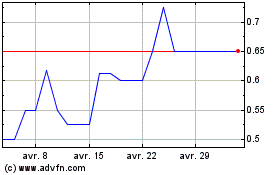

Kazera Global (LSE:KZG)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Kazera Global (LSE:KZG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024