TIDMKZG

RNS Number : 7471G

Kazera Global PLC

31 March 2022

31 March 2022

Kazera Global plc

Interim Results for the six months ended 31 December 2021

Kazera Global plc ("Kazera Global", "Kazera" or "the Company"),

the AIM quoted investment company, is pleased to announce its

unaudited interim results for the six months ended 31 December 2021

("the Period").

Highlights:

Management

-- Dennis Edmonds was appointed sole CEO in October 2021

Operational

-- 3-year tantalum contract secured, through to 31 December 2024

with Jiujiang Jinxin Nonferrous Metals Co Ltd at Tantalite Valley,

Namibia

-- High quality "chemical grade" Lithium and Feldspar samples

were taken from the Tantalite Valley Mine

-- Extensive work was undertaken on the processing plant at

Tantalite Valley progressing towards production capability

-- Acquired 60% of Whale Head Minerals which is applying for a

Mining Permit over Heavy Mineral Sands with an NPV of GBP150

million

-- Established a new loan facility to facilitate the Company to

draw down up to GBP250,000 over the 6 months

-- Diamond production exceeded 1,000 carats during the December/January production cycle

Post Period

-- Diamond production has continued to be consistently maintained

-- Plan to be significantly cash flow positive during 2022 with

the intention to reinvest the proceeds into resource definition and

mining, particularly at Tantalite Valley

-- The processing plant at Tantalite Valley in Namibia is now

nearing completion offering a substantial contribution to cash

flow.

Outlook

-- The granting of the Heavy Mineral Sands Permit will

substantially increase the Company's asset base as well as

cashflow.

-- The Company is looking to continue to maximise production

from its current assets as well as evaluating potential M&A

opportunities.

-- Kazera will also continue to invest in the business where

needed and focus on maximising growth for shareholders

Dennis Edmonds, CEO of Kazera Global, said:

"Kazera continues to make positive progress across its

operations and has weathered the effects of Covid on the industry

well. As soon as cash is being generated by both diamonds and

Tantalum the Company will be self-sustaining and any future cash

will only be required if it is decided to accelerate growth or to

fund an acquisition.

The Board remain focused on increasing shareholder value and

delivering strong growth from both organic and inorganic

opportunities that arise."

For further information on the Company, visit: www. kazeraglobal

.com

Kazera Global plc (c/o Camarco) Tel: +44 (0)203 757 4980

Dennis Edmonds (CEO)

finnCap (Nominated Adviser and Joint Broker) Tel: +44 (0)207 220 0500

Christopher Raggett / Tim Harper (Corporate Finance)

Camarco (PR)

James Crothers / Hugo Liddy / Gordon Poole Tel: +44 (0)20 3781 8331

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 31 DECEMBER 2021

Unaudited Unaudited Audited

six months six months year

ended ended ended

30

31 December 31 December June

2021 2020 2021

Notes GBP'000 GBP'000 GBP'000

--------------------------------------------------------- ------ ------------ ------------ ---------

Revenue 100 - 55

Cost of Sales (100) - (55)

--------------------------------------------------------- ------ ------------ ------------ ---------

Gross Profit - - -

Pre-production expenses (72) (72) (111)

Administrative expenses (474) (381) (881)

Share based payment expense (55) (87) (172)

--------------------------------------------------------- ------ ------------ ------------ ---------

Operating loss and loss before tax (601) (540) (1,164)

Tax on profit on ordinary activities - - -

Loss for the period (601) (540) (1,164)

--------------------------------------------------------- ------ ------------ ------------ ---------

Loss attributable to owners of the Company (589) (530) (1,146)

(Loss)/profit attributable to non-controlling interests (12) (10) (18)

(601) (540) (1,164)

--------------------------------------------------------- ------ ------------ ------------ ---------

Loss per share

Basic and diluted (loss) per share (pence) 4 (0.08) p (0.08) p (0.17) p

Loss for the period (589) (530) (1,146)

Exchange differences on translation of foreign operations (210) (10) 107

Total comprehensive loss for the year attributable to equity holders of the parent (379) (540) (1,039)

------------------------------------------------------------------------------------ ------ ------ --------

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2021

Unaudited Unaudited Audited

As at As at As at

30

31 December 31 December June

2021 2020 2021

GBP'000 GBP'000 GBP'000

---------------------------------------------- ------------ ------------ ---------

Non-current assets

Mines under construction 3,056 2,904 2,897

Property, plant & equipment 650 881 716

Total non-current assets 3,706 3,785 3,613

---------------------------------------------- ------------ ------------ ---------

Current assets

Trade and other receivables 192 103 168

Cash and cash equivalents 83 22 47

Total current assets 275 125 215

---------------------------------------------- ------------ ------------ ---------

Current liabilities

Trade and other payables 561 235 209

Total current liabilities 561 235 209

---------------------------------------------- ------------ ------------ ---------

Non-current liabilities

Other payables 473 - 431

Provisions 55 - 55

Total non-current liabilities 528 - 486

---------------------------------------------- ------------ ------------ ---------

Net assets 2,892 3,675 3,133

---------------------------------------------- ------------ ------------ ---------

Capital and reserves

Called up share capital 3,340 3,261 3,279

Share premium account 16,317 15,738 15,863

Capital redemption reserve 2,077 2,077 2,077

Share option reserve 392 252 337

Currency translation reserve (687) (331) (477)

Retained earnings (18,506) (17,301) (17,917)

---------------------------------------------- ------------ ------------ ---------

Equity attributable to owners of the Company 2,933 3,696 3,162

Non-controlling interests (41) (21) (29)

---------------------------------------------- ------------ ------------ ---------

Shareholder funds 2,892 3,675 3,133

---------------------------------------------- ------------ ------------ ---------

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 31 DECEMBER 2021

Share Capital Share Currency Equity

Share premium redemption option translation Retained shareholders' Non-controlling

capital account reserve reserve reserve earnings funds interests T otal

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

================ ======= ======= ========== ======= =========== ======== ============= =============== =======

Balance at 1

July 2019 2,866 14,307 2,077 51 (34) (14,552) 4,715 (1,174) 3,541

================ ======= ======= ========== ======= =========== ======== ============= =============== =======

Comprehensive

loss for the

period - - - - - (769) (769) (251) (1,020)

Other

comprehensive

income - - - - (550) - (550) - (550)

---------------- ------- ------- ---------- ------- ----------- -------- ------------- --------------- -------

Total

comprehensive

expense - - - - (550) (769) (1,319) (251) (1,570)

---------------- ------- ------- ---------- ------- ----------- -------- ------------- --------------- -------

Non-controlling

interest on

acquisition of

a subsidiary - - - - - - - (10) (10)

Transactions

with

Non-controlling

interest - - - - - (1,450) (1,450) 1,424 (26)

Issue of share

capital, net of

share issue

costs 389 1,404 - - - - 1,793 - 1,793

Share based

payment expense - - - 114 - - 114 - 114

================ ======= ======= ========== ======= =========== ======== ============= =============== =======

Balance at 30

June 2020 3,255 15,711 2,077 165 (584) (16,771) 3,853 (11) 3,842

================ ======= ======= ========== ======= =========== ======== ============= =============== =======

Comprehensive

loss for the

period - - - - - (1,146) (1,146) (18) (1,164)

Other

comprehensive

income - - - - 107 - 107 - 107

---------------- ------- ------- ---------- ------- ----------- -------- ------------- --------------- -------

Total

comprehensive

expense - - - - 107 (1,146) (1,039) (18) (1,057)

---------------- ------- ------- ---------- ------- ----------- -------- ------------- --------------- -------

Issue of share

capital, net of

share issue

costs 24 152 - - - - 176 - 176

Share based

payment expense - - - 172 - - 172 - 172

================ ======= ======= ========== ======= =========== ======== ============= =============== =======

Balance at 30

June 2021 3,279 15,863 2,077 337 (477) (17,917) 3,162 (29) 3,133

================ ======= ======= ========== ======= =========== ======== ============= =============== =======

Comprehensive

loss for the

period - - - - - (589) (589) (12) (601)

Other

comprehensive

income - - - - (210) - (210) - (210)

---------------- ------- ------- ---------- ------- ----------- -------- ------------- --------------- -------

Total

comprehensive

expense - - - - (210) (589) (799) (12) (811)

---------------- ------- ------- ---------- ------- ----------- -------- ------------- --------------- -------

Issue of share

capital, net of

share issue

costs 61 454 - - - - 515 - 515

Share based

payment expense - - - 55 - - 55 - 55

================ ======= ======= ========== ======= =========== ======== ============= =============== =======

Balance at 31

December 2021 3,340 16,317 2,077 392 (687) (18,506) 2,933 (41) 2,892

================ ======= ======= ========== ======= =========== ======== ============= =============== =======

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 31 DECEMBER 2021

Unaudited Unaudited Audited

Six months Six months year

ended ended ended

31 30

31 December December June

2021 2020 2021

GBP'000 GBP'000 GBP'000

-------------------------------------------------------- ------------ ------------ --------

Cash flows from operating activities

Operating loss (601) (540) (1,164)

Adjustments for:

Depreciation and amortisation 65 3 126

Share based payment charge for year 55 87 172

Foreign exchange (143) 250 (39)

Provisions for mine rehabilitation and decommissioning 55

Operating cashflow before working capital changes (624) (200) (850)

Decrease/(increase) in receivables (24) 86 21

Increase in payables 427 11 382

--------------------------------------------------------- ------------ ------------ --------

Net cash outflow from operating activities (220) (103) (447)

--------------------------------------------------------- ------------ ------------ --------

Investing activities

Purchase of property, plant & equipment - (246) (197)

Development costs (259) (87) -

Net cash outflow from investing activities (259) (333) (197)

--------------------------------------------------------- ------------ ------------ --------

Financing activities

Net proceeds from share issues 515 33 176

Loan received - - 90

Net cash inflow from financing activities 515 33 266

--------------------------------------------------------- ------------ ------------ --------

Net (decrease)/increase in cash in the period 36 (403) (378)

Cash and cash equivalents at beginning of period 47 425 425

--------------------------------------------------------- ------------ ------------ --------

Cash and cash equivalents at end of period 83 22 47

--------------------------------------------------------- ------------ ------------ --------

NOTES TO THE UNAUDITED INTERIM ACCOUNTS

FOR THE SIX MONTHSED 31 DECEMBER 2021

1. Basis of preparation

The financial statements included in the interim accounts have

been prepared under the historical cost convention and in

accordance with International Financial Reporting Standards (IFRS).

The comparative figures for the six months ended 31 December 2020

are also included in these interim accounts under the historical

cost convention.

The principal accounting policies used in preparing these

interim accounts are those expected to apply in the Company's

Financial Statements for the year ending 30 June 2022 and are

unchanged from those disclosed in the Company's Annual Report for

the year ended 30 June 2021.

The interim accounts were approved by the Board of Kazera Global

plc on 31 March 2022. The interim financial information for the six

months ended 31 December 2021 does not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006 and is unaudited. The comparatives for the year ended 30 June

2021 are not the Company's full statutory accounts for that period.

A copy of the statutory accounts for that year has been delivered

to the Registrar of Companies. The auditors' report on those

accounts was unqualified, and did not contain statements under

sections 498(2) or (3) of the Companies Act 2006. Copies of the

accounts for the year ended 30 June 2021 are available on the

Company's website (https://kazeraglobal.com/).

2. Accounting policies

The principal accounting policies are:

Basis of preparation

The comparative figures for the six months ended 31 December

2021 have been presented on the same basis as the interim accounts

for the six months ended 31 December 2020.

Going concern

The interim financial statements have been prepared on the going

concern basis as, in the opinion of the Directors, at the time of

approving the interim financial statements, there is a reasonable

expectation that the Company will continue in operational existence

for the foreseeable future. The interim financial statements do not

include any adjustments that would result from the going concern

basis of preparation being inappropriate.

Sales of Tantalite

The interim accounts have been prepared on the basis that the

Group is not deemed to be in commercial production; therefore, the

proceeds of sales of Tantalite have been set off against the

development costs associated with the Tantalite mine site.

3. Share based payment expense

On 21 December 2018, 10,000,000 options were granted to L.

Johnson, vesting on 21 December 2021 at an exercisable at 1.75p per

share.

On 23 March 2020, a total of 66,666,667 share warrants were

issued to G Clarke (50,000,000), N Harrison (8,333,333) and R

Jennings (8,333,333) at an exercise price of 0.3p per share. On 13

October 2021, the Company issued 16,666,666 ordinary shares to

satisfy the exercise of warrants at 0.3 pence per share.

On 4 June 2020, a total of 26,500,000 share options were issued

to G Clarke (5,000,000), N Harrison (5,000,000), L Johnson

(5,000,000), D Edmonds (10,000,000) and B James (1,500,000) at an

exercise price of 1p per share.

4. Loss per share

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

31 December 2021 31 December 2020 30 June 2021

GBP'000 GBP'000 GBP'000

----------------------------------------------------------------- ----------------- ----------------- -------------

Loss used for calculation of basic and diluted EPS (589) (530) (1,164)

Loss for the year attributable to owners of the Company (589) (530) (1,164)

----------------------------------------------------------------- ----------------- ----------------- -------------

Weighted average number of ordinary shares in issue used for

calculation of basic and diluted

EPS* 744,005,591 681,224,613 686,324,120

Loss per share (pence per share)

Basic and fully diluted*:

-from continuing and total operations (0.08) p (0.08) p (0.17) p

----------------------------------------------------------------- ----------------- ----------------- -------------

*The Company has outstanding warrants and options which may be

dilutive in future periods. The effect in respect of the current

and comparative periods would have been anti-dilutive (i.e.

reducing the loss per share) and accordingly is not presented.

5. Distribution of Interim Report and Registered Office

A copy of the Interim Report will be available shortly on the

Company's website, https://kazeraglobal.com/, in accordance with

rule 26 of the AIM Rules for Companies; and copies will be

available from the Company's registered office, Unit D, De Clare

House Sir Alfred Owen Way, Pontygwindy Industrial Estate,

Caerphilly, Wales, CF83 3HU.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GIGDXLBXDGDB

(END) Dow Jones Newswires

March 31, 2022 04:21 ET (08:21 GMT)

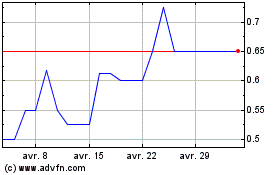

Kazera Global (LSE:KZG)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Kazera Global (LSE:KZG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024