TIDMKZG

RNS Number : 5049I

Kazera Global PLC

19 April 2022

19 April 2022

Kazera Global plc

("Kazera" or the "Company")

Diamond sales and operational update

Kazera Global plc, the AIM quoted investment company, is pleased

to announce that diamond sales of $236,547 for the December

2021/January 2022 cycle were achieved from production at Alexander

Bay, South Africa. Following a trial period of operating the

Muisvlak plant in conjunction with MV5, management have now decided

to hire a Pan Plant which will give the Company total independence

from the Muisvlak plant and will give it a much greater level of

control over the processing of its diamonds.

In Namibia, Kazera has upgraded the tantalum processing plant to

ensure that the plant can meet the Company's export expectations.

As a result, the Company expects successful production to be

imminent.

Finally, in expectation of the grant of the Heavy Mineral Sands

permit, the Company's subsidiary, Whale Head Minerals ('WHM'), has

appointed Dr Gil Mahlati and Dr Dempsey Naidoo, two highly

respected South African businessmen to its Board.

Highlights

-- Gross diamond sales from December 2021/January 2022 cycle equate to US$236,547.71.

-- A further 160 carats remain to be sold.

-- The 13 carat stone sold for US$45,938.

-- Future diamond operations are now totally independent of the Muisvlak plant.

-- 30% of future sales income is no longer payable to MV5.

-- Management have concluded that the Tantalite Valley

processing plant will not meet production targets in its current

form. The plant is being upgraded and further updates are expected

shortly.

-- The appointments of Dr Gil Mahlati and Dr Dempsey Naidoo to

the Board of Whale Head Minerals in anticipation of the grant of

the Mining Permit will greatly increase the profile of WHM locally,

as well as adding a wealth of expertise in infrastructure projects

and Heavy Mineral Sands ('HMS').

Details

Diamond Project

Gross diamond sales for the December 2021/January 2022 sales

cycle totaled US$ 236,547.71. From this amount Alexkor are entitled

to 30% as the owner of the mine and MV5 are entitled to a further

30% in terms of the Joint Venture entered into with them. A further

160 carats remain to be sold. It was expected that the Company's

previous issues with processing diamonds through the Muisvlak plant

would be resolved by the JV with MV5 referred to in previous

announcements. Despite record numbers of carats being produced,

various political factors together with the fact that MV5 received

30% of diamond sales made the project unsustainable. To resolve

this, the Company has now agreed to work with a third party who

will provide a Pan Plant, which will not only eliminate the need

for the Company to use the Muisvlak plant at all, but will also

reduce processing costs. Payment for the use of the Pan Plant will

only be made as diamonds are sold. The Company has also instituted

legal action against MV5 for payment of monies due.

In a further major development, the Company has been working

with another third party to trial a new X Ray sorting process for

diamonds. This process is now in the final stages of approval and

will give Deep Blue Minerals even greater control over its diamond

production.

Tantalum Project

In Namibia, the works undertaken by the Company's wholly owned

subsidiary, African Tantalum, in conjunction with DJ Drilling, has

led to the entire refurbishment and redesign of the plant. From

test production it is clear that the plant is in an appreciably

better condition than it has been since 2017. However, to further

ensure that it is capable of handling the tonnage now projected for

2022 and beyond, a classifier has been added to the process and the

current spirals are being refurbished. It is expected that on

completion of these the plant will have both the capacity and a

level of redundancy to enable it to meet projected demand. Water

usage remains comfortably within manageable levels.

Heavy Mineral Sands Project

As mentioned in the Company's announcement of 15 February 2022,

the Company is awaiting a ruling from the Minister of Mines in

South Africa on the one appeal received against the application for

its HMS Mining Permit. An advocate has been appointed to examine

the application and to make a recommendation to the Minister. In

the interim, Alexkor, whose CEO at the time lodged the appeal, have

appointed a new CEO, who took office on 1 April 2022. It is hoped

that he will reconsider the (to the Company and its professional

advisers) illogical and unsubstantiated appeal by his predecessor.

In the interim, and in anticipation of the Mining Permit being

granted imminently, the Company is delighted to announce the

appointment to the Board of Whale Head Minerals, Dr Gil Mahlati as

Chairman and of Dr Dempsey Naidoo as a non-executive director

(further details in Appendix (1) below).

Dennis Edmonds, Kazera Chief Executive Officer, commented:

"In South Africa, we are greatly encouraged by the words of the

President of South Africa, Mr Cyril Ramaphosa, who is actively

encouraging foreign investment into South Africa. We are also

hopeful that the new Board of Alexkor will bring a fresh and

entrepreneurial approach to the region.

Within the scope of our own operations, the last couple of

months have been frustrating for the Company, however, we are very

proud of becoming largely independent of the ability of outside

forces to influence our diamond production. It is also very

encouraging to see the developments in Namibia which will give us a

facility capable of meeting all our requirements in the very near

future.

On behalf of the Board, I am very excited to welcome Gil and

Dempsey to the Board of WHM. I have no doubt that their wisdom,

experience and local knowledge will be huge factor in making WHM

the success it deserves to be, both financially, but also in terms

of the creation of jobs and opportunities in a community which is

desperately short of both "

Appendix (1)

Dr Mahlati

Dr Mahlati trained in both South Africa and the UK as a liver

transplant surgeon. Since ceasing to practice as a surgeon he has

focused on healthcare ventures throughout Africa. He has acted as a

senior executive of a number of healthcare related businesses,

including Vuwa Investments and Enaleni Pharmaceuticals (now

Amabhubesi Healthcare). He is also currently the Chairman of

African Financial Group, which focuses on investments and advisory

services.

Dr Naidoo

Dr Naidoo is a highly qualified engineer, having worked at Anglo

American and De Beers (where he was part of the Management Team at

Namaqua Sands Mine). He is also the founder of the PD Naidoo Group,

the largest multi-disciplinary engineering consultancy in the newly

democratic South Africa. He has served on numerous boards in both

the public and private sectors in South Africa and

internationally.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No. 596/2014 ('MAR').

For further information on the Company, visit: www. kazeraglobal

.com

Kazera Global plc (c/o Camarco) Tel: +44 (0)203 757 4980

Dennis Edmonds (CEO)

finnCap (Nominated Adviser and Joint Broker) Tel: +44 (0)207 220 0500

Christopher Raggett / Tim Harper (Corporate

Finance)

Tel: +44 (0) 207 220 9797

Peterhouse Capital Limited (Joint Broker)

Duncan Vasey and Lucy Williams (Corporate

Broker)

Camarco (PR)

James Crothers / Hugo Liddy/Gordon Poole Tel: +44 (0)20 3781 8331

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFFFLLSIITLIF

(END) Dow Jones Newswires

April 19, 2022 02:01 ET (06:01 GMT)

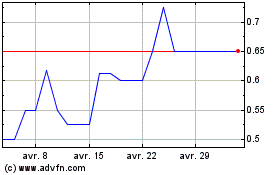

Kazera Global (LSE:KZG)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Kazera Global (LSE:KZG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024