TIDMKZG

RNS Number : 5525P

Kazera Global PLC

21 June 2022

21 June 2022

Kazera Global plc

("Kazera" or the "Company")

Acquisition of Rare Earth Elements Project in Kenya

Kazera Global plc, the AIM quoted investment company, is

delighted to announce the signature of Binding Heads of Terms for

the proposed acquisition of a 71% interest in Great Lakes Graphite

(PTY) Ltd ("Great Lakes Graphite"), which owns 100% of 3

exploration licenses covering the Homa Bay and Buru Hill Rare Earth

Elements projects (the "Project") in Kenya.

This is in accordance with the Company's investing policy to

achieve shareholder returns through direct investments in companies

and accretive projects in Africa within the mining and resource

sectors.

Transaction Highlights

-- Acquisition of controlling interest in the Homa Bay and Buru

Hill exploration licenses in Kenya which comprises of Rare Earth

Element exploration opportunities

o Rare Earth Elements are a major constituent material in the

manufacturing of magnets which are used for electronic vehicles and

turbines

-- New country entry, in an area of significant local and

national infrastructure, supported by a new, progressive Mining Act

and fast-growing exploration and mining presence

-- Two initial exploration targets:

o Buru Hill's PL305 license, which has a previous JORC compliant

exploration target of 27Mt @1.89% grade for 510Kt Total Rare Earth

elements ("TREO's") and;

o Kuge area, PL303 licence, which has demonstrated extensive

zones of elevated Light Rare Earth Elements within drilling along a

strike length of 500m

-- At-surface mineralisation presents highly favourable conditions for economic recovery

-- JORC Compliant Resource and Scoping Study expected within 6 months

-- Planned, low-impact work programme to progress licences to

the granting of a Definitive Feasibility study for a cost of up to

US$2.5m, funded via future cash flows

-- Historic detailed data estimates approximately 65,000 tonnes

of Ce, 52,000 tonnes of Lanthanum and 18,000 tonnes of Nd from an

assumed low recovery rate of 50% of the top 50m layer of the

resource

-- Terms of the acquisition are found below

Dennis Edmonds, Chief Executive Officer of Kazera commented:

"At Kazera, we are continually looking at new and exciting

opportunities to deliver shareholder value both through operational

delivery, but also through accretive acquisitions. The acquisition

of a 71% interest in Great Lakes Graphite, gives the Company a

unique exposure to three highly exciting exploration licenses which

have demonstrable potential for economic delivery of some of the

most important materials for the 21 (st) century.

"With our diamond operation already in production, tantalum

about to come on stream and the expected imminent resolution of the

issues around our HMS licence, the Company will soon have three

separate revenue streams. This acquisition represents an exciting

new opportunity for our Company to utilise its increasing cash flow

to deliver material growth and a step change in outlook for our

shareholders."

Rationale and Background to the Acquisition

Kenya is a stable country with an established infrastructure.

Great Lakes Graphite own 3 licences in near proximity to each other

in Kenya, covering a total area of 346 square kilometres. The

majority of historical work has only been done in one licence area,

Buru Hills, which has a JORC compliant exploration target of 27Mt

at a grade of 1.89% Total Rare Earth Elements. The licence areas

are all near established rail and road transport links and

proximate to large towns.

Establishing a JORC compliant Resource and Scoping Study will

only take approximately 6 months and will require a detailed survey

as well as resampling of the core samples and revised modelling to

calculate revised tonnages and grades. We anticipate having a

Definitive Feasibility Study in hand within 24-30 months. Extensive

historical work has been already been undertaken and a vast amount

of information on the project already exists.

Transaction Details

As per the terms of the acquisition, Kazera will acquire a 71%

interest in Great Lakes Graphite. The acquisition is for in

aggregate GBP750,000 to be paid for in three stages with all

consideration to be satisfied by the issuance of shares in Kazera

to the vendors. Completion of the various stages of the planned

work programme are as follows:

-- First tranche, of GBP250,000 at 1.5p per share, locked in for one year.

-- Second Tranche, of GBP250,000 at completion of the Definitive

Feasibility Study ("DFS"), at the lower of 2.5p per share or the 10

days VWAP preceding the DFS RNS announcement, also locked in for

one year.

-- Third Tranche, of GBP250,000 on initial ore production at the

lower of 2.5p per share or the 10 days VWAP preceding the RNS

announcement of initial production. No share lock in.

Identified exploration milestones will be funded by Kazera and

will lead to completion of a DFS and facilitate the granting of a

Mining License over the project. Cumulatively, these technical

milestones are expected to cost up to US$2.5m and will be funded

through the Company's cash flows. Completion of all milestones is

expected to take 24-30 months.

As part of the transaction, Kazera will also grant an option to

Caracal Investments Limited ("CI") to acquire 20% of Great Lakes

Graphite Pty Ltd for the sum of $1m. This option period will run

for 18 months from the period of execution. Assuming the exercise

of the option the shareholding of Great Lakes Graphite will be 51%

Kazera, 20% CI and 29% current shareholders.

If CI elect to not exercise the option, the current shareholders

in Great Lakes Graphite can take over the option on the same

terms.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No. 596/2014 ('MAR').

For further information on the Company, visit: www. kazeraglobal

.com

Kazera Global plc (c/o Camarco) Tel: +44 (0)203 757 4980

Dennis Edmonds (CEO)

finnCap (Nominated Adviser and Tel: +44 (0)207 220 0500

Joint Broker)

Christopher Raggett / Tim Harper

(Corporate Finance) Tel: +44 (0) 207 220 9797

Peterhouse Capital Limited (Joint

Broker)

Duncan Vasey and Lucy Williams (Corporate

Broker)

Camarco (PR)

James Crothers / Hugo Liddy / Gordon Tel: +44 (0)20 3781 8331

Poole

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFMMPTMTTTBLT

(END) Dow Jones Newswires

June 21, 2022 02:00 ET (06:00 GMT)

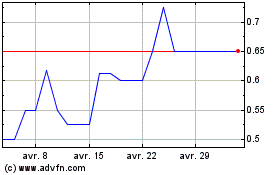

Kazera Global (LSE:KZG)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Kazera Global (LSE:KZG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024