TIDMKZG

RNS Number : 9926T

Kazera Global PLC

28 July 2022

Kazera Global plc

("Kazera" or the "Company")

Favourable Walviskop Mining Permit Decision

Kazera Global plc, the AIM quoted investment company, is pleased

to advise that the Department of Mining and Mineral Resources has

dismissed a third party's appeal against the grant of a mining

permit to the Company's 60% owned subsidiary Whale Head Minerals

(Pty)Ltd ("WHM"). WHM now expects to shortly receive final

documentation allowing it to commence production operations of

heavy mineral sands ("HMS") at the Walviskop mine in South

Africa.

Ore production from the JORC compliant resource at the Walviskop

mine is expected to generate positive cashflow from operations

within six months of receipt of the Mining Permit being granted

over a 5Ha beach sand deposit at Walviskop. Walviskop sits within

the diamond mining operations of the Company's other South African

subsidiary, Deep Blue Minerals.

Highlights

-- The Company expects to produce circa 6,000 tons of HMS per

month, achieving an estimated gross profit of in excess of US$

300,000 per month (based on current prices), within six months of

the Mining Permit being granted.

-- The Mining Permit gives WHM the right to mine a 5Ha beach sand deposit at Walviskop with:

o JORC Indicated Mineral Resource of 3.11 million tons of

Valuable Heavy Minerals at a grade of 61.2%

o Predominant Valuable Heavy Minerals are Garnet (30.29% Run of

Mine ("ROM")) and Ilmenite (27.54% ROM).

o Also present are Zircon and Rutile which have not been

included in the modelling.

o Independent NPV of approximately GBP150 million (applying a

20% discount rate) based on current FX rates.

-- Potential partners have already been identified to build the Walviskop processing plant.

-- WHM has applied for a prospecting right over an adjacent

beach which appears to share similar characteristics to Walviskop

and which is approximately 34 times larger.

-- Start up costs of the Walviskop mine are anticipated to be

covered by cash flows from Kazera's Alexander Bay Diamond Mine in

South Africa and Tantalum Valley Mine in Namibia.

Background on HMS Deposits

The opportunities represented by the HMS deposits in the

vicinity of Alexander Bay/Port Nolloth were recognized as early as

2016. Previous access to these deposits had been made difficult by

their location within the highly protected diamond mining areas on

the West Coast. These HMS deposits contain substantial diamond

deposits which means that HMS miners cannot obtain permission to

mine them. However, conversely, the density of the HMS makes it

prohibitively expensive for diamond miners to extract diamonds.

With Deep Blue, a Kazera subsidiary, having the right to mine

diamonds and Whale Head holding the rights to mine HMS, the Company

has overcome these issues. Further efficiencies will also be gained

in the mining process during the first stage in the separation

process as the gravel (containing diamonds) is separated from the

sand (containing Valuable Heavy Minerals).

The Company also expects that the 5-year Life of Mine of the 5

Ha deposit will be considerably enhanced due to the effect of wave

action redepositing HMS on the mined areas. This wave action should

also ensure that rehabilitation is constantly carried out.

Forward Strategy

The Mining Permit gives WHM the right to mine a 5 Ha deposit.

This will give the company a 5-year period to mine the deposit,

with the possibility of further extensions. The project has been

assessed by Creo Design (Pty) Ltd an independent third party who

has concluded that it contains a JORC compliant Indicated Mineral

Resource of 3.11 million tons at a zero-cut-off grade of 61.2%

valuable Heavy Minerals. Of these, Garnet (30.29% ROM) and Ilmenite

(27.54% ROM) predominate, with some Zircon (1.2% ROM) and some

Rutile (0.92% ROM). The latter two minerals have been excluded for

modelling purposes due to the negligible contribution and high

capital cost to separate.

The Company anticipates, within 6 months of the grant of the

Mining Permit, generating 6,000 tons of HMS per month with an

expected gross profit of in excess of US$ 300,000 per month. WHM

have also applied for a Prospecting Right over the adjacent beach

which will allow up to 5 years to conduct exploration although the

intention is to apply for Mining Rights over both properties within

a much shorter time frame.

Simultaneously, discussions have already commenced with

independent third parties to build and operate a plant at their own

cost to separate out the various component minerals, which will

considerably increase profitability to WHM without increasing

overhead. Prior to that, unseparated material will be sold in

bulk.

In addition, and, as a by-product of the HMS operation, Deep

Blue Minerals now expects to generate around 300 ct per month of

additional diamond production from the HMS operation - this being

incremental production to complement our existing diamond

operations. Beach diamonds tend to be larger and higher quality

than those found inland and so it is expected that these diamonds

will attract a premium at auction. Inland diamonds typically

attract prices of circa US$ 250 per carat, whereas the Company

confidently expects these diamonds to exceed a price of US$ 750 per

carat.

Dennis Edmonds, Kazera Chief Executive Officer, commented:

"This has been an incredible week for Kazera. We have been

anticipating being granted the right to mine Walviskop since

January of this year and to receive this news within a week of us

concluding the Lithium investment announced last week is great

timing.

The rejection of the Appeal reflects our previously expressed

confidence that the correct procedures had been followed by the

Department in initially approving the Mining Permit."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No. 596/2014 ('MAR'). Investor

Presentation.

For further information on the Company, visit: www. kazeraglobal

.com

Kazera Global plc (c/o Camarco) Tel: +44 (0)203 757 4980

Dennis Edmonds (CEO)

finnCap (Nominated Adviser and Joint Broker) Tel: +44 (0)207 220 0500

Christopher Raggett / Tim Harper (Corporate

Finance) Tel: +44 (0) 207 220 9797

Peterhouse Capital Limited (Joint Broker)

Duncan Vasey and Lucy Williams (Corporate

Broker)

Camarco (PR) Tel: +44 (0)20 3781 8331

Gordon Poole / James Crothers / Hugo Liddy

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCRRMRTMTBTBFT

(END) Dow Jones Newswires

July 28, 2022 02:00 ET (06:00 GMT)

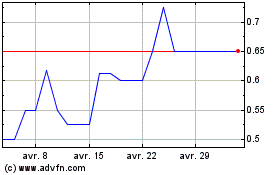

Kazera Global (LSE:KZG)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Kazera Global (LSE:KZG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024