TIDMMEX

RNS Number : 8743H

Tortilla Mexican Grill PLC

11 April 2022

11 April 2022

Tortilla Mexican Grill plc

("Tortilla", the "Group" or the "Company")

Audited Annual Results for the 52 week period ended 2 January

2022

Publication of Annual Report & Accounts and Notice of Annual

General Meeting

Tortilla wraps up first year with record results

Tortilla Mexican Grill plc ("Tortilla"), the largest and most

successful fast-casual Mexican restaurant group in the UK, is

pleased to announce its Annual Results for the financial period

ended 2 January 2022 ("the Period").

Financial highlights

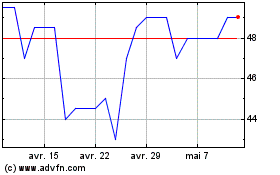

-- Transformational year: revenues increased 79.5 percent to a

record GBP48.1m (2020: GBP26.8m, 2019: GBP35.4m)

-- Achieved in spite of Covid-19 related site closures and

restrictions, and due to strong performance

across the existing estate and addition of new sites

-- Like-for-like (LFL) revenue increased 23.8% compared with 2019

-- Adjusted EBITDA (pre-IFRS 16) increased 262.5% to GBP8.7m (2020: GBP2.4m, 2019: GBP2.5m)

-- Strong balance sheet, with net cash of GBP6.7m at the period

end, supports ability to self-fund roll out plans

Operational highlights

-- Continued progress in the delivery of accelerated UK

restaurant roll out, with seven new sites added to the estate

during the Period, bringing the total number of sites at the period

end to 64

o Three company-run sites opened in Edinburgh, Windsor and

Exeter

o Three new delivery kitchens opened, supporting fast-growing

delivery proposition (bringing the total to five at the period

end)

o Launch of new partnership with Merlin Entertainments to open

at Chessington World of Adventures

-- Expansion of existing partnership with SSP to open two

further sites at Gatwick Airport and Leeds Skelton Services

Current trading & outlook

-- Strong trading momentum delivered in the Period has continued

into 2022, with LFL growth of 20.1% year to date, in line with

expectations

-- One new site opened in Q1 2022, one in April and at least

seven further site openings planned, underpinning the Board's

confidence in delivering the Group's target of 45 openings by the

end of 2026

-- Successful launch of franchise partnership with Compass Group

PLC - four locations now trading with plans to open at least 10

more over the next five years

-- Well-positioned to navigate macroeconomic pressures,

supported by strong brand, value-for-money proposition and flexible

operating model

-- Very strong platform for continued growth and strategic progress

Richard Morris, Chief Executive Officer of Tortilla,

commented:

"Capping off a transformational year for Tortilla, we are very

pleased to announce a record financial performance for the Group's

maiden Annual Results following its successful IPO in October

2021.

"During the year we made excellent progress in delivery of our

long-term growth strategy. We opened further sites in line with our

UK roll out plans, expanded our delivery kitchen estate to fulfil

growing customer demand, and both extended and launched franchise

partnerships which introduced the Tortilla brand to even more

customers across the UK. I would like to take this opportunity to

thank our teams both in the UK and internationally for their

commitment and hard work during the year.

"This strong financial and operational momentum has continued

into 2022 and underpinned by our flexible model, value-for-money

offer and clear long-term growth strategy, we are very excited to

capitalise on the growth opportunities presented by the

post-pandemic landscape. We remain confident of delivering our

exciting plans for Tortilla to the benefit of all

stakeholders."

Publication of Annual Report & Accounts and Notice of Annual

General Meeting

Tortilla Mexican Grill plc will publish later today its annual

report and accounts for the financial year ended 2 January 2022

(the "Annual Report"), including the Notice of Annual General

Meeting. These documents shall be available today on the Company's

website.

The Company's Annual General Meeting will be held on 15 June

2022 at 9:30am at the offices of Liberum Capital Limited, 25

Ropemaker Street, London, EC2Y 9LY.

ENQUIRIES

Tortilla Mexican Grill PLC Via Hudson Sandler

Emma Woods, Non-Executive Chair

Richard Morris, CEO

Andy Naylor, CFO

Liberum Capital Limited (Nominated Adviser, Tel: 020 3100 2222

Sole Broker)

Andrew Godber

Edward Thomas

Christopher Whitaker

Nikhil Varghese

Hudson Sandler (Public Relations) Tel: 020 7796 4133

Alex Brennan tortilla@hudsonsandler.com

Wendy Baker

Lucy Wollam

Charlotte Cobb

For further information , visit tortillagroup.co.uk

NOTES TO EDITORS

About Tortilla Mexican Grill plc

Tortilla is the largest and most successful fast-casual Mexican

restaurant group in the UK specialising in the sale of freshly made

Californian-inspired Mexican cuisine. The Group had 68 sites

worldwide as of 31 March 2022, comprising 52 sites in the UK

operated by the Group, three sites franchised to SSP Group in the

UK, four sites franchised to Compass Group UK & Ireland and

nine franchised sites in the Middle East.

The Group was founded in 2007 by Brandon Stephens, originally

from California who, upon his arrival in London in 2003, found it

difficult to satisfy his desire for quality burritos and tacos. As

a result, Brandon established Tortilla with a mission of offering

customers freshly prepared, customisable, and authentic

Californian-inspired Mexican food.

The brand is synonymous with an energetic, vibrant culture, and

with providing a great value-for-money proposition. It embraces

fast-growing sector trends (including eating out, healthy eating,

provenance, ethnic cuisine, delivery) across a variety of

locations, through a differentiated product offering which is

popular with a broad customer base, and a clearly defined

multi-channel marketing strategy. It benefits from flexible site

locations and formats, and a scalable central infrastructure.

CHAIR'S STATEMENT

I am delighted to be writing to you after six months of Tortilla

being a public company, through which time we have continued to

trade strongly.

Looking back at 2021, it was a year, like 2020, where the Group

showed its versatility and ability to be flexible during the

pandemic. It began with three months of national lockdown as the

country dealt with the new Delta variant. It then ended with the

arrival of yet another variant, Omicron, resulting in government

instructions to work from home and to think strongly about

socialising, which naturally suppressed eating out in the run up to

Christmas.

Covid-19 paradoxically became an opportunity for Tortilla. We

knew we had a strong delivery product and during the lockdown

periods we introduced the brand to new customers via delivery,

which in turn then saw them return to eat in our stores when we

were allowed to open fully.

Managing the stop-start nature of last year was also a test for

the ambition and resilience of the Tortilla Management team, a test

they passed with flying colours. The fact that, on top of this,

they also successfully managed the significant work of a listing

process (arriving on the Alternative Investment Market ("AIM") in

early October) is testament to the quality and ambition of the

Executive Directors Richard Morris, our CEO, and Andy Naylor, our

CFO. I have enjoyed getting to know them, and understanding this

great business better, over the last six months.

The Tortilla investment case - from 50 to 200, and creating a

national brand

The Tortilla brand was conceived by Brandon Stephens in 2007

when he arrived in London to study and struggled to find anywhere

to eat the freshly made burritos he ate when growing up in the

Mission District in San Francisco. At the time that he founded the

business, the UK consumer was a bit sceptical about the quality of

Mexican food and needed educating.

Fifteen years later we have a proven model, operating across 64

sites, and customers are increasingly favouring our food-type and

brand. We always have queues when opening new restaurants which

highlights the wide appeal of our offer. The current property

market is giving us access to a very strong pipeline of new sites

and we are confident of opening at least 45 locations over the next

five years.

The product is still made fresh and our central production

kitchen allows us to ensure the quality and consistency of sauces

and recipes. Given how well the product travels on delivery (not

all restaurant food does) this is now a major and growing sales

channel within the business. To date we have opened five

delivery-only kitchens and plan to open circa three to four more

per year going forward.

Finally, the business was early to test franchising, with ten

sites established across the Middle East in the United Arab

Emirates and Saudi Arabia, through a partnership with Eathos.

Tortilla has gained confidence in its franchising systems and has

extended its franchisee partners to SSP and then Compass, in the

UK. This ability to franchise clearly gives us further growth

opportunities in unchartered locations to supplement our own

expansion.

For me, as chair, what excites me about Tortilla is the headroom

for growth - with clear customer white space and the proven

flexibility of how the Tortilla brand can present itself to

customers.

Our new Board of Directors

Prior to the IPO, the Board benefitted from the experience of

Paul Campbell and Aarish Patel, both industry veterans and Tortilla

fans. I would like to thank them for all the advice they have given

me in taking the reins. However, I am very pleased to say that the

Board retains the institutional memory of the past and has both

Brandon Stephens, the founder, still playing an active role as

Founder Director and Loeïz Lagadec, a Quilvest partner, as Board

members. In terms of new experience, alongside myself (former CEO

of Wagamama) we are delighted to have Laurence Keen, CFO of

Hollywood Bowl plc; Laurence was part of the management team that

floated Hollywood Bowl over five years ago and, along with his

experience in the hospitality sector, has some invaluable insights

as we mature as a public company.

Challenges ahead

I anticipate you will have read about the set of challenges

facing our sector: from energy and cost of goods inflation to

labour shortages. Tortilla will not be immune to these, no business

will. However, I want to assure you that the calibre of the

Management team as well as the operational simplicity and

flexibility of the offer, mean that we are much better placed than

many to navigate these. We also suspect the ongoing economic

conditions will see customers turn to brands they trust which are

also great value for money, which should play into our Tortilla

sweet spot.

I expect 2022 to be an immensely exciting year in the evolution

of the business and the brand, with opportunities outweighing the

challenges. Expansion prospects arising from the favourable

property market alongside our partnerships with SSP and Compass,

provide a fantastic opportunity to take this business to the next

level.

Emma Woods

Chair

11 April 2022

CHIEF EXECUTIVE OFFICER'S STATEMENT

2021 was a year of great achievements for Tortilla, during which

we delivered record sales and profits, significant strategic

progress and celebrated the exciting milestone of becoming a public

company, which we believe will support our ability to further

capitalise on significant long-term growth opportunities in the

post-Covid-19 casual dining landscape.

The business has shown itself to be extraordinarily well

positioned throughout the pandemic. The Tortilla product

proposition is well-suited to the growing delivery market, and we

have proven the brand's flexibility to operate across a range of

locations and formats, including smaller sites and delivery-only

kitchens. As we continue to navigate Covid-19 and the current

inflationary context, I remain incredibly proud of the way Tortilla

has risen to the challenge. Our strong performance during this time

showcases the true value of the Group's flexibility, and our

ability to adapt, and indeed thrive, in difficult

circumstances.

In addition to delivering strong revenue growth of nearly 80%,

we were pleased to achieve progress on several strategic

objectives, including the launch and development of various

partnerships, and growing our estate of delivery kitchens and

traditional bricks and mortar locations.

Responding to Covid-19

Tortilla's success over the pandemic has been rooted in our

business model. By adjusting our operations several times during

this period, we were able to maximise sales across eat-in, takeaway

and delivery channels, resulting in only minimal temporary closures

- in great contrast to the numerous permanent closures across the

industry. Through our re-opening strategy, which optimised

locations in residential areas, we were able to flex according to

the changing trends, meeting new demand from those working from

home and turning this circumstance to our benefit.

Aware of the importance of consistent engagement with our

customers, we maintained our public presence through social media,

mirroring our customers' increased online activity and ensuring our

brand remained relevant and appealing. Equally critical was our

relationship with our employees. To counteract the uncertain

climate, we ensured regular communication and updates to support

and retain our team - crucial during the current staff shortages in

hospitality.

Alongside the wider hospitality industry and many other sectors,

the Group received financial government support which enabled us to

protect our financial position and avoid redundancies. However,

while many businesses restructured using company voluntary

arrangements ("CVAs") and other methods, Tortilla engaged in active

negotiations with landlords, maintaining our positive relationships

on a fair basis as the UK economy recovers.

Opportunities ahead

As we move forward, we're excited to capitalise on growth

opportunities the post-pandemic landscape presents. As rent levels

rebalance, we are accelerating our UK strategy, building on the

success of delivery-only kitchens and targeting further franchising

and licencing opportunities across a variety of venues looking to

add high street brands to their offer.

Our strategy comprises the following key growth pillars, against

each of which I am delighted to report that we delivered strong

progress during 2021:

UK roll-out

The primary objective of the Group's growth strategy is to

accelerate its UK presence, with 45 new sites targeted in the UK in

the next five years. We continue to believe that, due to the

Covid-19 pandemic and the consequent negative impact on the wider

hospitality industry and commercial property market, an exceptional

opportunity exists for the Group to secure favourable rental rates

and incentive packages and that the Group is well positioned to

capitalise on this.

In 2021, we opened three "bricks and mortar" stores (Edinburgh,

Windsor and Exeter) and we remain confident of opening ten sites in

2022 given our openings so far this year and upcoming pipeline.

Over the coming years we intend to expand further, seeking

opportunities of increased availability of former retail units and

lower post-pandemic rents.

Franchising and partnerships

To support our site expansion, we see exciting opportunities to

enter into franchise agreements that offer capital-light growth

opportunities into new areas for the brand. During 2021 we launched

a partnership with Merlin Entertainments to open at Chessington

World of Adventures, and we opened two further sites in partnership

with SSP at Gatwick Airport and Leeds Skelton Lakes motorway

services, taking our total number of sites with SSP to three.

We also commenced a trial with Compass to franchise the Tortilla

brand in higher education UK campuses and, as of the end of

February 2022, there are four locations trading (Brunel, Swansea,

Middlesex and Sussex). This is part of a partnership expected to

yield a further ten locations over a five-year period.

These additional partnerships, on top of our own store rollout,

are possible due to our flexible business model. The simplicity of

the fresh food and our simple kitchen setup enable the brand to

explore alternative locations which are out of reach of many of our

competitors.

Delivery-only kitchens

Tortilla's product proposition has been proven to be highly

suitable for home delivery. As well as leveraging our growing site

portfolio, we see an exciting opportunity to open selective

delivery-only kitchens. These enable us to extend the reach of our

delivery service, as well as enabling us to introduce the Tortilla

brand to new customers ahead of potentially opening a restaurant in

a new area.

During the year we opened three such kitchens (Balham,

Manchester and Brent Cross), taking the total to five and see the

opportunity to open a further three to four sites per year over the

medium term.

International

Tortilla is already the largest fast-casual Mexican chain in the

UK and Europe. With the popularity of burritos and tacos growing

worldwide with successful chains across Europe, Asia, the Middle

East and Australia, there is an opportunity for the Group to

establish a broader presence internationally. The Group is

exploring the opportunity to expand into Europe in the mid-term.

During the year, the Group successfully traded from 10 sites

operated in the Middle East by Eathos Ltd, as franchisees.

People, values, and culture

Past, present and future - Tortilla's people, values and culture

are the foundation of our success. By hiring the best people at all

levels, we maintain an inclusive culture where values such as

kindness, humility and integrity are of equal importance as

education, experience and skills.

We continue to embrace and encourage diversity throughout our

recruitment practice, and our workforce is now 48 percent

non-British national, with more than half management roles carried

out by women. With under 25-year-olds forming more than 50 percent

of our workforce, we believe in nurturing young talent through

training, career development and ongoing support of government

initiatives to help young people into work. Indeed, all staff

benefit from clear development plans including Manager in Training

programmes, accredited qualifications, industry specific

apprenticeships and online training, and we continue working to

fill at least half of our management roles with internal

candidates.

We understand that motivated and inspired staff do the best work

and have continued innovating to ensure our workforce is supported

and engaged. We encourage work-life balance for all our employees,

pay competitive salaries with hourly rates above the national

minimum and living wage thresholds, and promote health and

wellbeing through our free employee assistance programme. As well

as regular staff socials and recognition through awards, teams are

incentivised for outstanding sales performance and service. One

such incentive includes a team day out for the restaurant team with

the best customer feedback, for which our Head Office run the

restaurant for the day - quite a challenge for us...!

Our annual assessment of staff engagement gathers insight both

in-store and at our head office, and this year suggested that our

teams were happy with the way the company communicated and handled

the pandemic, leading to an overall score of 90 percent

satisfaction.

Moving forward

As we write this, the global economic and political situation

remains difficult, which will test us all, but we also know that

Tortilla is a resilient, dynamic enterprise, and generally in a

better place than most of our competitors to deal with economic

downturns. This report details the strategy and results achieved

against the odds and presents the Tortilla Group as a leading light

in the future of the hospitality sector.

We're very excited to capitalise on growth opportunities the

post-pandemic landscape presents. As rent levels rebalance, we are

accelerating our UK strategy, building on the success of

delivery-only kitchens and targeting further franchising and

licencing opportunities across a variety of venues.

Richard Morris

Chief Executive Officer

11 April 2022

KEY STRENGTHS

Through continuous innovation, we work hard to maintain high

standards in all aspects of business. Over the past few years, the

following elements have proven areas of particular strength.

Our products

Tortilla has developed a great reputation for its freshly

prepared, customisable, value-for-money product range of burritos,

tacos and salads. This has enabled us to appeal to a wide

demographic, maintaining our loyal customer base and generating

further customers as we grow. Our defining characteristics also

align with forecasted consumer trends and preferences, providing a

positive outlook for the future.

By offering great value-for-money, we have successfully expanded

operations across the UK, and are able to charge a minor delivery

premium (to address delivery commission costs) while remaining

highly competitive.

Embracing sector trends

The Tortilla Group observes and embraces key consumer trends,

flexing our products, services and formats to capitalise on growing

demand and maintain relevance in a rapidly changing market. Our

offering thus adheres to the dominant demands driving our sector,

which include:

-- Healthy eating - packed with rice, beans, vegetables and

plant-based options, our menu suits those seeking healthy

fast-casual food

-- Fresh and high provenance - our freshly prepared food is from

high quality, responsible sources communicated with full

transparency to the consumer

-- Convenience - Tortilla food is available in-store, via

takeaway or delivery, ensuring maximum options for optimum

convenience, and reaching more customers than ever before via our

widespread delivery-only kitchens

-- Customisation - a wide range of options enable customers to

tailor their Tortilla meal to their preferences and dietary

requirements

-- Ethnic food - Tortilla's authentic Mexican style food caters

to consumers' growing interest in ethnic food

Flexible business model

Much of the Group's success, during the pandemic and beyond, can

be attributed to our ability to adapt, flexing our business model

quickly and effectively to suit circumstances and locations.

Our flexibility is driven by three key factors of our business

model:

-- Trading strength over eat-in, takeaway and delivery channels

-- Ability to trade in small units and without extraction

-- Value-for-money offering that appeals to diverse customers

including students, local residents and office workers

In contrast to similar fast-casual restaurant businesses,

Tortilla has achieved significant geographical spread throughout

the UK - in terms of both presence and sales. Almost half our

estate and five of our top ten selling stores are located outside

of London, covering a wide range of sites including shopping

centres, high streets, residential areas, theme parks,

delivery-only kitchens and transport hubs. We are adept at scouting

and identifying the best format for new locations.

Moreover, our scalable central infrastructure, currently a 5,500

square foot Central Production Unit ("CPU") in Tottenham Hale,

provides cost advantages over our direct competitors, the

flexibility to increase its size in tandem with our growth strategy

and the assurance that product quality remains consistent across

all sites.

Marketing strategy

Through our clearly defined multi-channel marketing strategy,

the Group has built and maintained a loyal and diverse customer

base.

Our national campaigns run throughout the year with special

promotions for seasonal products and recipes across print, online

and social media, alongside targeted regional marketing for new

site launches.

With a large proportion of customers in the younger age

demographic (aged 16-34), we achieve significant engagement via

social media and our vast influencer network who drive widespread

engagement across the most popular social media platforms. Last

year saw the launch of our Tik Tok channel, sharing bite-size

videos reaching millions of views.

Strong leadership

Tortilla's senior Management team continues to excel in its

ability to deliver strong and sustainable growth. Under the

stewardship of an experienced Board of Directors, our team has

continued to execute Tortilla's growth strategy effectively, taking

full advantages of opportunities as they arose and conducting all

activity with kindness, integrity and ownership.

We focus on hiring the best people at all levels and work hard

to propagate our strong culture and values throughout the

organisation.

Our Board and senior Management team regularly visit stores and

speak with teams and guests to ensure a strong connection between

corporate objectives and on-the-ground practice.

Cost effective hiring model

The simplicity of Tortilla food means that recipes and methods

are straightforward, and managers can train those with limited

experience to high levels of competency within a short time period.

We can therefore focus on hiring those with the values and

behaviour we seek, enabling us to maintain our culture and avoid

the negative impact of the UK's chef shortage.

This also helps us to hire from within our stores' local

communities, reducing travel time and cost for employees. All

stores strive to get to know their customers on first name terms as

part of the 'Raving Fans' initiative, and by creating this

'independent' feel to each restaurant, we gain a further

competitive advantage.

Property portfolio and strategy

At the end of 2021, the Group had 64 sites worldwide: 51 UK

sites we operate ourselves, three UK sites franchised to SSP, and

ten franchised sites in the Middle East. The Group's property

portfolio is entirely leasehold.

Within the UK, the Group's portfolio of sites is well

diversified with respect to locations, with 29 sites within the M25

area and 22 sites outside of it. Five of Tortilla's top ten stores

(by profit) are located outside of the M25. As customers of

fast-casual operators tend to be primarily impulsive purchasers (65

percent of our customers visit on impulse), sourcing locations with

high footfall is a critical part of boosting brand awareness and

generating sales.

Tortilla's property portfolio

The Group's success is driven by our proven property strategy

with flexibility across site locations and formats. We generally

target locations ranging from 60 square metres to 200 square

metres, with the exception of our delivery-only kitchen sites,

which operate in typically 25-35 square metre sites. The estimated

capital expenditure per site (excluding delivery-only kitchens)

ranges from GBP250,000 to GBP425,000 depending on the size of the

unit, site condition and store front requirements.

The Group aims for a 35 percent minimum target investment hurdle

for its return on capital employed. Our sites are primarily located

in high street areas, residential locations, shopping centres and

transport hubs as these high footfall locations provide seven-day

trade with lunch and dinner availability, helping the brand appeal

to a wider range of consumers and trade throughout the day.

New sites

New sites have historically been a core driver of Tortilla's

development. Tortilla opened eight sites in 2014, and five/six

sites per year in 2015, 2016 and 2019, but slowed this rollout in

2017 and 2018 as rents did not provide the necessary value at that

time. Understandably, site openings slowed in 2020 but we

accelerated our pipeline by opening seven sites in 2021 (four

bricks and mortar and three delivery kitchens) along with two new

SSP franchise units.

New sites will continue to play a key role in our targeted

growth trajectory. Tortilla has a specialised property team that

supports our growth with a rigorous new site process including site

selection, assessment, contract negotiation and fitting. By opening

new sites on a regular basis, we have a well-established, reliable

infrastructure in place to manage the roll-out as required. We also

have a dedicated operations team that relocates to new sites to

ensure that new staff are adequately trained and are supervised

appropriately before they manage the site themselves.

As the number of sites within the Group's portfolio increases,

Tortilla will benefit from an expanding base of senior employees

familiar with these processes, and a larger regional management

infrastructure to support new site openings. The Group aims to open

a further 45 sites in the next five years including traditional

sites, delivery-only kitchens and smaller sites which focus more on

delivery/takeaway. In 2019 a Deloitte Whitespace Report confirmed

over 120 additional UK sites met the Group's ideal location

criteria.

CHIEF FINANCIAL OFFICER'S REVIEW

Group financial KPI summary

2021 2020 Change

--------- ---------- ------------

Revenue GBP48.1m GBP26.8m + 79.5%

Gross profit margin 79.6% 77.4% + 2.2% pts

Administrative expenses GBP36.5m GBP24.7m + 47.8%

Net profit/(loss) after tax GBP1.4m (GBP1.7m) + 182.4%

Cash generated from operations GBP11.7m GBP4.2m + 178.6%

Alternative performance measures ("APMs")

LFL revenue growth (vs 2019)(1) 23.8% 0.0% + 23.8% pts

Adjusted

EBITDA

(pre

-IFRS +

16)(2) GBP8.7m GBP2.4m 262.5%

Net

cash/(debt) +

(pre-IFRS-16)(3) GBP6.7m (GBP2.3m) 391.3%

--------- ---------- ------------

(1) defined as the percentage change in like-for-like sales

compared to 2019 and so it excludes periods of non-trading

(2) defined as statutory operating profit before interest, tax,

depreciation and amortisation (before application of IFRS 16 and

excluding exceptional costs) and reflects the underlying trade of

the Group. The reconciliation to profit from operations is set out

below in this section of the report.

(3) defined as cash and cash equivalents less gross debt.

Calculated on a pre-IFRS 16 basis and so does not include lease

liabilities.

Last year was transformational for the Group, with record

profits and a successful admission to AIM on Friday 8(th) October.

To say we are pleased with our year, considering the backdrop of

the pandemic, would be an understatement and we remain excited

about our future.

Revenues

Much like the prior year, 2021 was defined by the pandemic with

revenues in Q1 2021 particularly impacted by the lockdowns imposed

by the UK Government. Despite this challenge, revenue increased to

GBP48.1m which represents an increase of 79.5 percent compared to

2020. This was achieved through strong performance of the existing

estate and the addition of seven new restaurants (three of which

were delivery-only kitchens). The existing estate performed very

strongly, achieving LFL sales growth of 23.8 percent compared to

the pre-pandemic levels of 2019 (excluding Q1, this LFL sales

growth increases to 30.3 percent).

In 2021, 285 trading weeks (11% of the total possible) were lost

across the estate due to store closures arising because of the

pandemic. We remain optimistic that the trading conditions in 2022

will be better due to the easing of restrictions and improved

immunity from the pandemic.

The Group performs well across all store formats and throughout

the UK. Incredibly, in spite of the challenges the pandemic

presented us with, 73 percent of stores achieved a record sales

week in 2021 and the profitability levels inside and outside of the

M25 remain comparable (average Store Adjusted EBITDA of GBP350k and

GBP300k respectively). This provides us with confidence over the

ability of the Group to continue the rollout to all corners of the

UK.

Gross profit margin

The Group achieved a record gross profit margin in 2021 of 79.6

percent (2020: 77.4 percent). This increase was driven by several

factors:

(1) an increased proportion of sales via the delivery channel

(delivered products are charged at a slightly higher price to cover

commission costs and these are reported as administrative

expenses);

(2) effective pricing negotiations with suppliers;

(3) improved efficiency at a store level to minimise waste and other losses; and

(4) the benefit of a reduction rate of VAT on some of the

Group's products (reduced from 20 percent to 5 percent until 30

September 2021 and then 12.5 percent for the remainder of the

year).

Administrative expenses

Under application of IFRS 16, administrative expenses exclude

property rents (except for turnover rent) but incorporate the

depreciation of right-of-use assets however in both 2020 and 2021,

these two factors largely offset.

Administrative costs increased by 47.8 percent year-on-year to

GBP36.5m with this being driven by the increased level of trade in

2021 as the restaurants were closed for a longer period during 2020

than 2021. In both years, the Group utilised the available

government support during periods of closure via the Coronavirus

Job Retention Scheme ("CJRS").

Administrative expenses also incorporate exceptional items which

increased to GBP1.9m in 2021 (2020: 0.3m). The GBP1.6m increase is

attributable to costs incurred for the Group's IPO with a further

GBP0.5m of IPO cost incurred relating to the issuing of new shares

(recorded as a deduction in share premium). This apportionment

between exceptional items and share premium has been undertaken in

accordance with IAS 32.

As a percentage of revenue, administrative expenses decreased

from 92.2 percent (2020) to 75.9 percent (2021) due to the improved

nature of trading in 2021 as a substantial portion of the Group's

property costs are fixed in nature.

Adjusted EBITDA (pre-IFRS 16)

The Group utilises Adjusted EBITDA (pre-IFRS 16) as the primary

assessment metric of profitability. A reconciliation of this

measure compared to profit from operations is below.

52 weeks 53 weeks ended

ended

2 January 3 January

2022 2021

GBP GBP

------------ ---------------

Profit/(loss) from operations 3,634,155 (469,275)

------------ ---------------

Pre-opening costs 126,753 78,778

Share option expense 90,507 -

Depreciation and amortisation 6,255,038 5,796,178

Exceptional items 1,856,268 272,182

Non-trading costs 244,639 60,100

IFRS 16 adjustment (3,466,784) (3,376,630)

Adjusted EBITDA (pre-IFRS 16) 8,740,576 2,361,333

------------ ---------------

The Group generated GBP8.7m of Adjusted EBITDA (pre-IFRS 16), an

improvement of GBP6.3m compared to 2020. The improved performance

was largely generated by the strong sales performance of the

business as we were able to introduce the brand to new customers

during the pandemic. This customer acquisition arose due to the

Group generally re-opening ahead of competitors and heavily

engaging with both new and existing customers during this

period.

When other businesses re-opened, despite the increased

competition, the newly acquired customers remained loyal and the

Group's sales went from strength to strength as 2021

progressed.

Operational cost controls were well controlled in the period and

along with utilisation of Government support, resulted in Adjusted

EBITDA (pre-IFRS 16) (as a percentage of sales) improving to 18

percent (2020: 9 percent).

Cash flow

Cash generated from operations increased in line with the

improvement in Adjusted EBITDA, save for the settlement of a number

of 2020 working capital related cash flows (namely leasehold

payments) that were deferred to early 2021.

Cash expenditure on property, plant and equipment increased due

to both the addition of more new sites in 2021 compared to 2020 and

higher maintenance capital costs arising from numerous

refurbishments when the Group re-opened the estate in the early

part of the year.

A significant cash outflow arose from the restructuring of the

Group's banking facilities prior to the IPO as the previous debt

facilities were fully repaid (GBP12.6m). The following cash inflows

partially offset this: (1) a GBP3.0m drawdown on a new debt

facility as outlined further below; and (2) a primary raise of

GBP5.0m from the IPO less GBP2.2m of fees (GBP1.6m recorded as

exceptional costs and the remainder recorded in equity).

Financing and net debt

The Group's net debt position has been materially reversed

during the course of 2021 to a net cash position of GBP6.7m at 2

January 2022 (3 January 2021: net debt of GBP2.3m). The business is

highly cash generative, benefits from a negative working capital

cycle and is accordingly able to fund the new store openings from

own cash.

The Group's GBP10.0m revolving credit facility (RCF) is held

with Santander UK plc and comprises of a drawn balance of GBP3.0m

at 2 January 2022 with a further GBP7.0m of undrawn facility

available to the Group.

The financing facility attracts interest at a rate of 2.75

percent above SONIA, subject to an upward-only ratchet based on

increased net leverage levels and is secured until 14 September

2026.

Share based payments

As part of the Group's admission to AIM, a Long Term Incentive

Plan ("LTIP") was created for senior Management. The detail of this

scheme for the Executive Directors is noted in the remuneration

report. These options vest subject to continuous employment over a

three and four year period, and attainment of certain performance

conditions relating to Adjusted EBITDA (pre IFRS-16). The Group

recognised a total charge of GBP0.1m in 2021 in relation to the

Group's share-based payment arrangements.

Dividend

The Board did not recommend a dividend for 2021. The Group's

capital over the coming years will be deployed to growth with the

dividend policy subject to re-assessment going forward.

Going concern

In assessing the going concern position of the Group for the

consolidated financial statements for the year ending 2 January

2022, the Directors have considered the Group's cash flow,

liquidity and business activities, as well as the ongoing

uncertainty caused by the Covid-19 pandemic.

The hospitality sector has been particularly impacted by

Covid-19 and the Group has taken a number of actions to improve

liquidity to ensure it is well placed to operate through the

pandemic and to achieve its strategic goals.

During 2021, the Group successfully listed on the AIM market

which gave the Group access to additional capital and combined with

the strong cash generation of the business, enabled the Group to

reduce the borrowing facilities from GBP11.9m to GBP3.0m. The Group

has access to a further GBP7.0m of financing and this remained

undrawn on 2(nd) January 2022. The Group had cash balances of

GBP9.7m on 2 January 2022 which translate to a net cash position of

GBP6.7m.

The Group has prepared forecasts for the next twelve months,

including a base case and a severe downside case. Refer to note 2.6

of the financial statements for details of the assumptions and

methodology applied.

Upon consideration of this analysis and the principal risks

faced by the Group, the Directors are satisfied that the Group has

adequate resources to continue in operation for the foreseeable

future, a period of at least twelve months from the date of this

report. Accordingly, the Directors have concluded that it is

appropriate to prepare these financial statements on a going

concern basis.

Approved by the Board on 11 April 2022 and signed on its behalf

by:

Andy Naylor

Chief Financial Officer

FINANCIAL STATEMENTS

Consolidated statement of comprehensive income

52 weeks 53 weeks

ended ended

2 January 3 January

2022 2021

Note GBP GBP

------------- -------------

Revenue 4 48,075,399 26,832,846

Cost of sales (9,797,235) (6,054,932)

------------- -------------

Gross profit 38,278,164 20,777,914

Other operating income 5 1,877,806 3,489,162

Administrative expenses (36,521,815) (24,736,351)

------------- -------------

Profit/(loss) from operations 6 3,634,155 (469,275)

Finance income 9 613 111,791

Finance expense 9 (1,372,504) (1,335,748)

------------- -------------

Profit/(loss) before tax 2,262,264 (1,693,232)

Tax charge 10 (900,690) -

------------- -------------

Profit/(loss) for the period and comprehensive

income attributable to equity holders

of the parent company 1,361,574 (1,693,232)

Earnings/(loss) per share for profit

attributable to the owners of the

parent during the period

Basic and diluted (pence) 11 3.5 (471.6)

------------- -------------

The accompanying notes within this announcement form an integral

part of these Financial Statements.

Consolidated statement of financial position

At At

2 January 3 January

2022 2021

Note GBP GBP

------------ ------------

Non-current assets

Right-of-use assets 12 24,939,614 25,324,841

Property, plant and equipment 13 9,264,167 9,112,143

------------ ------------

Total non-current assets 34,203,781 34,436,984

Current assets

Inventories 14 326,108 239,782

Trade and other receivables 15 1,888,702 1,898,295

Cash and cash equivalents 16 9,653,172 10,086,759

------------ ------------

Total current assets 11,867,982 12,224,836

Total assets 46,071,763 46,661,820

------------ ------------

Current liabilities

Trade and other payables 17 6,729,865 4,909,704

Lease liabilities 12 5,830,987 7,176,104

Loans and borrowings 18 - 1,000,000

Corporation tax liability 10 900,690 -

------------ ------------

Total current liabilities 13,461,542 13,085,808

Non-current liabilities

Lease liabilities 12 25,831,103 24,195,555

Loans and borrowings 18 2,911,941 11,426,235

------------ ------------

Total non-current liabilities 28,743,044 35,621,790

Total liabilities 42,204,586 48,707,598

------------ ------------

Net assets / (liabilities) 3,867,177 (2,045,778)

------------ ------------

Equity attributable to equity holders

of the company

Called up share capital 19 386,640 359,016

Share premium account 20 4,433,250 -

Merger reserve 20 4,793,170 4,793,170

Share based payment reserve 20 90,507 -

Retained earnings 20 (5,836,390) (7,197,964)

------------ ------------

Total equity 3,867,177 (2,045,778)

The accompanying notes within this announcement form an integral

part of these Financial Statements. The financial statements of

Tortilla Mexican Grill plc (registration number 13511888) were

approved by the Board and authorised for issue on 11 April 2022.

They were signed on its behalf by:

Andy Naylor

Chief Financial Officer

11 April 2022

Consolidated statement of changes in equity

Share-based

Share Share Merger payment Retained

capital premium reserve reserve earnings Total

GBP GBP GBP GBP GBP GBP

--------- ---------- ---------- ------------ ------------ ------------

Balance as at 29

December 2019 359,016 - 4,793,170 - (5,504,732) (352,546)

Loss for the period - - - - (1,693,232) (1,693,232)

Balance as at 3

January 2021 359,016 - 4,793,170 - (7,197,964) (2,045,778)

--------- ---------- ---------- ------------ ------------ ------------

Profit for the period - - - - 1,361,574 1,361,574

Newly issued equity

shares 27,624 4,972,376 - - - 5,000,000

Cost of issue of

equity shares - (539,126) - - - (539,126)

Share-based payments - - - 90,507 - 90,507

Balance as at 2

January 2022 386,640 4,433,250 4,793,170 90,507 (5,836,390) 3,867,177

--------- ---------- ---------- ------------ ------------ ------------

The accompanying notes within this announcement form an integral

part of these Financial Statements.

Consolidated statement of cash flows

52 weeks ended 53 weeks ended

2 January 2022 3 January 2021

Note GBP GBP

--------------- ---------------

Operating activities

Profit/(loss) after tax 1,361,574 (1,693,232)

Adjustments for:

Share based payments 8 90,507 -

Net finance expense 9 377,144 228,168

Finance cost on lease liabilities 9 994,747 995,789

Corporation tax charge 10 900,690 -

Depreciation of right to use assets 12 3,514,015 3,495,701

Impairment of right to use assets 12 99,868 (66,584)

Depreciation of property, plant

and equipment 13 2,634,304 2,033,690

Impairment of property, plant and

equipment 13 - 333,371

Loss on disposal of property, plant

and equipment 13 6,852 -

Increase in inventories 14 (86,326) (3,739)

Decrease in trade and other receivables 15 9,593 56,064

Increase/(decrease) in trade and

other payables 17 1,820,161 (1,197,011)

Cash generated from operations 11,723,129 4,182,217

--------------- ---------------

Investing activities

Interest received 9 613 1,964

Purchase of property, plant and

equipment 13 (2,793,181) (1,404,116)

Net cash used by investing activities (2,792,568) (1,402,152)

--------------- ---------------

Financing activities

Proceeds from issue of shares 5,000,000 -

Cost of issue of shares (539,126) -

Payments made in respect of lease

liabilities 12 (3,932,971) (655,652)

Interest paid (203,303) (284,549)

New loans secured 18 2,907,306 3,846,600

Repayment of loans 18 (12,596,054) (1,200,000)

Net cash (used by)/generated from financing

activities (9,364,148) 1,706,399

--------------- ---------------

Net (decrease)/increase in cash

and cash equivalents (433,587) 4,486,464

--------------- ---------------

Cash and cash equivalents at the

beginning of period 16 10,086,759 5,600,295

Cash and cash equivalents at the

end of period 9,653,172 10,086,759

--------------- ---------------

Notes to the consolidated financial information

1. General information

Tortilla Mexican Grill plc, the "Company" together with its

subsidiaries, "the Group", is a public limited company whose shares

are publicly traded on the Alternative Investment Market("AIM") and

is incorporated and domiciled in the United Kingdom and registered

in England and Wales.

The registered address of Tortilla Mexican Grill plc and all

subsidiaries is 142-144 New Cavendish Street, London, W1W 6YF,

United Kingdom. A list of the Company's subsidiaries is presented

in note 22.

The Group's principal activity is the operation and management

of restaurants trading under the Tortilla brand both within the

United Kingdom and the Middle East.

2. Accounting policies

2.1 Statement of Compliance

The consolidated financial statements have been prepared in

accordance with International Account Standards in conformity with

the requirements of the Companies Act 2006 and in accordance with

International Financial Reporting Standards.

2.2 Basis of preparation

The consolidated financial information contained in this

document includes the consolidated statement of comprehensive

income, the consolidated statement of financial position, the

consolidated statement of changes in equity, the consolidated

statement of cash flows and related notes for the companies which

comprise the Group.

2.3 New standards, amendments and interpretations adopted

In May 2020 the IASB issued COVID-Related Rent Concessions

(Amendments to IFRS 16) that provided a practical expedient

permitting lessees not to assess COVID-related rent concessions as

a lease modification. The Group has opted not to apply this

amendment.

Other amendments applied for the first time for the 52 weeks

ending 2 January 2022 were:

-- Definition of material - amendments to IAS 1 and IAS 8;

-- Definition of a business - amendment to IFRS 3;

-- Revised conceptual framework for financial reporting; and

-- Interest rate benchmark reform - amendments to IFRS 9, IAS 39 and IFRS 7.

The application of these did not have a material impact on the

Group's accounting treatment and has therefore not resulted in any

material changes.

2.4 Standards issued not yet effective

Standard/Amendments Applicable

for financial

periods beginning

on/after

------------------------------------------------------ -------------------

IAS 37 Onerous contracts - Cost of fulfilling 1 January

a contract 2022

Annual improvements to IFRS standards 2018-2020 1 January

2022

IAS 16 Property, plant and equipment: proceeds 1 January

before intended use 2022

IFRS 3 Reference to the conceptual framework 1 January

2022

IFRS 17 Insurance contracts 1 January

2023

IFRS 17 Amendments 1 January

2023

IAS 1 Classification of liabilities as current 1 January

or non-current 2023

IAS 1 Disclosure of accounting policies 1 January

2023

IAS 8 Definition of accounting estimates 1 January

2023

IAS 12 Deferred tax related to assets and liabilities 1 January

arising from a single transaction 2023

When applied, none of these amendments are expected to have a

material impact on the Group.

2.5 Basis of consolidation

The consolidated financial information incorporates the

financial statements of the Group and all of its subsidiary

undertakings. The financial statements of all Group companies are

adjusted, where necessary, to ensure the use of consistent

accounting policies. Where the Group has power, either directly or

indirectly, to govern the financial and operating policies of an

entity to obtain benefits from its activities, it is classified as

a subsidiary.

The consolidated financial information incorporates the results

of a business combination using the predecessor method.

Specifically, this is the acquisition of Mexican Grill Ltd, which

meets the definition of a common control business combination and

is therefore outside the scope of IFRS 3. In the consolidated

statement of financial position, the acquiree's identifiable

assets, liabilities and contingent liabilities are initially

recognised at their carrying values at the acquisition date.

The comparative figures for share capital are restated as if the

entities had been combined at the earliest reporting date

presented. The consolidated share capital at 29 December 2019 and 3

January 2021 therefore represents the share capital of Mexican

Grill Ltd adjusted for the share capital issued for the purposes of

the business combination.

The consolidated statement of financial position as at 2 January

2022 incorporates the results of Tortilla Mexican Grill plc and its

subsidiaries for all periods.

2.6 Going concern

In assessing the going concern position of the Group for the

consolidated financial statements for the 52 weeks ended 2 January

2022, the Directors have considered the Group's cash flow,

liquidity and business activities, as well as the ongoing

uncertainty caused by the COVID-19 pandemic.

The hospitality sector has been particularly impacted by

COVID-19 and the Group has taken a number of actions to improve

liquidity to ensure it is well placed to operate through the

pandemic and to achieve its strategic goals.

During 2021, the Group successfully listed on AIM which gave the

Group access to additional capital and combined with the strong

cash generation of the business, enabled the Group to reduce the

borrowing facilities to a principal amount of GBP3.0m. The Group

has access to a further GBP7.0m of financing and this remained

undrawn as at 2 January 2022. The Group had cash balances of

GBP9.7m as at 2 January 2022 which translate to a net cash position

of GBP6.7m.

The Group has prepared forecasts for the next twelve months,

including a base case and a severe downside case.

The base case assumes that there are no further lockdowns or

restrictions and assumes no further government financial support.

In this forecast there are no loan drawdowns and the Group remains

in compliance with its covenant obligations.

Under the severe downside case the following adjustments are

made:

-- Sales reduced by 20 percent in the second quarter of 2022 to

model a further prolonged lockdown;

-- Sales reduced by 10 percent in the third quarter and 5

percent for the remainder of the year to incorporate the impact of

increased restrictions throughout 2022; and

-- No further government support, such as reduced VAT, the

reintroduction of the Coronavirus Job Retention Scheme or business

rates relief, has been assumed.

Whilst this scenario would reduce Adjusted EBITDA by 29 percent,

the Group would still have sufficient liquidity and remain in a net

cash position. Consequently, the Group would not need to make a

further drawdown and would remain in compliance with its covenant

obligations. The Directors have also performed reverse stress

testing to assess the conditions that would lead to a covenant

breach. The Directors are comfortable with the outcome of this

exercise.

Upon consideration of this analysis and the principal risks

faced by the Group, the Directors are satisfied that the Group has

adequate resources to continue in operation for the foreseeable

future, a period of at least twelve months from the date of this

report. Accordingly, the Directors have concluded that it is

appropriate to prepare these financial statements on a going

concern basis.

2.7 Revenue recognition

Revenue represents the amount receivable from customers for

goods and services, exclusive of VAT and discounts.

The Group has recognised revenue in accordance with IFRS 15. The

standard requires revenue to be recognised when goods or services

are transferred to customers and the entity has satisfied its

performance obligations under the contract, and at an amount that

reflects the consideration to which an entity expects to be

entitled in exchange for those goods or services.

The Group's revenue comprises of:

-- Food and beverage sales at restaurants with one performance

obligation that is satisfied when control is transferred to the

customer at the point of sale, which is usually when payment is

received, and no contract assets or contract liabilities are

created. The Group also generates revenue with a third-party

delivery partner, which is payable the week after the revenue was

recorded. The delivery partner charges a commission on these sales,

which are recognised within administrative expenses. Revenue

comprises the fair value of the consideration received or

receivable for the sale of goods and provision of services in the

ordinary course of the Group's activities. Revenue is shown net of

sales/value added tax, returns and discounts; and

-- Franchise fees from the Group's role as franchisor in the UK

and Middle East. Revenue comprises ongoing royalties based on the

sales results of the franchisee and up-front initial site fees.

Royalty revenue is accrued in line with reported sales performance

once revenue can be reliably measured. Upfront initial site fees

are recognised on opening of the associated franchisee

restaurant.

The Group operates a loyalty scheme for customers which entitles

the customer to free products after a specified number of

purchases. IFRS 15 requires entities to recognise a liability for

the provision of these products as the customer, in effect, pays

the Group in advance for future goods. The Group has not recognised

this liability as the value is not material.

2.8 Alternative Performance Measures ("APM's")

The Group has identified certain measures that it believes will

assist the understanding of the performance of the business. These

APM's are not defined or specified under the requirements of IFRS.

The Group believes that these APM's, which are not considered to be

a substitute for, or superior to, IFRS measures, provide

stakeholders with additional useful information on the underlying

trends, performance and position of the Group and are consistent

with how business performance is measured internally.

The Group's APM's are: like for like ("LFL") revenue

growth/(decline), Adjusted EBITDA (Pre-IFRS), Operating cash flow

and net cash/(debt).

The Directors use Adjusted EBITDA as a primary KPI in managing

the business. This measure excludes exceptional items, share option

expenses and site pre-opening costs and applies pre-IFRS 16

treatment of leases. The Directors believe this measure gives a

more relevant indication of the underlying trading performance of

the Group and is also the measure used by the banks for the

purposes of assessing covenant compliance.

2.9 Employee benefits

i. Short-term benefits

Salaries, wages, paid annual leave and sick leave, bonuses and

non-monetary benefits are accrued in the period in which the

associated services are provided by employees of the Group.

ii. Defined contribution plan

Contributions to defined contribution schemes are charged to the

consolidated statement of comprehensive income in the financial

period to which they relate.

2.10 Leased assets

At the commencement date of the lease, the Group recognises

lease liabilities measured at the present value of lease payments

to be made over the lease term. The lease payments include lease

payments less any lease incentives receivable. In calculating the

present value of lease payments, the Group uses its incremental

borrowing rate at the lease commencement date because the interest

rate implicit in the lease is not readily determinable. After the

commencement date, the amount of lease liabilities is increased to

reflect the accretion of interest and reduced for the lease

payments made. In addition, the carrying amount of lease

liabilities is remeasured if there is a modification, for example a

rent review or a change in the lease term.

2.11 Property, plant and equipment

Items of property, plant and equipment are initially recognised

at cost. As well as the purchase price, cost includes directly

attributable costs.

Depreciation is provided on all items of property, plant and

equipment so as to write off their carrying value over the expected

useful economic lives. It is provided at the following rates:

Short term leasehold property - over the lease term

Plant and machinery - over 5 years

Fixtures and fittings - over 3 years

Office equipment - over 3 years

Computer equipment - over 3 years

2.12 Impairment

For the purposes of assessing impairment, assets are grouped at

the lowest levels for which there are separately identifiable cash

inflows which are largely independent of the cash inflows from

other assets or groups of assets (cash-generating units).

Other assets are tested for impairment whenever events or

changes in circumstances indicate that the carrying amount may not

be recoverable. An impairment loss is recognised for the amount by

which the asset's carrying amount exceeds its recoverable

amount.

2.13 Inventories

Inventories are initially recognised at cost, and subsequently

at the lower of the cost and net realisable value. Cost comprises

all costs of purchase, costs of conversion and other costs incurred

in bringing the inventories to their present location and

condition.

2.14 Cash and cash equivalents

Cash is represented by cash in hand and deposits with financial

institutions repayable without penalty on notice of not more than

24 hours. Cash equivalents are highly liquid investments that

mature in no more than three months from the date of acquisition

and that are readily convertible to known amounts of cash with

insignificant risk of change in value. Payments taken from

customers on debit and credit cards are recognised as cash.

2.15 Deferred taxation

Deferred tax assets and liabilities are recognised where the

carrying amount of an asset or liability in the consolidated

statement of financial position differs from its tax base, except

for differences arising on:

-- the initial recognition of an asset or liability in a

transaction which is not a business combination and at the time of

the transaction affects neither accounting or taxable profit;

and

-- investments in subsidiaries and jointly controlled entities

where the Group is able to control the timing of the reversal of

the difference and it is probable that the difference will not

reverse in the foreseeable future.

Recognition of deferred tax assets is restricted to those

instances where it is probable that taxable profit will be

available against which the difference can be utilised.

The amount of the asset or liability is determined using tax

rates that have been enacted or substantially enacted by the

balance sheet date and are expected to apply when the deferred tax

liabilities or assets are settled or recovered. Deferred tax

balances are not discounted.

Deferred tax assets and liabilities are offset when the Group

has a legally enforceable right to offset current tax assets and

liabilities and the deferred tax assets and liabilities relate to

taxes levied by the same tax authority on either:

-- the same taxable group company; or

-- different company entities which intend either to settle

current tax assets and liabilities on a net basis, or to realise

the assets and settle the liabilities simultaneously, in each

future period in which significant amounts of deferred tax assets

and liabilities are expected to be settled or recovered.

2.16 Operating segments

Operating segments are reported in a manner consistent with the

internal reporting provided to the Chief Operating Decision-Maker

(CODM). The CODM has been identified as the Management team

including the Chief Executive Officer, Chief Operating Officer and

Chief Financial Officer.

The Directors have taken a judgement that individual sites meet

the aggregation criteria in IFRS 8, constituting one operating and

one reporting segment and hence have concluded that the Group only

has a single reporting segment, as discussed in note 4.

2.17 Financial assets

Financial assets held at amortised cost are trade and other

receivables and cash.

Trade receivables are all due for settlement within one year.

Due to their short-term nature, the Directors consider the carrying

amount of trade and other receivables to equal their fair

value.

Fees paid on the establishment of loan facilities are recognised

as transactional costs of the loan and the fee is netted against

the loan balance and amortised on a straight line basis over the

period of the facility to which it relates.

Financial assets that are measured at cost and amortised cost

are assessed at the end of each reporting year for objective

evidence of impairment. If objective evidence of impairment is

found, an impairment loss is recognised in the consolidated

statement of comprehensive income.

2.18 Financial liabilities

Financial liabilities held at amortised cost include trade and

other payables, lease liabilities and borrowings.

There are no material differences between the carrying values of

financial assets and liabilities held at amortised cost and their

fair values.

Financial assets and liabilities are offset and the net amount

reported in the consolidated statement of financial position when

there is an enforceable right to set off the recognised amounts and

there is an intention to settle on a net basis or to realise the

asset and settle the liability simultaneously.

2.19 Financial risk

The Group's activities expose it to a variety of financial

instrument risks. The risk management policies employed by the

Group to manage these risks are detailed below. The primary

objectives of the financial instrument risk management function are

to establish risk limits and then ensure exposure to risks remains

within these limits.

i. Interest rate risk

The Group is exposed to interest rate risk as the Group's

borrowings have an interest rate of SONIA plus a margin. Given the

quantum of the borrowings and the current low interest environment,

the risk is not considered material and therefore the Directors

have accepted this risk with the position being regularly

re-assessed based on wider macro-economic conditions.

ii. Commodity price risk

The Group is exposed to movements in wholesale prices of food

and drinks. The Group sources the majority of its products in the

UK, however there is the risk of disruption to supply caused by

COVID-19 or Brexit. The Group always benchmarks any cost changes

and typically fixes prices for periods of between three and six

months.

iii. Liquidity risk

Liquidity risk is the risk that the Group may encounter

difficulties in meeting its financial obligations as they fall due.

They may arise from the Group's management of working capital,

finance charges and principal repayments on its debt.

The Directors regularly review cash flow forecasts to determine

whether the Group has sufficient reserves to meet obligations and

take advantage of opportunities.

iv. Capital risk

The Group manages the capital structure to ensure it will be

able to operate as a going concern, whilst maximising the return to

shareholders. The Directors look to optimise the debt-to-equity

balance and may adjust the capital structure by paying dividends to

shareholders, returning capital to shareholders, issue new shares

or sell assets to reduce debt. The Directors intend to maintain low

net leverage levels as the Group's operating cash flows are

sufficient to fund the addition of new restaurants to the

portfolio.

v. Credit risk

The Group's credit risk is attributable to trade and other

receivables and cash with the carrying amount best representing the

maximum exposure to credit risk. The Group places its cash only

with banks with high-quality credit standings. Trade and other

receivables relate to day-to-day activities which are entered into

with creditworthy counterparties.

vi. Liquidity risk

Liquidity risk arises from the Group's management of working

capital and the finance charges and principal repayments on its

debt instruments. It is the risk that the Group will encounter

difficulty in meeting its financial obligations as they fall

due.

Management review cash flow forecasts regularly to determine

whether the Group has sufficient cash reserves to meet future

working capital requirements.

Maturity analysis

The table below analyses the Group's contractual undiscounted

cash flows for the Group's financial liabilities.

Within 1 More than

year 1 to 2 years 2 to 5 years 5 years Total

GBP GBP GBP GBP GBP

----------- ------------- ------------- ----------- -----------

2 January 2022

Trade and other

payables 6,729,865 - - - 6,729,865

Lease liabilities 5,830,987 4,225,074 10,085,891 11,520,138 31,662,090

Borrowings - - 2,911,941 - 2,911,941

----------- ------------- ------------- ----------- -----------

12,560,852 4,225,074 12,997,832 11,520,138 41,303,896

----------- ------------- ------------- ----------- -----------

3 January 2021

Trade and other

payables 4,909,704 - - - 4,909,704

Lease liabilities 7,176,104 3,864,422 9,140,207 11,190,926 31,371,659

Borrowings 1,000,000 1,300,000 10,126,235 - 12,426,235

=========== ============= ============= =========== ===========

13,085,808 5,164,422 19,266,442 11,190,926 48,707,598

----------- ------------- ------------- ----------- -----------

2.20 Equity instruments

Financial instruments issued by the Group are treated as equity

only to the extent that they do not meet the definition of a

financial liability. The Group's ordinary shares are classified as

equity instruments.

2.21 Government grants

Coronavirus job retention scheme grants (CJRS) and other

government grants are recognised under the accruals model with any

deferred element included in creditors as deferred income. Grants

of a revenue nature are recognised in the consolidated statement of

comprehensive income in the same period as the related

expenditure.

3. Critical accounting estimates and judgements

The Group makes certain estimates and assumptions regarding the

future. Estimates and judgements are continually evaluated based on

historical experience and other factors, including the expectations

of future events that are believed to be reasonable under the

circumstances. In the future, actual experience may differ from

these estimates and assumptions. The estimates and judgements that

have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next

financial year are discussed below.

3.1 Determining the discount rate for IFRS 16

At the commencement date of property leases the lease liability

is calculated by discounting the lease payments. The discount rate

used should be the interest rate implicit in the lease. However, if

that rate cannot be readily determined, which is generally the case

for property leases, the lessee's incremental borrowing rate is

used. This is the rate that the individual lessee would have to

pay, to borrow the funds necessary, to obtain an asset of similar

value to the right-of-use asset in a similar economic environment

with similar terms, security and conditions. The weighted average

discount rate applied to the Group's leases is 3.4 percent, there

has been a judgement applied that the portfolio has the same

discount rate. For the lease liabilities at 2 January 2022 a 0.5

percent increase in the discount rate would reduce the total

liabilities by GBP136,000, which is not considered material.

3.2 Impairment of right-of-use assets and property, plant and equipment

Right-of-use assets and property, plant and equipment are

reviewed for impairment when there is an indication that the assets

might be impaired by comparing the carrying value of the assets

with their recoverable amounts. The recoverable amount of an asset

or cash generating unit (CGU) is determined based on value-in-use

calculations prepared on the basis of the Directors' estimates and

assumptions. Individual sites are viewed as separate CGUs.

The main assumptions in the value-in-use calculations include

the growth rates of revenue and expenses, together with the Group's

weighted average cost of capital (WACC), which is used as a

discount rate.

An independent external consultancy was engaged to calculate the

Group's WACC and reasonable changes in the key assumptions were

assessed, which did not lead to a material impairment.

3.3 Useful economic lives of property, plant and equipment

The depreciation charge is dependent upon the assumptions used

regarding the useful economic lives of assets. A 10 percent

increase in average useful economic lives would result in a

GBP239,000 decrease in depreciation in 2021.

3.4 Share-based payments

The charge for share-based payments is calculated according to

the methodology described in note 8. The Black-Scholes model

requires subjective assumptions to be made including the volatility

of the Company's share price, fair value of the shares and the risk

free interest rates.

4. Revenue

52 weeks ended 53 weeks ended

2 January 3 January

2022 2021

GBP GBP

--------------- ---------------

Sale of goods 47,769,278 26,821,338

Franchise income 306,121 11,508

--------------- ---------------

48,075,399 26,832,846

--------------- ---------------

IFRS 8 Operating Segments requires operating segments to be

based on the Group's internal reporting to its Chief Operating

Decision Maker (CODM). The CODM is regarded as the Management team

of the Chief Executive Officer, the Chief Financial Officer and the

Chief Operating Officer.

The Group has three segments:

-- UK sales from Group-operated restaurants

-- UK franchise sales from franchised restaurants

-- Middle East franchise sales from franchised restaurants

There are similar economic characteristics between these

businesses with each following a similar sales and EBITDA

trajectory. These have been reviewed by the Directors along with

the non-financial criteria of IFRS 8. It is the Directors'

judgement that despite some short-term variability, all segments

have similar economic characteristics in the medium and long-term

and meet the criteria for aggregation into a single reporting

segment. Therefore, no segmental analysis is provided.

5. Other operating income

52 weeks ended 53 weeks ended

2 January 3 January

2022 2021

GBP GBP

--------------- ---------------

Eat Out to Help Out income - 473,401

CJRS income(1) 491,825 3,015,761

Other government grants(2) 1,385,981 -

1,877,806 3,489,162

--------------- ---------------

(1) Coronavirus Job Retention scheme

(2) I ncludes Retail Leisure Hospitality Grant, Local

Restriction Support Grants and Restart Grants