TIDMMNG

RNS Number : 0188C

M&G PLC

08 June 2023

8 June 2023

M&G plc Q1 2023 trading statement

Continued positive momentum across all three Group priorities:

Financial strength, Simplification and Growth

Delivered positive net flows and strong investment performance

across both the Asset Management and Wealth businesses

Completed the first phase of the Transformation programme, and

maintained a strong and conservatively positioned balance sheet

Q1 net client Q1 Shareholder

flows Q1 AUMA Solvency II

excl. Heritage ratio

GBP344bn

GBP0.4bn 200%

2022 YE:

2022 FY: GBP0.3bn GBP342bn 2022 YE: 199%

Andrea Rossi, Group Chief Executive Officer, said:

"M&G started the year building on our strong momentum from

2022. At Full-Year Results we identified three priorities for the

Group: maintain financial strength through capital discipline,

simplify the business, and deliver profitable growth focusing on

Asset Management and Wealth. I am pleased to say we have made good

progress on each of those fronts and are on track to deliver on our

ambitious targets.

"I am particularly encouraged by the GBP1.0 billion net client

inflows achieved in Wholesale Asset Management in just three

months. Thanks to this success, we more than offset the expected

redemptions from institutional clients and drove inflows into

high-margin propositions. Much of this growth has come from our

home market, the UK, where we were amongst the 'top five' managers

by net flows in the period(1) , ending a long period of subdued

performance.

(1) Source: The Pridham report

"In Institutional Asset Management, despite known headwinds in

the UK, we have continued to expand our presence in Europe, winning

large mandates in the Netherlands and Switzerland, where we secured

GBP0.8 billion in funding from the Swiss Investment Fund for

Emerging Markets.

"Turning to M&G Wealth, we continue to see good momentum,

with PruFund sales growing to GBP1.6 billion in Q1. In May we

launched PruFund Growth, PruFund Cautious and PruFund Risk Managed

versions on our digital platform, further expanding the reach of

this unique proposition. Making the wider PruFund range more

accessible to financial intermediaries will support flows in the

second half of the year and beyond.

"Looking ahead, I'm both confident and excited about the

prospects for M&G, as we execute on the strategy outlined at

Full-Year Results. I am enthused by the progress to date and remain

focused on delivering operational efficiencies to benefit both

clients and shareholders. Notwithstanding an uncertain external

environment, we are building on the inherent strengths of our

differentiated business model, delivering profitable growth

alongside attractive shareholders returns."

Growth

- Despite volatile markets, achieved net client inflows of GBP0.4

billion (excluding Heritage), absorbing expected redemptions

from UK institutional clients that were triggered in September

2022 by the 'mini-budget crisis', which were highlighted at

Full-Year Results

- After returning to net client inflows in 2022, momentum in Wholesale

Asset Management accelerated further, with net client inflows

of GBP1.0 billion in Q1 and continued strong investment performance.

As of March, 68% of our mutual funds ranked in the upper two

performance quartiles over one year and 75% over three years

- Wealth and Other Retail & Savings delivered net inflows of GBP0.3

billion, driven by strong investment performance. After achieving

GBP5.4 billion gross sales in 2022 (+42% year-on-year), PruFund

volumes further improved in Q1 with gross inflows of GBP1.6

billion

Simplification

- We are moving at pace on the Transformation programme, continuing

to identify opportunities to streamline the business and achieve

our cost saving target while delivering better outcomes to our

clients and colleagues

- The Voluntary Redundancy programme launched in March is now

closed, with over 200 accepted applications, corresponding to

c. 4% of the total workforce. The majority of these exits are

expected to become effective between Q4 2023 and Q1 2024

- We are right sizing our office footprint to reflect the needs

of the business. During the first half of the year we have concluded

sub-leases on surplus space in our London estate. Work will

continue on reviewing our footprint in the second half of the

year

Financial strength

- Despite continued volatility in financial markets, Shareholder

Solvency II coverage ratio improved to 200% (2022: 199%) even

after factoring in the GBP310 million 2022 final dividend announced

in March (corresponding to a seven percentage points reduction)

- Our shareholder annuity portfolio continues to perform resiliently

and remains conservatively positioned, with a clear focus on

high credit quality. 98% of the assets are investment grade,

with no defaults experienced in Q1 and a very low level of downgrades

- We remain committed to our disciplined capital management framework

and policy of stable or increasing dividends per share

Group AUMA movements 31 December 2022 to 31 March 2023

GBPbn As at Gross Gross Net Market/Other As at

31 Dec Inflows outflows client movements 31 Mar

2022 flows 2023

Wholesale Asset

Management 53.9 4.6 (3.6) 1.0 1.3 56.2

Institutional

Asset Management 99.2 4.5 (5.4) (0.9) (1.2) 97.1

Other Asset Management 1.1 - - - - 1.1

========================= ========= ========== =========== ========= ============== =========

Total Asset Management 154.2 9.1 (9.0) 0.1 0.1 154.4

========================= ========= ========== =========== ========= ============== =========

Wealth 83.4 2.2 (2.0) 0.2 1.2 84.8

- Of which PruFund

UK 52.3 1.6 (1.1) 0.5 0.7 53.5

Heritage 94.1 0.0 (1.5) (1.5) 1.4 94.0

Other Retail and

Savings 8.9 0.3 (0.2) 0.1 0.1 9.1

========================= ========= ========== =========== ========= ============== =========

Total Retail

and Savings 186.4 2.5 (3.7) (1.2) 2.7 187.9

========================= ========= ========== =========== ========= ============== =========

Corporate assets 1.4 - - - 0.3 1.7

========================= ========= ========== =========== ========= ============== =========

Total AUMA 342.0 11.6 (12.7) (1.1) 3.2 344.0

========================= ========= ========== =========== ========= ============== =========

Group AUMA movements 31 December 2021 to 31 December 2022

GBPbn As at Gross Gross Net Market/Other As at

31 Dec Inflows outflows client movements 31 Dec

2021 flows 2022

Wholesale Asset

Management 52.7 16.0 (15.5) 0.5 0.7(2) 53.9

Institutional

Asset Management 103.1 13.1 (13.8) (0.7) (3.2)(3) 99.2

Other Asset Management 0.9 - - - 0.2 1.1

========================= ========= ========== =========== ========= ============== =========

Total Asset Management 156.7 29.1 (29.3) (0.2) (2.3) 154.2

========================= ========= ========== =========== ========= ============== =========

Wealth 84.2 8.0 (7.8) 0.2 (1.0)(4) 83.4

- Of which PruFund

UK 52.4 5.4 (4.9) 0.5 (0.6) 52.3

Heritage 117.8 0.2 (6.2) (6.0) (17.7) 94.1

Other Retail and

Savings 9.1 0.9 (0.6) 0.3 (0.5) 8.9

========================= ========= ========== =========== ========= ============== =========

Total Retail

and Savings 211.1 9.1 (14.6) (5.5) (19.2) 186.4

========================= ========= ========== =========== ========= ============== =========

Corporate assets 2.2 - - - (0.8) 1.4

========================= ========= ========== =========== ========= ============== =========

Total AUMA 370.0 38.2 (43.9) (5.7) (22.3) 342.0

========================= ========= ========== =========== ========= ============== =========

(2) Includes GBP2.2bn additional AUMA due to process

improvements from the AUMA elimination methodology process

review

(3) Includes cGBP2.9bn additional AUMA from the acquisition of

responsAbility in H1 2022

(4) Includes cGBP2.4bn additional AUMA from the acquisition of

Sandringham in H1 2022

Net client flows (excluding Heritage) in Q1 2023 and comparison

with Q4 2022 (quarter-on-quarter) and Q1 2022 (year-on-year)

Q1 2023 Q4 2022 Q1 2022

============================ ============================ ============================

GBPbn Gross Gross Net Gross Gross Net Gross Gross Net

inflows outflows client Inflows outflows client Inflows outflows client

flows flows flows

Wholesale Asset

Management 4.6 (3.6) 1.0 4.0 (3.6) 0.4 5.1 (4.4) 0.7

Institutional

Asset Management 4.5 (5.4) (0.9) 3.5 (5.1) (1.6) 3.0 (1.9) 1.1

Wealth 2.2 (2.0) 0.2 2.1 (2.0) 0.1 1.8 (2.0) (0.2)

- Of which PruFund

UK 1.6 (1.1) 0.5 1.5 (1.3) 0.2 1.1 (1.3) (0.2)

Other Retail and

Savings 0.3 (0.2) 0.1 0.2 (0.1) 0.1 0.2 (0.2) -

===================== ======== ========= ======= ======== ========= ======= ======== ========= =======

Client flows

(excl. Heritage) 11.6 (12.7) 0.4 9.8 (10.8) (1.0) 10.1 (8.5) 1.6

===================== ======== ========= ======= ======== ========= ======= ======== ========= =======

Asset Manager AUMA and flows by client type

GBPbn As at Net Market/Other As at

31 Dec client movements 31 Mar

2022 flows 023

Wholesale 53.9 1.0 1.3 56.2

Institutional 99.2 (0.9) (1.2) 97.1

Internal 149.9 3.3 153.2

====================== ========= ========================= =========

Total Asset Manager

AUMA 303.0 306.5

====================== ========= ========= ============== =========

Asset Manager AUMA and flows by asset class

GBPbn As at Net client Market/Other As at

31 Dec flows movements 31 Mar

2022 2023

Private assets

- External clients 46.5 0.9 (0.4) 47.0

Private assets

- Internal 30.1 (0.7) 29.4

====================== ========= ============================ =========

Total Private

AUMA 76.6 76.4

====================== ========= ============ ============== =========

Public assets -

External clients 106.6 (0.8) 0.5 106.3

Public assets -

Internal 119.8 4.0 123.8

====================== ========= ============================ =========

Total Public AUMA 226.4 230.1

====================== ========= ============ ============== =========

Total Asset Manager

AUMA 303.0 306.5

Enquiries:

Media Investors/Analysts

+44(0)20 8162 +44(0)20 8162

Jonathan Miller 1699 Luca Gagliardi 7307

Irene Chambers +44(0)7825 696815

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFBRGDLLUGDGXR

(END) Dow Jones Newswires

June 08, 2023 02:00 ET (06:00 GMT)

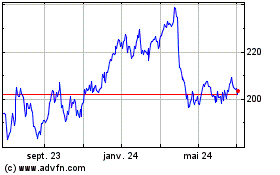

M&g (LSE:MNG)

Graphique Historique de l'Action

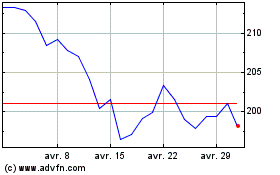

De Mar 2024 à Avr 2024

M&g (LSE:MNG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024