Melrose Industries PLC Capital Markets Event & New 2025 Guidance (7358Z)

17 Mai 2023 - 2:00PM

UK Regulatory

TIDMMRO

RNS Number : 7358Z

Melrose Industries PLC

17 May 2023

17 May 2023

MELROSE INDUSTRIES PLC

Capital Markets Event & New 2025 Guidance

Ahead of today's Capital Markets Event starting at 2.15pm in

London, Melrose Industries PLC ("Melrose") publishes the following

statement. All numbers are calculated at constant currency and

exclude the businesses recently demerged to Dowlais Group PLC.

Material new information

Material new information is announced today and will be

discussed at the Capital Markets Event. A presentation will be

available on the Melrose website before the event starts and a

recording of the event will be available on the Melrose website

after the event has concluded.

Trading expectations for 2023 were announced last week, on 10

May, along with a statement that the 14%+ Aerospace adjusted(1)

operating margin target is expected to be reached on a run rate

basis during 2024. Today, new guidance for 2025 is given which

materially exceeds previous adjusted(1) operating margin

expectations.

In addition, for the first time Aerospace is reported as two

divisions, Engines and Structures. The expected 2025 adjusted(1)

operating margin for Engines is 28% and Structures 9%, thus

increasing the blended expected Aerospace adjusted(1) operating

margin from 14%+ previously, to between 17% and 18%.

For ease of presentation in the following tables, the 2023

guidance is assumed to be in the middle of the expected ranges

announced by Melrose on 10 May 2023.

Aerospace 2023 and new 2025 guidance (prior to PLC costs(2)

)

Assumes GBP1 = $1.25

Total Aerospace(3) 2023(4) 2025

Revenue GBP3.4bn(5) GBP4.0bn

------------- ------------

Operating profit GBP350m GBP700m

------------- ------------

Operating margin 10% to 11% 17% to 18%

------------- ------------

EBITDA GBP505m GBP870m

------------- ------------

EBITDA margin 15% 22%

------------- ------------

Engines(3) 2023 2025

Revenue GBP1.3bn GBP1.8bn

---------- ----------

Operating profit GBP290m GBP500m

---------- ----------

Operating margin 22% 28%

---------- ----------

EBITDA GBP350m GBP580m

---------- ----------

EBITDA margin 27% 32%

---------- ----------

Structures(3) 2023 2025

Revenue GBP2.1bn(5) GBP2.2bn

------------- ----------

Operating profit GBP60m GBP200m

------------- ----------

Operating margin 3% 9%

------------- ----------

EBITDA GBP155m GBP290m

------------- ----------

EBITDA margin 7% 13%

------------- ----------

The Capital Markets Event today will lay out clearly why

Aerospace is on track to achieve this higher performance and that

further growth is expected beyond 2025.

The Aerospace profits are increasingly coming from Engines with

over 85% of this being from aftermarket activities by 2025.

In addition, lifetime net cash inflows, from RRSP engines

contracts, being approximately half the Engines business today, are

expected to total GBP20 billion with a net present value of GBP5.5

billion(6) .

Free cash flow margin(7) is expected to reach 12% in 2025 and

long-term 15% rising to greater than 20%.

This gives Melrose the capacity from 2024 onwards, after the

completion of current restructuring programmes, to buy back between

5% and 10% of its market capitalisation per annum in addition to

paying a progressive annual dividend, whilst maintaining a prudent

Balance Sheet.

Simon Peckham, Chief Executive of Melrose Industries PLC,

said:

"We are making clear today that after 5 years hard work,

Aerospace is now positioned to fulfil the potential it had at

acquisition, with a highly enviable aftermarket presence and

predictable strong cashflows. This is a great business in a very

attractive global aerospace sector and is being deliberately

focused to produce both top level equity performance and very

significant cash returns. We are totally focused on completing,

over the next 12 months, the work we need to do to maximise returns

for shareholders."

1. Described in the glossary to the Melrose Industries PLC

Annual Report and considered by the Board to be a key measure of

performance

2. PLC costs reducing to c.GBP30 million in 2023 and to c.GBP25 million in 2025

3. Unless otherwise stated, metrics refer to adjusted(1) measures

4. Consistent with guidance given in the 10 May 2023 trading update

5. Including c.GBP150 million of Structures revenue from planned

site closures to be exited in 2024

6. Using a discount rate of 7.5%, which is between a debt

related discount rate and a GKN Aerospace pre-tax weighted average

cost of capital

7. Unlevered and pre-tax

-ends-

Enquiries:

Montfort Communications: +44 (0) 20 3514 0897

Nick Miles +44 (0) 7739 701634 / Charlotte McMullen +44 (0) 7921

881800

miles@montfort.london / mcmullen@montfort.london

Investor Relations: Chris Dyett +44 (0) 7974 974690

ir@melroseplc.net

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEANSXFFEDEEA

(END) Dow Jones Newswires

May 17, 2023 08:00 ET (12:00 GMT)

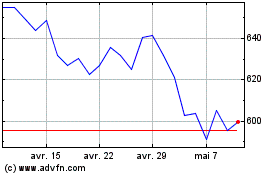

Melrose Industries (LSE:MRO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Melrose Industries (LSE:MRO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024