TIDMQQ.

RNS Number : 7704Z

QinetiQ Group plc

16 January 2024

News release

This announcement contains inside information

QinetiQ Group plc

Third Quarter Trading Update and

Share Buyback Programme

16 January 2024 - QinetiQ Group plc ("QinetiQ" or the "Group")

today issues a trading update covering its third quarter and

announces its intention to commence a share buyback programme to

return up to GBP100 million to shareholders over 12 months.

On-track to deliver full year expectations

The Group has delivered good operational performance in the

third quarter, with continued organic revenue growth and operating

profit margin in line with our expectations. Order intake has

continued to remain strong, with year-to-date orders at circa

GBP1.35bn and revenue under contract for the full year improving to

95%, higher than this time last year. As expected, cash generation

has been very strong with cash conversion significantly above 100%

in the quarter. We are now back in-line with our normal cash

profile and on-track to deliver 90%+ cash conversion for the full

year, as previously guided. Overall, the Group is making good

progress and we remain on-track to deliver in line with

expectations for FY24 [1] .

EMEA Services has continued to perform particularly well with

strong revenue growth offsetting modestly lower Global Solutions

revenue, due to longer than expected continuation of US market

uncertainty and budget delays. Reflecting this Avantus revenue

growth will be around the lower end of our second half

expectations, however the business continues to win significant new

business strategically aligned to national defence and security

priorities, pleasingly ahead of our plan, with $872m [2] of new

contract awards so far this year. Strong orders momentum and good

programme execution, demonstrated by the successful transition of

the Tethered Aerostat Radar System (TARS) under our operational

control ahead of schedule in December, underpins our continued

confidence in Avantus delivering our medium and long-term growth

expectations.

Capital allocation and launch of GBP100m share buyback

programme

Our strategy to deliver long-term sustainable growth is

unchanged and underpinned by our disciplined capital allocation

policy. As explained at our Investor Seminar in October 2023, we

continuously evaluate the deployment of our capital to maximise

value through organic and inorganic investments and to deliver

healthy returns for our shareholders, whilst maintaining a prudent

balance sheet.

During the third quarter we have continued to manage our

pipeline of inorganic opportunities, but at this present time no

potential acquisitions meet our rigorous strategy-led and financial

criteria. Given the strength of the Group's balance sheet, the

highly cash generative nature of the business and the Board's view

of the current undervaluation of the Group, we have concluded that

now represents a compelling time to return excess capital to

shareholders. We are therefore pleased to announce the launch of a

GBP100m share buyback programme in February 2024, subject to

shareholder approval, that we expect to complete over the next 12

months.

The proposed share buyback programme represents an attractive

use of our capital to drive shareholder value, whilst maintaining

leverage less than 1.5x (net debt/EBITDA) and maintaining the

financial flexibility to invest in the ongoing execution of our

strategy to deliver sustainable growth and attractive returns.

Steve Wadey, Group Chief Executive Officer said:

"QinetiQ has a critical role in ensuring our customers across

our home countries of the UK, US and Australia have the defence and

security capabilities they need. Our excellent order intake

demonstrates the continuing demand for our high-value, cutting-edge

services and products. Our operational performance in the third

quarter underlines our confidence in delivering another year of

good organic growth at stable margins with strong cash

conversion.

"Given the Group's high cash generation and confidence in the

long-term outlook, we are pleased to announce the launch of a

GBP100m share buyback programme to increase returns to

shareholders, whilst maintaining the ability to deliver our

long-term growth strategy."

Inside Information

The information relating to the proposed share buyback programme

in this announcement constitutes inside information as stipulated

under the Market Abuse Regulation (EU) No.596/2014 (as it forms

part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018). On the publication of this announcement via

a Regulatory Information Service, such information is now

considered to be in the public domain. The person responsible for

arranging for the release of this announcement on behalf of QinetiQ

is James Field, Company Secretary.

About QinetiQ

QinetiQ is an integrated global defence and security company

focused on mission-led innovation. QinetiQ employs circa 8,500

highly-skilled people, committed to creating new ways of protecting

what matters most; testing technologies, systems, and processes to

make sure they meet operational needs; and enabling customers to

deploy new and enhanced capabilities with the assurance they will

deliver the performance required.

For further information please contact :

John Haworth, Group Director Investor Relations: +44 (0) 7920 545841

Lindsay Walls, Group Director Communications

(Media enquiries): +44 (0) 7793 427582

Notes

QinetiQ has announced its intention, subject to shareholder

approval, to purchase ordinary shares in the capital of the Group

("Ordinary Shares") up to a maximum aggregate consideration payable

of GBP100 million (the "Buyback Programme"). If approved, the

Buyback Programme is expected to be completed in two separate

tranches of GBP50 million each, commencing on or around 6 February

2024 and is expected to run for a period of approximately 12 months

from commencement.

The commencement of the first tranche of the Buyback Programme

is conditional on the approval by QinetiQ shareholders of a

resolution giving QinetiQ the authority to purchase its own shares

up to a limit of 28,937,856 Ordinary Shares (the "Buyback

Authority") which represents approximately 5 per cent of its issued

ordinary share capital. A shareholder circular (the "Circular")

convening a general meeting of QinetiQ to be held at 8:30 a.m. on 6

February 2024 at Cody Technology Park, Ively Road, Farnborough,

Hampshire, GU14 0LX (the "General Meeting"), at which approval for

the Buyback Authority will be sought, will be despatched or

otherwise made available to shareholders today.

The first tranche of the Buyback Programme is expected to

commence on or around 6 February 2024 and end no later than 6

August 2024 (subject to no regulatory objections or concerns

arising), for an aggregate consideration of GBP50 million. This

first tranche will be carried out through an irrevocable

non-discretionary agreement with Barclays Bank PLC, acting through

its Investment Bank ("Barclays"). Barclays will make trading

decisions under the first tranche of the Buyback Programme

independently of the QinetiQ in accordance with certain pre-set

parameters. The maximum number of Ordinary Shares that could be

purchased in the first tranche of the Buyback Programme will be

28,937,856 Ordinary Shares (based on the Buyback Authority to be

sought at the General Meeting).

Any purchase of Ordinary Shares under the first tranche of the

Buyback Programme will be carried out on the London Stock Exchange

and any other UK recognised investment exchange which may be

agreed, in accordance with pre-set parameters and in accordance

with the Buyback Authority, Chapter 12 of the UK Financial Conduct

Authority's Listing Rules, and Regulation (EU) No 596/2014 and

Commission Delegated Regulation (EU) No 2016/1052 (both as they

form part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018), including where relevant pursuant to the UK

Market Abuse (Amendment) (EU Exit) Regulations 2019. Any purchase

of Ordinary Shares pursuant to the Buyback Programme will be

announced by not later than 7:30 a.m. on the business day following

the calendar day on which the purchase occurred.

Any Ordinary Shares purchased pursuant to the Buyback Programme

will be cancelled (and the number of Ordinary Shares in issue

reduced accordingly). The purchase by QinetiQ of Ordinary Shares

under the proposed Buyback Programme is not expected to impact

long-term trading liquidity in QinetiQ's Ordinary Shares.

Availability of Circular

The Circular and accompanying form of proxy will be available to

view or download from QinetiQ's website at

www.qinetiq.com/investors.

In compliance with Listing Rule 9.6.1, copies of the above

documents will be submitted to the National Storage Mechanism and

will shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

This announcement should be read in conjunction with the

Circular.

Important Notice

This announcement does not constitute, or form part of, an offer

or any solicitation of an offer for securities in any

jurisdiction.

[1] Analyst expectations (average) for FY24 as at 15/01/24:

Revenue GBP1,871m, Op profit GBP210m

[2] Of which only $293m recognised in our order intake

to-date

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTQKPBQBBKBFDD

(END) Dow Jones Newswires

January 16, 2024 02:00 ET (07:00 GMT)

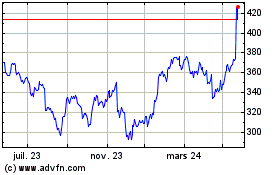

Qinetiq (LSE:QQ.)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

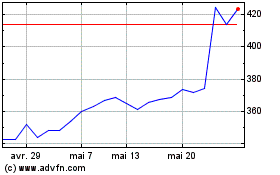

Qinetiq (LSE:QQ.)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024