TIDMSCHO

RNS Number : 3306T

Scholium Group PLC

24 November 2021

Scholium Group plc

Interim Report & Financial Statements

Six Months ended 30 September 2021

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014.

The directors of Scholium Group plc ("Scholium", the "Company"

or, together with its subsidiaries, the "Group") present their

report and financial statements for the Group for the six months

ended 30 September 2021.

Operating highlights

-- Revenues up by 35% compared with prior corresponding period

-- Gross profit up by 47% compared with last year and at a

better margin of 34% (2020: 31%) due to higher margins in Shapero

Rare Books

-- Pre-tax profit of GBP135k due to improved trading and

recovery from Covid-19 (2020: loss of GBP158k)

-- Shapero Rare Books benefitted from higher levels of online

activity and the return of clients to its retail premises

-- Cash (excluding GBP250k Covid loan) increased by GBP1,248k

from 31 March to GBP1,250k at 30 September 2021

Financial Summary

Six months ended September 2021 2020 Change

(GBP000 unless otherwise stated)

Revenue 4,203 3,120 35%

Gross Profit 1,443 978 47%

Gross Margin 34% 31%

Pre-Tax Profit / (Loss) 135 (158)

Inventories 8,895 8,740 2%

Net Cash 1,000 348

Net Assets 9,357 9,501 -2%

NAV/Share (pence) 68.8 69.9

David Harland, recently appointed Chairman of Scholium,

noted

"We are pleased that the Group has traded profitably, despite

the cancellation of books and other trade fairs and the enforced

closure of the shop for some of the period. The Group has recovered

well from the restrictions imposed by Covid 19.

The Group remains focussed on maximising sales through online

and other channels as well as its premises, and is welcoming the

return to London of visitors from overseas, in particular the

United States."

For further information, please contact:

Scholium Group plc

David Harland, Chairman

Peter Floyd, Chief Financial Officer +44 (0) 207 493 0876

WH Ireland Ltd - Nominated Adviser

Chris Fielding

Megan Liddell +44 (0) 207 220 1666

Business Review

Scholium is engaged in the business of rare books, modern

prints, art and collectibles. Its primary operating subsidiary is

Shapero Rare Books, one of the leading UK dealers trading

internationally in rare and antiquarian books and works on paper,

which also trades as Shapero Modern, a leading UK dealer in the

growing marketplace of modern and contemporary prints.

The Group also trades alongside other third party dealers in the

broader arts and collectibles business as Scholium Trading, and

deals in and sells by auction stamps and philatelic items as

Mayfair Philatelics.

Revenue streams

The Group earned revenue in the six months to 30 September 2021

from:

-- the sale of rare books, prints and works on paper through Shapero Rare Books;

-- the sale of other rare and collectible items through Scholium Trading; and

-- the sale of philatelic items through Mayfair Philatelics

Strategy and key performance indicators (KPIs)

The Group's strategy is to:

-- build, either organically or by acquisition, a portfolio of

art and collectibles focused businesses to enable further

diversification of its revenue and profit streams;

-- attract individuals or teams of specialists in markets

complementary to the Group's existing businesses;

-- optimize working capital in existing businesses to provide

funds for new business development; and

-- continue to develop all its entities by trading alongside

other dealers in high value rare and collectible items and by

participating in the acquisition for onward sale of large

consignments.

The Directors intend, as soon as practicable, to provide an

attractive level of dividends to shareholders along with stable

asset-backed growth driven by the markets in which the Group

operates.

The current principal KPIs are:

-- sales, gross profit, gross margin and profit before tax;

-- the breadth and distribution of the stock of rare books held by the Group;

-- stock turnover; and

-- cash position.

Performance Review

Overall Performance

The Group made a profit before tax of GBP135k during the six

months to 30 September 2021, a welcome recovery from the loss of

GBP158k for the corresponding period last year. Sales revenues and

margins were greatly improved, despite the early part of the period

being adversely affected by the restrictions imposed for

Covid-19.

Turnover increased by 35% compared to the same period in the

prior year. This was due to significantly higher sales in Shapero

Rare Books (SRB) and a small increase in Scholium Trading offset by

slightly lower sales in Mayfair Philatelics. SRB's sales were 40%

higher than last year at GBP3,814k, Scholium Trading's sales were

GBP11k higher than last year and Mayfair Philatelics decreased by

GBP12k. Gross Profit increased by 47% to GBP1,443k (2020: GBP978k;

2019: GBP1,380k) reflecting the higher margins available in this

period. Online sales and the return of clients to the Group's

retail premises contributed to this performance.

Group costs, including Distribution and Administrative expenses,

increased by 14% to GBP1,289k (2020: GBP1,132k; 2019: GBP1,310k).

Most of this increase was due to higher salary costs following the

end of furlough. The Group's costs are expected to increase in the

second half, as there will be the costs associated with returning

to fairs and exhibitions. There will be two public auctions in

Mayfair Philatelics compared to one in the first half of the year,

and both are expected to contribute to revenue and gross

margin.

The Group result for the six months was a profit before tax of

GBP135k (2020: loss of GBP158k; 2019: profit of GBP64k). There is

no current or deferred tax charge (2020: GBP0k; 2019: charge

GBP13k) as the Group has brought forward tax losses which are not

recognised as a deferred tax asset.

Inventories increased by GBP155k to GBP8,895k (2020: GBP8,740k;

2019: GBP8,753k). This is due to purchases slightly exceeding sales

during the period. The Group has turned round the negative cash

balance at 31 March 2021 with net cash of GBP1,000k at 30 September

2021 (2020: net cash of GBP348k; 2019: overdraft GBP33k), albeit a

portion of this net cash is held on behalf of clients. Free

cashflow during the six month period was therefore GBP1,248k (2020:

GBP348k; 2019: GBP(225k)).

Summary Group Financials

Six months ended September (all figures GBP'000) 2021 2020 Change

Revenue 4,203 3,120 35%

Gross Profit 1,443 978 47%

Gross Margin 34% 31%

Distribution Expenses (132) (118) 11%

Administrative Expenses (1,157) (1,014) 14%

Pre-Tax Profit /(loss) 135 (158)

Inventories 8,895 8,740 2%

Net cash 1,000 348

Net Assets 9,357 9,501 -2%

NAV/Share (pence) 68.8 69.9

Financial Position

The Group retains a strong balance sheet. Net assets of

GBP9,357k (2020: GBP9,501k; 2019: GBP9,962k) are supported by

GBP8,895k of stock (2020: GBP8,740k; 2019: GBP8,740k) and GBP1,000k

of net cash (2020: cash of GBP348k; 2019: overdraft of GBP33k).

Trade and other receivables and trade and other payables have

increased with the amounts owed to and from clients and the

increase in sales and costs of sales. The Group drew down a GBP250k

Covid loan in October 2020, but otherwise has no borrowings. There

is 68.8p of net assets per share (2020: 69.9p; 2019: 73.3p).

Shapero Rare Books & Shapero Modern

The Group continues to depend on Shapero Rare Books as the

driver of its sales growth and source of trading profits.

Shapero Rare Books is continuing to develop its Shapero Modern

prints and works on paper business, and has continued a

re-balancing of its stock between rare books and prints to enable

it to increase its sales of prints in the future.

Shapero Rare Books now has a first floor bookshop at 106 New

Bond Street, and a separate new gallery for modern prints nearby at

43 Maddox Street, as well as temporary retail premises on the

ground floor of 105 New Bond Street.

The Group is also focussed on reducing its inventories and cost

base as part of a process towards increasing its business towards

consignments from third parties for either retail or auction

sales.

The bulk of the trade, through Shapero Rare Books, is in rare

and antiquarian books and works on paper. Shapero Modern is a newer

business which was set up in 2014 to participate in the

increasingly large international trade in modern and contemporary

prints.

Trading in both Rare Books and Shapero Modern was at increased

levels during the first six months of the year compared to the

prior year. Turnover increased by 40% as compared to the prior-year

period to GBP3,814k (2020: GBP2,730k; 2019: GBP2,898k) due to the

re-opening after the restrictions of Covid-19. The gross margin of

33% (2020: 30%; 2019: 39%) reflected higher margins across both

books and prints. The profit achieved by this division for the

first six months of the financial year was GBP319k (2020: GBP19k;

2019: GBP126k).

Summary Performance, Shapero

Six months ended September (all figures GBP'000) 2021 2020 Change

Revenue 3,814 2,730 40%

Gross Profit 1,268 817 55%

Gross Margin 33% 30%

Pre-Tax Profit 319 19

Scholium Trading

Scholium Trading was set up to trade alongside third party

dealers in rare and collectible items. It typically trades in

paintings and works of art.

Scholium Trading's activity tends to be more uneven than the

other businesses in the Group, which has been evident in the six

months to 30 September 2021. The first half resulted in sales of

GBP18k (2020: GBP7k; 2019: GBP220k), with a gross profit of GBP6k

(2020: GBP1k; 2019: GBP54k). The continued low level of sales

resulted from the cancellation of all of the fairs which Scholium

Trading would normally attend, together with retail space also

being closed for a significant part of the period and a quieter

period in the Old Masters market.

Summary Performance, Scholium Trading

Six months ended September (all figures GBP'000) 2021 2020 Change

Revenue 18 7

Gross Profit 6 1

Gross Margin 35% 14%

Pre-Tax Profit / (loss) 2 (9)

Mayfair Philatelics

Mayfair Philatelics is now operating a full auction programme.

During the first half of the current year, it held three (one

public and two postal) auctions, the same as in the prior six

months to 30 September 2020. Two public auctions are planned for

the second half of the year. Public auctions generally achieve

higher sales than postal auctions.

The first half resulted in sales of GBP371k (2020: GBP383k;

2019: GBP496k) from both retail and auction activities. Gross

profit, which was principally from the auction activities, amounted

to GBP169k (2020: GBP161k; 2019: GBP208k). Direct costs and

overheads amounted to GBP197k (2020: GBP182k; 2019: GBP215k).

Summary Performance, Mayfair Philatelics

Six months ended September (all figures GBP'000) 2021 2020 Change

Revenue 371 383 -3%

Gross Profit 169 161 5%

Gross Margin 46% 42%

Pre-Tax (Loss) (28) (21) 33%

Central costs

The central costs of the business include all board directors

and other group level costs including the various costs associated

with the AIM listing. There were no recharges (2020: GBP0k; 2019:

GBP78k) made to the Group's subsidiaries for these central costs in

the six months ended 30 September 2021. The central costs were

therefore GBP158k (2020: GBP147k; 2019: GBP141k) on a comparable

basis with prior periods.

Summary Performance, Central costs

Six months ended September (all figures GBP'000) 2021 2020 Change

Pre-Tax (Loss) (158) (147) 7%

Outlook

The recovery from the restrictions imposed by governments

worldwide in response to Covid-19 has been impressive during the

first six months to 30 September 2021. The Group is continuing to

focus its efforts on its various online platforms, as well as

maintaining contact with clients remotely via email and telephone.

This is now being augmented with face to face contact in the

Group's premises and at trade fairs with clients now able to travel

with fewer restrictions.

Looking forward, the Group is viewing its trading for the second

half of the year with optimism.

Key Risks

Like all businesses, the Group faces risks and uncertainties

that could impact on the Group's strategy. The Board recognizes

that the nature and scope of these risks can change and regularly

reviews the risks faced by the Group and the systems and processes

to mitigate such risks.

The principal risks and uncertainties affecting the continuing

business activities of the Group were outlined in detail in the

Strategic Report section of the annual report covering the full

year ended 31 March 2021.

In preparing this interim report for the six months ended 30

September 2021, the Board has reviewed these risks and

uncertainties and considers that there have been no changes since

the publication of the 2021 Annual Report.

Independent Review Report to Scholium Group plc

Conclusion

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 September 2021 which comprises the condensed

consolidated statement of comprehensive income, the consolidated

statement of changes in equity, the condensed consolidated

statement of financial position, the consolidated statement of cash

flows and the related explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

September 2021 is not prepared, in all material respects, in

accordance with UK adopted International Accounting Standard 34 and

the AIM Rules.

Basis for Conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" issued for use in the United Kingdom. A review of interim

financial information consists of making enquiries, primarily of

persons responsible for financial and accounting matters, and

applying analytical and other review procedures. A review is

substantially less in scope than an audit conducted in accordance

with International Standards on Auditing (UK) and consequently does

not enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 2, the annual financial statements of the

group are prepared in accordance with UK adopted IFRSs. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with UK adopted

International Accounting Standard 34, "Interim Financial

Reporting".

Conclusions Relating to Going Concern

Based on our review procedures, which are less extensive than

those performed in an audit as

described in the Basis of Conclusion section of this report,

nothing has come to our attention to suggest that management have

inappropriately adopted the going concern basis of accounting or

that management have identified material uncertainties relating to

going concern that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with this ISRE, however future events or conditions may

cause the entity to cease to continue as a going concern.

Responsibilities of Directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the AIM rules.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's Responsibilities for the Review of Financial

Information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of Our Report

This report is made solely to the Company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Financial

Reporting Council. Our work has been undertaken so that we might

state to the Company those matters we are required to state to it

in an independent review report and for no other purpose. To the

fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the Company, for our review

work, for this report, or for the conclusions we have formed.

L Baker FCA

For and on behalf of

Wenn Townsend Chartered Accountants

Oxford, United Kingdom

23 November 2021

Consolidated statement of total comprehensive income

(unaudited)

Six-month Six-month

Period Period Year Ended

Ended (Unaudited) Ended (Unaudited) (Audited)

30 Sept 30 Sept 31 Mar

2021 2020 2021

Note GBP000 GBP000 GBP000

Revenue 3 4,203 3,120 6,029

Cost of Sales (2,760) (2,142) (3,957)

Gross profit 1,443 978 2,072

------------------- ----------------------- -----------

Distribution costs (132) (118) (282)

------------------- ----------------------- -----------

Administrative expenses (1,157) (1,014) (2,198)

Total administrative expenses (1,157) (1,014) (2,198)

------------------- ----------------------- -----------

Profit / (loss) from operations 154 (154) (407)

Financial income - - -

Financial expense 4 (19) (4) (30)

Profit / (loss) before taxation 135 (158) (437)

Income tax (expense) 5 - - -

Profit / (loss) for the period

from continuing operations 135 (158) (437)

Profit / (loss) for the period

and total comprehensive income

attributable to equity holders

of the parent company 135 (158) (437)

------------------- ----------------------- -----------

Basic and diluted profit

/ (loss) per share:

From continued operations

- pence 6 0.99 (1.16) (3.21)

Total diluted profit / (loss)

per share - pence 0.99 (1.16) (3.21)

------------------- ----------------------- -----------

Consolidated statement of financial position

30 Sept 30 Sept 31 Mar

2021 2020 2021

Note GBP000 GBP000 GBP000

Unaudited Unaudited Audited

Assets

Non-current assets

Property, plant and equipment 1,080 1,306 1,175

Intangible assets 6 10 8

Deferred corporation tax asset - - -

1,086 1,316 1,183

----------------- ---------- --------

Current assets

Inventories 8,895 8,740 9,025

Trade and other receivables 7 2,589 1,562 1,689

Cash and cash equivalents 1,250 348 2

12,734 10,650 10,716

----------------- ---------- --------

Total assets 13,820 11,966 11,899

----------------- ---------- --------

Current liabilities

Trade and other payables 8 3,163 1,259 1,308

Bank loans and borrowings 9 63 - 31

Right-of-use asset lease liabilities 10 166 161 139

Total current liabilities 3,392 1,420 1,478

----------------- ---------- --------

Liabilities due over one year

Bank loans and borrowings 9 187 - 219

Right-of-use asset lease liabilities 10 884 1,045 980

Total liabilities due over one

year 1,071 1,045 1,199

Total liabilities 4,463 2,465 2,677

----------------- ---------- --------

Net assets 9,357 9,501 9,222

----------------- ---------- --------

Equity and liabilities

Equity attributable to owners

of the parent

Ordinary shares 136 136 136

Share premium 9,516 9,516 9,516

Merger reserve 82 82 82

Retained earnings (377) (233) (512)

Total equity 9,357 9,501 9,222

----------------- ---------- --------

Net Asset Value per Share 68.8p 69.9p 67.8p

These interim financial statements were approved by the Board of

Directors on 23 November 2021 and signed on its behalf by Peter

Floyd.

Statement of changes in equity

Share Share Merger Retained Total

Capital Premium reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

-------- -------- -------- --------- -------

Balance at 1 April 2018 136 9,516 82 190 9,924

Loss for the period from continued operations - - - (56) (56)

-------- -------- -------- --------- -------

Total comprehensive income for the period - - - (56) (56)

-------- -------- -------- --------- -------

Balance at 30 September 2018 136 9,516 82 134 9,868

Profit for the period from continued operations - - - 43 43

-------- -------- -------- --------- -------

Total comprehensive income for the period 43 43

Balance at 31 March 2019 136 9,516 82 177 9,911

Profit for the period from continued operations - - - 51 51

-------- -------- -------- --------- -------

Total comprehensive income for the period - - - 51 51

-------- -------- -------- --------- -------

Balance at 30 September 2019 136 9,516 82 228 9,962

Loss for the period from continued operations - - - (303) (303)

-------- -------- -------- --------- -------

Total comprehensive income for the period - - - (303) (303)

-------- -------- -------- --------- -------

Balance at 31 March 2020 136 9,516 82 (75) 9,659

Loss for the period from continued operations - - - (158) (158)

-------- -------- -------- --------- -------

Total comprehensive income for the period - - - (158) (158)

-------- -------- -------- --------- -------

Balance at 30 September 2020 136 9,516 82 (233) 9,501

Loss for the period from continued operations - - - (279) (279)

-------- -------- -------- --------- -------

Total comprehensive income for the period - - - (279) (279)

-------- -------- -------- --------- -------

Balance at 31 March 2021 136 9,516 82 (512) 9,222

Profit for the period from continued operations - - - 135 135

-------- -------- -------- --------- -------

Total comprehensive income for the period - - - 135 135

-------- -------- -------- --------- -------

Balance at 30 September 2021 136 9,516 82 (377) 9,357

Consolidated statements of cashflows

30 Sept 30 Sept 31 Mar

2021 2020 2021

GBP000 GBP000 GBP000

Cash flows from operating activities

Profit / (loss) before tax 135 (158) (437)

Depreciation of property, plant

and equipment 15 15 34

Depreciation of right-to-use

assets 99 148 288

Amortisation of intangible assets 2 2 4

Finance expense 19 - -

270 7 (111)

Decrease / (increase) in inventories 130 241 (122)

(Increase)/ decrease in trade

and other receivables (900) (96) (70)

Increase/(decrease) in trade

and other payables 1,855 96 1,067

Net cash generated from operating

activities 1,355 248 764

------------ -------- -------

Cash flows from investing activities

Purchase of property, plant

and equipment (19) (29) (56)

Purchase of right to use assets - - (920)

------------ -------- -------

Net cash used in investing activities (19) (29) (976)

------------ -------- -------

Cash flows from financing activities

Lease repayments for right-of-use

assets (82) (148) (288)

Bank loan - - 250

Interest paid (6) (4) (30)

Net cash (used)/generated from financing

activities (88) (152) (68)

------------ -------- -------

Net increase / (decrease) in cash

and cash equivalents 1,248 67 (279)

Cash and cash equivalents at the beginning

of the period 2 281 281

Cash and cash equivalents at

the end of the period 1,250 348 2

------------ -------- -------

Cash 1,250 348 2

Bank loan (250) - (250)

Net cash at the end of the period 1,000 348 248

------ ---- ------

Notes

1. General information

Scholium Group plc and its subsidiaries (together 'the Group')

are engaged in the trading and retailing of rare and antiquarian

books, prints and works on paper and philatelic items primarily in

the United Kingdom. The Company is a public company domiciled and

incorporated in England and Wales (registered number 08833975).

The

address of its registered office is 106 New Bond Street, London W1S 1DN.

2. Basis of preparation

These condensed interim financial statements of the Group for

the six months ended 30 September 2021 (the 'Period') have been

prepared using accounting policies consistent with International

Financial Reporting Standards (IFRSs) including standards and

interpretations issued by the International Accounting Standards

Board and in accordance with International Accounting Standards in

conformity with the requirements of the Companies Act 2006. The

same accounting policies, presentation and methods of computation

are followed in the condensed set of financial statements as

applied in the Group's latest audited financial statements for the

year ended 31 March 2021. While the financial figures included

within this half-yearly report have been computed in accordance

with IFRSs applicable to interim periods, this half-yearly report

does not contain sufficient information to constitute an interim

financial report as set out in International Accounting Standard 34

Interim Financial Reporting. These condensed interim financial

statements have not been audited, do not include all of the

information required for full annual financial statements, and

should be read in conjunction with the Group's consolidated annual

financial statements for the year ended 31 March 2021. The

auditors' opinion on these Statutory Accounts was unqualified, did

not draw attention to any matters by way of emphasis and did not

contain a statement under s498 (2) or s498 (3) of the Companies Act

2006.

3. Revenue

30 Sept 30 Sept 31 Mar

2021 2020 2021

Group Group Group

GBP000 GBP000 GBP000

Sales of stock 3,948 3,025 5,738

Commissions 237 93 275

Other income 18 2 16

4,203 3,120 6,029

-------- -------- -------

4. Financial (expense)

30 Sept 30 Sept 31 Mar

2021 2020 2021

Group Group Group

GBP000 GBP000 GBP000

Interest payable (6) (4) (10)

Unwinding of discount on right-to-use liabilities (13) - (20)

Total financial (expense) (19) (4) (30)

------- ---- ------

5. Income Tax

30 Sept 30 Sept 31 Mar

2021 2020 2021

GBP000 GBP000 GBP000

Current and deferred tax expense

Current tax - - -

Deferred tax - - -

Total tax expense - - -

-------- -------- -------

The charge for the year can be reconciled

to the (loss) / profit per the income statement as

follows:

30 Sept 30 Sept 31 Mar

2021 2020 2021

GBP000 GBP000 GBP000

Profit / (loss) before tax 135 (158) (437)

-------- -------- -------

Applied corporation tax rates: 19% 19% 19%

Tax at the UK corporation tax rate of 19%: 26 (30) (83)

Unrecognised deferred tax asset - 30 83

Utilisation of tax losses (26) - -

Origination and reversal of temporary differences - - -

Current and deferred tax charge - - -

-------- -------- -------

6. Earnings/(Loss) per Share

30 Sept 30 Sept 31 Mar

2021 2020 2021

Group Group Group

GBP000 GBP000 GBP000

Profit / (loss) used in calculating basic and diluted earnings per

share attributable to the

owners of the parent 135 (158) (437)

Number of shares

Weighted average number of shares for the purpose of basic and

diluted earnings per share

13.6 13.6 13.6

million million million

--------- --------- ---------

Total basic and diluted earnings per share - pence 0.99 (1.16) (3.21)

--------- --------- ---------

Basic earnings per share amounts are calculated by dividing net

profit / (loss) for the year or period attributable to ordinary

equity holders of the parent by the weighted average number of

ordinary shares outstanding during the year.

The Company has no potentially issuable shares arising from

share options. As a consequence, the number of basic and fully

diluted shares in issue are equal.

No new shares were issued during the period, and the Company had

13.6 million shares in issue at the end of the period.

7. Trade and Other Receivables

30 Sept 30 Sept 31 Mar

2021 2020 2021

Group Group Group

GBP000 GBP000 GBP000

Trade debtors 2,268 1,372 1,421

Other debtors 33 46 36

Prepayments and accrued

income 288 144 232

2,589 1,562 1,689

-------- -------- -------

8. Trade and Other Payables

30 Sept 30 Sept 31 Mar

2021 2020 2021

Group Group Group

GBP000 GBP000 GBP000

Trade creditors 2,244 720 795

Other taxes and social

security 30 29 30

Accruals and deferred income 864 482 455

Other creditors 25 28 28

3,163 1,259 1,308

-------- -------- -------

9. Loans and Borrowings

30 Sept 30 Sept 31 Mar

2021 2020 2021

Group Group Group

GBP000 GBP000 GBP000

Bank loan due in less than

one year 63 - 31

Bank loan due in more than

one year 187 - 219

----------------- -------- -------

Total bank loan 250 - 250

----------------- -------- -------

11. Right-of-use asset lease liabilities

30 Sept 30 Sept 31 Mar

2021 2020 2021

Group Group Group

GBP000 GBP000 GBP000

Lease liabilities due in

less than one year 166 161 139

-------- -------- -------

Lease liabilities due in

more than one year 884 1,045 980

-------- -------- -------

These liabilities represent the future lease payments due under

the Group's leases of its Mayfair premises.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPGMPGUPGGMW

(END) Dow Jones Newswires

November 24, 2021 01:59 ET (06:59 GMT)

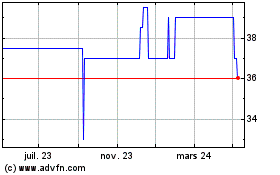

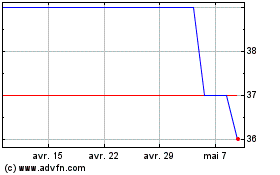

Scholium (LSE:SCHO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Scholium (LSE:SCHO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024