Standard Chartered PLC Update on directors' remuneration (3583T)

17 Mars 2023 - 9:59AM

UK Regulatory

TIDMSTAN

RNS Number : 3583T

Standard Chartered PLC

17 March 2023

Standard Chartered PLC

17 March 2023

Update on directors' remuneration

2020-22 Long-term incentive plan (LTIP) performance outcome

In the 2022 directors' remuneration report (DRR), Standard

Chartered PLC (SC) disclosed details of the expected performance

outcome for the 2020-22 LTIP awards which began to vest on 15 March

2023. This showed that the threshold Return on Tangible Equity

(RoTE) target had not been achieved and that the Remuneration

Committee had determined the vesting outcome for the strategic

measures at 22 per cent (out of a maximum 33.3 per cent). It was

also stated in the DRR that performance against the Total

Shareholder Return (TSR) threshold target would be measured in

March 2023 and that at the time of the DRR publication, it was not

expected to be achieved.

Unlike the RoTE and strategic performance measures, which are

assessed on a financial year timeframe, TSR is measured over the

LTIP performance period which starts from the date of grant (i.e.,

9 March 2020 for the 2020-22 LTIP) and ends on the day before the

third anniversary of the grant date. Performance is assessed by

calculating the change in TSR over the three-year performance

period, based on the average over a month at the start and end of

the performance period, and comparing this with SC's disclosed peer

group.

The final TSR performance was assessed on 9 March 2023.

Following improved share price performance relative to the peer

group since the start of 2023, SC ranked above median (i.e., the

target for minimum vesting), resulting in an outcome of 14.8 per

cent (out of a maximum 33.3 per cent) for TSR, and a total

performance outcome of 36.8 per cent, as shown below:

Measure Weighting Performance Performance Assessment Performance

for minimum for maximum of achievement outcome

vesting (25%) vesting (100%)

RoTE in 2022 RoTE 8%

with CET1

underpin One-third 8.5% 11.0% CET1 passed 0.0%

----------- --------------- ---------------- ---------------- ------------

Relative

TSR performance Above median,

against peer below upper

group One-third Median Upper quartile quartile 14.8%

----------- --------------- ---------------- ---------------- ------------

Details of the performance Improved

achieved against the performance

strategic proof points against our

Strategic are set out on page 197 strategic

measures One-third of the 2022 annual report. priorities 22.0%

----------- --------------------------------- ---------------- ------------

Total 2020-22 LTIP performance outcome 36.8%

------------

The Remuneration Committee considered carefully the vesting of

the 2020-22 LTIP awards, taking account of the factors set out in

the DRR and the fact that the TSR measure had been satisfied in

part. The Remuneration Committee considers that the values to be

delivered continue to remain appropriate, and, for the reasons set

out in the DRR, are not a windfall.

Updated single total figure of remuneration for 2022

The projected values disclosed and included in the single total

figure of remuneration table for Bill Winters and Andy Halford in

the DRR were based on 22 per cent vesting of the 2020-22 LTIP

awards, using the three-month average share price to 31 December

2022.

The table below sets out the single total figure of remuneration

for 2022 for Bill Winters and Andy Halford, updated with the final

performance outcome for the 2020-22 LTIP awards. The single total

figures for Bill and Andy represent year-on-year increases of 30

and 27 per cent respectively, reflecting the improved performance

achieved for the 2020-22 LTIP awards.

Bill Winters Andy Halford

GBP000 2022 2021 2022 2021

------- ------ ------- ------

Salary 2,418 2,370 1,546 1,515

------- ------ ------- ------

Pension 245 237 154 152

------- ------ ------- ------

Benefits 297 165 133 107

------- ------ ------- ------

Total fixed remuneration 2,960 2,772 1,833 1,774

------- ------ ------- ------

Annual incentive award 1,499 1,189 945 760

------- ------ ------- ------

Actual vesting of LTIP award

------- ------ ------- ------

Value of vesting awards based

on performance 1,540 779 954 498

------- ------ ------- ------

Value of vesting awards based

on share price growth 173 107

------- ------ ------- ------

Total variable remuneration 3,212 1,968 2,006 1,258

------- ------ ------- ------

Singe total figure of remuneration 6,172 4,740 3,839 3,032

------- ------ ------- ------

Notes to the single total figure of remuneration table are set

out on page 198 of the 2022 annual report.

Enquiries to:

Gregg J Powell, Head of Investor Relations +44 (0) 20 7885 5172

Shaun Gamble, Director, Group Media Relations: +44 (0) 20 7885 5934

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKOBQFBKKKND

(END) Dow Jones Newswires

March 17, 2023 04:59 ET (08:59 GMT)

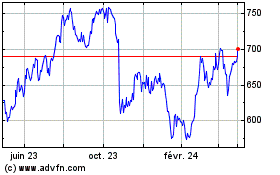

Standard Chartered (LSE:STAN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

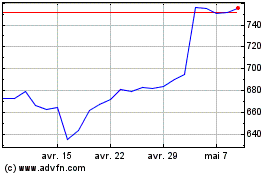

Standard Chartered (LSE:STAN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024