TIDMTAST

RNS Number : 8399Z

Tasty PLC

19 September 2022

19 September 2022

Tasty plc

("Tasty", the "Group" or the "Company")

Unaudited Interim Results for the 26 weeks ended 26 June

2022

Key Points:

-- Revenue of GBP21.5m (H1 2021: GBP11.6m); increase of 85%

-- Adjusted EBITDA(1) of GBP2.7m (H1 2021: GBP0.8m)

-- Impairment charge of GBP1.6m (H1 2021: GBPnil)

-- Loss after tax for the period of GBP2.7m (H1 2021: loss GBP2.7m)

-- Outstanding loan of GBP1.1m repaid in full in June 2022 (H1 2021: GBP1.25m)

-- Net cash after allowing for deferred creditors of GBP7.0m (H1

2021: net cash after allowing for repayment of bank loan and

deferred creditors of GBP4.2m)

-- 51 of 54 restaurants traded through the period

-- Staff shortage challenges remain

-- Cost of living pressures beginning to impact on revenue in H2 2022

-- Inflationary pressure on labour, food and utilities has impacted the business considerably

-- Despite staffing and inflationary challenges like-for-like

sales compared with pre Covid-19 position was encouraging

(1) Adjusted for depreciation, amortisation and share based

payments.

Chairman's statement

Introduction

Following the difficult period of the pandemic, we started 2022

expecting the year to be less challenging. Sales performance

compared to 2019 was strong but has been marred by labour shortages

and inflationary pressures impacting the hospitality industry.

These cost pressures became more acute towards the end of the first

half of 2022.

Like many of our competitors and the economy in general, we are

facing severe headwinds. Inflationary pressures on food, labour and

utility costs and the cost-of-living crisis will inevitably impact

the performance of the Company for at least the remainder of the

year.

Having navigated our way successfully through the difficult

periods in the recent past, we are in a good position to manage

these challenges once again; through a tight focus on cost controls

and ensuring that we are delivering an excellent experience for our

customers.

We have agreed heads of terms for a new Wildwood site in

Oxfordshire. Our dim t brand has experienced a resurgence, and we

are converting the former underperforming Wildwood in Loughton to a

dim t, which is due to open in the Autumn. Whilst there is a strong

pipeline of sites identified, due to current uncertainties, we have

slowed our previously announced expansion plans and will cautiously

approach any new openings as we brace ourselves for an even more

challenging economic environment, which is beginning to adversely

impact our profitability in the second half of 2022.

We continue to build solid teams and have invested at a central

level to overcome these challenges, streamline processes and

enhance our offering.

In June 2022, we repaid the amount outstanding under our

Barclays Bank facility of GBP1.1m and subsequently cancelled the

facility. Based on the base rate at the time, there will be an

annualised interest saving of approximately GBP57,000. The Board

made the decision that repaying the loan was the best course of

action given the Company's healthy cash balance and the base rates

rise.

People

In a tight labour market, we are pleased to say that the number

of people we employ is back to over 1,000 following the requisite

redundancies during the pandemic. However, with a competitive

labour market, we continue to work hard to engage our teams and

ensure that we are competitive through continuously reviewing

training, progression and pay.

In June 2022, Harald Samúelsson, stepped up to become an

Executive Director with responsibility for food and operational

support and, at the same time, Wendy Dixon was appointed as an

independent Non-Executive Director.

Wendy has spent two decades working with global brands, in a

variety of leadership roles in multiple markets. More recently she

was appointed as M&C Saatchi Group's first Chief Growth Officer

in 2019 with responsibility for leading internal collaboration,

building the brand of the company externally and bringing together

both capabilities and talent for new and existing clients to

grow.

To focus and improve our food offering a new Head of Food joined

the Company in May 2022 with the initial focus being the

development of our Christmas menu.

Inflationary costs

To reduce the impact of food and labour challenges, our menu is

constantly being reviewed. We are working with existing and new

suppliers to minimise disruption and continue to re-tender. The

well documented utility pressures are unprecedented, and the

hospitality industry is particularly badly affected. The Government

unveiled an energy support plan on 8 September 2022 to support

businesses for six months, but the details have yet to be

announced. In the meantime, we are looking at ways of minimising

our energy usage and improving efficiencies.

Environmental, social and governance

The wellbeing and safety of our employees and customers is at

the centre of all that we do. We have also retained our focus on

sustainability and the environmental impact of the business, and we

are an equal opportunities employer.

Property negotiations

The Group has been successful in achieving rent reductions and

lease concessions across most of the estate for the period impacted

by Covid-19 with the final few agreements completed during H1 2022.

We are continuing to review all our leases with a view to disposing

or re-gearing low performing sites.

Results

Revenue increased by 85% to GBP21.5m (H1 2021: GBP11.6m). In the

period under review, we have benefited from unrestricted dine-in

sales and also grown our takeaway and delivery business. However,

we have seen a slowdown in the second half due to our focus on

dine-in and changing consumer habits. Revenue for the comparative

period in 2021 was severely impacted by the lockdown

restrictions.

The adjusted EBITDA for the period was GBP2.7m (H1 2021:

GBP0.8m).

Operating profit before highlighted items was GBP0.4m (H1 2021:

loss GBP1.4m).

We have reviewed the impairment provision across the

right-of-use-assets and fixed assets and have made a net provision

of GBP1.6m (H1 2021: GBPnil).

After taking into account all non-trade adjustments, the Group

has a stated loss after tax for the period of GBP2.7m (H1 2021:

loss GBP2.7m).

Cash flows and financing

Cash inflow from operations was GBP0.9m (H1 2021: GBP2.4m).

Repayment of the bank loan amounted to GBP1.25m during the period

(H1 2021: drawn down of GBP1.25m).

Overall, the net cash outflow for the period was GBP3m (H1 2021:

inflow GBP1.8m). As at 26 June 2022, the Group had net cash after

the bank loan of GBP8.0m (H1 2021: net cash of GBP8.6m). After

allowing for deferred payments due to creditors, net cash was

GBP7.0m (H1 2021: net cash of GBP4.2m).

Going concern

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. In reaching this conclusion the Directors have

considered the financial position of the Group, together with its

forecasts for the next 12 months from the date of approval of these

interim accounts and taking into account possible changes in

trading performance. The going concern basis of accounting has,

therefore, been adopted in preparing the interim financial

report.

Outlook

Utility cost management and pressure on revenue as living costs

continue to rise will be our biggest challenges over the coming

months, although we await details of the Government's support

package. We will endeavour to mitigate all pressures carefully by

continuing to focus on savings and customer experience. Despite

these uncertainties the Board remains confident of managing current

challenges and the Group will cautiously consider future expansion

opportunities for growth .

Finally thank you once again to all our people, shareholders,

suppliers and other stakeholders who continue to support us.

K Lassman

Chairman

Tasty plc

19 September 2022

Enquiries:

Tasty plc Tel: 020 7637 1166

Jonny Plant, Chief Executive

Cenkos Securities Tel: 020 7397 8900

Katy Birkin / Mark Connelly

Certain of the information contained within this announcement is

deemed by the Company to constitute inside information as

stipulated under the UK version of the EU Market Abuse Regulation

(596/2014). Upon publication of this announcement via a regulatory

information service, this information is considered to be in the

public domain.

Consolidated statement of comprehensive income

for the 26 weeks ended 26 June 2022 (unaudited)

Restated

26 weeks 26 weeks 52 weeks

to to Ended

26 June 27 June 26 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Revenue 21,522 11,629 34,909

Cost of sales (20,375) (14,526) (33,567)

--------------------------------------- ----------- ----------- ------------

Gross profit/(loss) 1,147 (2,897) 1,342

Other income 213 2,050 4,208

Total operating expenses (2,778) (628) 555

Operating profit/(loss) before

highlighted items 445 (1,410) 4,112

Highlighted items (1,863) (65) 1,993

--------------------------------------- ----------- ----------- ------------

Operating (loss)/profit (1,418) (1,475) 6,105

Finance income 3 - -

Finance expense (1,249) (1,263) (2,497)

(Loss)/profit before tax (2,664) (2,738) 3,608

Income tax - - -

--------------------------------------- ----------- ----------- ------------

(Loss)/profit and total comprehensive

income for period and attributable

to owners of the parent (2,664) (2,738) 3,608

--------------------------------------- ----------- ----------- ------------

(Loss)/profit per share attributable

to the ordinary equity owners

of the parent

Basic (1.89p) (1.94p) 2.56p

Diluted (1.66p) (1.85p) 2.27p

The table below gives additional information to shareholders on

key performance indicators:

Post IFRS Pre IFRS Post IFRS Pre IFRS

16 16 16 16

26 weeks 26 weeks 26 weeks 26 weeks

to to to to

26 June 26 June 27 June 27 June

2022 2022 2021 2021

GBP'000 GBP'000 GBP'000 GBP'000

EBITDA before highlighted

items 2,733 101 824 (1,207)

Depreciation of PP&E

and amortisation (958) (980) (663) (689)

Depreciation of right-of-use

assets (IFRS16) (1,330) - (1,571) -

------------------------------ ---------- --------- ---------- ---------

Operating profit/(loss)

before highlighted

items 445 (879) (1,410) (1,896)

------------------------------ ---------- --------- ---------- ---------

Analysis of highlighted items Restated

26 weeks 26 weeks 52 weeks

to to ended

26 June 27 June 26 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Profit on disposal of property

plant and equipment - - 3

Restructuring costs - - (7)

Impairment of right-of-use assets (1,258) - (1,347)

Impairment (charge)/release of

property, plant and equipment (304) - 3,207

Share based payments (31) (65) (120)

(Loss)/gain on lease modifications (270) - 257

------------------------------------ ----------- ----------- ------------

Total highlighted items (1,863) (65) 1,993

The above items have been highlighted to give more detail on

items that are included in the Consolidated statement of

comprehensive income and which when adjusted shows a profit or loss

that reflects the ongoing trade of the business.

Consolidated statement of changes in equity

for the 26 weeks ended 26 June 2022 (unaudited)

Share Share Merger Retained Total

Capital Premium Reserve Deficit Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 26 December

2021 (restated) 6,061 24,254 992 (26,980) 4,327

Total comprehensive income

for the period - - - (2,664) (2,664)

Share based payments - credit

to equity - - - 31 31

Balance at 26 June 2022 6,061 24,254 992 (29,613) 1,694

Balance at 27 December

2020 6,061 24,251 992 (30,708) 596

Issue of ordinary shares - 3 - - 3

Total comprehensive income

for the period - - - (2,738) (2,738)

Share based payments - credit

to equity - - - 65 65

Balance at 27 June 2021 6,061 24,254 992 (33,381) (2,074)

Balance at 27 December

2020 6,061 24,251 992 (30,708) 596

Issue of ordinary shares - 3 - - 3

Total comprehensive income

for the period - - - 3,608 3,608

Share based payments - credit

to equity - - - 120 120

Balance at 26 December

2021 (restated) 6,061 24,254 992 (26,980) 4,327

In January 2021, Daniel Jonathan ("Jonny") Plant was awarded

15,676,640 'B' shares in Tasty plc which can be converted to 'A'

shares subject to achievement of certain hurdle rates. These 'B'

shares were issued at nominal value of 0.00001 pence. The first

hurdle was achieved, and 5,225,546 B Ordinary Shares were converted

into 5,225,546 new Ordinary Shares on 27 June 2022.

Consolidated balance sheet

At 26 June 2022 (unaudited)

Restated

26 weeks 26 weeks 52 weeks

to to ended

26 June 27 June 26 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 28 30 28

Property, plant and equipment 17,282 15,098 18,026

Right-of-use- assets 34,639 38,337 36,006

Other non-current assets 65 129 105

Total non-current assets 52,014 53,594 54,165

--------------------------------- ----------- ----------- ------------

Current assets

Inventories 1,995 1,834 2,103

Trade and other receivables 2,949 1,397 1,355

Cash and cash equivalents 8,010 9,884 11,005

Total current assets 12,954 13,115 14,463

--------------------------------- ----------- ----------- ------------

Total assets 64,968 66,709 68,628

--------------------------------- ----------- ----------- ------------

Current liabilities

Trade and other payables (10,336) (12,210) (10,493)

Lease liabilities (2,202) (3,620) (2,024)

Borrowings - (104) (313)

Total current liabilities (12,538) (15,934) (12,830)

--------------------------------- ----------- ----------- ------------

Non-current liabilities

Provisions (335) (335) (297)

Lease liabilities (50,273) (51,288) (50,157)

Long-term borrowings - (1,146) (937)

Other payables (128) (80) (80)

Total non-current liabilities (50,736) (52,849) (51,471)

--------------------------------- ----------- ----------- ------------

Total liabilities (63,274) (68,783) (64,301)

--------------------------------- ----------- ----------- ------------

Total net assets/(liabilities) 1,694 (2,074) 4,327

--------------------------------- ----------- ----------- ------------

Equity

Share capital 6,061 6,061 6,061

Share premium 24,254 24,254 24,254

Merger reserve 992 992 992

Retained deficit (29,613) (33,381) (26,980)

Total equity 1,694 (2,074) 4,327

--------------------------------- ----------- ----------- ------------

Consolidated cash flow statement

for the 26 weeks ended 26 June 2022 (unaudited)

26 26 52

weeks weeks weeks ended

to to

26 June 27 June 26 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Operating activities

Cash generated from operations 945 2,365 7,826

-------- -------- -------------

Net cash inflow from operating

activities 945 2,365 7,826

----------------------------------- -------- -------- -------------

Investing activities

Proceeds from sale of property,

plant and equipment - - 3

Purchase of property, plant

and equipment (516) (192) (544)

Interest received 3 - -

-------- -------- -------------

Net cash flows used in investing

activities (513) (192) (541)

----------------------------------- -------- -------- -------------

Financing activities

Net proceeds from issue

of ordinary shares - 3 3

Bank loan receipts - 1,250 1,250

Bank loan repayment (1,250) - -

Finance expense (30) (26) (59)

Finance expense (IFRS 16) (1,219) (1,237) (2,438)

Principal paid on lease

liabilities (928) (307) (3,064)

-------- -------- -------------

Net cash flows used in financing

activities (3,427) (317) (4,308)

----------------------------------- -------- -------- -------------

Net increase in cash and

cash equivalents (2,995) 1,856 2,977

Cash and cash equivalents at

beginning of the period 11,005 8,028 8,028

-------- -------- -------------

Cash and cash equivalents as

at 26 June 2022 8,010 9,884 11,005

----------------------------------- -------- -------- -------------

Notes to the condensed financial statements

for the 26 weeks ended 26 June 2022 (unaudited)

1 General information

Tasty plc is a public limited company incorporated in the United

Kingdom under the Companies Act (registration number 05826464). The

Company is domiciled in the United Kingdom and its registered

address is 32 Charlotte Street, London, W1T 2NQ. The Company's

ordinary shares are traded on the AIM Market of the London Stock

Exchange ("AIM"). Copies of this Interim Report and the Annual

Report and Financial Statements may be obtained from the above

address or on the investor relations section of the Company's

website at www.dimt.co.uk .

2 Basis of accounting

The condensed set of financial statements included in this

interim financial report has been prepared in accordance with IAS

34 'Interim Financial Reporting', as adopted by the United Kingdom

and accounting policies consistent with International Financial

Reporting Standards (IFRS) and International Financial Reporting

Interpretations Committee (IFRIC) interpretations as endorsed by

the United Kingdom. The same accounting policies, presentation and

methods of computation have been followed in the preparation of

these results as were applied in the Company's latest annual

audited financial statements.

The financial information for the 26 weeks ended 26 June 2022

has not been subject to an audit nor a review in accordance with

International Standard on Review Engagements 2410, Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity, issued by the Financial Reporting Council.

The financial information for the period ended 26 December 2021

does not constitute the full statutory accounts for that period.

The Annual Report and Financial Statements for 2021 have been filed

with the Registrar of Companies. The Independent Auditors' Report

on the Annual Report and Financial Statements for 2021 was

unqualified, did not draw attention to any matters by way of

emphasis, and did not contain a statement under 498(2) or 498(3) of

the Companies Act 2006.

The condensed financial statements are presented in sterling and

all values are rounded to the nearest thousand pounds

(GBP'000).

Except when otherwise indicated, the consolidated accounts

incorporate the financial statements of Tasty plc and its

subsidiary, Took Us A Long Time Limited, made up to the relevant

period end.

Use of judgements and estimates

In preparing these interim financial statements management has

made judgements and estimates that affect the application of

accounting policies and measurement of assets and liabilities,

income and expense provisions. Actual results may differ from these

estimates.

Going concern

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. In reaching this conclusion the Directors have

considered the financial position of the Group, together with its

forecasts for the next 12 months from the date of approval of these

interim accounts and taking into account possible changes in

trading performance. The Group monitors cash balances and impact of

inflation closely to ensure there is sufficient liquidity.

Accordingly, t he Directors believe that it remains appropriate to

prepare the financial statements on a going concern basis.

IFRS 16 'Leases'

Group's accounting policies for leases are as follows:

Lessee accounting

IFRS 16 distinguishes between leases and service contracts on

the basis of whether the use of an identified asset is controlled

by the customer. Control is considered to exist if the customer

has:

-- The right to obtain substantially all of the economic

benefits from the use of an identified asset; and

-- The right to direct the use of that asset in exchange for consideration.

The Group first adopted IFRS 16 for its period starting 30

December 2019 using the modified retrospective approach on

transition, recognising leases at the carried forward value had

they been treated as such from inception, without restatement of

comparative figures. On adoption of IFRS 16, the Group recognised

right-of-use assets and lease liabilities in relation to the

restaurant sites it leases for its business.

All leases are accounted for by recognising a right-of-use asset

and a lease liability except for:

-- Leases of low value assets, and

-- Leases with a duration of 12 months or less.

Subsequent to initial measurement lease liabilities increase as

a result of interest charged at a constant rate on the balance

outstanding and are reduced for lease payments made. Right-of-use

assets are amortised on a straight-line basis over the remaining

term of the lease.

Lessor accounting

Under IFRS 16, a lessor continues to classify leases as either

finance leases or operating leases and account for those two types

of leases differently.

Based on an analysis of the Group's operating leases as at 26

June 2022 on the basis of the facts and circumstances that exist at

that date, the Directors of the Group have assessed that the impact

of this change has not had any impact on the amounts recognised in

the Group's consolidated financial statements.

Short-term leases and leases of low-value assets

The Group has elected not to recognise right-of-use assets and

lease liabilities for short-term leases that have a lease term of

12 months or less and leases of low value assets. The Group

recognises these payments as an expense on a straight-line basis

over the lease term. Currently the Group has no low value assets or

short-term leases.

Covid-19 related rent concessions

IFRS 16 defines a lease modification as a change in the scope of

a lease, or the consideration for a lease, that was not part of the

original terms and conditions of the lease. The Group has

considered the Covid-19 related rent concessions and applied the

lease modifications accounting treatment, rather than the practical

expedient.

Impairments

All assets (ROU and fixed assets) are reviewed for impairment in

accordance with IAS 36 Impairment of Assets, when there are

indications that the carrying value may not be recoverable.

Assets are subject to impairment tests whenever events or

changes in circumstances indicate that their carrying amount may

not be recoverable. Where the carrying value of an asset or a cash

generating unit (CGU) exceeds its recoverable amount, i.e. the

higher of value in use and fair value less costs to dispose of the

asset, the asset is written down accordingly. The Group views each

restaurant as a separate CGU. Value in use is calculated using cash

flows excluding outflows from financing costs over the remaining

life of the lease for the CGU discounted at 8% (2021: 6%), being

the rate considered to reflect the risks associated with the CGUs.

A growth rate of 2% has been applied (2021: 0.5%).

An impairment review was undertaken across the ROU assets and

fixed assets which resulted in a net impairment charge of GBP1.6m

(2021: GBPnil). Where an impairment reversal is recognised, the

carrying amount of the asset will be increased to its recoverable

amount with the increase being recognised in the income statement.

This increased amount cannot exceed the carrying amount that would

have been determined, net of depreciation, had no impairment loss

been recognised for the asset in prior years.

The assumptions will be reviewed at year-end to ensure that the

cashflow expectations are in line with the latest outlook.

Other income

In accordance with IAS 20 (Accounting for Government Grants and

Disclosure of Government Assistance) guidelines, the Group has

recognised the salary expense as normal and recognised the grant

income in profit and loss as the Group becomes entitled to the

grant.

Other income includes Government Coronavirus Job Retention

Scheme ("CJRS") of GBPnil (2021: GBP1.9m), sub-let property income

of GBP0.2m (2021: GBP0.1m) and Government Grants of GBPnil (2021:

GBP1.8m).

3 Income tax

The income tax charge has been calculated by reference to the

estimated effective corporation tax and deferred tax rates of 19%

(2021: 19%).

Tax charge GBPnil (2021: GBPnil).

4 Earnings per share

26 weeks 26 weeks Restated

to to 52 weeks

ended

26 June 27 June 26 December

2022 2021 2021

Pence Pence Pence

Basic (loss)/profit

per ordinary share (1.89p) (1.94p) 2.56p

Diluted (loss)/profit

per ordinary share (1.66p) (1.85p) 2.27p

26 June 27 June 26 December

2022 2021 2021

Number Number Number

'000 '000 '000

Profit/(loss) per share

has been calculated

using the numbers shown

below:

Weighted average number

of ordinary shares

used as the denominator

in calculating basic

earnings per share 141,090 141,090 141,090

Adjustments for calculation

of diluted earnings

per share:

Ordinary B shares 15,677 6,977 14,815

Options 3,265 - 3,265

Weighted average number

of ordinary shares

and potential ordinary

shares used as the

denominator in calculating

diluted earnings per

share 160,032 148,067 159,170

Restated

26 June 27 June 26 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

(Loss)/profit for the

financial period (2,664) (2,738) 3,608

The basic and diluted (loss)/profit per share figures are

calculated by dividing the net (loss)/profit for the period

attributable to shareholders by the weighted average number of

ordinary shares in issue during the period. The diluted earnings

per share figure allows for the dilutive effect of the conversion

into ordinary shares of the weighted average number of options

outstanding during the period. Options are only taken into account

when their effect is to reduce basic earnings per share.

5 Reconciliation of result before tax to net cash generated from operating activities

26 weeks 26 weeks Restated

to to 52 weeks

ended

26 June 27 June 26 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

(Loss)/profit before tax (2,664) (2,738) 3,608

Finance income (3) - -

Finance expense 30 26 59

Finance expense (IFRS 16) 1,219 1,237 2,438

Share based payment charge 31 65 120

Depreciation of right-of-use

assets (IFRS 16) 1,330 1,545 2,579

Depreciation of property, plant

and equipment 956 687 1,297

Amortisation of intangible assets 2 2 3

Impairment charge/(release)

of property, plant and equipment 304 - (3,207)

Impairment of Right-of-use assets 1,258 - 1,347

Profit from sale of property,

plant and equipment - - (3)

Dilapidations provision charge 38 - -

Dilapidations provision utilisation - - (38)

(Increase)/decrease in inventories 108 (12) (282)

(Increase)/decrease in trade

and other receivables (1,553) (34) 32

Increase/(decrease) in trade

and other payables (111) 1,587 (127)

Net cash inflow from operating

activities 945 2,365 7,826

------------------------------------- --------- --------- ------------

6 Property, plant and equipment and right-of-use assets

Leasehold Furniture Total ROU assets Total

improvements fixtures fixed

and computer assets

equipment

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 27 December

2020 37,176 9,892 47,068 53,446 100,514

Additions 145 399 544 951 1,495

Lease modification - - - (830) (830)

At 26 December

2021 37,321 10,291 47,612 53,567 101,179

----------------------- -------------- -------------- -------- ----------- --------

Additions 249 267 516 - 516

Lease modification - - - 1,221 1,221

At 26 June

2022 37,570 10,558 48,128 54,788 102,916

----------------------- -------------- -------------- -------- ----------- --------

Depreciation

At 27 December

2020 23,834 7,662 31,496 13,635 45,131

Provided for

the period 743 554 1,297 3,142 4,439

Impairments 157 100 257 (257) -

At 26 December

2021 (as previously

stated) 24,734 8,316 33,050 16,520 49,570

----------------------- -------------- -------------- -------- ----------- --------

Prior year adjustment (2,677) (787) (3,464) 1,041 (2,423)

At 26 December

2021 (as restated) 22,057 7,529 29,586 17,561 47,147

----------------------- -------------- -------------- -------- ----------- --------

Provided for

the period 587 369 956 1,330 2,286

Impairments 295 9 304 1,258 1,562

At 26 June

2022 22,939 7,907 30,846 20,149 50,995

----------------------- -------------- -------------- -------- ----------- --------

Net book value

At 26 June

2022 14,631 2,651 17,282 34,639 51,921

----------------------- -------------- -------------- -------- ----------- --------

At 26 December

2021 (as restated) 15,264 2,762 18,026 36,006 54,032

----------------------- -------------- -------------- -------- ----------- --------

Prior year adjustment

The prior year adjustment relates to the treatment of

depreciation on impaired assets and reversal of impairment.

The depreciation charge on ROU assets should have been reduced

for the impairment to allow depreciation to run to the end of the

life of the lease. In addition, when reversing an impairment that

depreciation should be recognised if the amount at which the asset

would have been carried (net of depreciation) had there been no

impairment or the lower or the irrecoverable amount.

52 weeks 52 weeks

Ended Ended 26

26 December Adjustment December

(as restated) (as previously

stated)

2021 2021 2021

GBP'000 GBP'000 GBP'000

Cost of sales (33,567) 563 (34,130)

Operating expenses 555 1,860 (1,305)

Highlighted items (included

within Operating expenses) 1,993 1,860 133

Profit and total comprehensive

income for the period 3,608 2,423 1,185

--------------------------------- ---------------- ------------- --- ------------------

At 26

December

2021

(as restated)

At 26 December

2021

Adjustment (as previously

stated)

2021 2021 2021

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 18,026 3,464 14,562

Right-of-use assets 36,006 (1,041) 37,047

Equity

Retained deficit (26,980) 2,423 (29,403)

--------------------------------- ---------------- ------------- --- ------------------

Total equity 4,327 2,423 1,904

--------------------------------- ---------------- ------------- --- ------------------

7 Leases

26 26 52

weeks weeks weeks ended

to to

26 June 27 June 26 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Current

Lease liabilities 2,202 3,620 2,024

Non-current

Lease liabilities 50,273 51,288 50,157

Total 52,475 54,908 52,181

------------------------ -------- -------- -------------

Due within one year 2,202 3,620 2,024

Due two to five years 12,792 15,362 12,371

Due over five years 37,481 35,926 37,786

------------------------ -------- -------- -------------

Total 52,475 54,908 52,181

------------------------ -------- -------- -------------

Lease liabilities are measured at the present value of the

remaining lease payments, discounted using the Group's incremental

borrowing rate of 4.5% and the Bank of England (BoE) base rate at

the time of any lease modification or a new lease. The average rate

used for modification in 2022 was 5.1% (2021: 4.6%).

The lease liabilities as at 26 June 2022 were GBP52.5m (2021:

GBP54.9m).

The right-of-use assets all relate to property leases. The

right-of-use assets as at 26 June 2022 were GBP34.6m (2021:

GBP38.3m). During the period ended 26 June 2022 the Group made a

provision for impairment of the right-of-use assets against a

number of sites totalling GBP1.3m (2021: GBPnil).

Included in profit and loss for the period is GBP1.3m

depreciation of right-of-use assets and GBP1.2m financial expenses

on lease liabilities.

8 Borrowings

26 weeks 26 weeks 52 weeks

to to ended

26 June 27 June 26 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Current

Secured bank borrowings - 104 313

------------------------- ----------- --------- ------------

Non-current

Secured bank borrowings - 1,146 937

------------------------- ----------- --------- ------------

Total - 1,250 1,250

------------------------- ----------- --------- ------------

The GBP1.25m loan was a four-year term loan which had a capital

repayment holiday of 12 months and carried interest at a rate of

4.5% per annum over the Bank of England Base Rate. The outstanding

loan of GBP1.25m was repaid in full during the period.

9 Reconciliation of financing activity

Lease liabilities Lease liabilities Bank Loan Bank Loan Total

Due within Due after Due within Due after

1 year 1 year 1 year 1 year

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Net debt as at 30

December 2019 1,647 55,761 800 852 59,060

Cashflow (1,735) - (800) (852) (3,387)

Addition/(decrease)

to lease liability 2,992 (3,542) - - (550)

--------------------- ------------------ ------------------ ----------- ---------- --------

Net debt as at 27

December 2020 2,904 52,219 - - 55,123

Cashflow (3,064) - 313 937 (1,814)

Addition/(decrease)

to lease liability 2,184 (2,062) - - 122

--------------------- ------------------ ------------------ ----------- ---------- --------

Net debt as at 26

December 2021 2,024 50,157 313 937 53,431

Cashflow (927) - (313) (937) (2,177)

Addition/(decrease)

to lease liability 1,105 116 - - 1,221

--------------------- ------------------ ------------------ ----------- ---------- --------

Net debt as at 26

June 2022 2,202 50,273 - - 52,475

--------------------- ------------------ ------------------ ----------- ---------- --------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EDLFFLKLZBBL

(END) Dow Jones Newswires

September 19, 2022 02:01 ET (06:01 GMT)

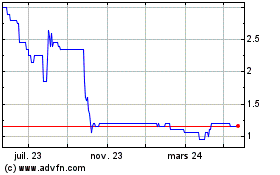

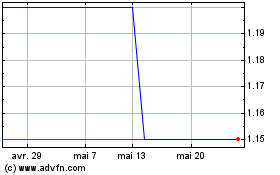

Tasty (LSE:TAST)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Tasty (LSE:TAST)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025