TOTALENERGIES SE: TotalEnergies Energy Outlook 2022: TotalEnergies Publishes its Annual Contribution to the Energy Transition Dialogue

27 Septembre 2022 - 2:33PM

UK Regulatory

TIDMTTE

In view of the forthcoming COP27, the multi-energy Company

TotalEnergies (Paris:TTE) (LSE:TTE) (NYSE:TTE) aims at improving

the understanding of the global energy system and thus contributing

to the Energy Transition debate with its annual publication, the

TotalEnergies Energy Outlook 2022 (document available at this

link).

TotalEnergies Energy Outlook 2022

Published for the fourth consecutive year, the TotalEnergies

Energy Outlook 2022 reexamines the two core scenarios -- Momentum

and Rupture -- elaborated by TotalEnergies to achieve the energy

transition by 2050, taking into consideration current energy

markets and societal trends. It also integrates new Net Zero

pledges made since the presentation of last year's Energy Outlook

in September 2021, thus strengthening global climate ambition.

-- TotalEnergies' Momentum scenario is a forward-looking approach based on

existing decarbonization strategies of Net Zero 2050 countries, as well

as NDCs (Nationally Determined Contributions) of other countries. In

addition to major economies like the US, European countries, Japan and

South Korea, Momentum incorporates this year new Net Zero 2050 pledges

from Australia, Singapore, Taiwan and the UAE. The increasing number of

countries with carbon neutrality commitments by 2050 following the COP26

in Glasgow is excellent news for the climate but still results in a

2.1-2.3deg temperature increase by 2100 in our models (using IPCC curves

AR6 P66).

-- TotalEnergies' Rupture isa scenario built to reach the objectives of the

Paris Agreement by 2050, with temperatures' rise well-below 2degC (P66)

vs. pre-industrial levels. It involves dissemination at large-scale of

decarbonization drivers to all emerging economies, the construction a new

low carbon energy system at a global scale while gradually transitioning

from the existing one. It will not happen without richer countries

supporting emerging ones by promoting a just energy transition (via

investments, technology transfers, training...) with a funding at least

at the level forecasted in the Paris agreement (100 B$/year from 2020).

-- By extending a combination of levers already applied in the Rupture

scenario onwards to all countries around the world, the TotalEnergies

Energy Outlook 2022 gives a Rupture+ scenario, which allows to limit the

temperature rise to 1,5degC (P50). Oil demand in 2050 is comparable to

IEA NZE but the trajectory to reach this target is different as new oil

projects are still needed until the mid-2030s to meet demand and avoid

prices spikes.

"Current energy markets disruptions have reinforced the

necessity of dialogue on a global basis about the energy

transition, involving worldwide participation of all actors of the

society" declared Patrick Pouyanné, Chairman and CEO of

TotalEnergies. "With this document, in line with our climate

ambition to get to Net Zero by 2050 and our ongoing transformation

into a multi-energy company putting the sustainable development

goals at the core of our strategy, TotalEnergies intends to share

its knowledge of the global energy system, in order to contribute

to the decisions that will foster the energy transition and help to

tackle climate change."

Helle Kristoffersen, President Strategy & Sustainability and

member of the Executive Committee, will present this document today

as an introduction to the Investors Days. This webcast will be

streamed live and available for replay at the following link.

Below are some of the key messages from the TotalEnergies Energy

Outlook 2022:

-- The short-term trajectory of global energy demand is not going in the

right direction (pick up in coal use) due to the economic recovery post

Covid in 2021 and the current market disruptions. More efforts will be

needed to decarbonize while ensuring energy security and affordability.

-- Current high energy prices have put energy efficiency at the top of the

energy policy agenda in many OECD countries. The current crisis should be

an opportunity to increase and anchor energy saving and efficiency

measures as they are the fundamental basis of any scenario to reach the

Paris agreement objectives.

-- In the OECD, the electrification of end-user demand thanks to clean power

is a structural evolution that helps reduce emissions and increase energy

efficiency. The biggest impacts are to be found in road transport (Light

Vehicles, 2-3 wheelers, Heavy Duty Vehicles) and industry. Strong public

policies such as the ban on sales of new internal combustion vehicles in

Europe and California are important to drive evolutions in demand. Heavy

investment in electrical grids at state and interstate levels are

fundamental requirements for the success of this electrification.

-- In non-OECD countries, in particular in Africa, the switch away from

traditional biomass to modern energy is core to increasing energy

efficiency while providing affordable energy access, better living

standards and economic development to growing populations.

-- Renewables, already the main driver of the decarbonization of the power

mix, are experiencing a higher and faster penetration as energy security

becomes a key concern for many countries.

-- With the increased penetration of renewables globally, natural gas keeps

a key role in the energy transition to ensure firm power, in addition to

pushing out coal in all sectors of final demand. Gas will become greener

over time and its growth is accompanied by carbon capture and methane

emissions control solutions.

-- H2 and Sustainable Liquid Fuels based on e-fuels are promising

decarbonization drivers, but they will not scale up before 2030; in the

meantime, renewable diesel and biogas are expected to pick up. Once at

scale, hydrogen and hydrogen-based fuels will increase demand for clean

power and carbon abated gas by more than 10% by 2050.

-- The transition will require a step up in spending to build a new low

carbon energy system and maintain the existing one for a while. The

current decade is decisive. Investment in low carbon power must double to

2030 to reach 1.5 T$/year. Meanwhile, investment in new oil and gas

developments is required until at least the mid-2030s to satisfy customer

demand, even in a well below 2degC scenario.

-- Massive investment in clean tech R&D is needed to develop the

technologies that will power this new energy system. TotalEnergies is

committed to this transition and devotes already more than 60% of its R&D

Budget to clean tech.

***

About TotalEnergies

TotalEnergies is a global multi-energy company that produces and

markets energies: oil and biofuels, natural gas and green gases,

renewables and electricity. Our more than 100,000 employees are

committed to energy that is ever more affordable, cleaner, more

reliable and accessible to as many people as possible. Active in

more than 130 countries, TotalEnergies puts sustainable development

in all its dimensions at the heart of its projects and operations

to contribute to the well-being of people.

Twitter: @TotalEnergies LinkedIn: TotalEnergies Facebook:

TotalEnergies Instagram: TotalEnergies

Cautionary Note

The terms "TotalEnergies", "TotalEnergies company" or "Company"

in this document are used to designate TotalEnergies SE and the

consolidated entities that are directly or indirectly controlled by

TotalEnergies SE. Likewise, the words "we", "us" and "our" may also

be used to refer to these entities or to their employees. The

entities in which TotalEnergies SE directly or indirectly owns a

shareholding are separate legal entities. This document may contain

forward-looking information and statements that are based on a

number of economic data and assumptions made in a given economic,

competitive and regulatory environment. They may prove to be

inaccurate in the future and are subject to a number of risk

factors. Neither TotalEnergies SE nor any of its subsidiaries

assumes any obligation to update publicly any forward-looking

information or statement, objectives or trends contained in this

document whether as a result of new information, future events or

otherwise. Information concerning risk factors, that may affect

TotalEnergies' financial results or activities is provided in the

most recent Universal Registration Document, the French-language

version of which is filed by TotalEnergies SE with the French

securities regulator Autorité des Marchés Financiers (AMF), and in

the Form 20-F filed with the United States Securities and Exchange

Commission (SEC).

TotalEnergies Contacts

Media Relations: +33 (0)1 47 44 46 99 l presse@totalenergies.com

l @TotalEnergiesPR

Investor Relations: +33 (0)1 47 44 46 46 l

ir@totalenergies.com

View source version on businesswire.com:

https://www.businesswire.com/news/home/20220927005719/en/

CONTACT:

TotalEnergies

SOURCE: TotalEnergies SE

Copyright Business Wire 2022

(END) Dow Jones Newswires

September 27, 2022 08:33 ET (12:33 GMT)

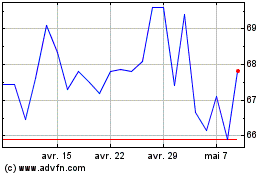

Totalenergies (LSE:TTE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Totalenergies (LSE:TTE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024