TIDMUSF TIDMUSFP

RNS Number : 9030N

US Solar Fund PLC

28 September 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO OR WITHIN

THE UNITED STATES, AUSTRALIA, CANADA OR JAPAN, OR ANY OTHER

JURISDICTION WHERE, OR TO ANY OTHER PERSON TO WHOM, TO DO SO WOULD

BE UNLAWFUL. THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE

OR FORM PART OF ANY OFFER TO SELL OR ISSUE, OR ANY SOLICITATION OF

ANY OFFER TO PURCHASE, SUBSCRIBE FOR OR OTHERWISE ACQUIRE, ANY

INVESTMENTS IN ANY JURISDICTION.

28 September 2023

US SOLAR FUND PLC (USF, the "Company")

Interim Results to 30 June 2023 , NAV Update and Quarterly

Dividend

US Solar Fund plc (LON: USF (USD)/USFP (GBP)) is pleased to

announce its interim results for the period to 30 June 2023, along

with a dividend of 1.29 cents per share for the quarter ended 30

June 2023, and its NAV at 30 June 2023 of $284.2 million or $0.855

per share.

Highlights for the quarter to 30 June 2023:

-- NAV at 30 June 2023 of $284.2 million ($0.855 per Ordinary

Share), 11.2% lower than 31 December 2022 NAV of $320.0 million

($0.963 per Ordinary Share).

-- Macroeconomic headwinds impacted the infrastructure sector as

US inflation increased operating costs and discount rates also

rose; combined, these factors more than offset improved merchant

curves for the Company's operating portfolio.

-- Given the current market conditions and feedback from the

Strategic Review, the Board determined the figure at the bottom of

the consultant's valuation range was appropriate to include in the

Company's NAV (as compared to around the mid-point valuations in

all prior periods).

-- The Company announces its Q2 2023 dividend of 1.29 cents per

Ordinary Share, in line with its annual dividend target of 5.66

cents per Ordinary Share. The dividend will be paid as timetabled

below:

-- Ex-Dividend Date: 5 October 2023

-- Record Date: 6 October 2023

-- Payment Date: 27 October 2023

-- Of this dividend 0.30 cents per Ordinary Share has been

designated as an interest distribution while the remaining 0.99

cents per Ordinary Share will be paid as a dividend.

-- The Company paid its Q1 2023 dividend of 1.29 cents per

Ordinary Share on 7 July 2023. Including the gain on the sale of

MS2, the Company expects to cash cover the 2023 dividend.

-- Dividend cover for the twelve months to 30 June 2023 was

1.19x, which also reflects:

-- non-weather losses such as outages and asset unavailability

improving by approximately 20% in the first half of 2023 compared

with 2022

-- lower than expected portfolio generation in the first half

largely due to poor weather, unscheduled maintenance, and

non-reimbursed grid outages

-- 40% of underperformance accounted for by MS2, which is no

longer in the portfolio

Commenting on the Company's results, Gill Nott, Chair of US

Solar Fund, said:

" The Company has faced challenging market conditions over the

first six-months of this year as the macroeconomic environment has

become more volatile. We are pleased that the portfolio has

performed well, confirming the attributes commonly associated with

long term, contracted real assets. However, a variety of market

related factors has impacted the valuation of the assets and the

Board's ability to respond to some of our Shareholder's wishes

during the period. The most significant changes to the market

relate to the current interest rate environment, inflation and

legislative changes affecting the solar industry in the US. As a

result, and as previously announced, the Strategic Review was

unsuccessful in attracting binding offers for the assets or

Company.

We have worked with our advisors and Shareholders throughout the

first six-months of this year to adapt our strategy to the current

and unexpected market conditions and are now laying the groundwork

necessary to move on from the Strategic Review and build confidence

around the future of the Company and the portfolio.

In July, USF announced that it had mutually agreed with NESM

that USF's existing investment management agreement would not

extend beyond the expiry of the initial five year term. We had

already included the possibility of a change of investment manager

in the Strategic Review and were pleased to have several credible

candidates to choose from. After a careful selection process, and

suitable due diligence, we chose Amber as our preferred candidate

to take over the management of the Company from NESM. We have

entered a period of exclusivity with Amber who have now met many of

our shareholders (over 70% by value of shares) to understand their

concerns and opinions on the way forward for the Company. The

Board, NESM, and Amber will be working closely together in the

coming weeks to finalise arrangements for the transfer. Further

details of the buyback/return of capital and other balance sheet

management initiatives will be provided in due course. "

Half-year report

A copy of the half-year report has been submitted to the

National Storage Mechanism and is available at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism . The

half-year report is also available on US Solar's website, where you

can find all information about the Company:

https://www.ussolarfund.co.uk/investor-centre/key-documents-and-disclosure

.

For further information, please contact:

US Solar Fund

Whitney Voute +1 718 230 4329

Cavendish Securities Plc

James King

Tunga Chigovanyika

Will Talkington +44 20 7397 8900

Jefferies International Limited

Stuart Klein

Gaudi Le Roux +44 20 7029 8000

KL Communications +44 20 3995 6673

Charles Gorman

Charlotte Francis

About US Solar Fund plc

US Solar Fund plc, established in 2019, listed on the premium

segment of the London Stock Exchange in April 2019. The Company's

investment objective is to provide investors with attractive and

sustainable dividends with an element of capital growth by owning

and operating solar power assets in North America and other OECD

countries in the America.

The solar power assets that the Company acquires or constructs

are expected to have an asset life of at least 30 years and

generate stable and uncorrelated cashflows by selling electricity

to creditworthy offtakers under long-term power purchase agreements

(or PPAs). The Company's portfolio currently (excluding the

Company's 50% interest in MS2) consists of 41 operational solar

projects with a total capacity of 443MW(DC) , all located in the

United States.

Further information on the Company can be found on its website

at http://www.ussolarfund.co.uk .

About the Investment Manager

USF is managed by New Energy Solar Manager (NESM). NESM also

manages New Energy Solar, an Australian Securities Exchange

(ASX)-listed fund. Combined, US Solar Fund and New Energy Solar

have committed approximately US$1.3 billion to 57 projects

totalling 1.2GW(DC) . NESM is owned by E&P Funds, the funds

management division of E&P Financial Group, an ASX listed

company (ASX: EP1) with over A$20 billion of funds under

advice.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIGDCSSDDGXR

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

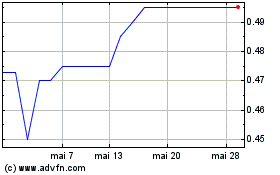

Us Solar (LSE:USF)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Us Solar (LSE:USF)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024