US Solar Fund PLC Dividend Declaration and NAV Update (2776V)

30 Novembre 2023 - 5:19PM

UK Regulatory

TIDMUSF TIDMUSFP

RNS Number : 2776V

US Solar Fund PLC

30 November 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO OR WITHIN

THE UNITED STATES, AUSTRALIA, CANADA OR JAPAN, OR ANY OTHER

JURISDICTION WHERE, OR TO ANY OTHER PERSON TO WHOM, TO DO SO WOULD

BE UNLAWFUL. THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE

OR FORM PART OF ANY OFFER TO SELL OR ISSUE, OR ANY SOLICITATION OF

ANY OFFER TO PURCHASE, SUBSCRIBE FOR OR OTHERWISE ACQUIRE, ANY

INVESTMENTS IN ANY JURISDICTION.

30 November 2023

US SOLAR FUND PLC (USF, the "Company")

Dividend and NAV Update

US Solar Fund plc (LON: USF (USD)/USFP (GBP)) announces that its

unaudited NAV at 30 September 2023 was $286.3 million or $0.862 per

share.

Highlights for the quarter to 30 September 2023:

-- USF's NAV at 30 June 2023 was $284.2 million or $0.855 per

Ordinary Share. Adjusting for cash flows during the period, the

unaudited NAV at 30 September 2023 is $286.3 million or $0.862 per

Ordinary Share, 0.7% higher than the 30 June 2023 NAV.

-- T he Company announces its Q3 2023 dividend of 1.54 cents per

Ordinary Share, in line with its annual dividend target of 5.66

cents per Ordinary Share. The dividend will be paid as timetabled

below:

o Ex-Dividend Date: 7 December 2023

o Record Date: 8 December 2023

o Payment Date: 29 December 2023

-- Of this dividend declared of 1.54 cents per Ordinary Share,

none of the dividend has been designated as an interest

distribution.

-- The Company paid its Q2 2023 dividend of 1.29 cents per

Ordinary Share on 27 October 2023.

-- Dividend cover for the twelve months to 30 September 2023 was

1.25x, inclusive of cash flow reserve carried forward and the gain

on the sale of MS2. The forecast coverage for the full 2023 year is

1.09x.

Highlights post period end:

-- USF announced in August that Amber Infrastructure Investment

Advisor, LLC, a member of the Amber Infrastructure Group (Amber)

had been selected to replace New Energy Solar Manager (NESM) as the

Company's Investment Manager. Amber is a specialist international

infrastructure investment manager with approximately GBP5 billion

of funds under management, including a leading track record built

over the past 15 years in UK investment company management. On 17

November, a General Meeting was held and a resolution was passed

approving changes to the Investment Policy. The Board also

confirmed that the approval satisfied conditions to appoint Amber

as the new Investment Manager. Amber and NESM are working together

to ensure a smooth transition of the investment manager role, with

a target transition date of 1 December 2023.

-- Prior to the publication of this update, six of USF's Oregon

projects (Chiloquin, Turkey Hill, Merrill, Lakeview, Dairy and

Tumbleweed) signed new long-term contracts to sell Renewable Energy

Certificates (RECs). The cashflows resulting from the new REC

contracts will be included in the calculation of USF's NAV as at 31

December 2023 and will be announced to the market following

consultation with the Company's independent valuation

consultant.

The NAV update and the Company's factsheet for Q3 2023 are

available on the Company's website at:

www.ussolarfund.co.uk/investor-centre .

For further information, please contact:

Cavendish Securities

James King

Tunga Chigovanyika

Will Talkington +44 20 7397 8900

Jefferies International Limited

Stuart Klein

Gaudi Le Roux +44 20 7029 8000

KL Communications +44 20 3995 6673

Charles Gorman

Charlotte Francis

About US Solar Fund plc

US Solar Fund plc, established in 2019, listed on the premium

segment of the London Stock Exchange in April 2019. The Company's

investment objective is to provide investors with attractive and

sustainable dividends with an element of capital growth by owning

and operating solar power assets in North America and other OECD

countries in the Americas.

The solar power assets that the Company acquires or constructs

are expected to have an asset life of at least 30 years and

generate stable and uncorrelated cashflows by selling electricity

to creditworthy offtakers under long-term power purchase agreements

(or PPAs). The Company's portfolio currently consists of 41

operational solar projects with a total capacity of 443MW(DC) , all

located in the United States.

Further information on the Company can be found on its website

at http://www.ussolarfund.co.uk .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVNKKBDABDDADN

(END) Dow Jones Newswires

November 30, 2023 11:19 ET (16:19 GMT)

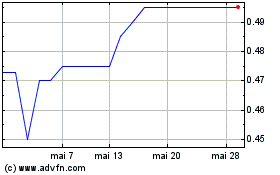

Us Solar (LSE:USF)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Us Solar (LSE:USF)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024