TIDMUSF TIDMUSFP

RNS Number : 0369X

US Solar Fund PLC

18 December 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO OR WITHIN

THE UNITED STATES, AUSTRALIA, CANADA OR JAPAN, OR ANY OTHER

JURISDICTION WHERE, OR TO ANY OTHER PERSON TO WHOM, TO DO SO WOULD

BE UNLAWFUL. THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE

OR FORM PART OF ANY OFFER TO SELL OR ISSUE, OR ANY SOLICITATION OF

ANY OFFER TO PURCHASE, SUBSCRIBE FOR OR OTHERWISE ACQUIRE, ANY

INVESTMENTS IN ANY JURISDICTION.

18 December 2023

US SOLAR FUND PLC (USF, the "Company")

NEW RENEWABLE ENERGY CERTIFICATE CONTRACTS SIGNED

US Solar Fund plc (LON: USF (USD)/USFP (GBP)) is pleased to

announce that six of USF's Oregon projects have signed new

long-term contracts to sell Renewable Energy Certificates (RECs).

The REC contracts and revised estimates of future REC prices are

expected to result in a NAV increase of approximately $7.6 million

based on the 30 September NAV ($286.3 million) and contribute to

additional operational cash dividend coverage from 2024

onwards.

Renewable Energy Certificates are awarded to generators of

renewable energy and are tradeable financial instruments. The award

of RECs to incentivise renewable power generation in the US has

increased in recent years as states seek to meet their renewable

energy objectives. The new REC contracts will commence in January

2024, following the expiry of existing contracts in December 2023

and will expire in 2031/32. The offtaker is 3Degrees, a leading

global provider of climate solutions who will pay a fixed price per

REC for the duration of the contracts.

The revenues resulting from the new REC contracts exceed the

assumptions made for income from REC's for these assets in the

Company's current NAV, reflecting a trend for increasing REC prices

in Oregon and across the US. The relevant projects are Chiloquin,

Turkey Hill, Merrill, Lakeview, Dairy and Tumbleweed, which

represent in aggregate 79.4MW of generation.

The new REC contracts will be included in USF's NAV as at 31

December 2023 when the Company's Solar Power Assets are next valued

by an independent third-party appraiser [1] . In line with the

strategy of the manager, Amber Infrastructure Investment Advisor

LLC ('Amber'), Amber will continually appraise opportunities for

recontracting RECs, entering into accretive power purchase

agreements and securing new credits or grants attributable to

renewable power generation in the US on behalf of the Company.

Tom O'Shaughnessy, Head of North America at Amber, US Solar

Fund's Manager, said:

"US state-level policies are mandating increasing levels of

renewables output and driving rising renewable power prices,

particularly from operational solar assets. These supportive

long-term trends underpin US Solar Fund's portfolio with favourable

income characteristics and a more stable outlook for the asset

class .

"Those characteristics are evidenced in the higher prices for

the recontracted RECs we have announced today. Our active approach

to capitalise on these trends means we see more opportunities to

create value in the portfolio, and we look forward to keeping

shareholders updated."

For further information, please contact:

US Solar Fund

Meredith Frost (Amber Infrastructure) +44 20 7939 0550

Cavendish Securities Plc

Tunga Chigovanyika

James King

Will Talkington +44 20 7397 8900

Jefferies International Limited

Stuart Klein

Gaudi Le Roux +44 20 7029 8000

KL Communications +44 20 3995 6673

Charles Gorman

Charlotte Francis

Patrick Lodge

About US Solar Fund plc

US Solar Fund plc, established in 2019, listed on the premium

segment of the London Stock Exchange in April 2019. The Company's

investment objective is to provide investors with attractive and

sustainable dividends with an element of capital growth by owning

and operating solar power assets in North America and other OECD

countries in the Americas.

The solar power assets that the Company acquires or constructs

are expected to have an asset life of at least 30 years and

generate stable and uncorrelated cashflows by selling electricity

to creditworthy offtakers under long-term power purchase agreements

(or PPAs). The Company's portfolio currently consists of 41

operational solar projects with a total capacity of 443MW (DC) ,

all located in the United States.

Further information on the Company can be found on its website

at http://www.ussolarfund.co.uk .

About Amber Infrastructure Group

Amber Infrastructure is an international infrastructure

specialist, focused on investment origination, development, asset

management and in Europe, fund management. Amber's core business

focuses on infrastructure assets across the public, transport,

energy, digital and demographic infrastructure sectors that support

the lives of people, homes and businesses internationally.

Among other funds, Amber Infrastructure advises International

Public Partnerships, a FTSE 250-listed company with a market cap of

approximately GBP2.5 billion and 15-year track record of long-term

investment in infrastructure assets globally. Amber is

headquartered in London with offices in Europe, North America and

Australia and employs over 180 infrastructure professionals. Amber

has had a strategic partnership with the Hunt

Group of Companies in the US since 2015. Learn more at www.amberinfrastructure.com .

[1] Fair value and NAV movements at 31 December 2023 may be more

or less than $7.6 million depending on the impact of tax, working

capital, and other adjustments applied on that valuation date.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CNTBUBDDLGBDGXU

(END) Dow Jones Newswires

December 18, 2023 02:00 ET (07:00 GMT)

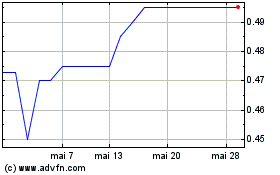

Us Solar (LSE:USF)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Us Solar (LSE:USF)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024