Update on Funding and on Repayment of Asset Based Debt Facility

& General Corporate Update

Vast Resources plc / Ticker: VAST / Index: AIM /

Sector: Mining

29 April 2024

Vast Resources plc

(‘Vast’ or the ‘Company’)

Update on Funding and on Repayment of

Asset Based Debt Facility

General Corporate Update

Funding

Vast Resources plc, the AIM-listed mining

company, is pleased to announce an update in relation to the Asset

Backed Debt facility from A&T Investments SARL (“Alpha”) as

announced on 16 May 2022 and the debt owed to Mercuria Energy

Trading SA (“Mercuria”) relating to Tranche A of the Prepayment

Agreement announced on 21 March 2018.

As announced on 15 January 2024, the totality of

the debt owed to Mercuria and Alpha had an effective repayment date

of 29 February 2024, and as announced on 13 March 2024 discussions

regarding the terms and conditions of a further extension of the

loans have been continuing.

The debt currently due to Alpha is approximately

US$5.5 million and the Company has now concluded legal

documentation with Alpha under which US$1.5 million will be due to

be repaid on 7 May 2024; a further US$1.5 million will be due to be

repaid 30 days from the first repayment; and a further US$1.5

million will be due to be repaid 60 days from the first repayment.

The Company expects to fund these amounts, to a large extent, from

the refinancing as further detailed below.

Mercuria, to whom approximately US$3.9 million

is currently due, have confirmed that a further extension and an

appropriate contract with Mercuria will be prepared in due

course.

At the same time the Company is also pleased to

announce that discussions with the owner of the Swiss investment

company (also the owner of the PGM metals subject to the Platinum

Group Metals agreement and referred to above and in the Company’s

Circular of 14 February 2024) for the provision of major

restructuring finance for the Company, including payment of the

amounts due to Alpha as set out above, have now reached an advanced

stage; subject to the provider finalising their own financing

arrangements, and in relation to this the Company can announce that

these discussions are no longer conditional on completion of the

first sale under the Platinum Group Metals agreement as stated in

the Company’s Circular announced on 14 February 2024.

Should the Company not be able to conclude this

refinancing it will need to source alternative funding to be able

to meet its obligations to Alpha including the payment due on the 7

May 2024 or otherwise agree revised payment terms.

Baita Plai

The first delivery has been completed under the

new offtake agreement with Trafigura announced on 13 March 2024. At

the mine, the anticipated higher-grade ore has been reached,

although production levels have been constrained as the Company

awaits the comprehensive refinancing as foreshadowed in the

Company’s Circular of 14 February 2024 and as further referred to

above.

Licence extension documentation is in the

process of being finalised in order that this be submitted by the

12 May 2024 deadline.

Tajikistan

- Processing project – Production at

the mine was stopped during the winter due to extreme cold weather,

but mining restarted at the beginning of March. 12,000

tons of ore has been stockpiled and is ready for processing. In

addition, underground mining is continuing and will accumulate a

two-month stockpile to be available at all times.

It is planned to fully insulate the plant so

that there is no need for any stoppage next winter. The cost of

this will not be for the account of the Company.

Takob and the Company are also in discussions

with a new offtake partner to sell the fluorspar concentrate which

would result in further revenue streams of the producing mine for

which the Company expects to receive financial compensation.

- Aprelevka – The Company had placed

a team on the ground at Aprelevka for four weeks working within the

production facility, and this has resulted in an improvement in

recovery by 15%. The Company has also

appointed consultant mining engineers who arrived on site on 11

April in order to advise on improving efficiencies at the mine and

improving mining techniques. A programme for reprocessing high

grade tailings together with fresh ore is also being implemented

and is expected to yield results within the next two quarters.

The current plant installed capacity is 1,800tpd

and is currently operating at 800tpd. The reprocessing of

high-grade tailings will increase the plant production to over

1,000tpd while improvements in the mining and efficiencies in the

plant continue. That, coupled with the recovery increases, will

bring Aprelevka back to historic gold production levels.

In addition to the improvements on the

production facility, and following a mine site visit by the

Company’s consultants, the presence of high-grade ore in the

current working areas has been confirmed. Vast has commissioned

Formin to provide an updated resource report based on the SRK

produced wireframes, collated historic data and the 2019-2022

drilling results.

Finally, during the Company’s recent site visit

of the 400ha Kushmullo exploration licence area, the team

encountered a high-grade copper hydroxide outcropping on which the

Company tested copper grades between 7-37% at surface.

The exploration programme referred to in the announcement of 16

January 2024 and which was carried out between 2019 and 2022 did

not test for copper. We are therefore sending all the cores taken

in this area for re-testing of copper and other non-ferrous

metals.

The various developments at Aprelevka described

above are all financed by Bay Square Pacific Ltd (‘Bay Square’),

the 49% owner of Aprelevka, and the Company should benefit

therefrom through its 10% earnings share agreement with Bay Square

announced on 16 January 2024.

The Historic Parcel

The Company continues to have reason to believe

that the delivery of the Parcel will be finalised at some stage.

However, there can be no absolute certainty of this and therefore

notwithstanding the Board’s continuing belief the Board is

progressing the refinancing along with other funding discussions to

provide for its immediate funding requirements.

PGM Marketing contract

Sample material is out with three interested

purchasers, which purchasers include the Nikash Group with whom a

contract was announced on 22 January 2024. The sample grades have

been good but very variable between the different PGMs, and the

variability has necessitated a longer period for testing than might

otherwise have been the case. The test work being carried out will

allow the concentrates to be separated into categories to maximise

payables on a batch-by-batch basis. As a result of these processes,

no sale of material has yet taken place, but the first sale is then

expected to occur and this will be confirmed in due course

**ENDS**

For further information, visit

www.vastplc.com or please contact:

Vast

Resources plc

Andrew Prelea (CEO)

|

www.vastplc.com

+44 (0) 20 7846 0974 |

Beaumont

Cornish – Financial & Nominated Advisor

Roland Cornish

James Biddle

|

www.beaumontcornish.com

+44 (0) 20 7628 3396 |

Shore

Capital Stockbrokers Limited – Joint Broker

Toby Gibbs / James Thomas (Corporate Advisory)

|

www.shorecapmarkets.co.uk

+44 (0) 20 7408 4050 |

Axis

Capital Markets Limited – Joint Broker

Richard Hutchinson

|

www.axcap247.com

+44 (0) 20 3206 0320 |

St Brides

Partners Limited

Susie Geliher / Charlotte Page |

www.stbridespartners.co.uk

+44 (0) 20 7236 1177 |

ABOUT VAST RESOURCES PLC

Vast Resources plc is a United Kingdom AIM

listed mining company with mines and projects in Romania,

Tajikistan, and Zimbabwe.

In Romania, the Company is focused on the rapid

advancement of high-quality projects by recommencing production at

previously producing mines.

The Company's Romanian portfolio includes 100%

interest in Vast Baita Plai SA which owns 100% of the producing

Baita Plai Polymetallic Mine, located in the Apuseni Mountains,

Transylvania, an area which hosts Romania's largest polymetallic

mines. The mine has a JORC compliant Reserve & Resource Report

which underpins the initial mine production life of approximately

3-4 years with an in-situ total mineral resource of 15,695 tonnes

copper equivalent with a further 1.8M-3M tonnes exploration target.

The Company is now working on confirming an enlarged exploration

target of up to 5.8M tonnes.

The Company also owns the Manaila Polymetallic

Mine in Romania, which the Company is looking to bring back into

production following a period of care and maintenance. The Company

has also been granted the Manaila Carlibaba Extended Exploitation

Licence that will allow the Company to re-examine the exploitation

of the mineral resources within the larger Manaila Carlibaba

licence area.

Vast has an interest in a joint venture company

which provides exposure to a near term revenue opportunity from the

Takob Mine processing facility in Tajikistan. The Takob Mine

opportunity, which is 100% financed, will provide Vast with a 12.25

percent royalty over all sales of non-ferrous concentrate and any

other metals produced.

Also in Tajikistan, Vast has been contracted to

develop and manage the Aprelevka gold mines on behalf of its owner

Gulf International Minerals Ltd (“Gulf”) under which Vast is

entitled, inter alia, to 10% of the earnings that Gulf receives

from its 49% interest in Aprelevka in joint venture with the

government of Tajikistan. Aprelevka holds four active operational

mining licences located along the Tien Shan Belt that extends

through Central Asia, currently producing approximately 11,600oz of

gold and 116,000 oz of silver per annum. It is the intention of the

Company to assist in increasing Aprelevka’s production from these

four mines closer to the historical peak production rates of

approximately 27,000oz of gold and 250,000oz of silver per year

from the operational mines.

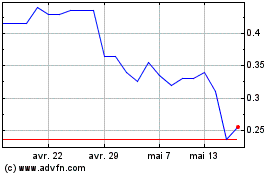

Vast Resources (LSE:VAST)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Vast Resources (LSE:VAST)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024