TIDMWBI

RNS Number : 8518U

Woodbois Limited

04 August 2022

04 August 2022

Woodbois Limited

("Woodbois", the "Group" or the "Company")

Half Year Results

Woodbois Limited (AIM: WBI), the African focused forestry,

timber trading, reforestation and voluntary carbon credit company,

is pleased to announce its half year results for the six months to

30 June 2022.

Financial Highlights

-- H1 2022 revenue up 38% to $11.3m vs H1 2021 $8.2m

-- H1 2022 Group gross profit up 59% to $2.7m vs H1 2021 $1.7m: margin improved to 23% from 20%

-- H1 2022 EBITDAS [1] $1.1m vs H1 2021 $0.46m, up 141%

-- First ever operating profit in H1 2022 of $15k vs $0.7m operating loss in H1 2021

-- H1 2022 positive operating cash inflow (before income taxes

and finance costs) of $0.2m vs outflow in H1 2021 of $2.2m

-- Cash balance $2.1m as at 30 June 2022

-- Period end working capital of $9.8m of which inventory was

$6.4m and excluding short and longer-term bank and other loans of

$12.4m

-- 2022 on track to deliver strong revenue and profitability growth

Operational Highlights

-- Total sawn timber production 9,565m3 in H1 2022, a 37% increase over H1 2021.

-- Total veneer production 2,740m3 in H1 2022, a 50% increase on H1 2021.

-- Best quarter and half-year for volume of product shipped

since before the pandemic. Total number of containers shipped in Q2

2022 increased by 24% over Q1 2022

-- The second veneer line installed at the factory in Mouila is

currently undergoing final testing and will commence production in

August. This will generate additional higher value product and will

represent another significant milestone of achievement.

-- Work on FSC certification has continued and is now over 60%

complete and we aim for completion during 2023.

Commenting on the results, Paul Dolan, CEO said:

"In the first half of 2022 we have achieved record levels of

production, strong revenue growth, further improvement in both

margin and EBITDAS, as well as a first maiden operating profit with

a positive operating cash inflow. Whilst there are challenges our

highly motivated team are on-track to deliver further strong growth

in our metrics, including revenue and profitability. "

The Report is available on the Company's website at:

www.woodbois.com

Enquiries:

Woodbois Limited

Paul Dolan - CEO + 44 (0)20 7099 1940

Canaccord Genuity, Nominated

Advisor

Henry Fitzgerald-O'Connor

Gordon Hamilton + 44 (0)20 7523 8000

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which forms part of UK

law by virtue of the European Union (Withdrawal) Act 2018

("MAR").

Non-IFRS measures

The Company uses certain measures to assess the financial

performance of the company. These terms may be defined as "non-IFRS

measures" as they exclude amounts that are included in, or include

amounts that are excluded from, the most directly comparable

measure calculated and presented in accordance with IFRS. They also

may not be calculated using financial measures that are in

accordance with IFRS. These non-IFRS measures include the Company's

EBITDAS.

The Company uses such measures to measure and monitor

performance and liquidity, in presentations to the Board and as a

basis for strategic planning and forecasting. The directors believe

that these and similar measures are used widely by market

participants, stakeholders, and other interested parties as

supplemental measures of performance and liquidity.

The non-IFRS measures may not be directly comparable to other

similarly titled measures used by other companies and may have

limited use as an analytical tool. This should not be considered in

isolation or as a substitute for analysis of the Company's

operating results as reported under IFRS.

The Company does not regard these non-IFRS measures as a

substitute for, or superior to, the equivalent measures calculated

and presented in accordance with IFRS or those calculated using

financial measures that are calculated in accordance with IFRS.

CEO's Statement

H1 Financial performance

The Company generated a 38% increase in YOY revenues in H1 2022,

with EBITDAS improving by 141% to $1,104k vs $459k in H1 2021,

achieved through a further increase in levels of sawn-timber

production and correspondingly higher sales volumes, underpinned by

strict cost-efficiencies.

The Group delivered a 59% increase in gross profit compared to

the same period for 2021 with margins improving to 23% for H1 2022

from 20% at H1 2021 reflecting robust demand and pricing. Having

delivered positive EBITDAS consistently for the last 18 months, the

Group also booked its first ever operating profit in H1 2022 of

$15k compared to a $0.7m operating loss in H1 2021: this is

especially significant given it includes the costs related to our

Carbon Solutions division. Significantly, in H1 2022 the Company

generated positive operating cash inflows (before tax and finance

costs) of $0.2m for the first time compared to a loss of $2.2m for

H1 2021.

Six months Six months

to June 2022 to June 2021

EBITDAS $'000 $'000

----------------------------- ------------------- -----------------

Loss before tax (489) (980)

Depreciation 977 1,002

Share based payment expense 175 167

Finance cost 441 270

------------------------------ ------------------- -----------------

EBITDAS 1,104 459

H1 gross margin within our own production division held stable

at 32% while the margin from third party trading increased to 14.8%

in H1 2022 compared to 11.3% for H1 2021. Operating and

Administration expenses increased by 18% when compared to the same

period for 2021, as we continued to recruit additional high-quality

personnel to drive and scale the business, including those related

to the Carbon Solutions division. The management team continued to

exert a strong influence over the items within their control,

providing confidence that the Company is on track to drive revenues

to a level substantially in excess of fixed and variable operating

costs.

Finance costs increased by $0.2m (63%) from the same period in

2021 reflecting the increase in the Group's borrowings from a very

low level in 2021, but for context, finance costs remain 79% lower

than in H1 2020. The $2m unsecured facility agreed with Rhino

Ventures, was fully drawn down in February 2022 to fund the

increase in working capital required due to higher volumes of

production. The working capital facility available to the trading

division through its Danish banking partners was increased by $2.3m

and has also been drawn down, helping to accelerate trading growth.

$1m of the $2m conditional facility agreed with Lombard Odier was

also utilised in June 2022 as a short-term measure.

The funds provided by the new borrowings also enabled the

Company to keep pace with the uptick in demand and business

activity towards the latter part of H1 2022 over H2 2021, resulting

in additional investment in working capital, particularly Trade

receivables and Inventory. Total period end working capital is

$9.8m (Dec 2021: $7.7m), including cash of $2.1m (Dec 2021: $0.9m),

excluding loans of $12.4m (Dec 2021: $8.3m).

The primary goal for the Group is to consistently increase

levels of positive cash flow via the delivery of greater volumes of

high-quality product, improve the ratio of high-value hardwoods and

veneers within our product mix, and through incrementally improving

margins in all areas of the business to provide the strongest

possible foundations upon which to drive scale.

Production and trading

Total output at the sawmill and veneer factory in Gabon

increased by 37% and 50% respectively on a year over year basis for

the period, with both facilities consistently achieving their

highest levels of production to date thanks to implementation of

enhanced best practices, improved programmes for maintenance of

equipment and full involvement, motivation and training of staff.

Particular credit must go to the team at the veneer factory for

achieving this result despite the ongoing heavy engineering work

that has been required to install the second veneer line within the

existing factory, which is now undergoing final testing and is

expected to be fully functioning this month. A total of $1.2m in

capex has been allocated to the veneer factory to date during 2022

for this and other improvements and the expanded factory will

signal another major milestone in the growth of the Company once

the second veneer line is fully operational, further boosting

output capacity, revenue and bottom-line potential.

Our continued investment in proprietary trading technology was

rewarded during H12 2022 as gross profit margins within the trading

division of 14.8%, were almost a threefold increase on FY 2020,

while gross profit margins on the higher levels of our own

production remained consistent at 32%. It should be noted that

these have been delivered against a backdrop of continued

disruption being experienced at many ports around the world,

including Libreville, and that the cost of shipping goods has

remained at elevated levels during the period.

Woodbois' profile has continued to grow in Gabon, and more

widely in Africa and beyond, as our sales team has sought to

broaden our customer base and prospect in new geographies to sell

our products into. As output of higher-value product from our

factories increases, markets where premium pricing can be achieved

will increasingly be focused on, with bulk shipment of standard

product directed towards high consumption markets. It is with this

strategy in mind that sales team was well represented at both the

Dubai and Nantes wood shows during H1 2022, and will also be

prominent at Algeria Woodtech in September 2022 as we seek to

expand in the rapidly growing North-African market and to our

existing client base in Asia and the Middle East.

Mozambique

The Group continues to fund a limited level of operations on a

largely care and maintenance basis in Mozambique while retaining

the optionality to increase the scale of operations there, subject

to the level of investment required and demand and pricing of

product in the future. Management intends to dedicate time to

exploring the potential for generating revenues from the carbon

market for preserving forests in the country directly with the

government of Mozambique.

Carbon Division

We are fortunate to have our core operations based in Gabon, one

of the last countries in the world with high forest cover and low

levels of deforestation (HFLD) of between 0 and 0.05%. In 2019

Gabon signed up to an independently audited, results-based

agreement with the UN worth $150m, making it the first HFLD country

in Africa to enter into such a payment agreement for emission

reductions and removals through forest preservation. On 9(th) July

2022 the UN signed the 3(rd) phase of the CAFI (Central African

Forest Initiative) program, congratulating Gabon on its

contribution towards a 'transformation to a green and blue

economy'. It is within this context that Woodbois submitted a

comprehensive feasibility study and proposal to the Government of

Gabon to develop a large-scale afforestation project in the

country. Woodbois aims to be a standard bearer for best practice

within Gabon as the country continues to show leadership on forest

preservation on the world stage. It has been encouraging to see

Gabon receive widespread recognition during H1 2022 for its work

with the United Nations Framework Convention on Climate Change's

REDD+ mechanism to create carbon credits and with the Central

African Forestry Initiative backed by European governments, as well

as becoming the 55(th) member of The Commonwealth in June 2022.

While we wait for government approval for our proposed initial

large-scale afforestation project for carbon sequestration in

Gabon, we continue to work to align our operations with the

interests of the country through increasing employment, continued

investment and commitment to achieving full FSC certification. We

also continue to invest in this important division which we expect

to be a key driver of medium to long-term revenues . We have high

confidence in the future of carbon markets to continue to evolve

positively and in line with shifting public and corporate attitudes

as well as policy changes. We hope to receive the green light to

commence our maiden project in H2 2022 which will be followed by a

comprehensive four-year trial phase. The implementation of our

initial project is intended to position the Company as a pioneer in

this area, distinguishing Woodbois from the rapidly expanding group

of consultants becoming active in the space. Few, if any, other

listed companies have the combination of in-house financial

structuring skills and on-the-ground implementation experience

required to deliver on projects of such scale

ESG

Woodbois has a clear social purpose ingrained within its DNA and

our solid, verifiable ESG credentials are articulated clearly in

the Company's recently published Integrated Report for the year

ending December 2021. The report details our strategy, performance,

opportunities and future outlook in relation to material financial,

economic, social and governance issues and explains how we strive

to achieve balance in all facets of our operations while also

addressing value-creation considerations for investors and all key

stakeholders. From providing truly equal-opportunity-based

employment (our veneer factory has 75% female staff), to our

commitment to best environmental practice within our forest

concessions, multiple community projects including linking villages

through repairing roads and the donation of tools, to sponsoring

UNICEF managed events for local children and forming a partnership

with a cutting-edge, science-based forestry monitoring

organisation, the Company strives to deliver positive social

impact, something our staff are quite rightly proud of. The full

report is available on the Company's website at:

www.woodbois.com

FSC Certification

Woodbois ESG Team, Management team and outside consultant

Silvafrica continued the process of creating the culture needed to

demonstrate changes and dedication to the principles of the

certification throughout the business in order to be fully prepared

for audit by both Legal Source and FSC. In this regard, the focus

during H1 2022 was on continuing to enhance our relationship with

local communities, improve the quality of life of our employees,

provide more health support to our staff, improve our employees'

transportation to and from work and empowering several employees to

be members of our Health and Safety committee. Training was also

provided to our harvesting team on best practices, Health and

Safety and respect for the environment.

At the end of H1 2022, following the guidelines of the FSC

auditing system, our operations in Gabon are now over 60%

compliant. We are aiming to become 100% compliant during 2023.

Outlook

Having previously expressed confidence in the Group's ability to

further increase output, continue to increase margins and grow the

top line very significantly over time, I am understandably happy to

provide confirmation and evidence thereof within this set of half

year results. As noted previously however when the impact of the

pandemic created such huge levels of uncertainty, immediate growth

projections must of course carry a health warning, particularly

given Covid's lingering disruptive effects on international trade,

rising interest rates and the inflationary effects of the war in

Ukraine on the global macro-economic environment. Ultimately,

global demographics and the supply demand imbalance for sawn timber

is in our favour, and operators like ourselves are protected from

inflationary pressures on our raw material input through ownership

of the whole supply chain from forest to buyer. In common with most

other manufacturing companies however, we are not immune to higher

energy costs and fuel shortages and it is clear that due to these

and other inflationary pressures, economies in some parts of the

world may experience a period of lower levels of growth or indeed

slip into recession. We will therefore continue to carefully

monitor risk exposure at both a country and customer level and will

use the levers at our disposal such as switching geographic sales

direction in line with prevailing economic conditions in order to

minimise any potential margin erosion. The challenges of the last

two years have forced the Company to become nimble, resilient,

efficient and adaptable, all qualities that are likely to be

required in order to maintain progress and continue to deliver

growth in the months ahead

Our emphasis on efficiency, sustainability, transparency and

best practice will continue as they are key to our corporate

identity, and we expect will only offer increasing appeal to

customers and investors as the transition to a net zero carbon

economy gathers momentum.

As ever, your board express their sincere gratitude to our

colleagues and to all of our staff for their contribution towards

such significant improvements to key performance metrics, and for

delivering on more key milestones as we seek to build an

industry-leading business.

Paul Dolan

CEO

3 August 2022

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

For the six months ended 30 June 2022

Six months

to 30

June

Six months Year to

to 30 31 December

2022 June 2021

Notes 2021

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

------------------------------------- -------- -------------- -------------- -------------

Turnover 11,318 8,220 17,465

Cost of sales (8,665) (6,553) (13,970)

------------------------------------- -------- -------------- -------------- -------------

Gross profit 2,653 1,667 3,495

------------------------------------- -------- -------------- -------------- -------------

Operating costs (1,576) (1,454) (3,620)

Administrative expenses (750) (521) (1,324)

Depreciation (137) (179) (326)

Share based payment expense 13 (175) (167) (233)

Gain on fair value of biological

assets - - 4,253

------------------------------------- -------- -------------- -------------- -------------

Operating profit/(loss) 15 (654) 2,245

Gain on bargain purchase - - 88,292

Foreign exchange loss (63) (56) 756

Finance costs 4 (441) (270) (591)

------------------------------------- -------- -------------- -------------- -------------

(Loss)/profit before tax (489) (980) 90,702

Taxation 5 (44) 46 (591)

------------------------------------- -------- -------------- -------------- -------------

(Loss)/profit for the period (533) (934) 90,111

------------------------------------- -------- -------------- -------------- -------------

Other comprehensive income:

Items that will not be reclassified

to profit or loss

Revaluation of land and buildings,

net of tax - 6,254 6,254

Items that may be reclassified

subsequently to profit or loss

Currency translation differences (2,053) (690) (3,032)

Total comprehensive (loss)/income

for the period (2,586) 4,630 93,333

------------------------------------- -------- -------------- -------------- -------------

Basic (loss)/earnings per share

(cents) 6 (0.02) (0.04) 3.69

------------------------------------- -------- -------------- -------------- -------------

Diluted (loss)/earnings per share

(cents) 6 (0.02) (0.04) 3.65

------------------------------------- -------- -------------- -------------- -------------

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2022

Notes 30 June 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

------------------------------- -------------- -------------- -------------- -------------

ASSETS

Non-current assets

Biological assets 336,798 204,223 336,798

Property, plant and equipment 29,293 29,944 30,119

------------------------------- -------------- -------------- -------------- -------------

Total non-current assets 366,091 234,167 366,917

------------------------------- -------------- -------------- -------------- -------------

Current assets

Trade and other receivables 7 4,777 5,179 4,616

Inventory 6,382 5,134 6,159

Cash and cash equivalents 2,091 6,321 887

------------------------------- -------------- -------------- -------------- -------------

Total current assets 13,250 16,634 11,662

TOTAL ASSETS 379,341 250,801 378,579

------------------------------- -------------- -------------- -------------- -------------

LIABILITIES

Non-current liabilities

Borrowings 9 (5,208) (4,139) (2,898)

Deferred tax 5 (106,475) (67,383) (106,475)

Convertible bonds - host

liability 10 - (885) (931)

------------------------------- -------------- -------------- -------------- -------------

Total non-current liabilities (111,683) (72,407) (110,304)

------------------------------- -------------- -------------- -------------- -------------

Current liabilities

Trade and other payables 8 (3,351) (2,677) (4,078)

Borrowings 9 (7,162) (5,397) (5,369)

Provisions (130) (140) (130)

Contingent acquisition

liability - (500) (250)

Convertible bonds - host

liability 10 (712) - -

------------------------------- -------------- -------------- -------------- -------------

Total current liabilities (11,355) (8,714) (9,827)

------------------------------- -------------- -------------- -------------- -------------

TOTAL LIABILITIES (123,038) (81,121) (120,131)

------------------------------- ----- ----------------------- -------------- -------------

NET ASSETS 256,303 169,680 258,448

------------------------------- ----- ----------------------- -------------- -------------

EQUITY

Share capital 11 32,601 32,528 32,528

Share premium 12 65,475 65,254 65,254

Convertible bonds - equity

component 10 24 52 52

Foreign exchange reserve (10,376) (5,981) (8,323)

Share based payment reserve 13 610 393 435

Revaluation reserve 6,254 6,254 6,254

Retained earnings 161,715 71,180 162,248

------------------------------- ----- ----------------------- -------------- -------------

TOTAL EQUITY 256,303 169,680 258,448

------------------------------- ----- ----------------------- -------------- -------------

Approved by the board and authorised for issue on 3 August

2022.

P Dolan

Chief Executive Officer

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2022

Share

Foreign based

Share Share Convertible exchange payment Revaluation Retained Total

capital premium bonds reserve reserve reserve Earnings equity

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

--------------- ---------- ----------- ------------- ---------- ---------- ------------- ---------- ----------

Balance at 1

January 2021 31,119 58,609 52 (5,291) 226 - 72,113 156,828

Loss for the

period - - - - - - (933) (933)

Other

comprehensive

income - - - (690) - 6,254 - 5,564

Total

comprehensive

loss for the

period - - - (690) - 6,254 (933) 4,631

Transactions

with owners:

Issue of

ordinary

shares 1,409 6,645 - - - - - 8,054

Share based

payment

expense - - - - 167 - - 167

Balance at 30

June 2021 32,528 65,254 52 (5,981) 393 6,254 71,180 169,680

Profit for the

period - - - - - - 91,044 91,044

Other

comprehensive

income - - - (2,342) - - - (2,342)

Total

comprehensive

loss for the

period - - - (2,342) - - 91,044 88,702

Transactions

with owners:

Share options

forfeited - - - - (24) - 24 -

Share based

payment

expense - - - - 66 - - 66

Balance at 31

December 2021 32,528 65,254 52 (8,323) 435 6,254 162,248 258,448

Loss for the

period - - - - - - (533) (533)

Other

comprehensive

income - - - (2,053) - - - (2,053)

Total

comprehensive

loss for the

period - - - (2,053) - - (533) (2,586)

Transactions

with owners:

Redemption of

convertible

bonds (note

10) 73 221 (28) - - - - 266

Share based

payment

expense (note

13) - - - - 175 - - 175

Balance at 30

June 2022 32,601 65,475 24 (10,376) 610 6,254 161,715 256,303

--------------- ---------- ----------- ------------- ---------- ---------- ------------- ---------- ----------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 June 2022

Six months

to 30 June

Six months Year to

to 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

Cash flows from operating activities $'000 $'000 $'000

------------------------------------------ ---- -------------- -------------- -------------

(Loss)/profit before taxation (489) (980) 90,702

Adjustment for:

Foreign exchange 63 56 (756)

Depreciation of property, plant

and equipment 977 1,002 2,063

Fair value adjustment of biological

asset - - (4,253)

Transaction costs deducted from

equity - (42) (42)

Share based payment expense 175 167 233

Finance costs 441 270 591

Accrued expense 222 460 391

Gain on bargain purchase - - (88,292)

Increase in trade and other receivables (161) (1,285) (838)

Decrease in trade and other payables (769) (1,609) (460)

Increase in inventory (223) (242) (1,267)

Cash inflow/(outflow) from operations 236 (2,203) (1,928)

------------------------------------------ ---- -------------- -------------- -------------

Income taxes paid (8) (44) (57)

Finance cost paid (306) (206) (495)

Net cash outflow from operating

activities (78) (2,453) (2480)

Cash flows from investing activities

Expenditure on property, plant

and equipment (2,267) (1,451) (4,310)

Settlement of deferred consideration (250) - (500)

Investment in acquired subsidiary (214) - (1,107)

Net cash outflow from investing

activities (2,731) (1,451) (5,917)

------------------------------------------ ---- -------------- -------------- -------------

Cash flows from financing activities

Inflows/(payments) from loans and

borrowings 4,013 (446) (1,387)

Proceeds from the issue of ordinary

shares - 8,111 8,111

Net cash inflow from financing

activities 4,013 7,665 6,724

------------------------------------------ ---- -------------- -------------- -------------

Net increase/(decrease) in cash

and cash equivalents 1,204 3,761 (1,673)

Cash and cash equivalents at the

start of period 887 2,560 2,560

------------------------------------------ ---- -------------- -------------- -------------

Cash and cash equivalents at the

end of the period 2,091 6,321 887

------------------------------------------ ---- -------------- -------------- -------------

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

For the six months ended 30 June 2022

1. BASIS OF PREPARATION

The condensed consolidated interim financial statements

('interim financial statements') for the six months ended 30 June

2022 have been prepared in accordance with the requirements of the

AIM Rules for Companies. As permitted, the Group has chosen not to

adopt IAS 34 "Interim Financial Statements" in preparing this

interim financial information. The interim financial statements

should be read in conjunction with the annual financial statements

for the year ended 31 December 2021, which have been prepared in

accordance with international accounting standards in accordance

with the requirements of the Companies (Guernsey) Law 2008

applicable to Companies reporting under IFRS as adopted by the

United Kingdom (UK). The interim financial statements have been

prepared under the historical cost convention except for biological

assets and certain financial assets and liabilities, which have

been measured at fair value.

The interim financial statements of Woodbois Limited are

unaudited financial statements for the six months ended 30 June

2022. These include unaudited comparatives for the six-month ended

30 June 2021 together with audited comparatives for the year to 31

December 2021. The condensed financial statements do not constitute

statutory accounts, as defined under section 244 of the Companies

(Guernsey) Law 2008. The statutory accounts for the period to 31

December 2021, which were approved by the Board of Directors on 1

April 2022, have been reported on by the Group's auditors and have

been delivered to the Guernsey Registrar of Companies. The report

of the auditors on those financial statements was unqualified.

The accounting policies applied in preparing these financial

statements are in terms of IFRS and are consistent with those

applied in the previous annual financial statements for the year

ended 31 December 2021.

The interim financial statements for the six months ended 30

June 2022 were approved by the Board of Directors on 3 August

2022.

Going Concern:

The interim financial statements have been prepared assuming

that the Group will continue as a going concern in accordance with

the recognition and measurement criteria of IFRS.

Under this assumption, an entity is ordinarily viewed as

continuing in business for the foreseeable future with neither the

intention nor necessity of liquidation, ceasing trading or seeking

protection from creditors for at least 12 months from the date of

the signing of the financial statements.

An assessment of going concern is made by the Directors at the

date the Directors approve the interim financial statements, taking

into account the relevant facts and circumstances at that date

including:

-- The current state of the Group's life cycle;

-- Review of profit and cash flow forecasts;

-- Review of actual results against forecast;

-- Timing of cash flows;

-- Financial or operational risks; and

-- The impact of COVID-19

The Directors have a reasonable expectation that the Group has

or will have adequate resources to continue in operational

existence for the foreseeable future, being 12 months from the date

of approval of these interim financial statements and have

therefore adopted the going concern basis of preparation in the

interim financial statements.

2. CRITICAL ACCOUNTING ESTIMATES AND AREAS OF JUDGEMENT

The preparation of financial statements in conformity with IFRS

requires management to make estimates and assumptions concerning

the future. It also requires management to exercise judgment in

applying the Company's accounting policies and the reported amounts

of assets and liabilities, revenue and expenses, and related

disclosures.

Estimates and judgments are continually evaluated and are based

on current facts, historical experience and other factors,

including expectations of future events that are believed are

reasonable under the circumstances. Accounting estimates will, by

definition, seldom equal the actual results.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those described in the last annual

report.

3. SEGMENT REPORTING

Segmental information is presented on the basis of the

information provided to the Chief Operating Decision Maker

("CODM"), which is the Executive Board.

The Group is currently focused on Forestry, Timber Trading and

Carbon Solutions. These are the Group's primary reporting segments,

operating in Gabon, Mozambique, Denmark, London, Guernsey and head

operating offices in Mauritius. Certain support services are

performed in the UK.

The Group's CEO and CFO review the internal management reports

of each division at least weekly, and the Board monthly.

There are varying levels of integration between the Forestry and

Trading segments. This integration includes transfers of sawn

timber and veneer, respectively. Inter-segment pricing is

determined on an arm's length basis.

Information relating to each reportable segment is set out

below. Segment profit/(loss) before tax is used to measure

performance, because management believes that this information is

the most relevant in evaluating the results of the respective

segments relative to other entities that operate in the same

industry. All amounts are disclosed after taking into account any

intra-segment and intra-group eliminations

The following table shows the segment analysis of the Group's

loss before tax for the six months period and net assets as at 30

June 2022:

Forestry Trading Carbon Solutions Total

$000 $000 $000 $000

--------------------------------- ---------- --------- ----------------- ----------

INCOME STATEMENT

Turnover 5,553 5,765 - 11,318

Cost of Sales (3,757) (4,908) - (8,665)

--------------------------------- ---------- --------- ----------------- ----------

Gross profit 1,796 857 - 2,653

--------------------------------- ---------- --------- ----------------- ----------

Operating costs (614) (585) (377) (1,576)

Administrative expenses (211) (182) (357) (750)

Depreciation (137) - - (137)

Share based payment expense (44) (44) (87) (175)

Segment operating profit/(loss) 790 46 (821) 15

Foreign exchange (218) 155 - (63)

Finance costs (148) (293) - (441)

--------------------------------- ---------- --------- ----------------- ----------

Profit/(loss) before taxation 424 (92) (821) (489)

Taxation (44) - - (44)

--------------------------------- ---------- --------- ----------------- ----------

Profit/(loss) for the period 380 (92) (821) (533)

--------------------------------- ---------- --------- ----------------- ----------

NET ASSETS

Assets: 369,694 9,647 - 379,341

Liabilities: (4,920) (11,643) - (16,563)

Deferred tax liability (106,475) - - (106,475)

Net assets 258,299 (1,996) - 256,303

--------------------------------- ---------- --------- ----------------- ----------

The following table shows the segment analysis of the Group's

loss before tax for the six months to and net assets at 30 June

2021:

Forestry Trading Carbon Solutions Total

$000 $000 $000 $000

--------------------------------- --------- -------- ----------------- ---------

INCOME STATEMENT

Turnover 3,422 4,798 - 8,220

Cost of Sales (2,311) (4,242) - (6,553)

--------------------------------- --------- -------- ----------------- ---------

Gross profit 1,111 556 - 1,667

--------------------------------- --------- -------- ----------------- ---------

Operating costs (692) (510) (252) (1,454)

Administrative expenses (130) (132) (259) (521)

Depreciation (177) (2) - (179)

Share based payment expense (42) (42) (83) (167)

Segment operating profit/(loss) 70 (130) (594) (654)

--------------------------------- --------- -------- ----------------- ---------

Foreign exchange 65 (121) - (56)

Finance costs (101) (169) - (270)

--------------------------------- --------- -------- ----------------- ---------

Profit/(loss) before taxation 34 (420) (594) (980)

Taxation 46 - - 46

--------------------------------- --------- -------- ----------------- ---------

Profit/(loss) for the period 80 (420) (594) (934)

--------------------------------- --------- -------- ----------------- ---------

NET ASSETS

Assets: 239,144 11,657 - 250,801

Liabilities: (3,834) (9,904) - (13,738)

Deferred tax liability (67,383) - - (67,383)

--------------------------------- --------- -------- ----------------- ---------

Net assets 167,927 1,753 - 169,680

--------------------------------- --------- -------- ----------------- ---------

4. FINANCE COST

Year to

31 December

6 months to 30 June 2022 6 months to 30 June 2021 2021

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

-------------------------------------- ------------------------- ------------------------- --------------

Interest on bank facilities 306 227 503

Interest on trade finance facilities 71 - -

Interest on convertible bonds 48 43 88

Other finance costs 16 - -

-------------------------------------- ------------------------- ------------------------- --------------

Total 441 270 591

-------------------------------------- ------------------------- ------------------------- --------------

Finance costs increased due to an increase in working capital

facilities provided by the Group's Danish banking partners ($2.3m)

and Rhino Ventures ($2m). See note 9 for more information.

5. TAXATION

The prevailing tax rates in the geographies here the Group

operates range between 3% and 32%. A rate of 19% best represents

the weighted average tax rate experienced by the Group. As at 31

December 2021, the Group had estimated losses of $28 million (2020:

$29 million) available to carry forward against future taxable

profits. No deferred tax asset has been raised on these estimated

losses.

The Group has recognised a net deferred tax liability of $106.5

million at 30 June 2022 (30 June 2021: $67.4 million, 31 December

2021: $106.5 million) and which mainly arose on the revaluation of

biological assets and owner occupied land and buildings. This would

only be payable on the sale of these assets at their book

value.

6. EARNINGS PER SHARE

6 months to 30 June 2022 6 months to 30 June 2021

(Unaudited) (Unaudited)

$'000 $'000

Loss attributable to equity shareholders (533) (934)

Weighted average number of ordinary shares in issue

('000) 2,482,464 2,406,426

Basic and diluted loss per share (cents) (0.02) (0.04)

-------------------------------------------------------- ------------------------- -------------------------

The Company has incurred a loss in the six-month period to 30

June 2022, and therefore the diluted earnings per share is the same

as the basic loss per share as the loss has an anti-dilutive

effect.

Reconciliation of shares in issue to weighted average number of

ordinary shares:

6 months 30 June 2022 6 months 30 June 2021

(Unaudited) (Unaudited)

$'000 $'000

----------------------------------------------------------------- --- ---------------------- ----------------------

Shares in issue at beginning of year 2,482,117 2,382,216

Treasury shares - (99)

Shares issued during the period weighted for period in issue (note

11) 347 24,309

Weighted average number of ordinary shares in issue for the period 2,482,464 2,406,426

---------------------------------------------------------------------- ---------------------- ----------------------

7. TRADE AND OTHER RECEIVABLES

30 June 31 December

2022 30 June 2021 2021

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

------------------------ ------------- ------------- ------------

Trade receivables 2,632 1,740 2,093

Other receivables 12 9 12

Deposits 127 130 127

Current tax receivable 15 13 14

VAT receivable 666 725 589

Prepayments 1,325 2,562 1,781

------------------------ ------------- ------------- ------------

Total 4,777 5,179 4,616

------------------------ ------------- ------------- ------------

The Directors consider that the carrying amount of trade and

other receivables approximates to their fair value.

8. TRADE AND OTHER PAYABLES

30 June 31 December

2022 30 June 2021 2021

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

--------------------------------------------- ------------- ------------- ------------

Trade payables 1,106 781 1,275

Contract liabilities (prepayments received) 872 1,191 1,643

Accruals 766 509 680

Current tax payable 105 40 69

Other payables 459 59 340

Debt due to concession holders 43 97 71

--------------------------------------------- ------------- ------------- ------------

Total 3,351 2,677 4,078

--------------------------------------------- ------------- ------------- ------------

The Directors consider that the carrying amount of trade and

other payables approximates to their fair value.

9. BORROWINGS

30 June 31 December

2021 2021

30 June 2022 (Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

-------------------------- -------------------------- ------------- ------------

Non-current liabilities

-------------------------- -------------------------- ------------- ------------

Business loans 1,269 2,099 1,282

Working capital facility 3,939 2,040 1,616

-------------------------- -------------------------- ------------- ------------

5,208 4,139 2,898

-------------------------- -------------------------- ------------- ------------

Current liabilities

-------------------------- -------------------------- ------------- ------------

Business loans 545 1,246 1,250

Bank overdraft 233 174 128

Working capital facility 6,384 3,977 3,991

-------------------------- -------------------------- ------------- ------------

7,162 5,397 5,369

-------------------------- -------------------------- ------------- ------------

Total borrowings 12,370 9,536 8,267

-------------------------- -------------------------- ------------- ------------

The increase in borrowings in the six months to 30 June 2022 is

owing to the following:

-- A new two year, $2m unsecured facility with Rhino Ventures,

the Company's largest shareholder, advanced during February 2022.

Full details of this and the Lombard Odier facility noted below

were disclosed on 13 January 2022.

-- An increase of $2.3m in the working capital facility from the

Company's Danish banking partners.

-- An advance of $1m of the $2m Lombard Odier short-term

facility during June 2022. The $1m is repayable in 90 days from

drawdown and is secured against certain receivables.

The Group paid-down approximately $0.7m of bank loans and

equipment lease obligations during the period ended 30 June

2022.

10. CONVERTIBLE BONDS

31 December

30 June 2022 30 June 2021 2021

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

---------------------------------------- ------------- ------------- ------------

Convertible bonds: Liability component 712 885 931

Convertible bonds: Equity component 24 52 52

---------------------------------------- ------------- ------------- ------------

Total 736 937 983

---------------------------------------- ------------- ------------- ------------

Convertible bond liability 539 741 741

Interest accrued 173 144 190

---------------------------------------- ------------- ------------- ------------

Total 712 885 931

---------------------------------------- ------------- ------------- ------------

During the first half of 2022, $293,591 of the 2023 0%

Convertible Bonds were converted into 5,871,820 Voting Ordinary

Shares. The Convertible Bond terms specify conversion is at an

exchange rate of GBP:$1.25 and 4p per Ordinary Share. The Bonds are

repayable on 30 June 2023.

11. SHARE CAPITAL

Number $'000

---------------------------------- -------------- ----------

Authorised:

Ordinary shares of 1 pence each Unlimited Unlimited

---------------------------------- -------------- ----------

Allotted, issued and fully paid:

Ordinary shares of 1p each

At 1 January 2021 2,382,216,431 31,119

Issued in the period 99,900,622 1,409

---------------------------------- -------------- ----------

At 31 December 2021 2,482,117,053 32,528

Issued in the period (note 10) 5,871,820 73

---------------------------------- -------------- ----------

At 30 June 2022 2,487,988,873 32,601

---------------------------------- -------------- ----------

Balances classified as share capital represent the nominal value

on issue of the Company's equity share capital, comprising ordinary

shares of 1p each.

The total number of Ordinary Shares in issue as at the date of

this report is 2,487,988,873, which consists of 2,077,988,873

Voting Ordinary Shares and 410,000,000 Non-Voting Ordinary

Shares.

12. SHARE PREMIUM

$'000

-------------------------------- -------

At 1 January 2021 58,609

Issued in the period 6,645

--------------------------------- -------

At 31 December 2021 65,254

Issued in the period (note 11) 221

--------------------------------- -------

At 30 June 2022 65,475

--------------------------------- -------

Balances classified as share premium include the net proceeds in

excess of the nominal share capital on issue of the Company's

equity share capital.

13. SHARE BASED PAYMENT/LONG-TERM INCENTIVES

On the 1(st) of March 2022, the Company issued LTIP's (long-term

incentive plan) to its directors and key employees of which 35.5m

were in issue at 30 June 2022. The fair value of these LTIP's as at

the grant date was determined by an independent specialist in

financial valuations.

17.75m of the granted LTIP's are subject to TSR (Total

Shareholder Return) linked criteria and were valued using a Monte

Carlo simulation. 17.75m share options are subject to EBITDA-linked

criteria and were valued using a Monte Carlo Simulation on the

basis that they include a market-based exercise condition. Only

market conditions have been considered in estimating the fair value

of the LTIP's.

The key terms and conditions related to the LTIP's are as

follow:

A. Market Performance Condition

-- Grant Date: 1 March 2022

-- Contractual life of LTIP's: 4.6 years

-- Vesting conditions: Total Shareholder Return - The

performance criteria sets out that of the total 35.5m LTIP's

granted, up to 50% can vest in increments of 10% if the VWAP

(Weighted Average Price) remains above each of the following

thresholds for a period of 30 consecutive days: GBP0.06, GBP0.07,

GBP0.08, GBP0.09 and GBP0.10. Full vesting of this 50% tranche will

be achieved if the share price increases to over GBP0.10.

B. Non-Market Performance Condition

-- Grant Date: 1 March 2022

-- Contractual life of LTIP's: 4.6 years

-- Vesting conditions: Target EBITDA - Of the total 35.5m LTIP's

granted, 50% can vest

at an incremental rate of 16.6% per annum by the Company

achieving internal EBITDA targets for each of the financial years

2022-2024. Any vesting shall arise equally for the achieving of

each target, which is subject to a cumulative "catch-up" being

permitted.

C. Service Condition

-- Recipients must be employed by Woodbois at the time of

vesting and the share price must be above 6p at the exercise date.

This condition applies to all of the granted share options.

The table below shows the input ranges for the assumptions used

in the valuation models:

Fair value at grant date GBP0.02 - GBP0.03

Exercise price GBP0.01

Share price at grant date GBP0.0405

Annual share price volatility (weighted average) 65%

Risk free rate 0.83%

Expected life 4.6 years

----------------------------------------------------- ------------------

The annualised volatility in the share price was determined

using the historical volatility of Woodbois Limited and other

listed companies in similar businesses over a time period in line

with the simulation period. A monthly volatility of 19.0% was used

in the simulation (annual volatility of 65%).

Reconciliation of the share options in issue:

Weighted

average strike

Total options price (Pence)

------------------------------------ ------------- ---------------

As at 31 December 2020 144,500,000 2p

Forfeited during the financial year (30,500,000) (2p)

As at 31 December 2021 114,000,000 2p

------------------------------------ ------------- ---------------

Issue of LTIP's 35,500,000 1p

------------------------------------ ------------- ---------------

As at 30 June 2022 149,500,000 1.76p

------------------------------------ ------------- ---------------

The following charge has been recognised in the current

financial period:

$000

--------------------------------- -----

As at 31 December 2020 968

--------------------------------- -----

Reserve transfer for forfeitures (766)

Share based payment expense 233

As at 31 December 2021 435

--------------------------------- -----

Share based payment expense 175

--------------------------------- -----

As at 30 June 2022 610

--------------------------------- -----

At the date of this report the share options of the directors

were:

Director Total number Number of Total number Share Options

of Share LTIP's granted of Shares as a % of

Options held on 1 March under option Issued Share

as at 31 2022 (1p Capital

December exercise

2021 (2p price)

exercise

price)

-------------------------- -------------- ---------------- -------------- --------------

P Dolan (CEO) 50,000,000 4,000,000 54,000,000 2.17%

-------------------------- -------------- ---------------- -------------- --------------

C Geddes (CFO) 22,500,000 4,000,000 26,500,000 1.07%

-------------------------- -------------- ---------------- -------------- --------------

H Ghossein (Deputy

Chair) 22,500,000 4,000,000 26,500,000 1.07%

-------------------------- -------------- ---------------- -------------- --------------

G Thomson (Chair

& Senior Non-Executive) 10,000,000 - 10,000,000 0.40%

-------------------------- -------------- ---------------- -------------- --------------

14. RELATED PARTY TRANSACTIONS

The final instalment of $0.25m was paid in cash to Mr Ghossein,

Deputy Chair, relating to the contingent acquisition

liability/deferred consideration for the acquisition of Woodbois

ApS, more fully set out in note 22 in the Annual Report for the

year ended 31 December 2021.

During the first half of 2022 Rhino Ventures Limited, the

Company's largest shareholder, disposed of 325,000,000 of its

Non-Voting Ordinary Shares to an unconnected third party. In the

period, Rhino Ventures Limited also converted a total of 65,000,000

Non-Voting Ordinary Shares into Voting Ordinary Shares. Upon

Conversion, Rhino Ventures Limited transferred the 65,000,000

shares to its beneficial owner, Mr Miles Pelham. Following

Admission, Rhino and Mr Miles Pelham together held 442,500,000

Voting Ordinary Shares in the Company, which represents 21.30% of

the enlarged Voting Ordinary Shares. Rhino's holding of 235,000,000

Non-Voting Ordinary Shares post Conversion represent 57.32% of the

410,000,000 Non-Voting Ordinary Shares in the Company at 30 June

2022.

As set out in note 9, during H1 2022 the Company drew down $1m

of the $2m Lombard Odier short-term facility and the $2m unsecured

facility agreed with Rhino Ventures was fully drawn down.

15. EVENTS OCCURING AFTER THE REPORTING DATE

None noted as at the date of this report.

16. INTERIM FINANCIAL STATEMENTS

A copy of this interim report as well as the full Annual Report

for the year ended 31 December 2021 can be found on the Company's

website at www.woodbois.com

[1] Earnings before interest, tax, depreciation, amortization,

share based payments and other non-cash items

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SSLFUDEESEDA

(END) Dow Jones Newswires

August 04, 2022 02:00 ET (06:00 GMT)

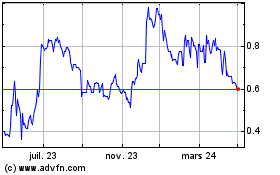

Woodbois (LSE:WBI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

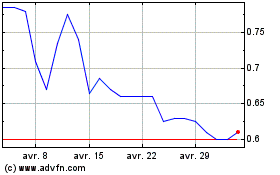

Woodbois (LSE:WBI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024