Webis Holdings PLC Delay in publication of the Annual Report (7991T)

29 Novembre 2021 - 8:00AM

UK Regulatory

TIDMWEB

RNS Number : 7991T

Webis Holdings PLC

29 November 2021

7.00am 29 November 2021

Webis Holdings plc

("Webis" or the "Company")

Delay in publication of the Annual Report and Consolidated

Financial Statements for the year ended 31 May 2021

The board of Webis hereby notifies shareholders that the

completion of the audit of the accounts for the Company, for the

year ended 31 May 2021 (the "Accounts") are delayed due to a

Covid-19 related issue. Unfortunately, the completion of an annual

report from Deloitte USA reviewing the activities of AmTote - the

third-party wagering hub provider to Watch&Wager LLC - is

delayed as a result of the pandemic. Our auditors, KPMG, are

obliged under standard IFRS audit procedures to use this report to

provide the verification required to complete the audit by 30

November 2021. The Board is confident that the verification is

merely a matter of procedure only and will occasion no change to

the Accounts which are anticipated to contain an unqualified audit

report. Accordingly, the Company has agreed with AIM an extension

to 28 February 2022 for the publication deadline of its Accounts.

Every effort is being made to complete the Accounts as soon as

possible and they will be published via RNS thereafter.

Meanwhile, the board of Webis provides the following trading

update for the year-ended 31 May 2021 which anticipates a US$ 1.1

million uplift in profitability over the previous year: -

Consolidated Statement of Comprehensive Income

For the year ended 31 May 2021

U naudited

2021 2020

US$000 US$000

---------------------------------------------------------------------------------------- ------------- -----------

Amounts wagered 132,149 105,325

---------------------------------------------------------------------------------------- ------------- ---------

Revenue 55,668 43,436

Cost of sales (49,757) (38,820)

Betting duty paid (114) (83)

---------------------------------------------------------------------------------------- ------------- -----------

Gross profit 5,797 4,533

---------------------------------------------------------------------------------------- ------------- -----------

Operating costs (5,314) (4,908)

Impairment movement on trade receivables 7 (18)

Re-organisational and other costs - (28)

Other gains / (losses) 2 (29)

Government grant 272 48

Other income 185 212

Operating profit / (loss) 949 (190)

---------------------------------------------------------------------------------------- ------------- -----------

Finance costs (125) (94)

---------------------------------------------------------------------------------------- ------------- -----------

Profit / (loss) before income tax 824 (284)

---------------------------------------------------------------------------------------- ------------- ---------

Income tax expense - -

---------------------------------------------------------------------------------------- ------------- -----------

Profit / (loss) for the year 824 (284)

---------------------------------------------------------------------------------------- ------------- ---------

Other comprehensive income:

Items that may be subsequently reclassified to profit or loss:

Currency translation differences on disposal of foreign subsidiaries - -

---------------------------------------------------------------------------------------- ------------- -----------

Other comprehensive profit / (loss) for the year - -

---------------------------------------------------------------------------------------- ------------- -----------

Total comprehensive profit / (loss) for the year 824 (284)

---------------------------------------------------------------------------------------- ------------- ---------

Basic earnings per share for profit / (loss) attributable to the equity holders of the

Company

during the year (cents) 0.21 (0.07)

---------------------------------------------------------------------------------------- ------------- -----------

Diluted earnings per share for profit / (loss) attributable to the equity holders of the

Company

during the year (cents) 0.20 (0.07)

---------------------------------------------------------------------------------------- ------------- -----------

Statements of Financial Position

As at 31 May 2021

Unaudited Unaudited

31.05.21 31.05.21 31.05.20 31.05.20

Group Company Group Company

US$000 US$000 US$000 US$000

------------------------------------------- ---------- ------------ ----------- ---------

Non-current assets

Intangible assets 12 - 30 -

Property, equipment and motor vehicles 380 6 415 7

Investments - 3 - 2

Bonds and deposits 101 - 101 -

------------------------------------------- ---------- ------------ ----------- ---------

Total non-current assets 493 9 546 9

------------------------------------------- ---------- ------------ ----------- ---------

Current assets

Bonds and deposits 882 - 882 -

Trade and other receivables 1,896 150 1,256 463

Cash, cash equivalents and restricted cash 5,083 2,142 3,969 1,780

------------------------------------------- ---------- ------------ ----------- ---------

Total current assets 7,861 2,292 6,107 2,243

------------------------------------------- ---------- ------------ ----------- ---------

Total assets 8,354 2,301 6,653 2,252

------------------------------------------- ---------- ------------ ----------- ---------

Equity

Called up share capital 6,334 6,334 6,334 6,334

Share option reserve 42 42 42 42

Retained losses (4,684) (5,516) (5,508) (5,526)

------------------------------------------- ---------- ------------ ----------- ---------

Total equity 1,692 860 868 850

------------------------------------------- ---------- ------------ ----------- ---------

Current liabilities

Trade and other payables 4,995 91 3,749 52

Deferred income - - 272 -

Loans, borrowings and lease liabilities 5 72 5 00 97 -

------------------------------------------- ---------- ------------ ----------- ---------

Total current liabilities 5,5 67 5 9 1 4,118 52

------------------------------------------- ---------- ------------ ----------- ---------

Non-current liabilities

Loans, borrowings and lease liabilities 1 ,095 8 5 0 1,667 1,350

------------------------------------------- ---------- ------------ ----------- ---------

Total non-current liabilities 1 ,095 8 5 0 1,667 1,350

------------------------------------------- ---------- ------------ ----------- ---------

Total liabilities 6,662 1,441 5,785 1,402

------------------------------------------- ---------- ------------ ----------- ---------

Total equity and liabilities 8,354 2,301 6,653 2,252

------------------------------------------- ---------- ------------ ----------- ---------

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ("MAR"), and is disclosed in accordance with the Company's

obligations under Article 17 of MAR.

For further information:

Webis Holdings plc Tel: 01624 639396

Denham Eke

Beaumont Cornish Limited Tel: 020 7628 3396

Roland Cornish/James Biddle

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBPBRTMTJTBMB

(END) Dow Jones Newswires

November 29, 2021 02:00 ET (07:00 GMT)

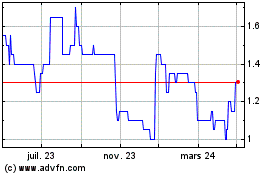

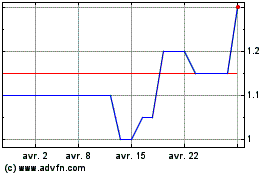

Webis (LSE:WEB)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Webis (LSE:WEB)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024