TIDMWEIR

RNS Number : 6071X

Weir Group PLC

27 April 2023

The Weir Group PLC trading update for the first quarter ended 31

March 2023(1)

Order growth and strong execution; margin expansion on track

Strong demand for Weir mining equipment

-- Brownfield activity and sustainability projects driving Group OE order growth(2) +22%

-- Growing pipeline for sustainable technology solutions, including redefined mill circuit

Group AM orders (2) flat; in line with expectations

-- Minerals AM orders(2) +5%: positive mining production trends and installed base growth

-- ESCO total orders(2) -6%: reflecting infrastructure markets and Q1 2022 pre-buy

Demonstrating strength of focused platform

-- Q1 revenues and operating margins up year-on-year

-- Performance Excellence programme on track

-- Full investment grade credit rating achieved

Outlook: Positive conditions in mining markets; 2023 guidance

reiterated

-- Growth in constant currency revenue, profit and operating margins

-- On track to deliver target of 17% operating margin in 2023

-- Free operating cash conversion of 80% to 90%

Jon Stanton, Chief Executive Officer, commented:

"The value creation opportunity for Weir is compelling. The

mining industry needs to produce more critical metals to support

the transition to Net Zero, and must extract these in a more

sustainable way. Our leading global brands, engineering capability

and technology-led strategy means we are well placed to capitalise.

This opportunity, together with our Performance Excellence

programme, underpins our growth, margin expansion and cash

conversion targets.

Our strong execution and order book growth in the first quarter

reinforces our confidence in achieving our 2023 guidance. We are on

track to deliver another year of growth in revenues and our

operating margin target of 17%."

First quarter review

Group

In 2022 we set out our through-cycle commitments to outgrow our

markets, expand our margins and convert our earnings to cash, while

remaining resilient and doing the right thing for our people and

the planet.

During the quarter we made good progress as we grew orders,

revenue and margins. We continued to increase market share with our

differentiated technology while also benefiting from the long-term

structural tailwinds which underpin our mining markets.

Commodity prices are well above miners' cost to produce, and

ongoing tightness in physical inventories and strong end market

demand are incentivising our customers to maximise ore production.

Miners are responding by accelerating production from existing

assets, as large projects remain slow to convert.

These factors, together with the ongoing effect of declining

grades and more complex ore bodies, drove demand for our mining

spares and expendables. Demand was strong across most hard rock

mining territories, and in particular in Asia Pacific and South

America where recent market share gains and installed based growth

drove incremental demand. The growth in our mining aftermarket

business again demonstrates our inherent resilience driven by

non-discretionary spend on spare parts.

Market trends and share gains are also driving OE demand.

Customers are ordering Weir solutions to debottleneck, expand and

improve the sustainability of existing mines, while also

increasingly engaging on new sustainability driven technologies,

such as our redefined mill circuit and the Motion Metrics digital

offering.

Group orders (2) in the quarter were +4%, with OE orders (2)

+22%, and AM orders (2) flat against a prior year comparator which

was a peak quarter for infrastructure and included a contribution

from pre-buy in ESCO and orders from Russia.

In the quarter we initiated key projects in our Performance

Excellence programme which will support future margin expansion and

cash conversion. These included consolidation of our North American

facilities in Minerals to improve customer proximity, projects to

implement lean enterprise principles across our global value

streams and resourcing the Weir Business Services (WBS) programme

transformation team.

The robustness of our more ambitious scope 1,2 & 3 emissions

reduction targets announced in July 2022 was validated in the

quarter with formal approval by the Science Based Targets

initiative (SBTi).

Minerals

-- Orders (2) +9%: AM orders (2) +5%; OE orders (2) +20%

-- AM growth driven by price and volume

Demand for AM was driven by mining production trends and

installed base growth. Year-on-year growth reflects the impact of

price increases and volume growth in hard rock mining, offset by

the loss of orders from Russia. Excluding Russia from the PY

comparator, AM orders (2) were +7%. Sequential movement in AM

orders reflects typical seasonal patterns.

In OE, demand was primarily driven by debottlenecking, expansion

and sustainability projects at existing mines. This included GBP12m

of orders for our GEHO pump solutions for a high-grade nickel

expansion project in Indonesia, as we further built our leadership

position in this high-growth attractive niche.

ESCO

-- YoY orders (2) -6%; sequential orders (2) +5%

-- Mining markets positive; as expected infrastructure markets

below peak but improving sequentially

Demand from our mining customers was strong, with quarterly

mining orders ahead of Q4 2022. Demand was high for mining

expendables, reflecting ore production trends and recent market

share gains, and also for attachments as we gained further traction

with our differentiated tech-enabled mining bucket, which is

underpinned by Motion Metrics' leading AI and rugged 3D camera

technology.

In infrastructure, as expected, in our largest market of North

America orders grew sequentially, though demand remained well below

the Q1 2022 peak. Demand in European infrastructure markets

remained suppressed.

Outlook

The business is executing well and conditions in our mining

markets are positive. High levels of activity and demand for our AM

spares and brownfield OE solutions are driving order book

growth.

Our guidance for 2023 is reiterated and we expect to deliver

growth in constant currency revenue, profit and operating margin.

We are on track to deliver our target of 17% operating margin in

2023, supported by operational efficiencies and early benefits from

Performance Excellence. We expect free operating cash conversion of

between 80% and 90%.

Phasing of operating profit is expected to follow typical

seasonal patterns and operating margins are expected to expand

sequentially through the year as initial Performance Excellence

benefits are realised.

Further out, the long-term fundamentals for mining and our

business are highly attractive, underpinned by decarbonisation, GDP

growth and the transition to sustainable mining. We have a clear

strategy to grow ahead of our markets, with specific growth

initiatives underpinning our ambition to deliver through-cycle

mid-to-high single digit percentage revenue growth.

Net debt

As expected, net debt increased in the quarter reflecting

typical seasonal patterns.

During the quarter S&P upgraded their credit rating on Weir

from BB+ to BBB- which, coupled with the Baa3 rating we already

have with Moody's, means we now have a full investment grade credit

rating.

New corporate broker appointments

Barclays and JP Morgan Cazenove have been appointed as our new

joint corporate brokers.

Notes:

1. Financial information is given for the three months ended 31 March 2023.

2. Orders are reported on a constant currency basis at March

2023 average exchange rates.

Analyst and investor conference call

A conference call for analysts and investors will be held at

0800 BST on Thursday 27 April 2023 to discuss this statement.

Participants can join the call by registering in advance by

visiting www.global.weir/investors and following the link on the

page. A recording of this conference call will be available until

Thursday 4 May 2023.

Enquiries:

Investors: Edward Pears +44 (0) 141 308 3725

Media: Sally Jones +44 (0) 141 308 3666

Citigate Dewe Rogerson: +44 (0) 207 638 9571

Kevin Smith Weir@citigatedewerogerson.com

-------------------------------

About The Weir Group PLC

Founded in 1871, The Weir Group PLC is one of the world's

leading engineering businesses with a purpose to make its mining

and infrastructure customers' operations more sustainable and

efficient. Weir's highly engineered technology enables critical

resources to be produced using less energy, water and waste while

reducing customers' total cost of ownership. The Group is ideally

positioned to benefit from structural trends that support long-term

demand for its technology including the need for more essential

metals to support economic development and carbon transition. The

Group has c.12,000 employees operating in over 60 countries with a

presence in every major mining region of the world. Find out more

at www.global.weir .

Weir's ordinary shares trade on the London Stock Exchange

(ticker: WEIR LN) and its American Depositary Receipts trade

over-the-counter in the USA (ticker: WEGRY).

Appendix 1 - Continuing operations(1) quarterly order trends

Reported growth Like-for-like growth(2)

-------------------- --------------------------------- --------------------------------

2022 2022 2022 2022 2023 2022 2022 2022 2023

Division Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

-------------------- ----- ----- ----- ----- ----- ------ ------ ------ ------

Original Equipment -18% -3% 13% 19% 20% -3% 13% 19% 20%

Aftermarket 23% 18% 25% 6% 5% 18% 25% 6% 5%

Minerals 9% 11% 21% 10% 9% 11% 21% 10% 9%

-------------------- ----- ----- ----- ----- ----- ------ ------ ------ ------

Original Equipment -17% 98% -6% 14% 39% 98% -6% 14% 38%

Aftermarket 37% 19% 14% 1% -9% 12% 7% -7% -15%

ESCO 32% 23% 13% 2% -6% 16% 6% -6% -12%

-------------------- ----- ----- ----- ----- ----- ------ ------ ------ ------

Original Equipment -17% 2% 12% 19% 22% 2% 11% 20% 22%

Aftermarket 28% 18% 21% 5% 0% 17% 19% 2% -2%

Continuing Ops 15% 14% 19% 8% 4% 13% 17% 6% 3%

-------------------- ----- ----- ----- ----- ----- ------ ------ ------ ------

Book-to-bill 1.22 1.13 1.02 0.95 1.04 1.13 1.02 0.94 1.04

-------------------- ----- ----- ----- ----- ----- ------ ------ ------ ------

Quarterly orders(3) GBPm Like-for-like orders(2,3)

-------------------- --------------------------------- --------------------------------

2022 2022 2022 2022 2023 2022 2022 2022 2023

Division Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

-------------------- ----- ----- ----- ----- ----- ------- ------- ------ ------

Original Equipment 114 152 149 148 137 152 149 148 137

Aftermarket 324 367 345 350 340 367 345 350 340

Minerals 438 519 494 498 477 519 494 498 477

-------------------- ----- ----- ----- ----- ----- ------- ------- ------ ------

Original Equipment 11 15 11 8 14 15 11 8 14

Aftermarket 182 166 165 163 166 157 155 150 156

ESCO 193 181 176 171 180 172 166 158 170

-------------------- ----- ----- ----- ----- ----- ------- ------- ------ ------

Original Equipment 125 167 160 156 151 167 160 156 151

Aftermarket 506 533 510 513 506 524 500 500 496

Continuing Ops 631 700 670 669 657 691 660 656 647

-------------------- ----- ----- ----- ----- ----- ------- ------- ------ ------

1. Continuing operations excludes the Oil & Gas Division,

which was sold to Caterpillar Inc. in February 2021 and the

Saudi-Arabian joint venture which was sold in June 2021.

2. Like-for-like excludes the impact of Carriere Industrial

Supply Limited acquired on 8 April 2022.

3. Restated at March 2023 average exchange rates.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUNUBRONUSUAR

(END) Dow Jones Newswires

April 27, 2023 02:00 ET (06:00 GMT)

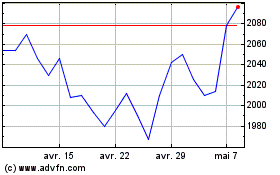

Weir (LSE:WEIR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Weir (LSE:WEIR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024