TIDMWKP

RNS Number : 2061T

Workspace Group PLC

21 July 2022

21 July 2022

Workspace GROUP PLC

FIRST Quarter business update FOR THE

PERIOD ENDING 30 JUNE 2022

Workspace Group, London's leading provider of flexible offices,

provides a business update for the first quarter ending 30 June

2022, unless otherwise stated.

HIGHLIGHTS

-- Continued good underlying levels of customer enquiries, viewings and lettings

-- Further improvement in pricing with like-for-like rent per

sq. ft. up 2.6% in the quarter to GBP38.07

-- Like-for-like occupancy stable at 89.6%

-- Like-for-like rent roll up 2.9% in the quarter to GBP93.8m

-- Strong demand at recently completed projects, with overall

occupancy on these schemes increasing by 5% to 74% in the

quarter

-- Integration of McKay assets progressing to plan with good traction on leasing activity

-- Exchanged contracts for disposal of residential scheme at

Riverside, Wandsworth, for GBP55m, in line with the March 2022

valuation. Completion expected December 2022

-- Progressing with the disposal of McKay non-core assets and

continue to target completion by December 2022

-- LTV at 32% on a proforma basis, before proceeds from planned disposal programme

Graham Clemett, Chief Executive Officer, Workspace Group PLC,

commented:

"We have had a good start to the year, with customer demand for

our distinctive flexible offering driving further like-for-like

pricing growth and high occupancy levels. We are also delivering

additional rent roll growth from the strong progress we are making

letting up recently completed schemes and the successful

integration of recent acquisitions.

We continue to closely monitor the wider economic situation but

are not currently seeing any meaningful impact on customer demand.

As we have consistently demonstrated in the past, in these more

challenging business environments our active operational

capabilities combined with the attractions of our flexible offer

and broad range of properties resonate strongly with our diverse

customer base of agile, innovative SMEs."

Customer Activity

We saw good underlying levels of demand in the first quarter,

although the reported levels of enquiries, viewings and lettings

were impacted by bank holidays including the timing of Easter, the

additional Jubilee holidays and disruption caused by tube and rail

strikes in June. Overall leasing activity was strong with 325

lettings completed in the first quarter, with a lease value of

GBP8.3m. This momentum has continued into the second quarter. In

the first two weeks of July 2022 there were 379 enquiries, 226

viewings and we completed 60 lettings with a lease value of

GBP1.4m.

Monthly Average Monthly Activity

-------------------------

Q1 Q1 30 Jun 31 May 30 Apr

2022/23 2021/22 2022 2022 2022

---------- ------- ------- -------

Enquiries 757 947 685 815 771

Viewings 508 615 447 562 516

Lettings 108 125 108 103 114

---------- --------- ------- ------- -------

Total rent roll increased by GBP24.3m to GBP135.3m in the

quarter, as detailed below:

Total Rent Roll GBPm

------------------------ -----

At 31 March 2022 111.0

Like-for-like portfolio 2.6

Completed projects 0.6

McKay portfolio 22.0

Other (0.9)

------------------------ -----

At 30 June 2022 135.3

------------------------ -----

Portfolio Activity

Occupancy in our like-for-like portfolio was stable at 89.6% and

we are seeing a further improvement in pricing with like-for-like

rent per sq. ft. up by 2.6 % in the first quarter to GBP38.07.

Quarter Ended

--------------------------------------

30 Jun 22 31 Mar 22** 31 Dec 21**

---------- ------------ ------------

Like-for-like occupancy 89.6% 89.5% 86.3%

Like-for-like occupancy

change* 0.1% 3.2% 0.6%

Like-for-like rent per GBP38.07 GBP37.12 GBP36.68

sq. ft.

Like-for-like rent per

sq. ft. change 2.6% 1.2% 1.6%

Like-for-like rent roll GBP93.8m GBP91.2m GBP87.6m

Like-for-like rent roll

change 2.9% 4.1% 2.2%

*Absolute change

** Prior periods restated for the reclassification of Riverside,

Wandsworth, which has been removed from like-for-like following

exchange for sale

We have made strong progress in letting up our recently

completed projects, with occupancy across these properties

increasing by 5% to 74% in the quarter. This includes:

-- Mirror Works, Stratford, up by 14.6% to 38.0%

-- Mare Street, Hackney, up 9.9% to 80.0%

-- Pall Mall Deposit, Ladbroke Grove, up 4.7% to 80.3%

Rent roll across the completed projects category in total

increased by 8.9% to GBP7.2m, with rent per sq. ft. up 1.8%.

We have made solid progress on the integration of the McKay

portfolio acquired in May 2022, with the London assets live on our

website and leasing interest and activity now coming through the

Workspace platform. We have seen good leasing traction since the

acquisition, with some 49,000 sq. ft. completing or coming under

offer, in line or ahead of March 2022 ERV's. This includes 13,500

sq. ft. of new deals and 4,000 sq. ft. of renewals in London and

4,500 sq. ft. of new deals and 27,000 sq. ft. of renewals in the

South East.

Disposals

We have exchanged on the sale of the residential element of our

Riverside redevelopment for GBP55m, in line with the March 2022

valuation. This sale was contingent on an amendment to the planning

application, for which we received a resolution to grant consent on

28 June 2022. Completion is due by 31(st) December 2022 subject to

us achieving vacant possession and signing of the s106

agreement.

We are progressing with the disposal of the non-core assets from

the McKay portfolio, which are performing in line with

expectations. We continue to target completion of these disposals

by December 2022.

Financing

Net debt as at 30 June 2022 was GBP909m, a GBP5m reduction from

the proforma 31 March 2022 position adjusted for the McKay

acquisition. The average maturity of drawn debt is 3.9 years and

the average effective interest rate is 3.2%, with 69% of the drawn

amount at fixed rates.

Total facilities at 30 June 2022 were GBP1.2bn, with cash and

available facilities of GBP336m. The required amendments to the

McKay facilities following acquisition are expected to be completed

by September 2022.

LTV at June 2022 was 32% on a proforma basis, based on the 31

March 2022 property valuations for Workspace and McKay (adjusted

for the disposal of Great Brighams Mead). The proceeds from our

programme of planned disposals during the current financial year

should reduce our LTV to well below 30%, and will significantly

increase our proportion of fixed-rate debt.

- ENDS -

For further information, please contact:

Workspace Group PLC 020 7138 3300

Graham Clemett, Chief Executive Officer

Dave Benson, Chief Financial Officer

Kate Annakin, Interim Investor Relations Manager

FGS Global 020 7251 3801

Chris Ryall

Guy Lamming

Notes to Editors

About Workspace Group PLC:

Established in 1987 and listed on the London Stock Exchange

since 1993. We are home to

thousands of businesses, including fast growing and established

brands across a wide range of sectors.

Workspace is geared towards helping businesses perform at their

very best. We provide inspiring, flexible work spaces in dynamic

London locations.

Workspace (WKP) is a FTSE 250 listed Real Estate Investment

Trust (REIT) and a member of the European Public Real Estate

Association (EPRA).

Workspace(R) is a registered trademark of Workspace Group Plc,

London, UK.

LEI: 2138003GUZRFIN3UT430

For more information on Workspace, please visit

www.workspace.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAKXEALDAEFA

(END) Dow Jones Newswires

July 21, 2022 02:00 ET (06:00 GMT)

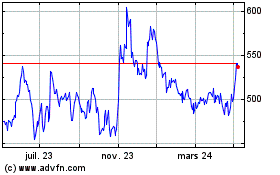

Workspace (LSE:WKP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

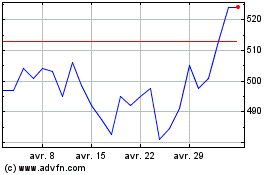

Workspace (LSE:WKP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024