TIDMWYN

RNS Number : 4928O

Wynnstay Group PLC

01 February 2023

AIM: WYN

Wynnstay Group Plc

("Wynnstay" or the "Group" or the "Company")

Final Results

For the year ended 31 October 2022

Record results and well-positioned for FY 2023

KEY POINTS

Financial

-- Record results reflect a strong trading performance and

substantial one-off gains arising from macroeconomic events (which

management does not believe will be repeated)

-- Revenue up 42% to GBP713.03 m (2021: GBP500.39m), primarily

the impact of commodity inflation

-- Underlying Group PBT* (incl. one-off gains) up 98% to GBP22.61m (2021: GBP11.44m)

-- Reported pre-tax profit up 92% to GBP21.12m (2021: GBP10.99m)

-- Basic EPS up 86% to 82.72p (2021: 44.40p)

-- Net cash up 53% to GBP14.15m (31 Oct 2021: GBP9.24m)

-- Net assets up 24% to record GBP130.70m or GBP6.31 per share

(2021: GBP105.72m /GBP5.25 per share)

-- Successful GBP10.3m (net) equity placing in August 2022 supports ongoing growth plans

-- Proposed final dividend of 11.60p (2021: 10.50p); total

dividend up 9.7% to 17.00p (2021: 15.50p)

o 19(th) consecutive year of dividend increases

Operational

-- Agriculture Division - revenue up 57% to GBP564.26m (2021:

GBP358.96m), segmental profit contribution up 247% to GBP14.66m

(2021: GBP4.22m)

o one-off gains from impact of global events on fertiliser

operations, with raw material stock values at Glasson substantially

boosted by natural gas prices and constricted supply, and very

strong contribution from merchanted fertiliser sales even on lower

volumes

o feed volumes up by 6%, ahead of national market trends

o grain marketing activity, GrainLink, traded record volumes

o total seed sales decreased, reflecting seasonal factors and

exit from lower-margin cereal seed sales, but grass seed

performance was ahead of national trend

-- Specialist Agricultural Merchanting Division - revenue up 5%

to GBP148.77m (2021: GBP141.43m) segmental profit contribution up

11% to GBP7.95m (2021: GBP7.15m)

o performance better than expected, boosted by strong bagged

feed sales and efficiencies

o continued investment in depot network and staff training

-- Joint Venture businesses contributed ahead of management expectations

-- Humphrey acquisition is integrating well and contributed in

line with management expectations at time of purchase in March

2022. It has added increased feed manufacturing capacity and

further growth opportunities

-- Investment in seed processing facility at Astley completed

and major investment programme at feed plant at Carmarthen

started

-- ESG strategy supported by the establishment of a Sustainable Farm Advisory Team

Outlook

-- Post period acquisition of Tamar Milling Ltd, animal feed

business based in Cornwall, in November 2022, extends geographic

footprint, farmer customer base and manufacturing capacity

-- Board believes Wynnstay remains well-positioned to attain its

growth targets despite the economic headwinds

* Underlying pre-tax profit is a non-GAAP (generally accepted

accounting principles) measure and is not intended as a substitute

for GAAP measures and may not be calculated in the same way as

those used by other companies. Refer to Note 15 for an explanation

on how this measure has been calculated and the reasons for its

use.

Gareth Davies, Chief Executive of Wynnstay Group plc,

commented:

"These results are exceptional and set record highs across all

key financial measures. While global events have driven substantial

one-off financial gains that we do not expect to repeat, the Group

in any case traded very strongly, helped by strong farmgate prices

and growth and efficiency initiatives.

"We also made excellent progress with our strategic growth

plans. The Humphrey acquisition has significantly expanded our

geographic trading area and added feed manufacturing capacity,

creating further growth opportunities. Our recent acquisition in

November 2022 of Tamar Milling further extends our trading

footprint, and we continue to drive investment in capacity,

efficiency, and staff across the Group.

"Trading in the new financial year to date has been in line with

expectations. While there are economic headwinds, we remain

confident of achieving our growth targets."

Enquiries:

Wynnstay Group Plc Gareth Davies, Chief T: 020 3178 6378 (today)

Executive T: 01691 827 142

Paul Roberts, Finance

Director

KTZ Communications Katie Tzouliadis / Robert T: 020 3178 6378

Morton / Dan Mahoney

Shore Capital (Nomad Stephane Auton / John T: 020 7408 4090

and Broker) More / Rachel Goldstein

CHAIRMAN'S REPORT

OVERVIEW

The Group performed strongly during the year and trading results

set new record highs across all key financial measures. It should

be noted that results benefited substantially from some singular

gains that we do not expect to be repeated in the new financial

year.

Underlying pre-tax profit* (which includes these gains) rose by

98% to GBP22.61m (2021: GBP11.44m) and revenues increased by 42% to

GBP713.03m (2021: GBP500.39m), with significant inflation primarily

driving the uplift in revenue. Reported profit before taxation was

GBP21.12m (2021: GBP10.99m). Basic earnings per share, including

non-recurring items, rose by 86% to 82.72p (44.40p).

These exceptionally strong results are significantly ahead of

initial market expectations. They reflect a combination of factors;

the benefits of growth and efficiency initiatives, farmer

confidence, which was underpinned by strong farm gate prices across

most sectors, but also significant one-off gains, in particular,

stock gains in our fertiliser activity, which we do not believe

will be repeated.

The advantages of the Group's diversified business model, with

its broad spread of products across agricultural supplies, was

again evident, with less robust sub-sectors offset by more positive

sector performances elsewhere.

Both Divisions contributed increased revenue and operating

profit, with almost all the Group's exceptional performance

delivered by the Agricultural Division. In this Division, feed

volumes were c.6% higher than last year and ahead of industry

trends, and arable activities benefited from record commodity

prices and a good 2022 harvest. Grain trading at GrainLink, our

grain marketing activity, reached record volumes and its

contribution also benefited from a significant one-off, non-cash

gain at the end of the financial year that has since unwound, as

previously announced. Total seed volumes reduced modestly,

reflecting seasonal factors although the decrease in cereal volumes

also reflected our decision to reduce the number of low-margin

wholesale cereal seed trades. In line with industry trends,

fertiliser volumes were significantly lower than last year, which

reflected the extreme rise in prices created by the highly

disrupted natural gas market. These market conditions however also

drove very significant stock gains at Glasson Grain Limited

("Glasson"), resulting in an exceptional performance, not expected

to be repeated.

The Specialist Agricultural Merchanting Division performed very

well, helped by increased efficiency and strong branded bagged feed

sales. The unusually dry summer dampened demand for some product

lines. We continued to invest in and optimise our depot network,

including closing a depot at Bethania in mid-Wales, while

successfully transferring sales to neighbouring sites.

Our Joint Venture businesses, Bibby Agriculture Limited, which

provides feed and forage products, and WYRO Developments Limited,

which develops residential homes, both contributed to the Group's

outperformance, delivering significantly higher contributions than

originally expected .

The acquisition of the Humphrey Poultry (Holdings) Ltd

("Humphrey") businesses based in Hampshire in March for an expected

final consideration of GBP12.1m net of cash acquired, was a

strategic highlight in the year. In mid-November 2022, just after

the financial year end, we also acquired Tamar Milling Limited

("Tamar"), a manufacturer and supplier of blended and coarse mix

feed products based in Cornwall, for an initial consideration of up

to GBP1.5m. Both acquisitions are earnings enhancing. In August

2022, we also raised GBP10.3m net, via an equity placing to UK

institutional shareholders and these new funds will support our

ongoing acquisition and organic growth strategy.

* Underlying pre-tax profit is a non-GAAP measure and is not

intended as a substitute to GAAP measures. Refer to Note 15 for a

reconciliation on the calculation of this measure and the reasons

for its use.

GROWTH STRATEGY

Wynnstay's growth strategy is centered on three key pillars,

organic and acquisitive growth, a multi-channel sales approach, and

Environmental, Social and Governance ("ESG"). At the forefront of

the Board's thinking is our customer base of arable and livestock

farmers. We aim to ensure that the Group continues to provide them

with trusted advice, a wide range of products and services that

cater for their changing needs, and high customer service.

Ultimately, our objective is to support farmers to grow food

profitably, sustainably and in an environmentally enhancing

manner.

Against the context of our growth strategy, I am very pleased to

highlight progress in the following areas in particular:

-- Organic and acquisitive growth

o Our acquisitions of the Humphrey business and Tamar have

significantly expanded the Group's trading footprint. They have

materially extended our presence in the South of England as well as

in the Midlands and Wales, bringing new farmer customer bases as

well as additional supply chain relationships.

o Both businesses have increased our feed manufacturing

capability, with the additional capacity also opening up the

opportunity to implement operational efficiencies.

o The Humphrey business has significantly increased our market

share in poultry feed for free-range egg production, boosting our

market share to an estimated c.11% from c.6%.

o We completed our investment projects at our seed processing

plant at Astley, which have added new capability and improved

efficiency.

o Organic growth also continues to be supported by our

investment in our specialist advisory services. Our two industry

events , The Arable Event and The Beef and Sheep Event, which

resumed in person in the year, also serve to support technical

knowledge transfer to farmers across our trading regions and were

very well attended.

-- Multi-channel

o Increased numbers of customers have now registered for our

digital portal, typically using it to access their accounts. While

farmers' purchasing habits remain strongly aligned towards

depot-based purchases rather than digital purchases, we nonetheless

continue to monitor buying patterns closely as we further develop

our multi-channel sales strategy.

-- ESG

o Our ESG work continued to evolve and we established a

Sustainable Farm Advisory Group in the year. It is made up of

recognised industry leaders, who are assisting us in the

development our ESG strategy and delivery plans.

o We launched a Holistic Whole Farm Solution in the year and

further advanced our offering of climate-friendly feeds.

o We intend to invest in on-site solar arrays, which will

provide the dual benefits of reducing the Group's carbon footprint

and its exposure to the wholesale energy markets.

FINANCIAL RESULTS

Group revenue increased by 42% year-on-year to GBP713.03m (2021:

GBP500.39m). This rise reflected significant commodity inflation,

with the Humphrey acquisition making a first-time partial revenue

contribution of GBP31.58m.

Underlying Group pre-tax profit, the Board's alternative

performance measure, rose by 98% to a record GBP22.61m (2021:

GBP11.44m) over the year. This includes the one-off trading gains

(which we do not believe will be repeated), gross share of results

from joint ventures but excludes share-based payments and

non-recurring items. Reported pre-tax profit increased by 92% to

GBP21.12m (2021: GBP10.99m). Basic earnings per share increased by

86% to 82.72p (2021: 44.40p).

Both Divisions contributed to revenue and profit growth, with

the Agricultural Division delivering a 57% uplift in revenues to

GBP564.26m (2021: GBP358.96m), and the Specialist Agricultural

Merchanting Division a 5% rise to GBP148.77m (2021: GBP141.43m).

The segmental profit contribution from the Agriculture Division

increased by 247% year-on-year to GBP14.66m (2021: GBP4.22m), with

the Specialist Agricultural Merchanting Division contributing

GBP7.95m (2021: GBP7.15m), an 11% rise.

The Group generates good operational cash flows, with cash

generated from operations being GBP13.84m (2021: GBP10.57m) despite

the challenges of working capital inflation.

Cash and cash equivalents at 31 October 2022 increased by 53% to

GBP14.15m (2021: GBP9.24m). October typically represents the

highest point of net cash in the Group's annual working capital

cycle.

During the year, 75,891 new ordinary shares (2021: 89,687) were

issued to existing shareholders who exercised their right to

receive dividends in the form of new shares. The equivalent cash

amount totalled GBP0.457m (2021: GBP0.439m). A further 1,965,689

shares were issued via the institutional equity placing and as a

result of employee options being exercised, for a total cash

consideration of GBP10.58m (2021: GBP0.59 million).

Capital investment in fixed assets amounted to GBP5.31m (2021:

GBP5.61m) in the year and GBP10.23m, net of cash acquired, was

invested in acquisitions (2021: GBP2.21m).

Group net assets at the financial year end increased by 24% to

GBP130.70m (2021: GBP105.72m), a record high. Based on the weighted

average number of shares in issue during the year of 20.722m (2021:

20.120m), this equates to GBP6.31 per share (2021: GBP5.25 per

share).

Return on assets from underlying pre-tax profits, increased to

17.4% (2021: 10.8%).

DIVIDS

The Board is pleased to propose an increased final dividend of

11.60p per share. The final dividend will be paid on 28 April 2023

(2021:10.50p per share) to shareholders on the register on 31 March

2023. Together with the interim dividend of 5.40p per share, paid

on the 31 October 2022, this makes a total dividend of 17.00p per

share for the year (2021: 15.5p per share), an increase of 9.7% on

the previous year. The final dividend is subject to shareholder

approval at the forthcoming AGM on 21 March 2023.

The total dividend payment represents the 19(th) consecutive

year of dividend growth since Wynnstay joined AIM in 2004. This

dividend is covered 4.1 times by earnings after non-recurring items

(2021: 2.8 times).

BOARD AND COLLEAGUES

The Board would like to acknowledge the dedication and hard work

of the Wynnstay team over the year. Our staff continue to provide

customers with an excellent service and on behalf of my fellow

Directors, I would like to thank everyone for their vital

contribution to the 2022 results.

We are delighted to welcome the senior management teams and

staff of Humphrey and Tamar to the Group. We are currently in the

process of recruiting a Head of Strategic Delivery to work with

senior management on key projects, including acquisitions and their

successful integration into the business.

Philip Kirkham, Board Vice-Chairman and Senior Independent

Director is due to retire during 2023. We have commenced a

recruitment process for an appropriately qualified successor and

will make a further announcement on the outcome of this process in

due course.

OUTLOOK

The Group has made strong operational and strategic progress

against its goals. While a number of one-off gains drove an

exceptional financial performance this year, which we do not expect

to be repeated in the new financial year, Group performance was

also very strong.

Looking ahead at prospects over 2023, the sector is facing

inflationary headwinds, as we have previously commented. We

anticipate this to impact raw material prices, as well as the

Group's energy, labour and distribution costs. We plan to manage

these headwinds through efficiency and productivity improvements

and other measures where possible. Farmers are facing similar

pressures although there have been some welcome downward moves in

energy and distribution costs in recent weeks.

Financially, the Group generates good cashflows and the balance

sheet remains robust. This gives a solid platform for continuing

development and supports our ongoing investment plans. These

include a major programme of works at Carmarthen Mill, renewable

energy projects and investments in the depot network. In the

meantime, the Board continues to review acquisition opportunities

that meet its criteria.

We believe that Wynnstay is in a good position to make further

progress and to achieve its growth targets for the financial

year.

Steve Ellwood

Chairman

CHIEF EXECUTIVE'S REPORT

INTRODUCTION

The Group's financial results this year are exceptional. They

reflect a strong performance, which was supported by a favourable

trading environment across most sectors, very significant one-off

gains (which we do not expect to be repeated) arising from global

events, and inflation. These one-off gains predominantly arose from

the fertiliser processing activity at Glasson Grain Ltd, which

experienced substantial stock gains following the sharp price

increases in natural gas over 2022, a key ingredient in fertiliser

production, particularly following the invasion of the Ukraine by

Russia.

Inflation was a major feature during the year, which impacted

grain and feed prices as well as fertiliser prices. It contributed

significantly to the Group's revenue outcome. Nonetheless, we

managed these inflationary pressures well, particularly in relation

to energy, fuel and labour costs. We have also sought to position

the business to be able to manage anticipated cost increases in the

year ahead.

We are pleased to have outperformed national trends in the

sectors in which we operate, and have made material progress in

expanding the Group's geographical coverage, as well as increasing

Group manufacturing capacity.

The acquisition of Humphrey Poultry (Holdings) Ltd ("Humphrey"),

based at Twyford in Hampshire, in March 2022, fulfilled multiple

strategic aims. Significantly, it has opened up new geographic

areas for us, particularly in the South of England, nearly doubled

our market share in poultry feed for free-range egg production, and

added additional feed manufacturing capacity, with the potential to

further enhance the Group's feed manufacturing operations. A

further acquisition, Tamar Milling Ltd, an animal feed business

based in Cornwall, which we completed after the end of the

financial year, has expanded our geographic reach in the South West

of England. Both acquisitions are immediately earnings

enhancing.

The Joint Venture businesses, particularly Bibby Agriculture Ltd

and WYRO Developments Limited, have performed very well,

contributing above our expectations.

We have continued to invest significantly in the business. Our

investment project at our seed processing plant in Astley was

completed, doubling grass seed mixing capacity and adding new

cereal seed processing technology. Our major capital investment

programme at the Carmarthen feed mill has started and is on course

to be completed in early 2024. We are also considering options to

redevelop the mothballed feed plant at Calne in Wiltshire.

Environment, Social and Governance principles ("ESG") is an

important pillar of Group strategy. We continue to provide products

and services to our customers that will help them deliver their

environmental ambitions, including meeting new Government policy

and legislation, in particular Environmental Land Management

Schemes ("ELMS"), the Sustainable Farming Scheme and Nitrate

Vulnerable Zones.

REVIEW OF ACTIVITIES

AGRICULTURE DIVISION

The Agriculture Division manufactures and processes feed,

fertiliser and seed, in addition to supplying a comprehensive range

of agricultural inputs for both arable and livestock farmers. The

Division includes Glasson Grain Limited, GrainLink, the Group's

specialist crop marketing business, and, since March 2022, the

Humphrey business.

Revenue generated by the Agriculture Division increased by 57%

to GBP564.26m (2021: GBP358.96m) and segmental contribution (see

Note 2 of the financial statements) rose by 247% to GBP14.66m

(2021: GBP4.22m).

Feed

Feed products are manufactured at our main feed mills at

Llansantffraid, Carmarthen and Twyford (acquired in March 2022),

supported by three blending facilities at Rhosfawr, Condover, near

Shrewsbury and Whitstone in Cornwall (acquired in November 2022).

We manufacture feed for dairy, beef, sheep and free-range egg

producers, the wide offering providing an internal hedge against

variations in individual sector performance. Feed is offered in

compounded, blended or meal form and can be bought in bulk or

bagged. The majority of the Wynnstay-branded bagged feed is sold

through our depot network. Our customers are also able to source

feed raw materials, liquid feeds and feed supplements from us. We

support our feed offering with a technical sales team, which

provides on-farm specialist advice on animal nutrition. This is a

differentiator for us to the wider market.

Our feed volumes during the financial year increased by 6% to a

record level and outperformed the national trend. Demand was

boosted by the dry summer, which reduced available grass and

forage. Dairy feed volumes were up by 7%, poultry by 2% and sheep

by 5%. Although feed volumes were strong, margins were affected by

raw material volatility and increased fuel and packaging costs,

which we were not able to pass on fully. This resulted in the

contribution from feed being slightly behind last year.

We have made further progress in enhancing the sustainability of

our offering, a key component of our overall strategy. We launched

a range of ruminant feeds that include a methane inhibitor approved

by the Carbon Trust. We are also working on a collaborative project

to reduce phosphate excretion from laying hens in order to reduce

water pollution.

The Humphrey business, which was acquired in March 2022, made a

good first-time contribution, in line with our expectations. This

was very pleasing given the pressures that the egg industry

experienced over the year, with feed, energy and labour costs

increasing without the corresponding increase in egg price. In

addition, Avian Influenza resulted in the culling of laying flocks,

which also reduced feed demand, a factor that is likely to continue

in 2023, while the organic sector has been affected by consumers

trading down to cheaper conventionally-produced eggs. We have

successfully reduced our cost base to mitigate these

challenges.

Our major investment programme at Carmarthen Mill is well under

way and on schedule to be completed by early 2024. It will

significantly increase our feed manufacturing capacity as well as

drive efficiency. As part of the acquisition of the Humphrey

business, we acquired a mothballed feed plant at Calne in

Wiltshire. There is an opportunity to redevelop this site and

replace the leased facility at Twyford, which was retained by the

vendors. We are considering all our options in developing the site

to ensure optimal benefits as we expand capacity and take advantage

of the opportunities to increase our market share in the South West

of England.

The increase in the price of grain during the second half of

2022 resulted in significant feed price rises for the winter of

2022/2023. Additionally, the mild autumn enabled farmers to keep

livestock out at grass longer than normal. This reduced feed demand

during the early part of the winter.

Arable Products

Our arable operations supply a wide range of services and

products to arable and grassland farmers. These include seeds,

fertilisers and agro-chemical, as well as grain marketing

services.

Overall, the Arable Division performed very well, with

significant contributions from GrainLink and our in-house

fertiliser trading operation.

GrainLink experienced an exceptional year, increasing volumes

traded by 31% to a record high. This reflected the good harvest

yields in both 2021 and 2022 and increased market share on the

eastern side of the country, where we had invested in additional

resource. Grain markets were extremely volatile in the period and

GrainLink's already strong contribution to Group results received a

significant boost by an unusual and very short-lived surge in the

price of wheat contracts on 31 October 2022, our financial year

end. As previously reported, this was caused by the Russian

Government's decision, which was reversed 72 hours later, to

withdraw from an agreement allowing grain to be exported from

Ukraine. This short-lived price movement created an additional,

non-cash accounting profit of approximately GBP0.4 million.

GrainLink's "Arable Event" successfully returned in June after a

break of two years due to the coronavirus. The specialised event

attracted around 800 farmers, who came to listen to keynote

speakers and obtain information on cutting-edge arable farming

technology.

Total cereal seed volumes were 19% lower year-on-year. This

reflected an increase in "farmer-saved" cereal seed being used for

autumn plantings after the early and good quality 2022 harvest, and

our decision to reduce lower-margin wholesale sales. Demand for

grass seed was also lower, with the dry spring and summer resulting

in a smaller acreage of both conventional and environmental grass

seed being sown. Nonetheless, our grass seed volumes, which were

down by 9%, were better than the national market trend.

We completed the investment at our seed processing plant at

Shrewsbury. This has enabled us to double grass seed mixing

capacity. We also installed a colour sorter into the cereal

processing facility, which now enables us to process hybrid cereal

seed. We are collaborating with seed breeders and stakeholders

within the sector to ensure that we continue to deliver innovation

to our arable customers.

Merchanted fertiliser sales performed ahead of last year and

management expectations. While the dry spring and summer, coupled

with significant price increases, flattened demand, particularly

from the livestock sector, improved margins more than offset lower

tonnage.

A large acreage of winter cereals was planted in the autumn of

2022. This typically results in a reduction of spring sown seed.

The large acreage of autumn sown seed bodes well for both demand

for crop inputs and a good harvest in 2023, although weather can

influence yield. We therefore view the outlook for the arable

sector positively, despite farmers' increased input costs.

Glasson Grain Limited ("Glasson")

Glasson is the second largest fertiliser blender in the UK, and

is based at Glasson Dock near Lancaster. As well as fertiliser

blending, Glasson has two other core activities, the supply of feed

raw materials and the manufacture of added-value animal feed

products.

Glasson delivered a record result, driven by one-off gains

(which we do not believe will be repeated) from the fertiliser

blending activity, which benefited from rising and volatile raw

material prices. This followed increases in the price for natural

gas - a key raw material in the production of fertiliser.

Sanction-related restrictions on Russian businesses tightened

global supplies of fertiliser products, substantially increasing

fertiliser prices. Whilst this reduced demand, it also generated

significant stock gains for Glasson. Gas prices rose again in the

summer of 2022, resulting in further fertiliser price rises. This

was followed by the permanent closure of the CF Industries

fertiliser production plant and certain manufacturers suspending

production, and the market remains tight.

The specialist animal feed operation experienced lower demand

for wild bird food and associated products, and margins were also

affected by rising energy and labour costs. The feed trading

operation performed ahead of management expectation, maintaining

both volumes and margins in a volatile market.

SPECIALIST AGRICULTURAL MERCHANTING DIVISION

The Specialist Agricultural Merchanting Division comprises a

network of 53 depots, located within predominantly livestock areas

of England and Wales. The depots supply a range of products that

cater predominantly for the needs of farmers but also rural

dwellers. The depot network is supported by our multi-channel sales

route to market, which includes a sales trading desk, specialist

catalogues and a digital platform. The division also incorporates

Youngs Animal Feeds, based in Staffordshire, which manufactures a

range of equine products. These are marketed throughout Wales and

the Midlands region.

Revenue from the Specialist Agricultural Merchanting Division

increased by 5% to GBP148.77m (2021: GBP141.43m). Its segmental

contribution rose by 11% to GBP7.95m (2021: GBP7.15m), which was

well ahead of management expectations and driven by strong sales of

higher-margin products, such as own-brand bagged feed, as well as

increased efficiencies.

Like-for-like sales at the depots increased by 5% year-on-year.

The long, dry summer affected sales of certain product categories

such as crop packaging, animal health and fencing products, and

spend on certain discretionary items reduced.

We continued with our depot optimisation programme, closing the

Bethania depot in Ceredigion in September 2022 while retaining its

trade via other depots in the area. We also continued to invest in

staff training, so that customers benefit from valuable advice and

guidance on products and their usage. Depot staff also continue to

work closely with our on-farm specialists.

Youngs Animal Feeds has been affected by the cost-of-living

increase, particularly in the second half of the year, with volumes

and margins impacted by the squeeze on consumer spending. This is

likely to continue into the new financial year.

JOINT VENTURES AND ASSOCIATE COMPANY

Wynnstay has three joint venture companies, Bibby Agriculture

Limited, WYRO Developments Limited and Total Angling Limited, and

an associate company, Celtic Pride Limited.

The combined contribution from our joint ventures and associated

company was significantly higher than budgeted at GBP0.80m (2021:

GBP0.68 m ). This reflected a strong performance from Bibby

Agriculture Limited and the completion of a housing development

site at WYRO Developments Limited.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ("ESG")

ESG considerations are very important to us as we continue to

develop the Group. Our ESG strategy has two fundamental aims. These

are to achieve net carbon zero by 2040 and to help farmers feed the

UK in an environmentally and sustainable way.

In order to support our ESG strategy, during the year we set up

a Sustainable Farm Advisory Team, comprising industry experts. They

will work with the Board and with the Environmental and

Sustainability Manager and provide counsel on our strategy and

delivery plans.

Over the next twelve months we will be focused on developing a

roadmap to enable the Group to fully integrate the recommendations

of the Financial Stability Board's Task Force on Climate-related

Financial Disclosures("TCFD"). This will improve and increase the

reporting of the Group's climate-related financial information.

Internally, we have a number of programmes under way to reduce

carbon emissions and energy consumption. These cover the Group's

lighting, vehicle fleet, biofuel use and power requirements. A

major initiative is a GBP1 million investment in solar photovoltaic

panels at six of our sites that have high electricity usage. We

intend this to be the first phase of a multi-site rollout of

renewables over the next five years.

In terms of our offering to farmers, Wynnstay is well-placed to

provide solutions at all points of food production. Precision

farming techniques can play a significant role in reducing carbon

emissions and protecting soil, water and air quality. These include

precision nutrient use for crops and livestock feeding management.

Careful soil management is also critical to better environmental

outcomes. New Government policy and legislation in England and

Wales, such as ELMS, the Sustainable Farming Scheme and Nitrate

Vulnerable Zones, are also requiring farmers to adopt new

practices.

We have continued to increase our offering of sustainable

products during the year, and launched our Holistic Whole Farm

Solution through our sales team. We also introduced into our range

of ruminant feeds a methane inhibitor, which has been approved by

the Carbon Trust, and are also working on other feed products.

We take our social and community responsibilities very

seriously. Our 'Colleagues Forum', introduced in the last financial

year, gives our staff the opportunity to more easily offer their

views on how to improve the business, and we wish to see this

initiative further develop. We continue to support the local

communities in which we operate through projects and supporting

local charities. We also support the charitable efforts of our

staff, which include fundraising events for the Royal Agricultural

Benevolent Institution and Children with Cancer.

As a Board, we aim to maintain very high standards of

appropriate corporate and commercial governance, which will support

the delivery of long-term shareholder value.

COLLEAGUES

I would like to thank all our staff for their loyalty,

commitment, and dedication over the year. The Group's record

results have been underpinned by their hard work in what was a

challenging year, with disruption from coronavirus, supply issues,

inflation, and the cost-of-living crisis. Wynnstay colleagues have

continued to demonstrate our values, and I am extremely proud of

them all.

OUTLOOK

Trading in the first two months of the new financial year was in

line with management expectations, and, looking further ahead, we

remain confident of continuing progress against our strategic

plans. We are also conscious of inflationary pressures, which will

increase costs for our customers, suppliers and consumers, and have

taken steps to manage these pressures. Farmgate prices are off the

peaks of 2022, and although there is sector variation, especially

for free-range eggs, prices are still strong against the average of

the last five years.

The year's excellent financial results included substantial

one-off profits that we do not believe will be repeated in the new

financial year. Nonetheless, the trading performance was also

strong, and the Group remains well-positioned to build on this

performance.

We remain firmly focused on our long-term growth ambitions and

are investing with confidence across the Group and will continue to

seek complementary acquisitions.

Gareth Davies

Chief Executive Officer

WYNNSTAY GROUP PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 October 2022

2022 2021

Note GBP000 GBP000 GBP000 GBP000

------- ---------- ------- ----------

Revenue 2 713,034 500,386

Cost of sales (622,228) (432,493)

Gross profit 90,806 67,893

Manufacturing, distribution

and selling costs (59,386) (50,072)

Administrative expenses (9,307) (7,096)

Other operating income 335 361

Adjusted operating profit(1) 22,448 11,086

Amortisation of acquired intangible

assets, goodwill impairment

and share-based payment expense 4 (416) (477)

Non-recurring items 4 (1,094) -

------------------------------------------------------------- ----- ------- ---------- ------- ----------

Group operating profit 20,938 10,609

Interest income 166 193

Interest expense (656) (383)

3 (490) (190)

Share of profits in joint ventures

and associates accounted for

using the equity method 808 677

Share of tax incurred by joint

ventures and associates (132) (105)

6 676 572

------- ---------- ------- ----------

Profit before taxation 21,124 10,991

Taxation 7 (3,982) (2,057)

------- ---------- ------- ----------

Profit for the year 17,142 8,934

Other comprehensive (expense)

/ income

Items that will be reclassified

subsequently to profit or loss

:

* Net change in the fair value of cashflow hedges taken

to equity, net of tax (2,462) 263

2,336 -

* Recycle cashflow hedge to income statement

Other comprehensive (expense)

/ income for the period (126) 263

------------------- ------- ------------

Total comprehensive income

for the period 17,016 9,197

=================== ======= ============

Basic earnings per share 9 82.72p 44.40p

Diluted Earnings per share 9 80.65p 43.53p

------------------- ------- ------------

(1) Adjusted operating profit are after adding back amortisation

of acquired intangible assets, goodwill impairment, share-based

payment expense and non-recurring items.

WYNNSTAY GROUP PLC

CONSOLIDATED BALANCE SHEET

As at 31 October 2022 2022 2021

Note GBP000 GBP000

---------- ---------

ASSETS

NON-CURRENT ASSETS

Goodwill 16,133 14,322

Intangible assets 4,936 236

Investment property 1,850 2,372

Property, plant and equipment 20,840 16,746

Right-of-use assets 8,202 11,043

Investments accounted for using

equity method 4,101 3,433

Derivative financial instruments 1 5

56,063 48,157

---------- ---------

CURRENT ASSETS

Inventories 71,095 50,550

Trade and other receivables 96,575 72,511

Financial assets - loan to

joint ventures 1,067 3,319

Cash and cash equivalents 11 31,177 19,641

Derivative financial instruments 598 320

200,512 146,341

---------- ---------

TOTAL ASSETS 256,575 194,498

---------- ---------

LIABILITIES

CURRENT LIABILITIES

Financial liabilities - borrowings 11 (3,043) (672)

Lease liabilities 11 (3,344) (3,995)

Derivative financial instruments (53) (53)

Trade and other payables (105,015) (76,212)

Current tax liabilities (1,639) (1,218)

Provisions (345) (243)

(113,439) (82,393)

---------- ---------

NET CURRENT ASSETS 87,073 63,948

---------- ---------

NON-CURRENT LIABILITIES

Financial liabilities - borrowings 11 (6,640) -

Lease liabilities 11 (3,999) (5,731)

Trade and other payables (36) (38)

Derivative financial instruments (80) (140)

Deferred tax liabilities (1,680) (474)

(12,435) (6,383)

---------- ---------

TOTAL LIABILITIES (125,874) (88,776)

---------- ---------

NET ASSETS 130,701 105,722

---------- ---------

EQUITY

Share capital 10 5,585 5,075

Share premium 42,130 31,600

Other reserves 4,267 4,131

Retained earnings 78,719 64,916

TOTAL EQUITY 130,701 105,722

---------- ---------

YNNSTAY GROUP PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

As at 31 October 2022

Share Cashflow

Share premium Other hedge Retained

capital account reserves reserves earnings Total

Group GBP000 GBP000 GBP000 GBP000's GBP000 GBP000

---------- --------- ---------- ---------- ----------- ----------

At 1 November 2020 5,013 30,637 3,525 - 59,003 98,178

---------- --------- ---------- ---------- ----------- ----------

Profit for the year - - - 8,934 8,934

Net change in the fair

value of cashflow hedges

taken to equity, net of

tax - - - 263 - 263

Total comprehensive income

for the year - - - 263 8,934 9,197

---------- --------- ---------- ---------- ----------- ----------

Transactions with owners

of the Company, recognised

directly in equity:

Shares issued during the

year 62 963 - - - 1,025

Dividends - - - - (3,021) (3,021)

Equity settled share-based

payment transactions - - 343 - - 343

Total contributions by

and distributions to owners

of the Company 62 963 343 - (3,021) (1,653)

---------- --------- ---------- ---------- ----------- ----------

At 31 October 2021 5,075 31,600 3,868 263 64,916 105,722

---------- --------- ---------- ---------- ----------- ----------

Profit for the year - - - - 17,142 17,142

Net change in the fair

value of cashflow hedges

taken to equity, net of

tax - - - (2,462) - (2,462)

Recycle cashflow hedge

to income statement - - - 2,336 - 2,336

Total comprehensive income

for the year - - - (126) 17,142 17,016

---------- --------- ---------- ---------- ----------- ----------

Transactions with owners

of the Company, recognised

directly in equity

Shares issued during the

year 510 10,530 - - - 11,040

Dividends - - - - (3,339) (3,339)

Equity settled share-based

payment transactions - - 262 - - 262

Total contributions by

and distributions to owners

of the Company 510 10,530 262 - (3,339) 7,963

---------- --------- ---------- ---------- ----------- ----------

At 31 October 2022 5,585 42,130 4,130 137 78,719 130,701

---------- --------- ---------- ---------- ----------- ----------

WYNNSTAY GROUP PLC

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 31 October 2022

2022 2021

Note GBP000 GBP000

--------- --------

Cash flows from operating activities

Cash generated from operations 12 13,839 10,577

Interest received 3 166 193

Interest paid 3 (399) (102)

Net movement in provisions - (96)

Tax paid (3,342) (1,462)

Net cash generated from operating

activities 10,264 9,110

--------- --------

Cash flows from investing activities

Proceeds from sale of property, plant

and equipment 264 340

Purchase of property, plant and equipment (3,560) (1,563)

Acquisition of business and assets,

net of cash acquired 13 (98) (2,156)

Acquisition of subsidiary undertaking,

net of cash acquired 13 (10,136) (82)

Decrease in short term loans to joint

ventures 2,252 570

Disposal of investments 7 -

Dividends received from joint ventures

and associates 4 753

Net cash used by investing activities (11,267) (2,138)

--------- --------

Cash flows from financing activities

Net proceeds from the issue of ordinary

share capital 11,040 1,025

Proceeds from new bank loan 9,485 -

Lease repayments (4,229) (4,392)

Repayment of borrowings (474) (900)

Dividends paid to shareholders 8 (3,339) (3,021)

Net cash generated from / (used in)

financing activities 12,483 (7,288)

--------- --------

Net increase in cash and cash equivalents 11,480 (316)

Effects of exchange rate changes 56 (23)

Cash and cash equivalents at the beginning

of the period 19,641 19,980

Cash and cash equivalents at the end

of the period 11 31,177 19,641

========= ========

WYNNSTAY GROUP PLC

NOTES TO THE ACCOUNTS

1. GENERAL INFORMATION AND SIGNIFICANT ACCOUNTING POLICIES

The Company is taking advantage of the exemption in s408 of the

Companies Act 2006 not to present its individual income statement

and related notes that form part of this approved financial

information.

Basis of Preparation

The Group's financial statements have been prepared in

accordance with international accounting standards in accordance

with UK-adopted International Accounting Standards and applicable

law. The Group financial statements have been prepared under the

historical cost convention other than certain assets which are at

deemed cost under the transition rules, share-based payments which

are included at fair value and certain financial instruments which

are explained in the relevant section below. A summary of the

material Group accounting policies is set out below and have been

applied consistently.

The preparation of financial statements in accordance with

UK-adopted International Accounting Standards requires the use of

certain critical accounting estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the

financial statements, and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual results ultimately may differ from those

estimates.

Going Concern

The directors have prepared the financial information presented

for Group and Company on a going concern basis having considered

the principal risks to the business and the possible impact of

plausible downside trading scenarios. The Board have concluded that

they have a reasonable expectation that the entity has adequate

resources to continue in operational existence for the foreseeable

future. The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Strategic Report of the Group's Annual Report.

The financial position of the Group and the principal risks and

uncertainties are also described in the Strategic report.

The Group has a sound financial base and forecasts that show

profitable trading and sufficient cash flow and resources to meet

the requirements of the business, including compliance with banking

covenants and on-going liquidity. In assessing their view of the

likely future financial performance of the Group, the Directors

consider industry outlooks from a variety of sources, and various

trading scenarios. This analysis showed that the Group is well

placed to manage its business risks successfully despite the

current uncertain economic outlook. More detail on outlook is

contained within the Group's Annual Report.

In conclusion, the Directors have a reasonable expectation that

the Group has adequate resources to continue in operational

existence for the foreseeable future. Thus, they continue to adopt

the going concern basis of accounting in preparing the annual

financial statements.

2. SEGMENTAL REPORTING

IFRS 8 requires operating segments to be identified on the basis

of internal financial information about the components of the Group

that are regularly reviewed by the chief operating decision maker

("CODM") to allocate resources to the segments and to assess their

performance.

The chief operating decision maker has been identified as the

Board of Directors ("the Board"). The Board reviews the Group's

internal reporting in order to assess performance and allocate

resources. The Board has determined that the operating segments,

based on these reports are Agriculture, Specialist Agricultural

Merchanting and Other.

The Board considers the business from a product/service

perspective. In the Board's opinion, all of the Group's operations

are carried out in the same geographical segment, namely the United

Kingdom.

Agriculture - manufacturing and supply of animal feeds,

fertiliser, seeds and associated agricultural products.

Specialist Agricultural Merchanting - supplies of a wide range

of specialist products to farmers, smallholders, and pet

owners.

Other - miscellaneous operations not classified as Agriculture

or Specialist Agricultural Merchanting.

The Board assesses the performance of the operating segments

based on a measure of operating profit. Non-recurring costs and

finance income and costs are not included in the segment result

that is assessed by the Board. Other information provided to the

Board is measured in a manner consistent with that in the financial

statements. No segment is individually reliant on any one

customer.

All revenue during the year has arisen from revenue recognised

at a point in time, and there were no revenues from transactions in

2022 or 2021 with individual customers which amounted to 10% or

more of Group revenues.in that period.

The segment results for the year ended 31 October 2022 are as

follows:

Specialist

Agricultural

Year ended 31 October Agriculture Merchanting Other Total

2022 GBP000 GBP000 GBP000 GBP000

------------ -------------- -------- ----------

Revenue from external

customers 564,263 148,771 - 713,034

------------ -------------- -------- ----------

Segment result

Group operating profit

before non-recurring

items 14,108 7,939 (15) 22,032

Share of results of

joint ventures before

tax 553 8 247 808

14,661 7,947 232 22,840

------------ -------------- -------- ----------

Non-recurring items (1,094)

Interest income 166

Interest expense (656)

----------

Profit before tax from

operations 21,256

Income taxes (includes

tax of joint ventures

and associates) (4,114)

----------

Profit for the year

attributable to equity

shareholders from operations 17,142

==========

Other Information:

------------ -------------- -------- ----------

Depreciation and amortisation 3,772 2,591 12 6,375

Non-current asset additions 13,490 1,260 - 14,750

------------ -------------- -------- ----------

Segment assets 146,008 75,099 4,212 225,319

Segment liabilities (80,906) (24,544) - (105,450)

------------ -------------- -------- ----------

119,869

Add corporate net cash

(note 11) 14,151

Less corporate and deferred

tax liabilities (3,319)

----------

Net assets 130,701

----------

Included in the segment

assets above are the

following investments

in joint ventures and

associates 2,746 117 1,150 4,013

2 . SEGMENTAL REPORTING (continued)

The segment results for the year ended 31 October 2021 are as

follows:

Specialist

Agricultural

Year ended 31 October Agriculture Merchanting Other Total

2021 GBP000 GBP000 GBP000 GBP000

------------ -------------- -------- ---------

Revenue from external

customers 358,961 141,425 - 500,386

------------ -------------- -------- ---------

Segment result

Group operating profit

before non-recurring

items 3,697 7,120 (208) 10,609

Share of results of

joint ventures before

tax 524 33 120 677

4,221 7,153 (88) 11,286

------------ -------------- -------- ---------

Non-recurring items -

Interest income 193

Interest expense (383)

---------

Profit before tax from

operations 11,096

Income taxes (includes

tax of joint ventures

and associates) (2,162)

---------

Profit for the year

attributable to equity

shareholders from operations 8,934

=========

Other Information:

------------ -------------- -------- ---------

Depreciation and amortisation 3,463 2,676 - 6,139

Non-current asset additions 3,860 2,094 - 5,954

------------ -------------- -------- ---------

Segment assets 101,812 66,237 6,808 174,857

Segment liabilities (56,547) (20,139) - (76,686)

------------ -------------- -------- ---------

98,171

Add corporate net cash

(note 11) 9,243

Less corporate and deferred

tax liabilities (1,692)

---------

Net assets 105,722

---------

Included in the segment

assets above are the

following investments

in joint ventures and

associates 2,386 115 840 3,341

3. FINANCE COSTS

2022 2021

GBP000 GBP000

Interest expense:

Interest payable on borrowings (399) (102)

Interest payable on finance leases (257) (281)

Interest and similar charges payable (656) (383)

------- -------

Interest income from banks deposits 66 57

Interest income from customers 100 136

Interest receivable 166 193

------- -------

Finance costs (490) (190)

======= =======

4. AMORTISATION OF ACQUIRED INTANGIBLE ASSETS, IMPAIRMENT OF

GOODWILL, SHARE-BASED PAYMENTS AND NON-RECURRING ITEMS

2022 2021

GBP000 GBP000

------- -------

Amortisation of acquired intangible assets

and share-based payments

Amortisation of intangibles 154 39

Impairment of goodwill - 95

Cost of share-based reward 262 343

416 477

------- -------

Non-recurring items

Business combination costs 572 -

Fair value movement in Investment property 522 -

------- -------

1,094 -

======= =======

Non-recurring items in relation to 2022 were:

- Business combination costs relating to the acquisition of

Humphrey Poultry (Holdings) Limited.

- The fair value movement in investment property followed a

professional valuation carried out by BNP Paribas Real Estate in

July 2022.

5. GROUP OPERATING PROFIT

The following items have been included in arriving at operating

profit:

2022 2021

GBP000 GBP000

Staff costs 37,724 31,085

Cost of inventories recognised as an expense 617,170 431,423

Depreciation of property plant and equipment:

- owned assets 2,290 2,165

Amortisation of right-of-use assets 4,085 3,974

Amortisation of intangibles 154 39

Fair value (gains) / losses on derivative

financial instruments (627) 23

Hedge ineffectiveness for the period 104 114

(Profit) on disposal of fixed assets (132) (86)

(Profit) on disposal of right of use assets (86) (14)

Other operating lease rentals payable 349 205

Services provided by the Group's auditor

During the year the Group obtained the following services from

the Group's auditor:

2022 2021

GBP000 GBP000

Audit services - statutory audit 175 119

6. SHARE OF POST-TAX PROFITS OF JOINT VENTURES

2022 2021

GBP000 GBP000

Total share of post-tax profits of joint

ventures 676 572

======= =======

7. TAXATION

2022 2021

Analysis of tax charge in year GBP000 GBP000

------- -------

Current tax

- Operating activities 3,627 1,901

- Adjustments in respect of prior years 136 (4)

------- -------

Total current tax 3,763 1,897

------- -------

Deferred tax

- Accelerated capital allowances (76) 57

- other temporary and deductible differences 295 103

------- -------

Total deferred tax 219 160

------- -------

Tax on profit on ordinary activities 3,982 2,057

======= =======

8. DIVIDS

2022 2021

GBP000 GBP000

------- -------

Final dividend paid for prior year 2,134 2,007

Interim dividend paid for current

year 1,205 1,014

3,339 3,021

======= =======

Subsequent to the year end it has been recommended that a final

dividend of 11.60p net per ordinary share (2021: 10.50p) be paid on

28 April 2023. Together with the interim dividend already paid on

29 October 2022 of 5.40p net per ordinary share (2021: 5.00p) this

will result in a total dividend for the financial year of 17.00p

net per ordinary share (2021: 15.50p).

9. EARNINGS PER SHARE

Basic earnings Diluted earnings

per share per share

2022 2021 2022 2021

-------- ------- --------- ---------

Earnings attributable to shareholders

(GBP000) 17,142 8,934 17,142 8,934

Weighted average number of shares

in issue during the year (number

'000) 20,722 20,120 21,254 20,524

Earnings per ordinary 25p share

(pence) 82.72 44.40 80.65 43.53

Basic earnings per 25p ordinary share is calculated by dividing

profit for the year from continuing operations attributable to

ordinary shareholders by the weighted average number of ordinary

shares in issue during the year.

For diluted earnings per share, the weighted average number of

ordinary shares is adjusted to assume conversion of all dilutive

potential ordinary shares (share options) taking into account their

exercise price in comparison with the actual average share price

during the year.

10. SHARE CAPITAL

2022 2021

----------------- ------------------

No. of GBP000 No. of GBP 000

shares shares

000 000

-------- ------- -------- --------

Authorised

Ordinary shares of 25p

each 40,000 10,000 40,000 10,000

-------- ------- -------- --------

Allotted, called up

and fully paid

Ordinary shares of 25p

each 22,340 5,585 20,299 5,075

======== ======= ======== ========

During the year 75,891 shares (2021: 89,687) were issued with an

aggregate nominal value of GBP19,000 (2021: GBP22,000) and were

fully paid up for equivalent cash of GBP459,000 (2021: GBP439,000)

to shareholders exercising their right to receive dividends under

the Company's dividend scrip scheme. A further 1,965,689 (2021:

158,138) shares with a nominal value of GBP491,000 (2021:

GBP40,000) were issued for a cash value of GBP10,581,000 (2021:

GBP586,000), with 65,689 being to satisfy the exercise of employee

options and 1,900,000 shares issued in a private placing to

institutional shareholders.

11. CASH AND CASH EQUIVALENTS, BORROWINGS AND LEASE LIABILITIES

2022 2021

GBP000 GBP000

Current

Cash and cash equivalents per balance

sheet and cash flow 31,177 19,641

Bank loans and other loans due within

one year or on demand:

Secured loans (2,371) -

Loanstock (unsecured) (672) (672)

- -

Financial liabilities - borrowings (3,043) (672)

Net obligations under finance leases:

Non-property leases (1,647) (1,626)

Property leases (1,697) (2,369)

--------- --------

Lease liabilities (3,344) (3,995)

Total current net cash and lease liabilities 24,790 14,974

Non-current

Bank loans:

Secured loans (6,640) -

Financial liabilities - borrowings (6,640) -

Net obligations under leases:

Non-property leases (1,645) (1,881)

Property leases (2,354) (3,850)

--------- --------

Lease liabilities (3,999) (5,731)

Total non-current net debt and lease

liabilities (10,639) (5,731)

Total net cash and lease liabilities 14,151 9,243

--------- --------

Memo: total net cash and lease liabilities

excluding property leases 18,202 15,462

========= ========

-- Cash and cash equivalents

Cash and cash equivalents are all cash at bank and held with

HSBC UK Bank Plc, except for GBP1,652,000 (2021: GBP585,000) which

is held at International FC Stones for wheat futures hedging. HSBC

UK Bank Plc's credit rating per Moody's is Aa3 (2021: Aa3) for long

term deposits. GBP3,623,000 (2021: GBP412,000) of the cash and cash

equivalent balances is denominated in foreign currencies (EUR (99%)

and USD (1%)) (2021: (90%) and USD (10%)). All other amounts are

denominated in GBP and are at booked at fair value.

-- Borrowings

Bank loans and overdrafts are secured by an unlimited composite

guarantee of all trading entities within the Group. During the

year, a new bank loan of GBP9,485,000 was drawn structured as a

term facility with quarterly repayments of 5% of the original loan

amount. Interest on this loan is 1.75% over the daily SONIA rate up

to the point of repayment.

Loan stock is redeemable at par at the option of the Company or

the holder. Interest of 1.5% (2021: 0.5%) per annum is payable to

the holders.

12 . C ASH GENERATED FROM OPERATIONS

2022 2021

GBP000 GBP000

--------- ---------

Profits for the year from operations 17,142 8,934

Adjustments for:

Tax 3,982 2,057

Investment and goodwill impairment - 95

Fair value movement in Investment property 522 -

Depreciation of tangible fixed assets 2,289 2,165

Amortisation of right-of-use assets 4,086 3,974

Amortisation of other intangible fixed

assets 154 39

Profit on disposal of property, plant

and equipment (132) (86)

Profit on disposal of right-of-use

asset (86) (14)

Loss on relinquishment of property

leases - 26

Interest income (166) (193)

Interest expense 656 383

Share of post-tax results of joint

ventures (676) (572)

Share-based payments 262 343

Derivative held at fair value (627) 23

Hedge ineffectiveness 104 46

Government grant (2) -

Movement in provisions (6) 193

Changes in working capital (excluding

effects of acquisitions and disposals

of subsidiaries):

(Increase) in inventories (18,401) (14,583)

(Increase) in trade and other receivables (18,467) (16,730)

Decrease in payables 23,205 24,477

Cash generated from operations 13,839 10,577

========= =========

13. BUSINESS COMBINATIONS

Humphrey Poultry (Holdings) Limited

On 18 March 2022, Wynnstay plc entered a business combination

and acquired 100% of the shares of Humphreys Poultry Holdings

Limited, which in turn owns 100% of the shares in two commercial

and operational entities Humphreys Feeds Limited and Humphreys

Pullets Limited.

The consideration is GBP13.147m inclusive of cash and cash

equivalents of GBP1.011m.

Current Non-Current Total

GBP'000 GBP'000 GBP'000

Trade Debtors 5,003 - 5,003

Other Debtors 595 - 595

Inventories 2,144 - 2,144

Cash and cash equivalents 1,011 - 1,011

Trade Creditors (3,469) - (3,469)

Other Creditors (368) - (368)

Leases (146) (64) (210)

Deferred tax - (104) (104)

==================================== ======== =========== ========

Net Current Assets and Non-Current

Liabilities 4,770 (168) 4,602

------------------------------------ ======== =========== --------

Tangible fixed assets - 1,545 1,545

------------------------------------ ======== =========== --------

Net Assets 4,770 1,377 6,147

------------------------------------ ======== =========== --------

The provisional consideration payable is dependent on future

product volumes of the commercial business acquired. The fair value

of the contingent consideration has been based on management's

expectation of the future performance of the business and that

could range from GBPnil to GBP2.000m.

A full analysis of the provisional consideration is provided in

the table below which includes the break-down of the tangible fixed

assets which incorporates freehold land and buildings for the

amount of GBP1.830m, which reflects the current fair value

assessment carried out by an independent third-party valuation,

which has not impacted the consideration, but only the analysis.

The goodwill balance represents the assembled workforce and future

sales opportunities and is not expected to be deductible for tax

purposes.

Fair Value of

Net Assets

GBP'000

Fair value of net assets acquired

Goodwill 1,811

Intangible - Brands 3,759

Intangible - Key and other accounts 1,095

Property, plant and equipment 2,566

Right of use assets 210

Trade Debtors 5,003

Other Debtors 595

Inventories 2,144

Cash and cash equivalents 1,011

Trade payables (3,469)

Other payables (368)

Lease liabilities (210)

Deferred tax (1.000)

------------------------------------------ --------------

Acquisition date - fair value of total

net assets acquired 13,147

------------------------------------------ --------------

Represented by: GBP'000

Cash settled to vendor during the period 11,147

Contingent as at 31 October 2022 2,000

------------------------------------------ --------------

Provisional Consideration 13,147

------------------------------------------ --------------

Cashflow Statement: GBP'000

Cash settled to vendor during the period 11,147

less cash and cash equivalents acquired (1,011)

plus, cash settled to vendors during

the period for prior acquisition 98

------------------------------------------ --------------

Acquisition date - fair value of total

net assets acquired 10,234

------------------------------------------ --------------

Directly attributable acquisition costs of GBP0.563m were

incurred with the transaction, and these have been recognised as

non-recurring expenses in the income statement for the period and

included in operating activities in the cash flow statement. During

the last available audited accounts of the acquired entities, for

the period to February 2021, the annual aggregate revenues on a

non-consolidated basis amounted to GBP41.446m and profit before tax

was GBP1.634m. Business combination accounting is expected to be

finalised within 12 months from the completion date of the

acquisition.

Amounts included in the Consolidated Statement of Comprehensive

Income in the period to 31 October 2022 in relation to the acquired

business are revenues of GBP31.567m and profit before tax of

GBP0.643m.

Contingent consideration of GBP0.098m was paid during the period

to 31 October 2022 relating to other prior period acquisitions,

resulting in a total gross cash outflow of GBP11.245m or GBP10.234m

net of cash acquired with the Humphrey transaction.

14. POST BALANCE SHEET EVENT

Acquisition of Tamar Milling Limited

On 17 November 2022, Wynnstay Group PLC announced that Wynnstay

(Agricultural Supplies) Ltd had acquired the entire share capital

of Tamar Milling Ltd, a manufacturer and supplier of blended feed

products ("Tamar"), for an initial consideration of up to GBP1.5m

(inclusive of up to GBP0.1m of contingent consideration based on

future product volumes).

Based in Whitstone, Cornwall, Tamar is a highly complementary

acquisition to the Group, which strengthens the Company's presence

in the south-west of England, adds a new farming customer base and

provides good cross selling opportunities for other Group

activities. The acquisition establishes the Group's first

south-western feed manufacturing facility which enables the

provision of its own bulk feed offering for the first time.

In the year ended 30 September 2021, Tamar generated revenues of

GBP6.40m, and a profit before tax of GBP0.42m. Net assets at 30

September 2021 were GBP0.92m. The transaction initially appears to

satisfy the IFRS 3 requirements of a business combination, and the

Group intends to account for the acquisition in the year ended 31

October 2023 where IFRS 3 criteria have been satisfied. As of the

date of this report, insufficient information is available to

complete the business combination accounting as transaction

completion accounts have not been completed by the vendors.

15. ALTERNATIVE PERFORMANCE MEASURE

Using the Board's preferred alternative performance measured

referred to as Underlying pre-tax profit, which includes the gross

share of results from joint ventures and associates but excludes

share-based payments and non-recurring items, the Group achieved

GBP22.61m (2020: GBP8.37m). A reconciliation with the reported

income statements and this measure, together with the reasons for

its use is given below:

2022 2021

GBP000 GBP000

------- -------

Profit before tax 21,124 10,991

Share of tax incurred by joint ventures

and associates 132 105

Share-based payments 262 343

Non-recurring items 1,094 -

------- -------

Underlying pre-tax profit 22,612 11,439

======= =======

The Board provides this alternative performance measure as it

believes it provides a view of the underlying commercial

performance of the current trading activities, providing investors

and other users of the accounts with an improved view of likely

future performance by making the following adjustments to the IFRS

results for the following reasons:

-- The add back of tax incurred by joint ventures and

associates. The Board believes the incorporation of

the gross result of these entities provides a fuller

understanding of their combined contribution to the

Group performance.

-- The add back of share-based payments. This charge

is a calculated using a standard valuation model,

with the assessed non-cash cost each year varying

depending on new scheme invitations and the number

of leavers from live schemes. These variables can

create a volatile non-cash charge to the income statement,

which is not directly connected to the trading performance

of the business.

-- Non-recurring items. The Group's accounting policies

include the separate identification of non-recurring

material items on the face of the income statement,

which the Board believes could cause a misinterpretation

of trading performance if not disclosed. See note

4.

16. RESPONSIBILTY STATEMENT

The Directors below confirm to the best of their knowledge:

-- the financial statements, prepared in accordance with

the applicable set of accounting standards, give a

true and fair view of the assets, liabilities, financial

position and profit or loss of the Company and the

undertakings included in the consolidation taken as

a whole; and

-- the management report includes a fair review of the

development and performance of the business and the

position of the issuer and the undertakings included

in the consolidation taken as a whole, together with

a description of the principal risks and uncertainties

that they face.

S J Ellwood

P M Kirkham

B P Roberts

G W Davies

H J Richards

C A Bradshaw

17. CONTENT OF THIS REPORT

The information in this announcement has been extracted from the

audited statutory financial statements for the year ended 31

October 2022 and as such, does not constitute statutory financial

statements within the meaning of section 435 of the Companies Act

2006 as it does not contain all the information required to be

disclosed in the financial statements prepared in accordance with

UK-adopted International Accounting Standards.

Statutory accounts for 2021 have been delivered to the Registrar

of Companies. The auditor, RSM UK Audit LLP, has reported on the

2021 accounts; the report (i) was unqualified, (ii) did not include

a reference to any matters to which the auditor drew attention by

way of emphasis without qualifying their report, and (iii) did not

contain a statement under section 498(2) or (3) of the Companies

Act 2006.

The statutory accounts for 2022 will be delivered to the

Registrar of Companies following the Annual General Meeting. The

auditor, RSM UK Audit LLP, has reported on these accounts; their

report is unqualified, does not include a reference to any matters

to which the auditor drew attention by way of emphasis without

qualifying their report, and; does not include a statement under

either section 498(2) or (3) of the Companies Act 2006.

The Annual Report and full Financial Statements will be

available to shareholders during February 2023. Further copies will

be available to the public, free of charge, from the Company's

Registered Office at Eagle House, Llansantffraid, Powys, SY22 6AQ

or on the Company's website at www.wynnstay.co.uk.

18. ANNUAL GENERAL MEETING

The Annual General Meeting of the Company will be held on

Tuesday 21 March 2023 at 11.45am in the Sovereign Suite at

Shrewsbury Town Football Club, Oteley Road, Shrewsbury, Shropshire,

SY2 6ST. Further details will be published on the Company's website

www.wynstayplc.co.uk .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UARRROKUAOUR

(END) Dow Jones Newswires

February 01, 2023 02:00 ET (07:00 GMT)

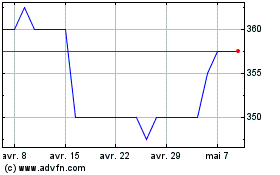

Wynnstay (LSE:WYN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Wynnstay (LSE:WYN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024