UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 7, 2023

Aura FAT Projects Acquisition Corp

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-901886 |

|

00-0000000N/A |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1 Phillip Street, #09-00, Royal One

Phillip, Singapore, 048692

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including

area code +65-3135-1511

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Units, each consisting of one Class A Ordinary Share and one Redeemable Warrant |

|

AFARU |

|

The Nasdaq Stock Market LLC |

| Class A Ordinary Share, $0.0001 par value per share |

|

AFAR |

|

The Nasdaq Stock Market LLC |

| Redeemable Warrants, each warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 per share |

|

AFARW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Material Definitive Agreement |

Business Combination Agreement

The following summary and description

of the Business Combination Agreement (the “Agreement) does not purport to be complete, describes the material provisions of the

Agreement (as defined below), and is qualified in its entirety by reference to the full text of the Agreement filed as Exhibit 1.1 to

this Current Report on Form 8-K and incorporated by reference. Unless otherwise defined herein, the capitalized terms used in this Current

Report on Form 8-K are defined in the Agreement.

On May 7, 2023, Aura FAT Projects Acquisition

Corp, a Cayman Islands exempted company limited by shares, with company registration number 384483 (“AFAR”), entered

into a definitive Business Combination Agreement (the “Agreement”) with Allrites Holdings Pte Ltd., a Singapore private

company limited by shares, with company registration number 201703484C (“Allrites”), and Meta Gold Pte. Ltd., a Singapore

exempt private company limited by shares, with company registration number 202001973W, in its capacity as the representative for the shareholders

of Allrites. The transactions contemplated by the Agreement are hereinafter referred to as the “Business Combination.”

Allrites Share Recapitalization

Immediately prior to the closing of the

Business Combination (the “Closing”), but contingent upon the Closing, Allrites

will effect a capital restructuring whereby (i) each then outstanding (A) Allrites restricted ordinary share, (B) Allrites non-voting

share, (C) Allrites preference share, and (D) Allrites option, will become vested and exercisable and will convert into Allrites Ordinary

Shares, and (ii) any retained shares (including the shares received from the exercise of all Allrites options) will be converted into

Company Ordinary Shares, and (iii) each of the Allrites option holders will (a) exercise each of their options for Allrites Ordinary

Shares and (b) retain such Allrites Ordinary Shares received upon exercise of the Options, as well as the remaining Allrites Ordinary

Shares.

Business Combination

The Agreement provides that, among other

things and upon the terms and subject to the conditions thereof, at Closing, Allrites will become a wholly owned subsidiary of AFAR and

AFAR’s Class A Ordinary Shares are expected to be listed on the Nasdaq Global Market.

Exchange Consideration

As consideration for the Business Combination,

subject to the terms and conditions set forth in the Agreement, and contingent upon the Closing, Allrites shareholders collectively shall

be entitled to receive from AFAR, in the aggregate, 9,200,000 AFAR Class A Ordinary Shares, valued at $10.00 per share, for an aggregate

value equal to ninety-two million and no/100s dollars ($92,000,000). Each Allrites shareholder shall be entitled to receive the amount

of AFAR Class A Ordinary Shares in accordance with the Agreement (the “Exchange”). Following the Exchange, the Allrites

shareholders will become shareholders of AFAR and Allrites will continue as a wholly owned subsidiary of AFAR. Each Allrites shareholder,

upon receiving the AFAR Class A Ordinary Shares, will cease to have any other rights in and to shares of Allrites.

As additional consideration for the Business

Combination, subject to certain conditions, if Allrites’ recurring revenue recognized solely from the sale of products and services

to its contracted subscription customer base in accordance with GAAP measured for each of the first two fiscal years following Closing

(each, an “Earnout Period”) exceeds the thresholds of $12,000,000 for the

first Earnout Period and $20,000,000 for the second Earnout Period, AFAR will issue to the Allrites shareholders: (i) in connection with

the first Earnout Period, if earned and payable, 800,000 AFAR Class A Ordinary Shares, valued at $10.00 per share, for an aggregate value

of $8,000,000; and (ii) in connection with the second Earnout Period, if earned and payable, 1,000,000 AFAR Class A Ordinary Shares,

valued at $10.00 per share, for an aggregate value of $10,000,000. If the recurring revenue for the first Earnout Period fails to meet

or exceed the Earnout Threshold but the recurring revenue for the second Earnout Period meets or exceeds the Earnout Threshold for the

second Earnout Period, AFAR shall issue to the Company Shareholders both the First Earnout and the Second Earnout.

Representations and Warranties; Covenants

Pursuant to the Agreement, the parties

made customary representations and warranties for transactions of this type as of the date of the Agreement. The representations and warranties

made by AFAR and Allrites will not survive the Closing. Many of the representations and warranties

are qualified by materiality including “material adverse effect” or Company Material Adverse Effect. “Company Material

Adverse Effect” as used in the Agreement means, with respect to Allrites and its subsidiaries, any event, state of facts,

development, circumstance, occurrence or effect that (i) has had or would reasonably be expected to have, individually or in the aggregate,

a material adverse effect on the business, assets and liabilities, results of operations or financial condition of Allrites and its subsidiaries,

taken as a whole or (ii) does or would in all likelihood be expected to, individually or in the aggregate, prevent or materially adversely

affect the ability of Allrites to consummate the Business Combination. Certain of the representations

are subject to specified exceptions and qualifications contained in the Agreement or in information provided pursuant to certain disclosure

schedules to the Agreement.

In addition, the parties agreed to be

bound by certain covenants that are customary for transactions of this type, including obligations of the parties to use reasonable best

efforts to operate their respective businesses in the ordinary course consistent with past practice, to refrain from taking certain specified

actions without the prior written consent of the applicable party, and not to engage in trading on material nonpublic information and

to maintain confidentiality, in each case, subject to certain exceptions and qualifications. AFAR has also covenanted to hold a meeting

of its shareholders for the purpose of approving the Business Combination and the Agreement. The covenants of the parties generally will

not survive the Closing, subject to certain exceptions, including certain covenants and agreements that by their terms are to be performed

in whole or in part after the Closing.

Conditions to Each Party’s Obligations

to Close

Pursuant to the Agreement, the obligations

of the parties to consummate the Business Combination are subject to the satisfaction or waiver of certain customary closing conditions

of the respective parties, including, without limitation: (i) the representations and warranties of the respective parties being true

and correct subject to the materiality standards contained in the Agreement; (ii) material compliance by the parties of their respective

pre-closing covenants and agreements, subject to the standards contained in the Agreement; (iii) the approval by AFAR’s shareholders

of the Business Combination; (iv) no governmental authority shall have enacted any law or order which has the effect of prohibiting the

consummation of the Business Combination; (v) a Registration Statement on Form F-4 containing a prospectus and proxy statement (as amended

or supplemented, the “Prospectus and Proxy Statement”) shall have been declared effective by the Securities and Exchange

Commission (the “SEC”) and shall remain effective as of the Closing, and no stop order or similar order shall be in

effect with respect to the Prospectus and Proxy Statement; and (vi) the members of the post-Closing board of directors of the combined

company shall have been elected or appointed as of the Closing in accordance with the requirements set forth in the Agreement.

Termination and Break-Up Fee

The Agreement may be terminated under

certain customary and limited circumstances at any time prior to the Closing. If the Agreement is

terminated, all further obligations of the parties related to public announcements, confidentiality, fees and expenses, trust account

waiver, termination and general provisions under the Agreement will terminate and will be of no

further force and effect, and no party to the Agreement will have any further liability to any other party thereto except for liability

for certain fraud claims or for willful breach of the Agreement prior to the termination.

The Agreement may be terminated at any

time prior to the Closing by either AFAR or Allrites if the Closing has not occurred on or prior to July 12, 2023 (the “Business

Combination Deadline”) unless AFAR, at its election, receives shareholder approval for a charter amendment to extend the term

it has to consummate a business combination (“Extension Option”), for an additional six months for AFAR to consummate

a business combination pursuant to the charter amendment. A party is not entitled to terminate the Agreement if the failure of the Closing

to occur by such date was caused by or the result of a breach of the Agreement by such party.

The Agreement may also

be terminated under certain other customary and limited circumstances prior the Closing, including, among other reasons: (i) by mutual

written consent of AFAR and Allrites; (ii) by either AFAR or Allrites if a governmental authority of competent jurisdiction has issued

an order or taken any other action permanently restraining, enjoining or otherwise prohibiting the Business Combination, and such order

or other action has become final and non-appealable; (iii) by Allrites for AFAR’s material uncured breach of the Agreement, if the

breach would result in the failure of the related Closing condition; (iv) by AFAR for the material uncured breach of the Agreement by

Allrites, if the breach would result in the failure of the related Closing condition; (v) by AFAR if there has been a Company Material

Adverse Effect with respect to Allrites since the date of the Agreement, which is uncured and continuing; or (vi) by either AFAR or Allrites

if AFAR holds an extraordinary general meeting of its shareholders to approve the Agreement and the Business Combination and such approval

is not obtained.

In the event the Agreement

is terminated pursuant to Section 10.1 of the Agreement, the terminating party shall pay $5,000,000 to the non-terminating party, within

three business days, by wire transfer of immediately available funds to an account specified by the non-terminating party, as liquidated

damages.

Governing

Law and Arbitration

The Agreement and all claims related to

the Business Combination shall be governed by the laws of the State of New York.

The foregoing description of the Agreement

does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement filed as Exhibit 1.1

to this Current Report on Form 8-K and incorporated by reference. The Agreement has been filed to provide investors with information

regarding its terms and is not intended to provide any factual or other information about AFAR, Allrites or any other party

to the Agreement. In particular, the assertions embodied in the representations and warranties contained in the Agreement were

made as of the execution date of the Agreement only and are qualified by information in confidential disclosure schedules provided by

the parties in connection with the signing of the Agreement. Moreover, certain representations and warranties in the Agreement may have

been used for the purpose of allocating risk between the parties rather than establishing matters of fact and

may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors and reports

and documents filed with the SEC. Accordingly, you should not rely on the representations and warranties in the Agreement as characterizations

of the actual statements of fact about the parties. In addition, the representations, warranties,

covenants and agreements and other terms of the Agreement may be subject to subsequent waiver or modification. Moreover, information

concerning the subject matter of the representations and warranties and other terms may change after the date of the Agreement, which

subsequent information may or may not be fully reflected in AFAR’s public disclosures. Shareholders of AFAR and other interested

parties are urged to read the Agreement in its entirety.

Sponsor Support Agreement

In connection with entry into the Agreement,

AFAR, Allrites, and Aura FAT Projects Capital LLC, a Cayman Islands limited liability company (the “Sponsor”),

entered into a sponsor support agreement (the “Sponsor Support Agreement”)

pursuant to which the Sponsor has agreed to, among other things, (i) appear at the AFAR shareholders’ meeting for purposes of constituting

a quorum, and (ii) vote to adopt and approve the Agreement and the Business Combination.

The foregoing description of the Sponsor

Support Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Sponsor Support

Agreement attached as Exhibit 2.2.

Company Holders Support Agreement

In connection with entry into the Agreement,

the attainment of a sufficient number of Allrites’ shares voted for the Agreement (the “Requisite Company Shareholders”)

have each executed and delivered to Allrites and AFAR, the company holders support agreement (the “Company Holders Support Agreement”),

pursuant to which the Requisite Company Shareholders have agreed, among other things, to (i) to vote against any proposals at any meeting

of Allrites’ shareholders and withhold any written consent to any proposal that would impede in any material respect the Business

Combination, and (ii) not to transfer any Allrites shares held by such Requisite Company Shareholders. The Requisite Company Shareholders

have agreed to a lock-up for a period of twelve (12) months following the Closing of the AFAR shares the Requisite Company Shareholders

will receive pursuant to the Exchange (subject to certain exceptions). The foregoing description of the Company Holders Support Agreement

does not purport to be complete and is qualified in its entirety by the terms and conditions of the Company Holders Support Agreement

attached as Exhibit 2.1.

Amendment to Letter Agreement

Similarly, in connection with the Agreement,

the Sponsor and officers and directors of AFAR, as holders of AFAR’s founder shares, have entered into an amendment to the original

Letter Agreement, dated April 12, 2022 (the “Amendment to Letter Agreement”),

which extends the lock-up period from six months to 12 months. The foregoing description of the Amendment to Letter Agreement does not

purport to be complete and is qualified in its entirety by the terms and conditions of the Amendment to Letter Agreement attached as

Exhibit 2.3.

Subscription Agreements

In

connection with entry into the Agreement, AFAR may enter into subscription agreements with certain accredited investors (the “Subscription

Agreements”), pursuant to which such investors would subscribe for AFAR Class A Ordinary Shares and/or any combination

of Allrites; Preference Shares that are convertible into AFAR Class A Ordinary Shares, or warrants, options or rights that are exercisable

for AFAR Class A Ordinary Shares at the Closing of the Business Combination, all in an aggregate amount equal on a fully-diluted basis

to one million (1,000,000) Class A Ordinary Shares (the “Pool Shares”). The Pool Shares would be issued for purposes

that are mutually reasonably acceptable to AFAR and Allrites and pursuant to Subscription Agreements and other related private placement

documents.

The

foregoing description of the Subscription Agreements does not purport to be complete and is qualified in its entirety by the terms and

conditions of the Subscription Agreements entered into from time-to-time.

Registration Rights Agreement

The Sponsor, certain Allrites shareholders and

their respective affiliates, will enter into a registration rights agreement (the “Registration Rights Agreement”),

pursuant to which, among other things, Allrites will be obligated to file a registration statement to register the resale of certain securities

of Allrites held by the Sponsor, certain Allrites shareholders and their respective affiliates. The Registration Rights Agreement will

also provide the respective parties with “piggy-back” registration rights, subject to certain requirements and customary conditions.

The foregoing description of the Registration

Rights Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Registration Rights

Agreement.

Restrictive Covenants Agreement

At the Closing, each Key Executive of

Allrites (as defined in the Agreement) will enter into a restrictive covenant agreement (collectively, the “Restrictive Covenant

Agreements”) with AFAR, which will be effective upon the Closing.

The foregoing description of the Restrictive

Covenants Agreements does not purport to be complete and is qualified in its entirety by the terms and conditions of the Restrictive Covenant

Agreements.

Share Exchange Agreement

At the Closing, each Allrites shareholder and

AFAR, will enter into a Share Exchange Agreement for the purpose of issuing the Exchange Consideration to each of the Allrites shareholders

that transfer the Allrites ordinary shares, providing for the exchange of that Allrites shareholder’s Allrites shares for AFAR Class

A Ordinary Shares.

The foregoing description of the Share

Exchange Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the form of Share

Exchange Agreement.

Prospectus and Proxy Statement

As promptly as practicable after the

effective date of the Agreement, AFAR will file with the SEC the Prospectus and Proxy Statement and certain related documents in connection

with a meeting of AFAR’s shareholders to consider approval and adoption of (i) the Agreement and the Business Combination; (ii)

any other proposals as either the SEC or the Nasdaq Global Market (or the respective staff members thereof) may indicate are necessary

in comments to the Prospectus and Proxy Statement or in correspondence related thereto; (iii) any other proposals as reasonably agreed

by AFAR and Allrites to be necessary or appropriate in connection with the Business Combination; and (4) the adjournment of the special

meeting, if necessary, to permit further solicitation of proxies because there are not sufficient votes to approve and adopt one or more

of the foregoing.

| Item 7.01 | Regulation FD Disclosure |

Press Release

On May 8, 2023, AFAR issued a press

release announcing the execution of the Agreement. The press release is attached as Exhibit 99.1. The information in this Item 7.01, including

Exhibit 99.1, is being furnished and will not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed

to be incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities

Act”).

Cautionary Statement

Regarding Forward-Looking Statements

This Current Report

on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations

and intentions with respect to future operations, products and services; and other statements identified by words such as “will

likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,”

“believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning.

These forward-looking statements include, but are not limited to, statements regarding Allrites’ industry and market sizes, future

opportunities for AFAR and Allrites, AFAR’s and the Allrites’ estimated future results and the Business Combination, including

the implied enterprise value, the Business Combination and ownership structure and the likelihood and ability of the parties to successfully

consummate the Business Combination. Such forward-looking statements are based upon the current beliefs and expectations of our management

and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult

to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated

in these forward-looking statements.

The Press Release contains

statements that constitute “forward-looking statements,” including with respect to the Business Combination, within the meaning

of the federal securities laws. Forward-looking statements may include, but are not limited to, statements with respect to Allrites’

products, the likelihood of regulatory approval of such products and their proposed uses; Allrites’ growth prospects and Allrites’

potential target markets, as well as the size of those markets; Allrites’ projected financial and operational performance; new product

and service offerings Allrites may introduce in the future; the potential Business Combination, including the implied enterprise value,

the expected post-closing ownership structure and the likelihood and ability of the parties to successfully consummate the Business Combination;

the anticipated effect of the announcement or pendency of the Business Combination on AFAR or Allrites’ business relationships,

performance, and business generally; and other statements regarding AFAR and Allrites’ expectations, hopes, beliefs, intentions

or strategies regarding the future.

In addition, any statements

that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions,

are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intends,” “outlook,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “should,” “would,”

and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not

forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks and uncertainties. You should carefully consider the risks and uncertainties

described in the “Risk Factors” section of the Prospectus and Proxy Statement, other documents filed by AFAR from time to

time with SEC, and any risk factors made available to you in connection with AFAR, Allrites and the Business Combination. These forward-looking

statements involve a number of risks and uncertainties (some of which are beyond the control of AFAR and Allrites), and other assumptions,

that may cause the actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

No assurance can be given that the Business Combination discussed above will be completed on the terms described, or at all. Forward-looking

statements are subject to numerous conditions, many of which are beyond the control of AFAR. Copies of these documents are or will be

available on the SEC’s website, www.sec.gov. AFAR undertakes no obligation to update these statements for revisions or changes after

the date of this Current Report on Form 8-K, except as required by law.

In addition to factors

previously disclosed in AFAR reports filed with the SEC and those identified elsewhere in this Current Report on Form 8-K, the following

factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results or other

expectations expressed in the forward-looking statements: (i) the risk that the Business Combination may not be completed in a timely

manner or at all, which may adversely affect the price of AFAR securities; (ii) the risk that the Business Combination may not be completed

by the Business Combination Deadline and the potential failure to obtain the Extension Option, if sought; (iii) the failure to satisfy

the conditions to the consummation of the Business Combination, including the adoption of the Agreement by the shareholders of AFAR, the

satisfaction of the minimum cash amount following redemptions by AFAR public shareholders, (iv) the receipt of certain governmental and

regulatory approvals; (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the Agreement;

(vi) the potential effect of the announcement or pendency of the Business Combination on Allrites’ business relationships, performance

and business generally; (vii) risks that the Business Combination disrupts current plans and operations of Allrites; (viii) the outcome

of any legal proceedings that may be instituted against Allrites or AFAR related to the Agreement or the Business Combination; (ix) the

risk that AFAR will be unable to maintain the listing of AFAR’s securities on Nasdaq Capital Market; (x) the risk that the price

of AFAR’s securities, including following the Closing, may be volatile due to a variety of factors, including changes in the competitive

and regulated industries in which Allrites operates, variations in performance across competitors, changes in laws and regulations affecting

Allrites’ business and changes in the capital structure; (xi) the inability to implement business plans, forecasts, and other expectations

after the completion of the Business Combination and identify and realize additional opportunities; (xii) the risk of downturns and the

possibility of rapid change in the highly competitive industry in which Allrites operates, (xiii) the risk of changes in applicable law,

rules, regulations, regulatory guidance, or social conditions in the countries in which Allrites’ customers and suppliers operate

in that could adversely impact Allrites’ operations or the market generally for special purpose acquisition companies; (xiv) the

risk of supply chain and supply route challenges, including COVID-19, could result in delays or increased costs for Allrites and partners

deploying their technologies; (xv) the risk that Allrites may not achieve or sustain profitability; (xvi) the risk that Allrites will

need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; (xvii) the risk

that Allrites experiences difficulties in managing its growth and expanding operations; (xviii) changes in overall economic conditions

that impact spending on Allrites’ products; and (xix) deterioration in conditions of the building construction industry or in broader

economic conditions.

Actual

results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements

and the assumptions on which those forward-looking statements are based. There can be no assurance that the data contained herein is reflective

of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future

performance as projected financial information and other information are based on estimates and assumptions that are inherently subject

to various significant risks, uncertainties and other factors, many of which are beyond our control. All information set forth herein

speaks only as of the date hereof in the case of information about AFAR and Allrites or the date of such information in the case of information

from persons other than AFAR or Allrites, and we disclaim any intention or obligation to update any forward-looking statements as a result

of developments occurring after the date of this Current Report on Form 8-K. Forecasts and

estimates regarding Allrites’ industry and end markets are based on sources we believe to be reliable, however there can be no assurance

these forecasts and estimates will prove accurate in whole or in part. Annualized, pro forma, projected, and estimated numbers are used

for illustrative purpose only, are not forecasts and may not reflect actual results.

Additional Information

and Where to Find It

In connection with

the Business Combination, AFAR intends to file relevant materials with the SEC, including the Prospectus and Proxy Statement and other

documents regarding the Business Combination. AFAR’s shareholders and other interested persons are advised to read this Current

Report on Form 8-K and, when available, the Prospectus and Proxy Statement and documents incorporated by reference therein filed in connection

with the Business Combination, as these materials will contain important information about Allrites, AFAR, and the Business Combination.

Promptly after the Prospectus and Proxy Statement is declared effective by the SEC, AFAR will mail the definitive Prospectus and Proxy

Statement and a proxy card to each shareholder of AFAR entitled to vote at the meeting relating to the approval of the Business Combination

and other proposals set forth in the Prospectus and Proxy Statement. Before making any voting or investment decision, investors, and shareholders

of AFAR are urged to carefully read the entire Prospectus and Proxy Statement, when they become available, and any other relevant documents

filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about

the Business Combination. Documents filed by AFAR with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov

(Commission File No: 001-901886) or by directing a request to Aura FAT Projects Acquisition Corp, 1 Phillip Street, #09-00, Royal One

Phillip, Singapore, 048692.

Participants

in the Solicitation

AFAR and its directors and executive officers

may be deemed participants in the solicitation of proxies from its shareholders with respect to the Business Combination. A list of the

names of those directors and executive officers and a description of their interests in AFAR will be included in the Prospectus and Proxy

Statement, when available, at www.sec.gov. Information about AFAR’s directors and executive officers and their ownership of AFAR

ordinary shares is set forth in AFAR’s prospectus, dated March 31, 2022, as modified or supplemented by any Form 3 or Form 4 filed

with the SEC since the date of such filing. Other information regarding the interests of the participants in the proxy solicitation will

be included in the Prospectus and Proxy Statement when it becomes available. These documents can be obtained free of charge from the source

indicated above.

Allrites and its directors

and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of AFAR in connection

with the Business Combination. A list of the names of such directors and executive officers and information regarding their interests

in the Business Combination will be included in the Prospectus and Proxy Statement.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute

a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the Business Combination. This Current

Report on Form 8-K shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, and there shall be

no sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act or an exemption therefrom.

|

Item 9.01. |

Financial Statements and Exhibits. |

The following exhibits are

being filed herewith:

| Exhibit No. |

|

Description |

| |

|

|

| 1.1* |

|

Business Combination Agreement, dated as of May 7, 2023, by and among Aura FAT Projects Acquisition Corp, Allrites Holdings Pte Ltd., and Meta Gold Pte. Ltd. |

| |

|

|

| 2.1** |

|

Company Holders Support Agreement, dated as

of May 7, 2023, by and among the Requisite Company Shareholders of Allrites Holdings Pte Ltd. in favor of Aura FAT Projects

Acquisition Corp and Allrites Holdings Pte Ltd. |

| |

|

|

| 2.2** |

|

Sponsor Support Agreement, dated as of May 7, 2023, by and among Aura FAT Projects Acquisition Corp, Allrites Holdings Pte Ltd. and Aura FAT Projects Capital LLC. |

| |

|

|

| 2.3 |

|

Amendment to Letter Agreement, dated as of May 7, 2023, by and among between Aura FAT Projects Acquisition Corp, Aura FAT Projects Capital LLC and each of the executive officers and directors of between Aura FAT Projects Acquisition Corp. |

| |

|

|

| 99.1 |

|

Press Release dated May 8, 2023 |

| |

|

|

| 104 |

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL (included as Exhibit 101). AFAR agrees to furnish supplementally a copy of all omitted exhibits and schedules to the SEC upon request. |

| * | Certain of the exhibits and schedules to this exhibit have been

omitted in accordance with Regulation S-K Item 601(b)(2). The Company agrees to furnish supplementally a copy of all omitted exhibits

and schedules to the SEC upon its request. |

| ** | Affixed as exhibits

to the Business Combination Agreement. |

SIGNATURES

Pursuant to the requirements

of the Exchange Act, AFAR has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AURA FAT PROJECTS ACQUISITION CORP |

| |

|

| Date: May 9, 2023 |

By: |

/s/ David Andrada |

| |

|

David Andrada |

| |

|

Co-Chief Executive Officer |

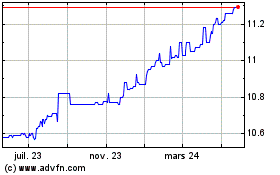

Aura FAT Projects Acquis... (NASDAQ:AFAR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

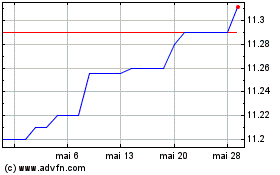

Aura FAT Projects Acquis... (NASDAQ:AFAR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024