Alto Ingredients, Inc. (NASDAQ: ALTO), a leading

producer and distributor of specialty alcohols and essential

ingredients, reported its financial results for the quarter ended

June 30, 2023.

“We continue to pursue opportunities to maximize

value through capital investments and onboarding strategic partners

that share our vision. Our strategy is coming to fruition,” said

Bryon McGregor, President and CEO of Alto Ingredients. “In the

second quarter of 2023, improved ethanol crush margins complemented

by favorable economics from our high-quality alcohol and essential

ingredients delivered strong profitability and positive operating

cash flow. Based on current trends, we expect to post positive

Adjusted EBITDA in the third quarter of 2023 as well.

“We have accelerated our investments in

longer-term capital projects to produce more high-quality products,

including grain neutral spirits, corn oil and high protein, as well

as to improve plant efficiency and reliability. Looking ahead, we

plan to advance our business transformation with a natural gas

pipeline, biogas conversion, enhanced cogeneration capabilities,

primary yeast and carbon capture and sequestration. We have $137

million in cash and excess borrowing availability to support our

business operations and near-term growth initiatives. For our

longer-term projects, we continue to hold productive discussions

with strategic partners, and we will judiciously finance capital

needs for those projects, as appropriate. With these investments,

we expect to increase annualized EBITDA incrementally by over $65

million by the end of 2025, with the completion of our near-term

projects, and by approximately $125 million by the end of 2026,

when our carbon capture and sequestration, cogeneration, and other

long-term initiatives are fully realized.”

Financial Results for the Three Months

Ended June 30, 2023 Compared to 2022

- Net sales were $317.3 million, compared to $362.2 million.

- Cost of goods sold was $300.1 million, compared to $353.3

million.

- Gross profit was $17.2 million, compared to $8.8 million.

- Selling, general and administrative expenses were $7.9 million,

compared to $9.0 million.

- Operating income was $9.3 million, compared to an operating

loss of $152,000.

- Net income available to common stockholders was $7.2 million,

or $0.10 per diluted share, compared to $21.5 million, which

included a $22.7 million USDA cash grant, or $0.29 per diluted

share.

- Adjusted EBITDA was $15.5 million, compared to $29.9

million, which included a $22.7 million USDA cash grant.

Cash and cash equivalents were $22.7 million at

June 30, 2023, compared to $36.5 million at December 31, 2022. At

June 30, 2023, the company’s borrowing availability included $49

million under its operating line of credit and $40 million under

its term loan facility with an option to request up to an

additional $25 million under the facility.

Financial Results for the Six Months

Ended June 30, 2023 Compared to 2022

- Net sales were $631.2 million, compared to $670.3 million.

- Cost of goods sold was $617.2 million, compared to $656.7

million.

- Gross profit was $14.0 million, compared to $13.6 million.

- Selling, general and administrative expenses were $15.8

million, compared to $16.6 million.

- Operating loss was $2.4 million, compared to $3.0 million.

- Net loss available to common stockholders was $6.2 million, or

$0.08 per diluted share, compared to net income available to common

stockholders of $18.6 million, including the $22.7 million USDA

cash grant, or $0.26 per diluted share.

- Adjusted EBITDA was $11.0 million, compared to $34.3 million,

including the aforementioned cash grant.

Second Quarter 2023 Results Conference

CallManagement will host a conference call at 2:00 p.m.

Pacific Time / 5:00 p.m. Eastern Time on Monday, August 7, 2023,

and will deliver prepared remarks via webcast followed by a

question-and-answer session.

The webcast for the conference call can be

accessed from Alto Ingredients’ website at www.altoingredients.com.

Alternatively, to receive a number and unique PIN by email,

register here. To dial directly twenty minutes prior to the

scheduled call time, dial (833) 630-0017 domestically and (412)

317-1806 internationally. The webcast will be archived for replay

on the Alto Ingredients website for one year. In addition, a

telephonic replay will be available at 8:00 p.m. Eastern Time on

Monday, August 7, 2023 through 8:00 p.m. Eastern Time on Monday,

August 14, 2023. To access the replay, please dial 877-344-7529.

International callers should dial 00-1 412-317-0088. The pass code

will be 6298351.

Use of Non-GAAP

MeasuresManagement believes that certain financial

measures not in accordance with generally accepted accounting

principles ("GAAP") are useful measures of operations. The company

defines Adjusted EBITDA as unaudited consolidated net income (loss)

before interest expense, interest income, provision for income

taxes, asset impairments, loss on extinguishment of debt,

acquisition-related expense, fair value adjustments, and

depreciation and amortization expense. A table is provided at the

end of this release that provides a reconciliation of Adjusted

EBITDA to its most directly comparable GAAP measure, net income

(loss). Management provides this non-GAAP measure so that investors

will have the same financial information that management uses,

which may assist investors in properly assessing the company's

performance on a period-over-period basis. Adjusted EBITDA is not a

measure of financial performance under GAAP and should not be

considered as an alternative to net income (loss) or any other

measure of performance under GAAP, or to cash flows from operating,

investing or financing activities as an indicator of cash flows or

as a measure of liquidity. Adjusted EBITDA has limitations as an

analytical tool and you should not consider this measure in

isolation or as a substitute for analysis of the company's results

as reported under GAAP.

About Alto Ingredients,

Inc.Alto Ingredients, Inc. (ALTO) is a leading producer

and distributor of specialty alcohols and essential ingredients.

The company is focused on products for four key markets: Health,

Home & Beauty; Food & Beverage; Essential Ingredients; and

Renewable Fuels. The company’s customers include major food and

beverage companies and consumer products companies. For more

information, please visit www.altoingredients.com.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995 Statements and

information contained in this communication that refer to or

include Alto Ingredients’ estimated or anticipated future results

or other non-historical expressions of fact are forward-looking

statements that reflect Alto Ingredients’ current perspective of

existing trends and information as of the date of the

communication. Forward looking statements generally will be

accompanied by words such as “anticipate,” “believe,” “plan,”

“could,” “should,” “estimate,” “expect,” “forecast,” “outlook,”

“guidance,” “intend,” “may,” “might,” “will,” “possible,”

“potential,” “predict,” “project,” or other similar words, phrases

or expressions. Such forward-looking statements include, but are

not limited to, statements concerning Alto Ingredients’ plant

improvement and other capital projects and other business

initiatives and strategies, and their financing, costs, timing and

effects, including, but not limited to, EBITDA and/or Adjusted

EBITDA that Alto Ingredients’ expects to generate as a result of

its projects, initiatives and strategies; estimates of EBITDA or

Adjusted EBITDA and Alto Ingredients’ other plans, objectives,

expectations and intentions. It is important to note that Alto

Ingredients’ plans, objectives, expectations and intentions are not

predictions of actual performance. Actual results may differ

materially from Alto Ingredients’ current expectations depending

upon a number of factors affecting Alto Ingredients’ business and

plans. These factors include, among others, adverse economic and

market conditions, including for fuel-grade ethanol, specialty

alcohols and essential ingredients; export conditions and

international demand for the company’s products; fluctuations in

the price of and demand for oil and gasoline; raw material costs,

including production input costs, such as corn and natural gas; and

the cost, ability to fund, timing and effects of, including the

financial and other results deriving from, Alto Ingredients’ plant

improvement and other capital projects and other business

initiatives and strategies. These factors also include, among

others, the inherent uncertainty associated with financial and

other projections; the anticipated size of the markets and

continued demand for Alto Ingredients’ products; the impact of

competitive products and pricing; the risks and uncertainties

normally incident to the specialty alcohol production, marketing

and distribution industries; changes in generally accepted

accounting principles; successful compliance with governmental

regulations applicable to Alto Ingredients’ facilities, products

and/or businesses; changes in laws, regulations and governmental

policies; the loss of key senior management or staff; and other

events, factors and risks previously and from time to time

disclosed in Alto Ingredients’ filings with the Securities and

Exchange Commission including, specifically, those factors set

forth in the “Risk Factors” section contained in Alto Ingredients’

Quarterly Report on Form 10-Q filed with the Securities and

Exchange Commission on May 9, 2023.

Company IR and Media Contact:

Michael

Kramer, Alto Ingredients, Inc., 916-403-2755,

Investorrelations@altoingredients.com

IR Agency Contact: Kirsten

Chapman, LHA Investor Relations, 415-433-3777,

Investorrelations@altoingredients.com

|

ALTO INGREDIENTS, INC.CONSOLIDATED

STATEMENTS OF OPERATIONS(unaudited, in thousands,

except per share data) |

|

|

|

|

|

|

|

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

317,297 |

|

|

$ |

362,189 |

|

|

$ |

631,188 |

|

|

$ |

670,307 |

|

| Cost of goods sold |

|

|

300,116 |

|

|

|

353,345 |

|

|

|

617,171 |

|

|

|

656,690 |

|

| Gross profit |

|

|

17,181 |

|

|

|

8,844 |

|

|

|

14,017 |

|

|

|

13,617 |

|

| Selling, general and

administrative expenses |

|

|

7,911 |

|

|

|

8,996 |

|

|

|

15,793 |

|

|

|

16,625 |

|

| Asset impairments |

|

|

— |

|

|

|

— |

|

|

|

574 |

|

|

|

— |

|

| Income (loss) from

operations |

|

|

9,270 |

|

|

|

(152 |

) |

|

|

(2,350 |

) |

|

|

(3,008 |

) |

| Interest expense, net |

|

|

(1,734 |

) |

|

|

(319 |

) |

|

|

(3,299 |

) |

|

|

(519 |

) |

| Income from cash grant |

|

|

— |

|

|

|

22,652 |

|

|

|

— |

|

|

|

22,652 |

|

| Other income (expense),

net |

|

|

59 |

|

|

|

(66 |

) |

|

|

78 |

|

|

|

388 |

|

| Income (loss) before provision

for income taxes |

|

|

7,595 |

|

|

|

22,115 |

|

|

|

(5,571 |

) |

|

|

19,513 |

|

| Provision for income

taxes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net income (loss) |

|

$ |

7,595 |

|

|

$ |

22,115 |

|

|

$ |

(5,571 |

) |

|

$ |

19,513 |

|

| Preferred stock dividends |

|

$ |

(315 |

) |

|

$ |

(315 |

) |

|

$ |

(627 |

) |

|

$ |

(627 |

) |

| Net income allocated to

participating securities |

|

|

(96 |

) |

|

|

(284 |

) |

|

|

— |

|

|

|

(251 |

) |

| Net income (loss) available to

common stockholders |

|

$ |

7,184 |

|

|

$ |

21,516 |

|

|

$ |

(6,198 |

) |

|

$ |

18,635 |

|

| Net income (loss) per share,

basic |

|

$ |

0.10 |

|

|

$ |

0.29 |

|

|

$ |

(0.08 |

) |

|

$ |

0.26 |

|

| Net income (loss) per share,

diluted |

|

$ |

0.10 |

|

|

$ |

0.29 |

|

|

$ |

(0.08 |

) |

|

$ |

0.26 |

|

| Weighted-average shares

outstanding, basic |

|

|

73,394 |

|

|

|

72,936 |

|

|

|

73,603 |

|

|

|

71,690 |

|

| Weighted-average shares

outstanding, diluted |

|

|

74,103 |

|

|

|

73,123 |

|

|

|

73,603 |

|

|

|

71,958 |

|

|

ALTO INGREDIENTS, INC.CONSOLIDATED BALANCE

SHEETS(unaudited, in thousands, except par

value) |

|

|

|

ASSETS |

|

June 30, 2023 |

|

December 31, 2022 |

|

Current Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

22,739 |

|

|

$ |

36,456 |

|

|

Restricted cash |

|

|

2,351 |

|

|

|

13,069 |

|

|

Accounts receivable, net |

|

|

63,367 |

|

|

|

68,655 |

|

|

Inventories |

|

|

71,115 |

|

|

|

66,628 |

|

|

Derivative instruments |

|

|

14,038 |

|

|

|

4,973 |

|

|

Other current assets |

|

|

5,919 |

|

|

|

9,340 |

|

|

Total current assets |

|

|

179,529 |

|

|

|

199,121 |

|

|

Property and equipment, net |

|

|

246,693 |

|

|

|

239,069 |

|

|

Other Assets: |

|

|

|

|

|

|

|

|

|

Right of use operating lease assets, net |

|

|

24,433 |

|

|

|

18,937 |

|

|

Intangible assets, net |

|

|

8,792 |

|

|

|

9,087 |

|

|

Goodwill |

|

|

5,970 |

|

|

|

5,970 |

|

|

Other assets |

|

|

5,993 |

|

|

|

6,137 |

|

|

Total other assets |

|

|

45,188 |

|

|

|

40,131 |

|

|

Total Assets |

|

$ |

471,410 |

|

|

$ |

478,321 |

|

| |

|

|

|

|

|

|

|

|

|

ALTO INGREDIENTS, INC.CONSOLIDATED BALANCE

SHEETS (CONTINUED)(unaudited, in thousands, except

par value) |

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

June 30, 2023 |

|

December 31, 2022 |

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

25,933 |

|

|

$ |

28,115 |

|

|

Accrued liabilities |

|

|

15,328 |

|

|

|

26,556 |

|

|

Current portion – operating leases |

|

|

3,914 |

|

|

|

3,849 |

|

|

Derivative instruments |

|

|

8,396 |

|

|

|

6,732 |

|

|

Other current liabilities |

|

|

5,115 |

|

|

|

12,765 |

|

|

Total current liabilities |

|

|

58,686 |

|

|

|

78,017 |

|

|

|

|

|

|

|

|

|

|

|

|

Long-term debt, net |

|

|

82,082 |

|

|

|

68,356 |

|

|

Operating leases, net of current portion |

|

|

21,058 |

|

|

|

15,062 |

|

|

Other liabilities |

|

|

8,791 |

|

|

|

8,797 |

|

|

Total Liabilities |

|

|

170,617 |

|

|

|

170,232 |

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000 shares authorized;Series

A: no shares issued and outstanding as ofJune 30, 2023 and December

31, 2022Series B: 927 shares issued and outstanding as ofJune 30,

2023 and December 31, 2022 |

|

|

1 |

|

|

|

1 |

|

|

Common stock, $0.001 par value; 300,000 shares authorized;75,923

and 75,154 shares issued and outstanding as ofJune 30, 2023 and

December 31, 2022, respectively |

|

|

76 |

|

|

|

75 |

|

|

Non-voting common stock, $0.001 par value; 3,553 shares

authorized;1 share issued and outstanding as of June 30, 2023 and

December 31, 2022 |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

1,039,735 |

|

|

|

1,040,834 |

|

|

Accumulated other comprehensive income |

|

|

1,822 |

|

|

|

1,822 |

|

|

Accumulated deficit |

|

|

(740,841 |

) |

|

|

(734,643 |

) |

|

Total Stockholders’ Equity |

|

|

300,793 |

|

|

|

308,089 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

471,410 |

|

|

$ |

478,321 |

|

| |

|

|

|

|

|

|

|

|

Reconciliation of Adjusted EBITDA to Net

Income

|

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

(in thousands) (unaudited) |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Net income (loss) |

|

$ |

7,595 |

|

|

$ |

22,115 |

|

|

$ |

(5,571 |

) |

|

$ |

19,513 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

1,734 |

|

|

|

319 |

|

|

|

3,299 |

|

|

|

519 |

|

|

Interest income |

|

|

(190 |

) |

|

|

(145 |

) |

|

|

(411 |

) |

|

|

(303 |

) |

|

Asset impairments |

|

|

— |

|

|

|

— |

|

|

|

574 |

|

|

|

— |

|

|

Acquisition-related expense |

|

|

700 |

|

|

|

875 |

|

|

|

1,400 |

|

|

|

1,750 |

|

|

Depreciation and amortization expense |

|

|

5,681 |

|

|

|

6,728 |

|

|

|

11,735 |

|

|

|

12,861 |

|

|

Total adjustments |

|

|

7,925 |

|

|

|

7,777 |

|

|

|

16,597 |

|

|

|

14,827 |

|

| Adjusted EBITDA |

|

$ |

15,520 |

|

|

$ |

29,892 |

|

|

$ |

11,026 |

|

|

$ |

34,340 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commodity Price

Performance

|

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

(unaudited) |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Renewable fuel production gallons sold (in millions) |

|

|

51.2 |

|

|

|

51.3 |

|

|

|

94.5 |

|

|

|

100.4 |

|

| Specialty alcohol production

gallons sold (in millions) |

|

|

16.6 |

|

|

|

25.8 |

|

|

|

38.0 |

|

|

|

49.1 |

|

| Third party renewable fuel

gallons sold (in millions) |

|

|

26.6 |

|

|

|

30.0 |

|

|

|

60.4 |

|

|

|

60.8 |

|

| Total gallons sold (in

millions) |

|

|

94.4 |

|

|

|

107.1 |

|

|

|

192.9 |

|

|

|

210.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total gallons produced (in

millions) |

|

|

70.5 |

|

|

|

77.0 |

|

|

|

131.1 |

|

|

|

151.3 |

|

| Production capacity

utilization |

|

|

81 |

% |

|

|

88 |

% |

|

|

76 |

% |

|

|

85 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average sales price per

gallon |

|

$ |

2.63 |

|

|

$ |

2.84 |

|

|

$ |

2.53 |

|

|

$ |

2.65 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average CBOT ethanol price per

gallon |

|

$ |

2.46 |

|

|

$ |

2.73 |

|

|

$ |

2.33 |

|

|

$ |

2.50 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corn cost per bushel – CBOT

equivalent |

|

$ |

6.52 |

|

|

$ |

7.46 |

|

|

$ |

6.56 |

|

|

$ |

6.84 |

|

| Average basis |

|

|

0.80 |

|

|

|

0.69 |

|

|

|

0.63 |

|

|

|

0.66 |

|

| Delivered corn cost |

|

$ |

7.32 |

|

|

$ |

8.15 |

|

|

$ |

7.19 |

|

|

$ |

7.50 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total essential ingredients

tons sold (in thousands) |

|

|

364.1 |

|

|

|

414.1 |

|

|

|

663.4 |

|

|

|

812.9 |

|

| Essential ingredients return %

(1) |

|

|

37.6 |

% |

|

|

32.7 |

% |

|

|

38.6 |

% |

|

|

34.6 |

% |

________________(1) Essential ingredients revenue as a

percentage of delivered cost of corn.

Segment Financials

|

|

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net

Sales |

|

|

|

|

|

|

|

|

|

Pekin Campus, recorded as gross: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alcohol sales |

|

$ |

127,694 |

|

|

$ |

143,768 |

|

|

$ |

260,075 |

|

|

$ |

259,818 |

|

|

Essential ingredient sales |

|

|

53,954 |

|

|

|

59,853 |

|

|

|

117,585 |

|

|

|

115,133 |

|

|

Intersegment sales |

|

|

444 |

|

|

|

269 |

|

|

|

757 |

|

|

|

525 |

|

|

Total Pekin Campus sales |

|

|

182,092 |

|

|

|

203,890 |

|

|

|

378,417 |

|

|

|

375,476 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Marketing and

distribution: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alcohol sales, gross |

|

$ |

72,589 |

|

|

$ |

63,558 |

|

|

$ |

156,936 |

|

|

$ |

117,484 |

|

|

Alcohol sales, net |

|

|

104 |

|

|

|

317 |

|

|

|

218 |

|

|

|

668 |

|

|

Intersegment sales |

|

|

2,499 |

|

|

|

3,242 |

|

|

|

5,342 |

|

|

|

6,239 |

|

|

Total marketing and distribution sales |

|

|

75,192 |

|

|

|

67,117 |

|

|

|

162,496 |

|

|

|

124,391 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other production, recorded as

gross: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alcohol sales |

|

$ |

44,384 |

|

|

$ |

67,184 |

|

|

$ |

65,316 |

|

|

$ |

126,991 |

|

|

Essential ingredient sales |

|

|

14,421 |

|

|

|

23,372 |

|

|

|

22,773 |

|

|

|

42,309 |

|

|

Intersegment sales |

|

|

62 |

|

|

|

— |

|

|

|

62 |

|

|

|

12 |

|

|

Total Other production sales |

|

|

58,867 |

|

|

|

90,556 |

|

|

|

88,151 |

|

|

|

169,312 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate and other |

|

|

4,151 |

|

|

|

4,137 |

|

|

|

8,285 |

|

|

|

7,904 |

|

| Intersegment eliminations |

|

|

(3,005 |

) |

|

|

(3,511 |

) |

|

|

(6,161 |

) |

|

|

(6,776 |

) |

| Net sales as reported |

|

$ |

317,297 |

|

|

$ |

362,189 |

|

|

$ |

631,188 |

|

|

$ |

670,307 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods

sold: |

|

|

|

|

|

|

|

|

| Pekin Campus |

|

$ |

168,419 |

|

|

$ |

195,691 |

|

|

$ |

366,596 |

|

|

$ |

364,573 |

|

| Marketing and

distribution |

|

|

71,746 |

|

|

|

63,796 |

|

|

|

154,871 |

|

|

|

118,510 |

|

| Other production |

|

|

57,834 |

|

|

|

91,606 |

|

|

|

91,815 |

|

|

|

169,851 |

|

| Corporate and other |

|

|

3,414 |

|

|

|

3,197 |

|

|

|

5,786 |

|

|

|

6,070 |

|

| Intersegment eliminations |

|

|

(1,297 |

) |

|

|

(945 |

) |

|

|

(1,897 |

) |

|

|

(2,314 |

) |

| Cost of goods sold as

reported |

|

$ |

300,116 |

|

|

$ |

353,345 |

|

|

$ |

617,171 |

|

|

$ |

656,690 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pekin Campus |

|

$ |

13,673 |

|

|

$ |

8,199 |

|

|

$ |

11,821 |

|

|

$ |

10,903 |

|

| Marketing and

distribution |

|

|

3,446 |

|

|

|

3,321 |

|

|

|

7,625 |

|

|

|

5,881 |

|

| Other production |

|

|

1,033 |

|

|

|

(1,050 |

) |

|

|

(3,664 |

) |

|

|

(539 |

) |

| Corporate and other |

|

|

737 |

|

|

|

940 |

|

|

|

2,499 |

|

|

|

1,834 |

|

| Intersegment eliminations |

|

|

(1,708 |

) |

|

|

(2,566 |

) |

|

|

(4,264 |

) |

|

|

(4,462 |

) |

| Gross profit as reported |

|

$ |

17,181 |

|

|

$ |

8,844 |

|

|

$ |

14,017 |

|

|

$ |

13,617 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

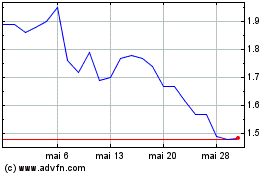

Alto Ingredients (NASDAQ:ALTO)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Alto Ingredients (NASDAQ:ALTO)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024