false

0001540684

0001540684

2024-08-23

2024-08-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 23, 2024

ATLAS

LITHIUM CORPORATION

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-41552 |

|

39-2078861 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

Rua

Antonio de Albuquerque, 156 – 17th Floor

Belo

Horizonte, Minas Gerais, Brazil, 30.112-010

(Address

of principal executive offices, including zip code)

(833)

661-7900

(Registrant’s

telephone number, including area code)

Not

applicable

(Former

address if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

Stock, $0.001 par value |

|

ATLX |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01. Other Items

Update

Regarding the Operations Committee

On

August 26, 2024, the Board of Directors (the “Board”) of Atlas Lithium Corporation (“Atlas Lithium” or the “Company”)

confirmed the appointment of James Schloffer to the Company’s recently instituted Operations Committee. Mr. Schloffer has been

engaged as a Company consultant in the role of Lithium Program Manager. He is an experienced lead process engineer with 15 years of extensive

experience in the mining and metals industry, including his work for Sigma Lithium Corp., a Canadian producer of spodumene concentrate

located in the same mineral district as Atlas Lithium’s Neves Project, Brazil’s Lithium Valley. Specializing in lithium processing,

Mr. Schloffer has expertise in both hard rock concentration and downstream lithium hydroxide processing. He has been involved in various

facets of lithium processing, including dense media separation (DMS) design, flotation, metallurgical test work, detailed engineering

design, commissioning, site operations, due diligence, and process optimization. The Company believes that his comprehensive knowledge

and hands-on experience make him an asset in the field. Mr. Schloffer has played important roles in several significant lithium projects.

In 2016, he worked in operations at the Mt. Marion Lithium Mine. He was instrumental in designing the Bald Hill Lithium Mine, recently

acquired by Mineral Resources, guiding the project from study phase through operations and successfully commissioning it to nameplate

capacity within three weeks. His contributions extend to Sigma Lithium’s Detailed Feasibility Study, by providing substantial input

to this nearby project which is now in production. He has collaborated with a diverse range of clients, from large established companies

such as BHP Group, to junior mining companies and both small and large engineering firms. Most recently, Mr. Schloffer has been lending

his expertise to Covalent Lithium at their Mt. Holland mine, which incorporates both DMS and flotation processing. His global experience

spans the Middle East, South and North America, Europe, and Australia, giving him a broad perspective on international mining operations

and practices. He holds a chemical engineering degree from the University of Melbourne.

DMS

Plant Update

On

August 23, 2024, during a meeting with state government representatives, Atlas Lithium was informed that the analysis of its permit

application is progressing well. Upon receipt of this license, the Company will be able to assemble and operate its

dense media separation (DMS) plant and to mine certain of its spodumene-containing areas. Atlas Lithium’s

primary goal is to become a producer of spodumene concentrate, a key commodity in the global lithium supply chain.

As previously announced,

the Company has completed the fabrication and trial assembly in South Africa of the major components of its DMS plant. South Africa was

chosen for its expertise in the manufacture of DMS plant equipment for the mining industry and its lower cost as compared to other locations.

Atlas Lithium’s plant is in the final phase of fabrication for its remaining components. Currently, 48 out of over 100 expected

containers with the Company’s plant parts are ready and awaiting shipment by chartered vessel from the port of Durham in South

Africa to the port of Santos in Brazil. It is anticipated that such shipment will leave South Africa during the fourth quarter of 2024

and take 20 to 25 days at sea. Upon arrival in Brazil, standard customs procedures may take several weeks, after which all containers

will be transported to Atlas Lithium’s Neves Project site in Brazil, a journey of approximately 760 miles. It is anticipated that

between the timing for transport and for the receipt of the permit, the earliest date in which the plant can be assembled is in the first

quarter of 2025, a delay to the Company’s original timeline of the fourth quarter of 2024.

Such additional timing provides Atlas Lithium with flexibility as it navigates the pricing

declines of spodumene concentrate. Spodumene concentrate

prices have fallen by approximately 90% since January 2023, as reported by Fastmarkets, a recognized lithium industry information source.

More recently, the price of spodumene concentrate dropped from approximately $1,000/ton as reported in July 2024 by S&P Global, to

approximately $750/ton in the middle of August 2024, as reported by Fastmarkets. This price deterioration can be traced to various contributing

factors including, among others, a softening economy in China which is the largest market for electric vehicles (“EV”), slower

uptake of EVs in the U.S. than previously expected, and new African supply sources. However, opposing these trends, Brazil’s Lithium

Valley, the mineral district where the Company’s Neves Project is located, has seen a surge of interest and visibility following

the announcement that Pilbara Minerals Limited, one of the largest lithium producers in the world, entered into a definitive

agreement for the acquisition of Latin Resources Limited, a pre-operational company in Lithium Valley, in a transaction valued at approximately US$370 million. Additionally,

Fastmarkets predicts that lithium demand in the U.S. is expected to increase by nearly 500% by 2030.

The

Company’s management has been closely monitoring these market developments and frequently discussing with the Board the overall

industry conditions. The Board has supported management’s recent efforts to reduce cash expenses, including the use of consultants

instead of employees, and additional cost-saving measures to minimize general and administrative expenditures.

Local Recognition

Atlas

Lithium’s DMS plant design has been selected as a finalist for a contest, organized by a non-profit civil society organization

in the state of Minas Gerais, to recognize environmentally sustainable approaches in the industry. The Company believes that its modular

plant represents a refinement and optimization of DMS technology as applied to lithium processing. Its reduced height, weight, and overall

physical footprint will make it an environmentally-friendly design that maximizes water recycling. Management believes that the plant’s

processing circuit will use the lowest amount of water of any other lithium plant currently in operation. Its modular design also significantly

reduces its physical footprint compared to traditional designs. The Company’s DMS plant design is both compact and modular,

with its weight, physical footprint, and water usage expected to be significantly lower than those of traditional plants. More details

are presented in a press release, a copy of which is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Forward

Looking Statements

This

current report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended

and Section 21E of the Securities Exchange Act of 1934, as amended. Forward looking statements are based upon the current plans, estimates

and projections of Atlas Lithium and its subsidiaries and are subject to inherent risks and uncertainties which could cause actual results

to differ from the forward- looking statements. Such statements include, among others, those concerning market and industry segment growth

and demand and acceptance of new and existing products; any projections of production, deposits, reserves, sales, earnings, revenue,

margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements

regarding future economic conditions or performance; uncertainties related to the lithium market and conducting business in Brazil, as

well as all assumptions, expectations, predictions, intentions or beliefs about future events. Therefore, you should not place undue

reliance on these forward-looking statements. The following factors, among others, could cause actual results to differ from those set

forth in the forward-looking statements: results from ongoing geotechnical analysis of projects; ability to receive the necessary permits

from the Brazilian regulators; business conditions in Brazil; general economic conditions, geopolitical events, and regulatory changes;

availability of capital; Atlas Lithium’s ability to maintain its competitive position; manipulative attempts by short sellers to

drive down our stock price; and dependence on key management.

Additional

risks related to the Company and its subsidiaries are more fully discussed in the section entitled “Risk Factors” in the

Company’s Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on March 27, 2024. Please also refer

to the Company’s other filings with the SEC, all of which are available at www.sec.gov. In addition, any forward-looking statements

represent the Company’s views only as of today and should not be relied upon as representing its views as of any subsequent date.

The Company explicitly disclaims any obligation to update any forward-looking statements.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

ATLAS

LITHIUM CORPORATION |

| |

|

|

| Dated:

August 27, 2024 |

By: |

/s/

Marc Fogassa |

| |

Name: |

Marc

Fogassa |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

ATLAS

LITHIUM RECOGNIZED FOR ITS PLANT DESIGN

BOCA

RATON, Florida — (August 27, 2024) – Atlas Lithium Corporation (NASDAQ: ATLX) (“Atlas Lithium”

or “Company”), a leading lithium exploration and development company, is pleased to announce that its spodumene concentrate

plant design has been selected as a finalist for a November 14, 2024 contest, organized by a non-profit civil society organization in

the state of Minas Gerais, to recognize environmentally-sustainable approaches in the industry. The Company’s plant design is both

compact and modular, with its weight, physical footprint, and water usage expected to be significantly lower than those of traditional

plants.

“Atlas

Lithium’s modular plant represents an exciting refinement and optimization of dense media separation (DMS) technology as applied

to lithium processing,” said Raimundo Almeida Jr., Atlas Lithium’s Vice President of Lithium Processing. “Its reduced

height, weight, and overall physical footprint will make it an environmentally friendly design that maximizes water recycling. We believe

that it will use the lowest amount of water of any other lithium plant currently operational. Its modular design also significantly reduces

its physical footprint compared to traditional designs.”

Atlas

Lithium’s modular DMS lithium processing plant is entering the final phase of fabrication for its remaining components. Currently,

48 out of over 100 expected containers are ready and awaiting shipment from South Africa, where manufacturing took place, to the Company’s

Neves Project site in Brazil.

In

other news, the Company is progressing in discussions with U.S. government officials focused on critical minerals. On July 18, 2024,

Atlas Lithium hosted a high-ranking delegation of U.S. diplomats at its office in Belo Horizonte, Brazil. Such delegation was headed

by U.S. Assistant Secretary of State Geoffrey Pyatt, the lead U.S. envoy on critical minerals. More recently, on August 23, 2024, U.S.

Ambassador Elizabeth Frawley Bagley hosted Marc Fogassa, the Company’s CEO and Chairman, for a meeting at the U.S. Embassy in Brasilia,

the capital of Brazil.

As

a demonstration of Atlas Lithium’s contributions to the community, on August 22, 2024, Mr. Fogassa received the title of Honorary

Citizen of Belo Horizonte, the capital of the state of Minas Gerais. Such honor was bestowed on him by a vote of the City Council of

Belo Horizonte in recognition of his work towards the progress of the city and the state. At the event, Mr. Fernando Passalio, Secretary

for Economic Development of Minas Gerais, spoke about the importance of private sector initiatives in advancing the city and state’s

progress, and Atlas Lithium was acknowledged for its role in these efforts.

About

Atlas Lithium Corporation

Atlas

Lithium Corporation (NASDAQ: ATLX) is focused on advancing and developing its 100%-owned

hard-rock lithium project in the state of Minas Gerais. In addition, Atlas Lithium has 100% ownership of mineral rights for other battery

and critical metals including nickel, rare earths, titanium, graphite, and copper. The Company also owns equity stakes in Apollo Resources

Corp. (private company; iron) and Jupiter Gold Corp. (OTCQB: JUPGF) (gold and quartzite).

Safe

Harbor Statement

This

press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. Forward looking statements are based upon the current plans, estimates and projections

of Atlas Lithium and its subsidiaries and are subject to inherent risks and uncertainties which could cause actual results to differ

from the forward- looking statements. Such statements include, among others, those concerning market and industry segment growth and

demand and acceptance of new and existing products; any projections of production, reserves, sales, earnings, revenue, margins or other

financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding

future economic conditions or performance; uncertainties related to conducting business in Brazil, as well as all assumptions, expectations,

predictions, intentions or beliefs about future events. Therefore, you should not place undue reliance on these forward-looking statements.

The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: results

from ongoing geotechnical analysis of projects; business conditions in Brazil; general economic conditions, geopolitical events, and

regulatory changes; availability of capital; Atlas Lithium’s ability to maintain its competitive position; manipulative attempts

by short sellers to drive down our stock price; and dependence on key management.

Additional

risks related to the Company and its subsidiaries are more fully discussed in the section entitled “Risk Factors” in the

Company’s Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on March 27, 2024. Please also refer

to the Company’s other filings with the SEC, all of which are available at www.sec.gov. In addition, any forward-looking statements

represent the Company’s views only as of today and should not be relied upon as representing its views as of any subsequent date.

The Company explicitly disclaims any obligation to update any forward-looking statements.

Investor

Relations:

Gary

Guyton

Vice

President, Investor Relations

+1

(833) 661-7900

gary.guyton@atlas-lithium.com

https://www.atlas-lithium.com/

@Atlas_Lithium

v3.24.2.u1

Cover

|

Aug. 23, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 23, 2024

|

| Entity File Number |

001-41552

|

| Entity Registrant Name |

ATLAS

LITHIUM CORPORATION

|

| Entity Central Index Key |

0001540684

|

| Entity Tax Identification Number |

39-2078861

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

Rua

Antonio de Albuquerque

|

| Entity Address, Address Line Two |

156 – 17th Floor

|

| Entity Address, Address Line Three |

Belo

Horizonte

|

| Entity Address, City or Town |

Minas Gerais

|

| Entity Address, Country |

BR

|

| Entity Address, Postal Zip Code |

30.112-010

|

| City Area Code |

(833)

|

| Local Phone Number |

661-7900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value

|

| Trading Symbol |

ATLX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

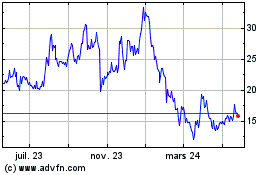

Atlas Lithium (NASDAQ:ATLX)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

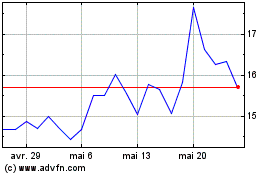

Atlas Lithium (NASDAQ:ATLX)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024