CPS Technologies Corporation Announces Second Quarter 2024 Financial Results

31 Juillet 2024 - 11:22PM

CPS Technologies Corporation (NASDAQ:CPSH) (“CPS” or the “Company”)

today announced financial results for the fiscal second quarter

ended June 29, 2024.

Second Quarter Summary

- Revenue of $5.0 million for the

second quarter of 2024 versus $7.4 million in the prior-year

period, reflecting lower overall shipments due to the end of the

Company’s HybridTech Armor® contract with Kinetic Protection for

the US Navy

- Gross margin of (4.6) percent

versus 29.6 percent in the second quarter of 2023, largely

reflecting lower manufacturing efficiencies and impact of fixed

costs on lower revenue.

- Operating loss of $1.3 million for

the quarter ended June 29, 2024 compared to an operating profit of

$0.7 million in the prior-year period

- The Company’s recent SBIR Phase II

award and ongoing product development initiatives in response to

customer requirements point to accelerating wins heading into

fiscal 2025

“This quarter’s results reflect the

previously-announced completion of our HybridTech® Armor contract

with Kinetic Protection, as the Navy’s current needs have been

fulfilled after many quarters of delivering our state-of-the-art

panels to provide ballistic protection for the U.S. Navy’s fleet of

aircraft carriers,” said Brian Mackey, President and CEO. “While

this near-term headwind has been well known for quite some time, it

does not lessen the impact it has had on our overall performance.

Despite the current operating environment, our growth path going

forward will be augmented by the continued expansion of our product

development pipeline.

“Notably, our latest SBIR contract from the U.S.

Navy Air Systems Command, valued at over $1 million, will enable us

to continue to develop our novel metal matrix composites for

thermal energy storage applications. Our MMCs have been shown to

provide cutting-edge thermal energy storage, which supports

long-range missile strike capability for the Navy. Potential

applications include avionics, weapons, and high-pulse power

modules. This new program, along with ongoing efforts to address

our customer’s pressing technical challenges, with materials such

as fiber reinforced aluminum, or “FRA”, and lightweight radiation

shielding material, will continue to enhance company value. Our new

Phase II contract, the company’s first in many years, clearly

underscores not only our unique capabilities but the successful

execution of a long-term growth strategy through expanded product

development that addresses critical customer requirements.”

Results of Operations CPS reported revenue of

$5.0 million in the second quarter of fiscal 2024 versus $7.4

million in the prior-year period, reflecting the completion of the

Company’s HybridTech Armor® contract with Kinetic Protection, the

prime contractor for the US Navy. Gross loss was $0.2 million, or

(4.6) percent of revenue, versus a gross profit of $2.2 million, or

29.6 percent of revenue, in the fiscal 2023 second quarter, with

the negative variance year-over-year due to the impact of fixed

costs on lower overall revenue and reduced production efficiencies

due to new product launches.

The Company reported an operating loss of $1.3

million in the fiscal 2024 second quarter compared with an

operating profit of $0.7 million in the prior-year period. Reported

net loss was $1.0 million, or $(0.07) per diluted share, versus net

income of $0.6 million, or $0.04 per diluted share, in the quarter

ended July 1, 2023.

Conference Call The Company will be hosting its

second quarter 2024 earnings call at 9:00 am tomorrow, August 1,

2024. Those interested in participating in the conference call

should dial the following: Call in Number: 1-844-943-2942

Participant Passcode: 281331

The Company encourages those who wish to

participate to call in 10 minutes before the scheduled start time

to ensure the operator can connect all participants.

About CPS CPS is a technology and manufacturing

leader in producing high-performance materials solutions for its

customers. The company’s products and intellectual property address

critical needs in a variety of applications, including electric

trains and subway cars, wind turbines, hybrid vehicles, electric

vehicles, Navy ships, the smart electric grid, 5G infrastructure

and others. CPS hermetic packages can be found in many Aerospace

and Satellite applications. CPS’ armor products provide

exceptional ballistic protection and environmental durability at

very light weight. CPS is committed to innovation and to supporting

our customers in building solutions for the transition to clean

energy.

Safe Harbor Statements made in this document

that are not historical facts or which apply prospectively,

including those relating to 2024 financial results, are

forward-looking statements that involve risks and uncertainties.

These forward-looking statements are identified by the use of terms

and phrases such as "will," "intends," "believes," "expects,"

"plans," "anticipates" and similar expressions. Investors should

not rely on forward looking statements because they are subject to

a variety of risks and uncertainties and other factors that could

cause actual results to differ materially from the company's

expectation. Additional information concerning risk factors is

contained from time to time in the company's SEC filings, including

its Annual Report on Form 10-K and other periodic reports filed

with the SEC. Forward-looking statements contained in this press

release speak only as of the date of this release. Subsequent

events or circumstances occurring after such date may render these

statements incomplete or out of date. The company expressly

disclaims any obligation to update the information contained in

this release.

CPS Technologies Corporation

111 South Worcester Street Norton, MA 02766

www.cpstechnologysolutions.com

Investor Relations: Chris Witty 646-438-9385

cwitty@darrowir.com

|

|

|

CPS TECHNOLOGIES CORP. Statements of

Operations and Other Comprehensive Income (Unaudited) |

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

June 29, |

|

|

July 1, |

|

|

June 29, |

|

|

July 1, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales |

$ |

5,030,313 |

|

|

$ |

7,418,138 |

|

|

$ |

10,942,947 |

|

|

$ |

14,518,405 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

5,030,313 |

|

|

|

7,418,138 |

|

|

|

10,942,947 |

|

|

|

14,518,405 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales |

|

5,260,305 |

|

|

|

5,221,880 |

|

|

|

10,266,629 |

|

|

|

10,077,444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin |

|

(229,992 |

) |

|

|

2,196,259 |

|

|

|

676,318 |

|

|

|

4,440,961 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general, and administrative expense |

|

1,084,995 |

|

|

|

1,465,349 |

|

|

|

2,250,917 |

|

|

|

3,015,871 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

|

(1,314,987 |

) |

|

|

730,910 |

|

|

|

(1,574,599 |

) |

|

|

1,425,090 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

90,851 |

|

|

|

79,652 |

|

|

|

170,021 |

|

|

|

95,242 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) before income tax |

|

(1,224,136 |

) |

|

|

810,562 |

|

|

|

(1,404,578 |

) |

|

|

1,520,332 |

|

|

Income tax provision (benefit) |

|

(269,832 |

) |

|

|

210,058 |

|

|

|

(307,120 |

) |

|

|

460,628 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

(954,304 |

) |

|

$ |

600,503 |

|

|

$ |

(1,097,458 |

) |

|

$ |

1,059,704 |

|

|

Other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unrealized gains on available for sale securities |

|

8,701 |

|

|

|

-- |

|

|

|

8,701 |

|

|

|

-- |

|

|

Total other comprehensive income |

|

8,701 |

|

|

|

-- |

|

|

|

8,701 |

|

|

|

-- |

|

|

Total comprehensive income |

|

(945,603 |

) |

|

|

-- |

|

|

|

(1,088,757 |

) |

|

|

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per basic common share |

$ |

(0.07 |

) |

|

$ |

0.04 |

|

|

$ |

(0.08 |

) |

|

$ |

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of basic common shares outstanding |

|

14,519,215 |

|

|

|

14,493,970 |

|

|

|

14,519,215 |

|

|

|

14,473,128 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per diluted common share |

$ |

(0.07 |

) |

|

$ |

0.04 |

|

|

$ |

(0.08 |

) |

|

$ |

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of diluted common shares outstanding |

|

14,519,215 |

|

|

|

14,621,929 |

|

|

|

14,519,215 |

|

|

|

14,630,765 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CPS TECHNOLOGIES CORP. Balance Sheets

(Unaudited) |

|

|

|

|

June 29, |

|

|

December 30, |

|

|

|

2024 |

|

|

2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

6,306,244 |

|

|

$ |

8,813,626 |

|

|

Marketable Securities |

|

758,701 |

|

|

|

-- |

|

|

Accounts receivable-trade, net |

|

4,064,293 |

|

|

|

4,389,155 |

|

|

Accounts receivable-other |

|

198,348 |

|

|

|

83,191 |

|

|

Inventories, net |

|

4,121,678 |

|

|

|

4,581,930 |

|

|

Prepaid expenses and other current assets |

|

366,655 |

|

|

|

276,349 |

|

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

15,815,919 |

|

|

|

18,144,251 |

|

|

|

|

|

|

|

|

|

|

|

Property and equipment: |

|

|

|

|

|

|

|

|

Production equipment |

|

9,940,480 |

|

|

|

11,271,982 |

|

|

Furniture and office equipment |

|

891,921 |

|

|

|

952,883 |

|

|

Leasehold improvements |

|

873,730 |

|

|

|

985,649 |

|

|

|

|

|

|

|

|

|

|

|

Total cost |

|

11,706,131 |

|

|

|

13,210,514 |

|

|

|

|

|

|

|

|

|

|

|

Accumulated depreciation and amortization |

|

(10,068,557 |

) |

|

|

(11,936,004 |

) |

|

Construction in progress |

|

496,331 |

|

|

|

281,629 |

|

|

|

|

|

|

|

|

|

|

|

Net property and equipment |

|

2,133,905 |

|

|

|

1,556,139 |

|

|

|

|

|

|

|

|

|

|

|

Right-of-use lease asset |

|

261,000 |

|

|

|

332,000 |

|

|

Deferred taxes, net |

|

1,877,302 |

|

|

|

1,569,726 |

|

|

|

|

|

|

|

|

|

|

|

Total assets |

$ |

20,088,126 |

|

|

$ |

21,602,116 |

|

| |

|

|

|

|

|

|

|

|

CPS TECHNOLOGIES CORP.Balance Sheets

(Unaudited)(concluded) |

|

|

| |

June 29, |

|

|

December 30, |

|

| |

2024 |

|

|

2023 |

|

|

LIABILITIES AND STOCKHOLDERS` EQUITY |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Note payable, current portion |

$ |

31,885 |

|

|

$ |

46,797 |

|

|

Accounts payable |

|

2,587,874 |

|

|

|

2,535,086 |

|

|

Accrued expenses |

|

671,853 |

|

|

|

1,075,137 |

|

|

Deferred revenue |

|

65,578 |

|

|

|

251,755 |

|

|

Lease liability, current portion |

|

160,000 |

|

|

|

160,000 |

|

| |

|

|

|

|

|

|

|

| Total current liabilities |

|

3,517,190 |

|

|

|

4,068,775 |

|

| |

|

|

|

|

|

|

|

| Note payable less current

portion |

|

-- |

|

|

|

8,090 |

|

| Deferred revenue – long

term |

|

31,277 |

|

|

|

31,277 |

|

| Long term lease liability |

|

101,000 |

|

|

|

172,000 |

|

| |

|

|

|

|

|

|

|

| Total liabilities |

|

3,649,467 |

|

|

|

4,280,142 |

|

| |

|

|

|

|

|

|

|

| Commitments and contingencies

(note 6) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Stockholders` equity: |

|

|

|

|

|

|

|

|

Common stock, $0.01 par value, authorized 20,000,000 shares; issued

14,601,487 shares; outstanding 14,519,215 shares at each June 29,

2024 and December 30, 2023 |

|

146,015 |

|

|

|

146,015 |

|

|

Additional paid-in capital |

|

40,386,335 |

|

|

|

40,180,893 |

|

|

Accumulated other comprehensive income |

|

8,701 |

|

|

|

-- |

|

|

Accumulated deficit |

|

(23,852,254 |

) |

|

|

(22,754,796 |

) |

|

Less cost of 82,272 common shares repurchased at each June 29, 2024

and December 30, 2023 |

|

(250,138 |

) |

|

|

(250,138 |

) |

| |

|

|

|

|

|

|

|

| Total stockholders`

equity |

|

16,438,659 |

|

|

|

17,321,974 |

|

| |

|

|

|

|

|

|

|

| Total liabilities and

stockholders` equity |

$ |

20,088,126 |

|

|

$ |

21,602,116 |

|

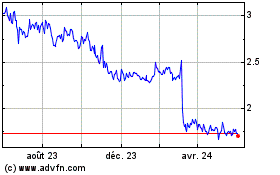

CPS Technologies (NASDAQ:CPSH)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

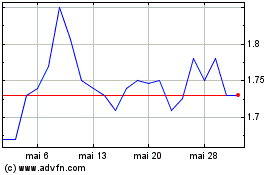

CPS Technologies (NASDAQ:CPSH)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024