Consolidated Water Co. Ltd. (NASDAQ Global Select Market: CWCO), a

leading designer, builder and operator of advanced water supply and

treatment plants, reported results for the third quarter ended

September 30, 2024. All comparisons are to the same prior year

period unless otherwise noted.

Consolidated Water will hold a conference call at 11:00 a.m.

Eastern time tomorrow to discuss the results (see dial-in

information below).

Third Quarter 2024 Financial Key Points

- Total revenue declined 33% to $33.4

million, due to two large construction projects that were underway

in 2023 but were completed earlier this year. Meanwhile, the

company’s ongoing $147 million design-build-operate desalination

plant project in Hawaii continues to progress through development

towards the construction phase.

- Retail revenue increased 5% to $7.6

million on higher sales volumes.

- Bulk revenue increased 3% to $8.8

million.

- Manufacturing revenue decreased by

$362,000 to $4.4 million.

- Services revenue declined by 57% (or

approximately $16.7 million) to $12.7 million due to a $20.6

million decline in construction revenue that was partially offset

by a $2.5 million increase in recurring operations and maintenance

(O&M) revenue and a $1.3 million increase in design and

consulting revenue.

- Net income from continuing

operations attributable to company stockholders totaled $5.0

million or $0.31 per diluted share, compared to $8.8 million or

$0.55 per diluted share in the third quarter of 2023.

- Net income including discontinued

operations attributable to company stockholders totaled $4.5

million or $0.28 per diluted share, compared to $8.6 million or

$0.54 per diluted share in the third quarter of 2023.

- Cash and cash equivalents totaled

$104.9 million and working capital was $133.9 million as of

September 30, 2024.

Third Quarter 2024 Operational Key Points

- Volume of retail water sold in the

company’s utility service area in Grand Cayman increased 4.2%

compared with the same period in 2023. The volume of water sold

increased due to a 4.8% increase in the number of customer

connections in the company’s license area from September 30, 2023

to September 30, 2024.

- Continued piloting, design and

permitting of a $147 million project to design, construct, operate

and maintain a seawater desalination plant for the Board of Water

Supply of Honolulu, Hawaii.

- Recognized $2.1 million in

operations and maintenance revenue from REC which Consolidated

Water acquired in October 2023 to provide a new channel for

expansion in water-stressed regions of Colorado.

Management Commentary

“In the third quarter, our revenue and profitability were

consistent with our expectations, given the completion of two large

design-build projects earlier this year,” stated company CEO, Rick

McTaggart. “We were pleased to see the continuing trend of

increasing retail water sales in our exclusive utility service area

on Grand Cayman due to the continued business and population growth

on the island.

“While our Bulk segment had relatively consistent revenue

compared to last year, we saw an increase in gross margin from our

new operations and maintenance (O&M) contract for the new Red

Gate II plant that we completed earlier this year for the Water

Authority-Cayman.

“Services revenue declined by about half due to our anticipated

reduction in construction revenue related to the conclusion of our

Liberty Utilities and Red Gate II projects. These projects had a

major impact on 2023 revenue but were completed prior to the start

of the current quarter.

“The decline in construction revenue was partially offset by a

$2.5 million increase in recurring O&M revenue. The increase

included $2.1 million from our REC subsidiary in Colorado which we

acquired in October of last year. REC provides us a new channel for

expansion of our design-build and O&M businesses into

water-stressed regions of Colorado. The balance of the increase in

recurring revenue from O&M contracts was generated by our PERC

Water subsidiary.

“Despite the small decline in manufacturing revenue this

quarter, manufacturing gross profit grew 84% to $1.6 million—thanks

to our relentless pursuit of higher-margin products and maximizing

production efficiency. Based on the opportunities we see ahead of

us, we believe that this improving trend in our manufacturing

segment will continue and its operating results will remain stable

and profitable.

“We continue to advance our development activities on the $147

million project to design, construct, operate and maintain a

seawater desalination plant for the Board of Water Supply of

Honolulu in Hawaii. Since we announced the project in June of last

year, we have been advancing through the piloting, design and

permitting stage. We plan to begin the construction phase late next

year, which represents the largest portion of the revenue we expect

to generate from the project.

“Looking ahead, we remain excited about the future and for many

reasons. At the macro level, growing water scarcity continues to

build interest in advanced treatment and desalination solutions for

impaired resources. As water supply challenges increase, there is a

rising demand for the specialized capabilities we provide.

“Specific positive factors include the strong water sales growth

in Grand Cayman and long-term recurring revenue from our

Caribbean-based bulk water business and U.S.-based O&M

business. Our manufacturing business continues its positive trend,

and we expect our desalination plant project in Hawaii to

significantly enhance revenue and earnings over the coming

years.

“Enabled by an exceptionally strong balance sheet, we will

continue to invest in new long-term projects. This includes the new

desalination plants for Cat Island, as well as new infrastructure

for serving the growing water needs of our utility customers in the

Cayman Islands which will ultimately drive future bulk and retail

revenue growth.

“Our strong balance sheet also enables us to move quickly on any

potential acquisitions. While we are currently in a period between

large construction projects, we believe that our award-winning

plant designs, our cost-efficient project delivery models, and our

unmatched industry experience will help us secure new projects we

are pursuing.

“The course we charted for our company several years ago, which

involved diversifying our product offerings and market areas beyond

seawater desalination in the Caribbean, has continued to prove

successful and lays the path for strong growth ahead.

“As we complete 2024 and prepare for the new year, we anticipate

that all of these positive factors will continue to support our

long-term growth, enhance future profitability, and further

strengthen shareholder value.”

Third Quarter 2024 Financial Summary

Revenue totaled $33.4 million, declining 33% from $49.9 million

in the third quarter of 2023. The decrease was due to decreases of

$16.7 million in the services segment and $362,000 in the

manufacturing segment. The decreases were partially offset by

increases of $369,000 in the retail segment and $279,000 in the

bulk segment.

Retail revenue increased due to a 4.2% increase in the volume of

water sold. The volume of water sold increased due to a 4.8%

increase in the number of customer accounts in the company’s

license area from September 30, 2023 to September 30, 2024.

The increase in bulk segment revenue was due to the commencement

on May 1, 2024 of the operating and maintenance contract for the

new Red Gate desalination plant for the Water Authority of the

Cayman Island. The increase was also due to an amendment of the

company’s North Sound contract, which became effective May 1,

2024.

The decrease in services segment revenue was due to plant

construction revenue decreasing from $24.2 million in 2023 to $3.6

million in 2024 as the result of two construction projects being

completed earlier this year. Revenue generated under operations and

maintenance contracts totaled $7.5 million in the third quarter of

2024, an increase of 49% from the third quarter of 2023. Newly

acquired REC contributed $2.1 million to the increase, with the

remainder related to incremental PERC contracts.

Manufacturing segment revenue decreased by $362,000 to $4.4

million as compared to $4.7 million in the third quarter of

2023.

Gross profit for the third quarter of 2024 was $11.6 million

(34.8% of total revenue), as compared to $16.6 million (33.3% of

total revenue) in the third quarter of 2023.

Net income from continuing operations attributable to

Consolidated Water stockholders for the third quarter of 2024 was

$5.0 million or $0.31 per diluted share, compared to net income of

$8.8 million or $0.55 per diluted share in the third quarter of

2023.

Including discontinued operations, net income attributable to

Consolidated Water stockholders for the third quarter of 2024 was

$4.5 million or $0.28 per diluted share, compared to net income of

$8.6 million or $0.54 per diluted share in the third quarter of

2023.

Cash and cash equivalents totaled $104.9 million as of September

30, 2024, with working capital of $133.9 million, debt of $0.2

million, and stockholders’ equity of $209.8 million.

First Nine Months 2024 Financial Summary

Revenue for the first nine months of 2024 was $105.6 million,

down 17% compared to $127.0 million in the same year-ago period.

The decrease was attributable to decreases of $0.4 million in the

bulk segment and $24.2 million in the services segment. The

decreases were partially offset by increases of $1.8 million in the

retail segment and $1.4 million in the manufacturing segment.

Retail revenue increased primarily due to a 6.9% increase in the

volume of water sold. The volume of water sold increased due to a

4.8% increase in the number of customer accounts in the company’s

license area from September 30, 2023 to September 30, 2024.

The decrease in bulk segment revenue was due to a decrease in

energy costs for CW-Bahamas, which decreased the energy

pass-through component of CW-Bahamas’ rates.

The decrease in services segment revenue was due to a $36.4

million decrease in plant construction revenue. Revenue generated

under operations and maintenance contracts totaled $21.7 million in

the first nine months of 2024, up 70% as compared to $12.8 million

in the same year-ago period. Newly acquired REC contributed $5.9

million of the increase, with the remainder related to incremental

PERC contracts.

The increase in manufacturing segment revenue was due to

increased production activity.

Gross profit for the first nine months of 2024 was $37.1 million

(35.2% of total revenue), down 13% from $42.6 million (33.6% of

total revenue) in the same year-ago period.

Net income from continuing operations attributable to

stockholders for the first nine months of 2024 was $16.1 million or

$1.01 per diluted share, compared to net income of $20.4 million or

$1.28 per diluted share for the first nine months of 2023.

Including discontinued operations, net income attributable to

Consolidated Water stockholders for the first nine months of 2024

was $26.8 million or $1.68 per fully diluted share, up from net

income of $19.7 million or $1.24 per fully diluted share in the

same period of 2023. The increase was primarily due to a $12.1

million gain on sale of land and project documentation in Mexico

during the second quarter of 2024.

Third Quarter Segment

Results

| |

Three Months Ended

September 30, 2024 |

| |

Retail |

|

Bulk |

|

Services |

|

Manufacturing |

|

Total |

|

Revenue |

$ |

7,585,992 |

|

|

$ |

8,767,168 |

|

|

$ |

12,677,837 |

|

|

$ |

4,359,560 |

|

|

$ |

33,390,557 |

|

| Cost of

revenue |

|

3,606,944 |

|

|

|

5,969,292 |

|

|

|

9,409,325 |

|

|

|

2,770,338 |

|

|

|

21,755,899 |

|

| Gross

profit |

|

3,979,048 |

|

|

|

2,797,876 |

|

|

|

3,268,512 |

|

|

|

1,589,222 |

|

|

|

11,634,658 |

|

| General

and administrative expenses |

|

4,359,476 |

|

|

|

381,230 |

|

|

|

1,469,845 |

|

|

|

745,418 |

|

|

|

6,955,969 |

|

| Gain on asset dispositions and

impairments, net |

|

201,582 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

201,582 |

|

| Income (loss) from

operations |

$ |

(178,846 |

) |

|

$ |

2,416,646 |

|

|

$ |

1,798,667 |

|

|

$ |

843,804 |

|

|

|

4,880,271 |

|

| Other

income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

724,040 |

|

| Income

before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,604,311 |

|

|

Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

490,209 |

|

| Net income from continuing

operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,114,102 |

|

| Income from continuing

operations attributable to non-controlling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

156,784 |

|

| Net

income from continuing operations attributable to Consolidated

Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,957,318 |

|

| Net loss

from discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(502,854 |

) |

| Net income attributable to

Consolidated Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

4,454,464 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

September 30, 2023 |

| |

Retail |

|

Bulk |

|

Services |

|

Manufacturing |

|

Total |

|

Revenue |

$ |

7,216,574 |

|

|

$ |

8,488,615 |

|

|

$ |

29,427,664 |

|

|

$ |

4,721,222 |

|

|

$ |

49,854,075 |

|

| Cost of

revenue |

|

3,371,891 |

|

|

|

5,835,837 |

|

|

|

20,174,645 |

|

|

|

3,857,274 |

|

|

|

33,239,647 |

|

| Gross

profit |

|

3,844,683 |

|

|

|

2,652,778 |

|

|

|

9,253,019 |

|

|

|

863,948 |

|

|

|

16,614,428 |

|

| General

and administrative expenses |

|

4,225,825 |

|

|

|

347,668 |

|

|

|

861,835 |

|

|

|

437,162 |

|

|

|

5,872,490 |

|

| Income

(loss) from operations |

$ |

(381,142 |

) |

|

$ |

2,305,110 |

|

|

$ |

8,391,184 |

|

|

$ |

426,786 |

|

|

|

10,741,938 |

|

| Other

income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

236,066 |

|

| Income

before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,978,004 |

|

|

Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,976,453 |

|

| Net

income from continuing operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,001,551 |

|

| Income

attributable to non-controlling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

163,428 |

|

| Net

income from continuing operations attributable to Consolidated

Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,838,123 |

|

| Net loss

from discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(232,994 |

) |

| Net

income attributable to Consolidated Water Co. Ltd.

stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

8,605,129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Nine Months Segment Results

| |

Nine Months Ended

September 30, 2024 |

| |

Retail |

|

Bulk |

|

Services |

|

Manufacturing |

|

Total |

|

Revenue |

$ |

24,392,814 |

|

|

$ |

25,557,220 |

|

|

$ |

42,017,917 |

|

|

$ |

13,591,154 |

|

|

$ |

105,559,105 |

|

| Cost of revenue |

|

10,828,421 |

|

|

|

17,632,010 |

|

|

|

30,536,801 |

|

|

|

9,428,978 |

|

|

|

68,426,210 |

|

| Gross profit |

|

13,564,393 |

|

|

|

7,925,210 |

|

|

|

11,481,116 |

|

|

|

4,162,176 |

|

|

|

37,132,895 |

|

| General and administrative

expenses |

|

12,842,624 |

|

|

|

1,088,639 |

|

|

|

4,264,323 |

|

|

|

1,930,706 |

|

|

|

20,126,292 |

|

| Gain on asset dispositions and

impairments, net |

|

195,452 |

|

|

|

— |

|

|

|

3,000 |

|

|

|

— |

|

|

|

198,452 |

|

| Income from operations |

$ |

917,221 |

|

|

$ |

6,836,571 |

|

|

$ |

7,219,793 |

|

|

$ |

2,231,470 |

|

|

|

17,205,055 |

|

| Other income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,560,650 |

|

| Income before income

taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18,765,705 |

|

| Provision for income

taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,175,838 |

|

| Net income from continuing

operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16,589,867 |

|

| Income from continuing

operations attributable to non-controlling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

448,724 |

|

| Net

income from continuing operations attributable to Consolidated

Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16,141,143 |

|

| Net

income from discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,637,926 |

|

| Net income attributable to

Consolidated Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

26,779,069 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Nine Months Ended

September 30, 2023 |

| |

Retail |

|

Bulk |

|

Services |

|

Manufacturing |

|

Total |

|

Revenue |

$ |

22,560,998 |

|

|

$ |

25,975,483 |

|

|

$ |

66,243,328 |

|

|

$ |

12,180,519 |

|

|

$ |

126,960,328 |

|

| Cost of

revenue |

|

10,355,817 |

|

|

|

18,010,718 |

|

|

|

46,466,864 |

|

|

|

9,489,870 |

|

|

|

84,323,269 |

|

| Gross

profit |

|

12,205,181 |

|

|

|

7,964,765 |

|

|

|

19,776,464 |

|

|

|

2,690,649 |

|

|

|

42,637,059 |

|

| General

and administrative expenses |

|

12,668,467 |

|

|

|

1,080,543 |

|

|

|

2,855,067 |

|

|

|

1,289,990 |

|

|

|

17,894,067 |

|

| Gain

(loss) on asset dispositions and impairments, net |

|

(7,287 |

) |

|

|

12,270 |

|

|

|

— |

|

|

|

1,933 |

|

|

|

6,916 |

|

| Income

(loss) from operations |

$ |

(470,573 |

) |

|

$ |

6,896,492 |

|

|

$ |

16,921,397 |

|

|

$ |

1,402,592 |

|

|

|

24,749,908 |

|

| Other

income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

522,256 |

|

| Income

before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25,272,164 |

|

|

Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,366,005 |

|

| Net

income from continuing operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,906,159 |

|

| Income

from continuing operations attributable to non-controlling

interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

463,775 |

|

| Net

income from continuing operations attributable to Consolidated

Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,442,384 |

|

| Net loss

from discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(699,858 |

) |

| Net

income attributable to Consolidated Water Co. Ltd.

stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

19,742,526 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Conference Call

Consolidated Water management will host a conference call

tomorrow to discuss these results, which will include a

question-and-answer period.

Date: Friday, November 15, 2024Time: 11:00 a.m. Eastern time

(8:00 a.m. Pacific time)Toll-free dial-in number:

1-844-875-6913International dial-in number:

1-412-317-6709Conference ID: 5709326

Please call the conference telephone number five minutes prior

to the start time. An operator will register your name and

organization. If you require any assistance connecting with the

call, please contact CMA at 1-949-432-7566.

A replay of the call will be available after 1:00 p.m. Eastern

time on the same day through November 22, 2024, as well as

available for replay via the Investors section of the Consolidated

Water website at www.cwco.com.

Toll-free replay number: 1-877-344-7529International replay

number: 1-412-317-0088Replay ID: 5709326

About Consolidated Water Co. Ltd.

Consolidated Water Co. Ltd. develops and operates advanced water

supply and treatment plants and water distribution systems. The

company designs, constructs and operates seawater desalination

facilities in the Cayman Islands, The Bahamas and the British

Virgin Islands, and designs, constructs and operates water

treatment and reuse facilities in the United States. The company

recently entered the U.S. desalination market with a contract to

design, construct, operate and maintain a seawater desalination

plant in Hawaii.

The company also manufactures and services a wide range of

products and provides design, engineering, management, operating

and other services applicable to commercial and municipal water

production, supply and treatment, and industrial water and

wastewater treatment. For more information, visit cwco.com.

Cautionary Note Regarding Forward-Looking

Statements

This press release includes statements that may constitute

"forward-looking" statements, usually containing the words

"believe", "estimate", "project", "intend", "expect", "should",

"will" or similar expressions. These statements are made pursuant

to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements inherently involve

risks and uncertainties that could cause actual results to differ

materially from the forward-looking statements. Factors that would

cause or contribute to such differences include, but are not

limited to (i) continued acceptance of the company's products and

services in the marketplace; (ii) changes in its relationships with

the governments of the jurisdictions in which it operates; (iii)

the outcome of its negotiations with the Cayman government

regarding a new retail license agreement; (iv) the collection of

its delinquent accounts receivable in the Bahamas; and (v) various

other risks, as detailed in the company's periodic report filings

with the Securities and Exchange Commission (“SEC”). For more

information about risks and uncertainties associated with the

company’s business, please refer to the “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and

“Risk Factors” sections of the company’s SEC filings, including,

but not limited to, its annual report on Form 10-K and quarterly

reports on Form 10-Q, copies of which may be obtained by contacting

the company’s Secretary at the company’s executive offices or at

the “Investors – SEC Filings” page of the company’s website at

http://ir.cwco.com/docs. Except as otherwise required by law, the

company undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise.Company Contact:David

W. SasnettExecutive Vice President and CFOTel (954) 509-8200Email

ContactInvestor & Media Relations Contact:Ron

Both or Grant StudeCMA Investor & Media RelationsTel (949)

432-7566Email Contact

|

CONSOLIDATED WATER CO. LTD.CONDENSED

CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

|

|

|

| |

September 30, |

|

December 31, |

| |

2024 |

|

2023 |

| |

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

104,869,627 |

|

|

$ |

42,621,898 |

|

|

Accounts receivable, net |

|

37,199,621 |

|

|

|

38,226,891 |

|

|

Inventory |

|

3,928,851 |

|

|

|

6,044,642 |

|

|

Prepaid expenses and other current assets |

|

5,675,517 |

|

|

|

4,056,370 |

|

|

Contract assets |

|

1,958,361 |

|

|

|

21,553,057 |

|

|

Current assets of discontinued operations |

|

314,847 |

|

|

|

211,517 |

|

| Total current

assets |

|

153,946,824 |

|

|

|

112,714,375 |

|

| Property, plant and equipment,

net |

|

53,203,218 |

|

|

|

55,882,521 |

|

| Construction in progress |

|

2,799,135 |

|

|

|

495,471 |

|

| Inventory, noncurrent |

|

5,180,540 |

|

|

|

5,045,771 |

|

| Investment in OC-BVI |

|

1,384,891 |

|

|

|

1,412,158 |

|

| Goodwill |

|

12,861,404 |

|

|

|

12,861,404 |

|

| Intangible assets, net |

|

2,860,907 |

|

|

|

3,353,185 |

|

| Operating lease right-of-use

assets |

|

3,328,936 |

|

|

|

2,135,446 |

|

| Other assets |

|

2,801,873 |

|

|

|

3,407,973 |

|

| Long-term assets of

discontinued operations |

|

— |

|

|

|

21,129,288 |

|

| Total

assets |

$ |

238,367,728 |

|

|

$ |

218,437,592 |

|

| |

|

|

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other current

liabilities |

$ |

7,108,726 |

|

|

$ |

11,604,369 |

|

|

Accrued compensation |

|

3,747,516 |

|

|

|

3,160,030 |

|

|

Dividends payable |

|

1,803,926 |

|

|

|

1,572,655 |

|

|

Current maturities of operating leases |

|

633,971 |

|

|

|

456,865 |

|

|

Current portion of long-term debt |

|

151,276 |

|

|

|

192,034 |

|

|

Contract liabilities |

|

6,018,720 |

|

|

|

6,237,011 |

|

|

Deferred revenue |

|

170,551 |

|

|

|

317,017 |

|

|

Current liabilities of discontinued operations |

|

451,839 |

|

|

|

364,665 |

|

| Total current

liabilities |

|

20,086,525 |

|

|

|

23,904,646 |

|

| Long-term debt,

noncurrent |

|

91,561 |

|

|

|

191,190 |

|

| Deferred tax liabilities |

|

227,253 |

|

|

|

530,780 |

|

| Noncurrent operating

leases |

|

2,784,742 |

|

|

|

1,827,302 |

|

| Other liabilities |

|

153,000 |

|

|

|

153,000 |

|

| Deferred revenue |

|

38,424 |

|

|

|

— |

|

| Total

liabilities |

|

23,381,505 |

|

|

|

26,606,918 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

| Consolidated Water Co. Ltd.

stockholders' equity |

|

|

|

|

|

|

|

|

Redeemable preferred stock, $0.60 par value. Authorized 200,000

shares; issued and outstanding 44,650 and 44,297 shares,

respectively |

|

26,790 |

|

|

|

26,578 |

|

|

Class A common stock, $0.60 par value. Authorized 24,655,000

shares; issued and outstanding 15,834,459 and 15,771,545 shares,

respectively |

|

9,500,675 |

|

|

|

9,462,927 |

|

|

Class B common stock, $0.60 par value. Authorized 145,000 shares;

none issued |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

93,074,517 |

|

|

|

92,188,887 |

|

|

Retained earnings |

|

107,164,155 |

|

|

|

85,148,820 |

|

| Total Consolidated Water Co.

Ltd. stockholders' equity |

|

209,766,137 |

|

|

|

186,827,212 |

|

| Non-controlling interests |

|

5,220,086 |

|

|

|

5,003,462 |

|

| Total

equity |

|

214,986,223 |

|

|

|

191,830,674 |

|

| Total liabilities and

equity |

$ |

238,367,728 |

|

|

$ |

218,437,592 |

|

| |

|

|

|

|

|

|

|

|

CONSOLIDATED WATER CO. LTD.CONDENSED

CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED) |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

$ |

33,390,557 |

|

|

$ |

49,854,075 |

|

|

$ |

105,559,105 |

|

|

$ |

126,960,328 |

|

| Cost of

revenue |

|

21,755,899 |

|

|

|

33,239,647 |

|

|

|

68,426,210 |

|

|

|

84,323,269 |

|

| Gross

profit |

|

11,634,658 |

|

|

|

16,614,428 |

|

|

|

37,132,895 |

|

|

|

42,637,059 |

|

| General and administrative

expenses |

|

6,955,969 |

|

|

|

5,872,490 |

|

|

|

20,126,292 |

|

|

|

17,894,067 |

|

| Gain on asset dispositions and

impairments, net |

|

201,582 |

|

|

|

— |

|

|

|

198,452 |

|

|

|

6,916 |

|

| Income from

operations |

|

4,880,271 |

|

|

|

10,741,938 |

|

|

|

17,205,055 |

|

|

|

24,749,908 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

626,801 |

|

|

|

196,567 |

|

|

|

1,341,797 |

|

|

|

396,348 |

|

|

Interest expense |

|

(32,801 |

) |

|

|

(34,020 |

) |

|

|

(99,740 |

) |

|

|

(108,111 |

) |

|

Profit-sharing income from OC-BVI |

|

20,250 |

|

|

|

12,150 |

|

|

|

52,650 |

|

|

|

38,475 |

|

|

Equity in the earnings of OC-BVI |

|

53,370 |

|

|

|

37,182 |

|

|

|

147,333 |

|

|

|

108,012 |

|

|

Other |

|

56,420 |

|

|

|

24,187 |

|

|

|

118,610 |

|

|

|

87,532 |

|

| Other income,

net |

|

724,040 |

|

|

|

236,066 |

|

|

|

1,560,650 |

|

|

|

522,256 |

|

| Income before income

taxes |

|

5,604,311 |

|

|

|

10,978,004 |

|

|

|

18,765,705 |

|

|

|

25,272,164 |

|

| Provision for income

taxes |

|

490,209 |

|

|

|

1,976,453 |

|

|

|

2,175,838 |

|

|

|

4,366,005 |

|

| Net income from

continuing operations |

|

5,114,102 |

|

|

|

9,001,551 |

|

|

|

16,589,867 |

|

|

|

20,906,159 |

|

| Income from continuing

operations attributable to non-controlling interests |

|

156,784 |

|

|

|

163,428 |

|

|

|

448,724 |

|

|

|

463,775 |

|

| Net income from

continuing operations attributable to Consolidated Water Co. Ltd.

stockholders |

|

4,957,318 |

|

|

|

8,838,123 |

|

|

|

16,141,143 |

|

|

|

20,442,384 |

|

| Net income (loss) from

discontinued operations |

|

(502,854 |

) |

|

|

(232,994 |

) |

|

|

10,637,926 |

|

|

|

(699,858 |

) |

| Net income

attributable to Consolidated Water Co. Ltd.

stockholders |

$ |

4,454,464 |

|

|

$ |

8,605,129 |

|

|

$ |

26,779,069 |

|

|

$ |

19,742,526 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings (loss)

per common share attributable to Consolidated Water Co. Ltd. common

stockholders |

|

|

|

|

|

|

|

|

|

|

|

| Continuing

operations |

$ |

0.31 |

|

|

$ |

0.56 |

|

|

$ |

1.02 |

|

|

$ |

1.30 |

|

| Discontinued

operations |

|

(0.03 |

) |

|

|

(0.01 |

) |

|

|

0.67 |

|

|

|

(0.05 |

) |

| Basic earnings per

share |

$ |

0.28 |

|

|

$ |

0.55 |

|

|

$ |

1.69 |

|

|

$ |

1.25 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings

(loss) per common share attributable to Consolidated Water Co. Ltd.

common stockholders |

|

|

|

|

|

|

|

|

|

|

|

| Continuing

operations |

$ |

0.31 |

|

|

$ |

0.55 |

|

|

$ |

1.01 |

|

|

$ |

1.28 |

|

| Discontinued

operations |

|

(0.03 |

) |

|

|

(0.01 |

) |

|

|

0.67 |

|

|

|

(0.04 |

) |

| Diluted earnings per

share |

$ |

0.28 |

|

|

$ |

0.54 |

|

|

$ |

1.68 |

|

|

$ |

1.24 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per common and redeemable preferred

shares |

$ |

0.11 |

|

|

$ |

0.095 |

|

|

$ |

0.30 |

|

|

$ |

0.265 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of common shares used in the determination of: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

15,833,715 |

|

|

|

15,742,854 |

|

|

|

15,830,599 |

|

|

|

15,734,234 |

|

|

Diluted earnings per share |

|

15,989,601 |

|

|

|

15,928,604 |

|

|

|

15,986,019 |

|

|

|

15,909,725 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

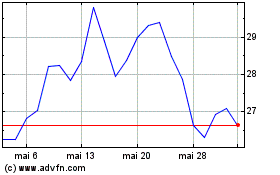

Consolidated Water (NASDAQ:CWCO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Consolidated Water (NASDAQ:CWCO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024