0001463101false00014631012024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

________________________________________________

ENPHASE ENERGY, INC.

(Exact name of registrant as specified in its charter)

________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-35480 | | 20-4645388 |

| (State or other jurisdiction of Incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

47281 Bayside Parkway

Fremont, CA 94538

(Address of principal executive offices, including zip code)

(707) 774-7000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.00001 par value per share | | ENPH | | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05. Costs Associated with Exit or Disposal Activities.

On November 7, 2024, Enphase Energy, Inc. (the "Company" or "Enphase") notified its employees of a restructuring plan (the “Plan”) designed to better align its workforce and cost structure with the Company’s business needs, strategic priorities and ongoing commitment to profitable growth – all while increasing operational efficiencies and reducing operating costs.

As part of the Plan, the Company will be reducing headcount and moving certain functions to cost efficient regions, affecting approximately 17% of its global workforce - approximately 500 employees and contractors. In addition, the Company will streamline its operations by focusing contract manufacturing in four existing locations: two in the United States, one in India and one in China; and it will cease its contract manufacturing operations in Guadalajara, Mexico. The Company’s global capacity for microinverters will remain steady at approximately 7.25 million microinverter units per quarter, of which approximately 5 million units of capacity is in the United States.

The Company estimates that it will incur approximately $17 million to $20 million in restructuring and asset impairment charges, of which approximately $14 million are expected to be incurred in the fourth quarter of 2024, and approximately $11 million to $12 million will be total cash expenditures. The estimated impact of charges related to the Plan is expected to be approximately $10 million to $13 million in employee severance and benefits, $4 million in asset impairment charges, and $3 million related to contract manufacturing and office closures.

The actions associated with employee restructuring under the Plan are expected to be substantially complete within the first half of 2025, subject to local laws.

Item 7.01. Regulation FD Disclosure.

The financial outlook for the fourth quarter of 2024 furnished in the Company’s third quarter of 2024 earnings release included with its Current Report on Form 8-K on October 22, 2024 remains unchanged except for GAAP operating expenses, which are expected to increase by approximately $14 million of restructuring and asset impairment charges in the fourth quarter in connection with the Plan.

The Company expects to reduce its non-GAAP operating expenses to be in the range of $75 million to $80 million a quarter in 2025 when these restructuring actions are substantially complete by end of the first quarter of 2025.

The Company published a Message from the CEO to Enphase Employees on its website about the implementation of the Plan. A copy of this Message from the CEO is attached as Exhibit 99.1 to this report. Information on the Company’s website is not, and will not be deemed, a part of this report or incorporated into this or any other filings that the Company makes with the Securities and Exchange Commission.

The information in Item 7.01 of this Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and shall not be incorporated by reference in any registration statement or other document filed under the Securities Act or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filings, except as shall be expressly set forth by specific reference in such a filing.

Non-GAAP Financial Measures

The Company reports its financial results in accordance with GAAP; however, the Company presents forward-looking non-GAAP operating expenses in this Current Report on Form 8-K. Non-GAAP financial measures are financial measures that are derived from the condensed consolidated financial statements, but that are not presented in accordance with GAAP. The Company uses these non-GAAP financial measures to analyze its operating performance and future prospects, develop internal budgets and financial goals, and to facilitate period-to-period comparisons. The Company believes that these non-GAAP financial measures reflect an additional way of viewing aspects of its operations that, when viewed with its GAAP results, provide a more complete understanding of factors and trends affecting its business. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, its financial measures prepared in accordance with GAAP.

With respect to non-GAAP operating expenses, the Company is not able to provide a reconciliation of forward-looking measures where the quantification of certain excluded items reflected in the measures cannot be calculated or predicted at this time without unreasonable efforts. In these cases, the reconciling information that is unavailable includes a forward-looking range of financial performance measures beyond its control, such as stock-based compensation. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could have a potentially unpredictable and potentially significant impact on its future GAAP operating expenses. Forward-looking non-GAAP financial measures may vary materially from the corresponding GAAP financial measures.

Forward-looking Statements

This Form 8-K contains forward-looking statements, including, but not limited to, statements related to the expected costs and charges associated with the Plan; the Company’s plans to better align its workforce and cost structure with the Company’s business needs, strategic priorities and ongoing commitment to profitable growth; its expectations about the increase to GAAP operating expenses in the fourth quarter of 2024; and its expectations about non-GAAP operating expense level in 2025. These forward-looking statements are based on the Company’s current expectations and inherently involve significant risks and uncertainties. The Company’s actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to cost reduction efforts and related key initiatives, in addition to other risks described in more detail in its most recently filed Annual Report on Form 10-K and other documents on file with the SEC from time to time and available on the SEC’s website at www.sec.gov. The Company undertakes no duty or obligation to update any forward-looking statements contained in this Form 8-K as a result of new information, future events or changes in its expectations.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits. | | | | | | | | |

| Exhibit Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| By: | November 8, 2024 | ENPHASE ENERGY, INC. |

| | By: | /s/ Mandy Yang |

| | | Mandy Yang |

| | | Executive Vice President and Chief Financial Officer |

November 8, 2024

To all employees:

I am reaching out to share an update on our restructuring efforts to help us manage the continued economic challenges in the solar industry. Since announcing our initial restructuring plan in December 2023, we have made concerted efforts to control spending and operate as efficiently as possible. Despite these actions, we must now make further adjustments to align our workforce and cost structure with our current business needs, strategic priorities, and long-term growth vision. As part of this plan, we will be reducing our global team by approximately 17%, impacting around 500 employees and contractors, and curbing other non-essential expenses.

This decision was not made lightly, and I know it affects us all, especially those directly impacted. Please know that we deeply value the contributions of every team member leaving Enphase. We are committed to supporting our departing colleagues with comprehensive severance packages, extended healthcare benefits, and resources to aid in their career transitions. I want to personally thank them for their invaluable contributions to the company’s growth and wish them all the best in their future endeavors.

Additional details

When we initiated our restructuring in late 2023, we resized the company to align with our internal financial operating model of 35-15-20 (non-GAAP Gross Margin, Operating Expenses, and Operating Income as a percentage of revenue). However, the ongoing challenges from a tough 2023 solar market have continued to impact us and our industry partners throughout 2024. Many large solar equipment companies and installers have faced significant cash flow issues, with some even filing for bankruptcy.

A combination of factors —including reduced U.S. residential solar demand due to high interest rates and declining demand in Europe due to policy changes and utility rate adjustments— has contributed to sustained unpredictability in our industry. Currently, our non-GAAP operating expenses range between $80 million and $85 million per quarter. Given the slower revenue growth, we need to lower our non-GAAP operating expenses to target between $75 million and $80 million per quarter for 2025. Meeting this target requires us to make these difficult yet necessary adjustments.

During this phase, it is crucial for us to remain humble and agile, continuously identifying opportunities to enhance our operational efficiency. Our strategy remains clear: to create best-in-class home energy systems, drive technological innovation, provide high-quality products and outstanding customer experience.

The changes

To prepare Enphase for long-term success, we are implementing several changes to navigate current industry challenges and support our strategic goals.

We are streamlining our manufacturing to align with current demand. This means continuing to operate from four locations: two in the United States, one in India, and one in China, while ceasing contract manufacturing in Mexico. Despite these changes, our global microinverter production capacity will remain steady at approximately 7.25 million units per quarter, with about 5 million units manufactured in the United States.

In response to shifting market demands, we are realigning our sales teams, cutting external spending, and leveraging AI to boost marketing efficiency. Our business units will focus on initiatives that generate immediate positive revenue impact while prioritizing our core products: microinverters, batteries, and EV chargers.

To further enhance efficiency across customer service, permitting, and business operations, we are integrating automation and AI/ML tools. We are reducing reliance on external contractors and testing labs, eliminating non-essential subscriptions, consolidating facilities, and offshoring select services to more cost-effective regions.

We understand these changes have significant implications and are committed to supporting everyone affected and ensuring that our remaining team members have the resources needed to focus on core priorities. As we move into 2025, we plan to offer merit-based salary increases, maintain our promotion process, and continue with annual evergreen stock grants. Additionally, our HR team will implement engagement and wellness programs to support and energize our team as we tackle the challenges and opportunities of the coming year.

These decisions are grounded in the current economic landscape, not due to recent election outcomes. While the Inflation Reduction Act (IRA) has supported U.S.-based manufacturing, our primary focus remains on creating a resilient and self-sustaining business model that will drive our long-term success.

All these actions will collectively result in one-time restructuring and asset impairment charges estimated at approximately $17 million to $20 million. We believe that these adjustments, though difficult, will better position our company for success and sustainability in the coming years.

Implementation

We have already notified all the affected employees, except for a few unique cases. We are committed to providing these individuals with relevant information as quickly as possible and supporting them throughout this transition.

In the United States:

•We will continue to pay employees until their separation date, generally December 2, 2024, with exceptions made to accommodate business or individual needs during this “notification period.”

•We are offering severance packages that include a minimum of 13 weeks of pay and accelerated vesting of certain restricted stock units (RSUs), pending proper approvals where necessary.

•Healthcare benefits will remain available to participating employees until the end of the month of their separation date. Afterward, employees may elect to continue coverage through COBRA at their own expense.

•We will allow employees to coordinate with their leadership team to use company time to seek their next opportunity during the notification period.

In countries outside the United States, we will support employees and follow separate processes in line with local practices and employment laws. However, a minimum of 13 weeks of severance pay and accelerated vesting of certain RSUs will be maintained across all regions, as applicable.

We are decreasing spending in every department by reducing headcount, non-people related expenditures, or both. These actions are not a reflection of poor employee performance, but we believe they are necessary in the current market environment.

Our way forward

This is a challenging time for all of us, as we say goodbye to many talented colleagues and friends who have contributed immensely to building one of the world’s most innovative solar companies. We are deeply grateful for their dedication and hard work. To each departing team member, thank you for your invaluable contributions. We wish you all the best as you move forward and continue to make a positive impact.

For those of us continuing on this journey, I understand that this transition brings uncertainty. While we cannot foresee everything that 2025 will bring, our recent actions are intended to sharpen our focus on key priorities: driving growth, creating value for our customers, and delivering exceptional support. We are excited about our strong pipeline of new products, including the upcoming three-phase battery for Europe, IQ® Balcony Solar, new IQ® EV Chargers, and the IQ® Portable Energy System. In the United States, we are advancing with our fourth-generation battery system, featuring a meter collar and an enhanced combiner that significantly reduces installation costs. Our GaN-powered IQ9™ Series Microinverters will expand our reach into three-phase commercial markets, including 208 V and 480 V, providing higher power and cost savings for residential customers.

With these innovations, our strategy and purpose remain strong: to advance a sustainable future by delivering best-in-class home energy systems globally. Let’s continue moving forward, committed to quality and exceptional customer experience. I am confident that, together, we will emerge from this period stronger, more resilient, and ready to shape the future.

Badri Kothandaraman

President and CEO

Enphase Energy, Inc.

This letter contains forward-looking statements, including, but not limited to, statements related to the expected costs and actions associated with the restructuring activities; the company’s plans to improve its operational efficiency; the company’s expectations about tax incentives and regulatory benefits of the IRA; expectations on the timing and release of new products; demand expectations in 2025; the company’s expectations about the decrease to non-GAAP operating expenses in 2025; and expectations regarding cost efficient regions. These forward-looking statements are based on the company’s current expectations and inherently involve significant risks and uncertainties. The company’s actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to cost reduction efforts and related key initiatives, in addition to other risks described in more detail in its most recently filed Annual Report on Form 10-K and other documents filed by the company from time to time with the SEC. In addition, please note that the date of this letter is November 8, 2024, and any forward-looking statements contained herein are based on assumptions that the company believes to be reasonable as of this date. The company undertakes no duty or obligation to update any forward-looking statements contained in this letter as a result of new information, future events or changes in its expectations.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

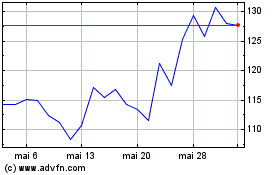

Enphase Energy (NASDAQ:ENPH)

Graphique Historique de l'Action

De Oct 2024 à Déc 2024

Enphase Energy (NASDAQ:ENPH)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024