0001000209True00010002092024-11-012024-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2024

MEDALLION FINANCIAL CORP.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

001-37747

(Commission File Number)

04-3291176

(IRS Employer Identification No.)

437 MADISON AVENUE, 38th Floor

NEW YORK, New York 10022

(Address of Principal Executive Offices) (Zip Code)

(212) 328-2100

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

MFIN |

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

Amendment 2 to Korr Cooperation Agreement

On November 1, 2024, Medallion Financial Corp. (the “Company”) entered into Amendment No. 2 to Cooperation Agreement (the “Second Amendment”) with KORR Value L.P., KORR Acquisitions Group, Inc., Kenneth Orr, David Orr and Jonathan Orr (the “KORR Parties”), which amended the Cooperation Agreement dated as of May 1, 2022 (the “Original Agreement”), as amended by that certain Amendment to Cooperation Agreement, dated as of August 10, 2022 (the “First Amendment,” and, the Original Agreement, as so amended by the First Amendment and the Second Amendment, the “Cooperation Agreement”) .

Pursuant to the Second Amendment,

•the requirement that the Company’s board of directors (the “Board”) increase the size of the Board by one director and appoint an additional independent director (along with the related obligation to appoint such director to the Investment Oversight Committee) was deleted.

•the Cooperation Agreement will automatically terminate:

(i)30 days before the nomination deadline for the Company’s 2028 Annual Meeting of Stockholders if the Company has publicly announced on or before the 30th day before the nomination deadline for the Company’s 2027 Annual Meeting of Stockholders that it intends to declare, or has declared, a quarterly dividend of at least $0.13 per share of common stock; and

(ii)30 days before the nomination deadline for the Company’s 2027 Annual Meeting of Stockholders if the Company has publicly announced on or before the 30th day before the nomination deadline for the Company’s 2026 Annual Meeting of Stockholders that it intends to declare, or has declared, a quarterly dividend of at least $0.12 per share of common stock; and

(iii)30 days before the nomination deadline for the Company’s 2026 Annual Meeting of Stockholders if the requirement of the foregoing clause (ii) is not fulfilled.

The other provisions of the Original Agreement and the First Amendment remain in full force and effect.

The foregoing summary of the Second Amendment does not purport to be complete and is subject to, and qualified in its entirety, by the full text of the Original Agreement, the First Amendment and the Second Amendment, which are incorporated herein by reference. See Exhibits 10.1, 10.2, and 10.3, respectively, below.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

10.1 |

Cooperation Agreement, dated as of May 1, 2022, by and among Medallion Financial Corp., KORR Value L.P., KORR Acquisitions Group, Inc., Kenneth Orr, David Orr, and Jonathan Orr. (Filed as Exhibit 10.1 to the Current Report on Form 8-K filed on May 2, 2022 (File No. 001-37747) and incorporated by reference herein.) |

10.2 |

Amendment to Cooperation Agreement, dated as of August 10, 2022, by and among Medallion Financial Corp., KORR Value L.P., KORR Acquisitions Group, Inc., Kenneth Orr, David Orr, and Jonathan Orr. (Filed as Exhibit 10.2 to the Current Report on Form 8-K/A filed on August 11, 2022 (File No. 001-37747) and incorporated by reference herein.). |

10.3 |

Amendment 2 to Cooperation Agreement, dated as of November 1, 2024, by and among Medallion Financial Corp., KORR Value L.P., KORR Acquisitions Group, Inc., Kenneth Orr, David Orr, and Jonathan Orr. |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 4, 2024

|

|

|

MEDALLION FINANCIAL CORP. |

|

|

By: |

|

/s/ Anthony N. Cutrone |

|

|

Name: Anthony N. Cutrone |

|

|

Title: Chief Financial Officer |

Amendment No. 2 to Cooperation Agreement

This AMENDMENT NO. 2 TO COOPERATION AGREEMENT (this “Amendment”) is made and entered into as of November 1, 2024, by and among Medallion Financial Corp., a Delaware corporation (the “Company”), on the one hand, and KORR Value L.P., a Delaware limited partnership (“KORR Value”), KORR Acquisitions Group, Inc., a New York corporation, Kenneth Orr, David Orr and Jonathan Orr (collectively, the “KORR Parties”), on the other hand. The Company and the KORR Parties are each herein referred to as a “party” and collectively, the “parties.” Capitalized terms used and not otherwise defined herein have the meanings ascribed to them in the Original Agreement, as amended by the First Amendment (each as defined below) (the Original Agreement, as amended by the First Amendment, the “Previous Agreement”);.

WHEREAS, the Company and the KORR Parties are party to that certain Cooperation Agreement, dated as of May 1, 2022 ("Original Agreement"), as amended by that certain Amendment to Cooperation Agreement, dated as of August 10, 2022 (the “First Amendment”); and

WHEREAS, the parties hereto desire to enter into certain amendments to the Previous Agreement (the Previous Agreement, as further amended by this Amendment, the “Agreement”), as further provided herein;

NOW, THEREFORE, in consideration of the foregoing premises and the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties, intending to be legally bound hereby, agree as follows:

1.Section 1(c) of the Agreement is hereby deleted in its entirety.

2.Section 9(a) of the Agreement is hereby amended and restated in its entirety as follows:

(a)This Agreement shall terminate (such effective date of termination, the “Termination Date”):

(i)30 days before the nomination deadline for the Company’s 2028 Annual Meeting of Stockholders if the Company has publicly announced on or before the 30th day before the nomination deadline for the Company’s 2027 Annual Meeting of Stockholders that it intends to declare, or has declared, a quarterly dividend of at least $0.13 per share of common stock; and

(ii)30 days before the nomination deadline for the Company’s 2027 Annual Meeting of Stockholders if the Company has publicly announced on or before the 30th day before the nomination deadline for the Company’s 2026 Annual Meeting of Stockholders that it intends to declare, or has declared, a quarterly dividend of at least $0.12 per share of common stock; and

(iii)30 days before the nomination deadline for the Company’s 2026 Annual Meeting of Stockholders if the requirement of the foregoing clause (ii) is not fulfilled.

For clarification, assuming the Company mails its proxy statement relating to the Annual Meeting of Stockholders on April 30, such nomination deadline would be December 31 of the previous year and such date 30 days before the nomination deadline would be December 1 of the previous year.

(b)Except as expressly modified herein, all terms of the Previous Agreement shall remain in full force and effect. For the avoidance of doubt, the provisions of Sections 11, 12, 13 and 15 of the Original Agreement shall apply to this Amendment, mutatis mutandis.

(c)This Amendment, and any disputes arising out of or related to this Amendment (whether for breach of contract, tortious conduct or otherwise), shall be governed by, and construed in accordance with, the laws of the State of Delaware, without giving effect to its conflict of laws principles.

(d)This Amendment is solely for the benefit of the parties and is not enforceable by any other persons.

(e)This Amendment shall not be assignable by operation of law or otherwise by a party without the consent of the other party. Any purported assignment without such consent is void ab initio. Subject to the foregoing sentence, this Amendment shall be binding upon, inure to the benefit of, and be enforceable by and against the permitted successors and assigns of each party.

(f)Neither the failure nor any delay by a party in exercising any right, power or privilege under this Amendment shall operate as a waiver thereof, nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any right, power or privilege hereunder.

(g)Any amendment or modification of the terms and conditions set forth herein or any waiver of such terms and conditions must be agreed to in a writing signed by each party.

(h)This Amendment may be executed in one or more textually identical counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same agreement. Signatures to this Amendment transmitted by facsimile transmission, by electronic mail in “portable document format” (“.pdf”) form, or by any other electronic means intended to preserve the original graphic and pictorial appearance of a document, shall have the same effect as physical delivery of the paper document bearing the original signature.

[Signature Pages Follow]

IN WITNESS WHEREOF, each of the parties has executed this Amendment No. 2 to Cooperation Agreement, or caused the same to be executed by its duly authorized representative, as of the date first above written.

THE COMPANY:

MEDALLION FINANCIAL CORP.

By: /s/ Alvin Murstein

Name: Alvin Murstein

Title: Chairman and Chief Executive Officer

Signature Page to Amendment No. 2 to Cooperation Agreement

THE KORR PARTIES:

|

KORR VALUE L.P.

By: KORR Acquisitions Group, Inc., its General Partner By: /s/ Kenneth Orr Name: Kenneth Orr Title: Chief Executive Officer |

|

|

KORR ACQUISITIONS GROUP, INC.

By: /s/ Kenneth Orr Name: Kenneth Orr Title: Chief Executive Officer |

|

|

KENNETH ORR /s/ Kenneth Orr |

|

|

JONATHAN ORR /s/ Jonathan Orr |

Signature Page to Amendment No. 2 to Cooperation Agreement

v3.24.3

Document and Entity Information

|

Nov. 01, 2024 |

| Cover [Abstract] |

|

| Entity Registrant Name |

MEDALLION FINANCIAL CORP.

|

| Amendment Flag |

true

|

| Entity Central Index Key |

0001000209

|

| Document Type |

8-K/A

|

| Document Period End Date |

Nov. 01, 2024

|

| Entity Incorporation State Country Code |

DE

|

| Entity File Number |

001-37747

|

| Entity Tax Identification Number |

04-3291176

|

| Entity Address, Address Line One |

437 MADISON AVENUE

|

| Entity Address, Address Line Two |

38th Floor

|

| Entity Address, City or Town |

NEW YORK

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10022

|

| City Area Code |

212

|

| Local Phone Number |

328-2100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Security 12b Title |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

MFIN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Description |

On November 1, 2024, Medallion Financial Corp. (the “Company”) entered into Amendment No. 2 to Cooperation Agreement (the “Second Amendment”) with KORR Value L.P., KORR Acquisitions Group, Inc., Kenneth Orr, David Orr and Jonathan Orr (the “KORR Parties”), which amended the Cooperation Agreement dated as of May 1, 2022 (the “Original Agreement”), as amended by that certain Amendment to Cooperation Agreement, dated as of August 10, 2022 (the “First Amendment,” and, the Original Agreement, as so amended by the First Amendment and the Second Amendment, the “Cooperation Agreement”) .

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

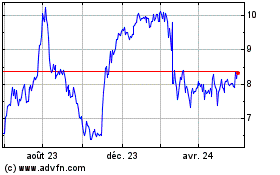

Medallion Financial (NASDAQ:MFIN)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

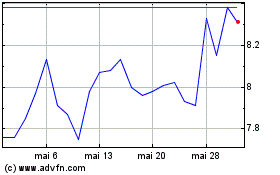

Medallion Financial (NASDAQ:MFIN)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024