UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

SB Financial Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a- 6(i)(1) and 0-11 |

2024

Proxy Statement

SB

FINANCIAL GROUP, INC.

401

Clinton Street

Defiance,

Ohio 43512

(419)

783-8950

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

Defiance,

Ohio

March

8, 2024

Dear

Shareholders:

The

2024 Annual Meeting of Shareholders (the “Annual Meeting”) of SB Financial Group, Inc. (“SB Financial”) will

be held on Wednesday, April 17, 2024, at 10:30 a.m., Eastern Daylight Savings Time, for the following purposes:

| 1. | To

elect three (3) directors, each to serve for a term of three years. |

| 2. | To

ratify the appointment of FORVIS, LLP as the independent registered public accounting firm

of SB Financial for the fiscal year ending December 31, 2024. |

| 3. | To

consider and vote upon a non-binding advisory resolution to approve the compensation of SB

Financial’s named executive officers. |

| 4. | To

transact such other business as may properly come before the Annual Meeting and any adjournment(s)

thereof. |

Your

Board of Directors recommends that you vote “FOR” the election as SB Financial directors of the nominees listed in SB Financial’s

proxy statement for the Annual Meeting, and “FOR” Proposals 2 and 3.

This

year’s Annual Meeting will again be held “virtually” through a live webcast. Shareholders will be able to vote and

submit questions by visiting www.virtualshareholdermeeting.com/SBFG2024 and participating live

in the webcast. A secure control number that will allow you to participate in the meeting electronically can be found on the enclosed

proxy card.

Shareholders

of record at the close of business on February 23, 2024 are entitled to receive notice of, and to vote at, the Annual Meeting and any

adjournment(s) thereof. All shareholders are cordially invited to participate in the Annual Meeting. Whether or not you plan to participate

in the Annual Meeting virtually, it is important that your Common Shares be represented. Accordingly, you are encouraged to vote electronically

via the Internet in advance of the Annual Meeting in accordance with the instructions on the enclosed proxy card. Alternatively, please

fill in, date, sign and return your proxy card promptly.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Mark A. Klein |

| |

Mark A. Klein |

| |

Chairman, President & CEO |

| |

SB Financial Group, Inc. |

SB

FINANCIAL GROUP, INC.

401

Clinton Street

Defiance,

Ohio 43512

(419)

783-8950

PROXY

STATEMENT FOR

THE

ANNUAL MEETING OF SHAREHOLDERS

TO

BE HELD ON WEDNESDAY, APRIL 17, 2024

GENERAL

INFORMATION

This

proxy statement and related materials are being made available to shareholders of SB Financial Group, Inc. (the “Company”,

“SB Financial” or “SBFG”) in connection with the solicitation of proxies by the Board of Directors of the Company

(the “Board”) for use at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Wednesday, April

17, 2024, at 10:30 a.m., Eastern Daylight Savings Time, and at any adjournment(s) thereof. The Annual Meeting will be hosted at the Company’s

headquarters located at 401 Clinton St., Defiance, Ohio 43512, and will be held “virtually” through a live webcast at www.virtualshareholdermeeting.com/SBFG2024.

Shareholders may participate by accessing the Annual Meeting online, voting their shares electronically, and submitting questions online

during the meeting. To participate and enter the live webcast meeting, you will need your unique control number, which is provided on

your proxy card.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR

THE ANNUAL MEETING TO BE HELD ON APRIL 17, 2024

The

Company’s Notice of Annual Meeting, this proxy statement, and the Company’s Annual Report to Shareholders for the fiscal

year ended December 31, 2023, are each available at http://www1.snl.com/irweblinkx/FinancialDocs.aspx?iid=101021.

Copies

of the Company’s Annual Report on Form 10-K for the 2023 fiscal year may be obtained at the Company’s website at www.YourSBFinancial.com

under the “SEC Filings” tab. Or, you can obtain paper copies, without charge, by sending a written request to: Anthony V.

Cosentino, Chief Financial Officer, SB Financial Group, Inc., 401 Clinton Street, Defiance, OH 43512.

The

Company is furnishing proxy materials for the Annual Meeting over the Internet to certain shareholders of the Company, who will receive

a Notice of Internet Availability of Proxy Materials instead of paper copies of the Notice of Annual Meeting of Shareholders, this proxy

statement, the form of proxy card and the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 2023 (the

“2023 fiscal year”), which includes the audited consolidated financial statements of the Company for the 2023 fiscal year

(the “Annual Report”). The Notice of Internet Availability of Proxy Materials contains instructions on how to access the

Company’s proxy materials over the Internet and how shareholders can receive a paper copy of the proxy materials. Shareholders

who receive a Notice of Internet Availability of Proxy Materials are reminded that the Notice is not itself a proxy card.

On

or about March 8, 2024, the Company will mail to all holders of record of common shares of the Company (“Common Shares”)

as of February 23, 2024 (the “Record Date”) either (1) a copy of the Notice of Annual Meeting of Shareholders, this proxy

statement, the form of proxy card and the Annual Report, or (2) a Notice of Internet Availability of Proxy Materials, which will indicate

how to access the Company’s proxy materials on the Internet.

Only

holders of record of the 6,787,451 Common Shares of the Company eligible to vote as of the Record Date are entitled to receive notice

of and to vote at the Annual Meeting. Each such holder is entitled to one vote for each Common Share held as of the Record Date with

respect to all matters acted upon at the Annual Meeting. The shares represented by all properly executed proxies submitted to the Company

will be voted as designated. Each person giving a proxy may revoke it at any time before it is voted at the Annual Meeting by giving

written notice of revocation to the Secretary of the Company at the address listed above, or by giving notice of revocation at the meeting.

The last-dated proxy you submit by any means will supersede any previously submitted proxy. If your Common Shares are held in “street

name” and you have instructed your broker, financial institution or other nominee to vote your Common Shares, you must follow directions

received from your broker, financial institution or other nominee to change your vote. No appraisal or dissenters’ rights exist

for any action proposed to be taken at the Annual Meeting.

Annually,

the Company provides each registered shareholder at a shared address, not previously notified, with a separate notice of the

Company’s intention to “household” proxy materials. Only one copy of the Notice of Annual Meeting of Shareholders

and this proxy statement, or Notice of Internet Availability of Proxy Materials, as applicable, is being delivered to previously

notified multiple registered shareholders who share an address unless the Company has received contrary instructions from one or

more of the shareholders. Registered shareholders who share an address and would like to receive a separate copy of the Annual

Report, this proxy statement and/or Notice of Internet Availability of Proxy Materials delivered to them, or have questions

regarding the householding process, may contact Investor Relations by calling 419-783-8920 or 419-785-3663, or by forwarding a

written request addressed to SB Financial Group, Inc., Attention: Investor Relations, 401 Clinton Street, Defiance, Ohio 43512.

Promptly upon receipt of a request, an additional copy of the Annual Report, this proxy statement and/or Notice of Internet

Availability of Proxy Materials, as applicable, will be sent. By contacting Investor Relations, registered shareholders sharing an

address can also (i) notify the Company that the registered shareholders wish to receive separate annual reports to shareholders,

proxy statements or Notices of Internet Availability of Proxy Materials, as applicable, in the future or (ii) request delivery of a

single copy of annual reports to shareholders, proxy statements or Notices of Internet Availability of Proxy Materials, as

applicable, in the future if they are receiving multiple copies. Beneficial shareholders, who hold Common Shares through a broker,

financial institution or other nominee, should contact their broker, financial institution or other nominee for specific information

on the householding process as it applies to their accounts.

VIRTUAL

MEETING INFORMATION

We

will be hosting a virtual Annual Meeting again this year. Shareholders will be able to participate in the Annual Meeting online via live

webcast. Provided below is the summary of the information that you will need to participate in the Annual Meeting:

| ● | Shareholders

can participate in the Annual Meeting via live webcast over the Internet at www.virtualshareholdermeeting.com/SBFG2024. |

| ● | You

will need your unique control number, which is provided on your proxy card, to enter the

Annual Meeting. |

| ● | The

webcast of the Annual Meeting will begin at 10:30 a.m., Eastern Daylight Savings Time, on

April 17, 2024. |

| ● | Shareholders

will have the ability to vote and submit questions during the Annual Meeting webcast. |

| ● | Instructions

as to how to participate via the Internet, including how to verify stock ownership, are available

at www.virtualshareholdermeeting.com/SBFG2024. |

| ● | If

you have questions regarding how to participate via the Internet, you may call Mark A. Klein,

Chairman, President and CEO at 419-783-8920 or Anthony V. Cosentino, CFO at 419-785-3663. |

| ● | Replay

of the Annual Meeting webcast will be available until April 17, 2025. |

VOTING

INFORMATION

Whether

or not you plan to participate in the Annual Meeting, you may ensure your representation by voting your Common Shares by one of the following

methods:

| ● | by

submitting a traditional paper proxy card prior to the Annual Meeting; |

| ● | by

submitting a proxy via the Internet or by Telephone prior to the Annual Meeting; or |

| ● | by

participating in the Annual Meeting online and voting electronically during the meeting. |

Submitting

a Proxy via the Internet or by Telephone. You may submit a proxy via the Internet or by telephone by following the instructions set

forth on the form of proxy card or the Notice of Internet Availability of Proxy Materials. The deadline for submitting a proxy via the

Internet or by telephone is 11:59 PM (EDT) on April 16, 2024. If your Common Shares are registered in the name of a broker, financial

institution or other nominee (i.e., you hold your Common Shares in “street name”), your nominee may allow you to submit

a proxy via the Internet or by telephone. In that case, the voting form your nominee sent you will provide instructions for submitting

your proxy via the Internet or by telephone. For shareholders whose Common Shares are registered in the name of a broker, financial institution

or other nominee, please consult the instructions provided by your nominee for information about the deadline for submitting a proxy

via the Internet or by telephone.

Voting

Electronically during the Annual Meeting. If you participate in the live webcast of the Annual Meeting, you will have the opportunity

to vote your Common Shares electronically during the Annual Meeting webcast. Shareholders can participate in the Annual Meeting via live

webcast and vote electronically over the Internet at www.virtualshareholdermeeting.com/SBFG2024.

In

accordance with company policy, proxy cards, ballots and voting instructions that identify individual shareholders will be kept confidential.

Exceptions to this policy, however, may be necessary in limited instances to comply with applicable legal requirements and, in the event

of a contested proxy solicitation, to verify the validity of proxies presented by any person and the results of the voting.

Quorum

Requirement for the Annual Meeting

Under

the Company’s Amended and Restated Regulations (the “Regulations”), the holders of a majority of the Common Shares

outstanding and entitled to vote at the Annual Meeting, represented in person or proxy, will constitute a quorum for the Annual Meeting.

Holders of Common Shares may be present in person, including via participation in the online webcast, or represented by proxy at the

Annual Meeting. Both abstentions and broker non-votes will be counted as being present for purposes of determining the presence of a

quorum.

In

general, broker non-votes occur when Common Shares held by a broker for a beneficial owner are not voted with respect to a particular

proposal because the broker has not received voting instructions from the beneficial owner and the broker lacks discretionary authority

to vote such Common Shares on the proposal(s). Brokers have discretionary authority to vote their customers’ Common Shares on “routine”

proposals, even if they do not receive voting instructions from their customers. Brokers cannot, however, vote their customers’

Common Shares on “non-routine” matters without instructions from their customers. Pursuant to applicable stock exchange rules,

the ratification of the appointment of the Company’s independent registered public accounting firm (Proposal No. 2) is the only

routine matter. The election of directors and Proposal No. 3 are considered non-routine matters and, therefore, your broker may vote

on these matters only if you provide voting instructions.

Cost

of Proxy Solicitation

The

Company will bear the costs of preparing, printing and delivering this proxy statement, the form of proxy card and any other related

materials, as well as all other costs incurred in connection with the solicitation of proxies on behalf of the Board (other than the

Internet access or telephone usage charges incurred if a shareholder appoints a proxy electronically or by telephone). Proxies will be

solicited by U.S. mail and electronic mail and may be further solicited, for no additional compensation, by officers, directors or employees

of the Company and its subsidiaries by further mailing and/or electronic mail, by telephone or by personal contact. The Company will

also pay the standard charges and expenses of brokers, voting trustees, financial institutions and other custodians, nominees and fiduciaries

who are record holders of Common Shares not beneficially owned by them, for forwarding materials to and obtaining proxies from the beneficial

owners of Common Shares entitled to vote at the Annual Meeting.

Your

Vote Is Important. Your prompt cooperation in voting your Common Shares is greatly appreciated.

PROPOSAL

NO. 1

ELECTION

OF DIRECTORS

In

accordance with the Regulations of the Company, three directors will be elected at the Annual Meeting for terms of three years each.

The Board proposes that each of the three director nominees identified below be re-elected for a new term of three years expiring in

2027. Each of these nominees was approved by the Board upon the recommendation of the Governance and Nominating Committee.

Each

individual elected as a director at the Annual Meeting will hold office for a term of three years and until his or her successor is elected

and qualified, or until his or her earlier resignation, removal from office or death. Pursuant to the procedures set forth under the

Regulations and Ohio law, the three nominees who receive the greatest number of votes will be elected as directors of the Company. Common

Shares represented by properly submitted proxies will be voted FOR the election of the Board’s nominees unless

authority to vote for one or more nominees is withheld. Shareholders may withhold authority to vote for the entire slate as nominated

or may withhold the authority to vote for one or more nominees. Common Shares as to which the authority to vote is withheld will be counted

for quorum purposes, but will not be counted toward the election of the individual nominees for whom the authority to vote has been withheld.

If a nominee becomes unavailable or unable to serve as a director for any reason prior to the Annual Meeting, the individuals designated

as proxy holders reserve full discretion to vote the Common Shares represented by the proxies they hold for the election of the remaining

nominees and for the election of any substitute nominee designated by the Board. The Board has no reason to believe that any of the nominees

named below will not serve if elected.

The

Board of Directors proposes the election of the following persons, all of whom were recommended by the Governance and Nominating Committee,

to three-year terms that will expire in 2027:

| Name |

|

Age |

|

Position(s)

Held |

|

Director

Since |

| George

W. Carter |

|

64 |

|

Director,

SBFG and State Bank |

|

2013 |

| Tom

R. Helberg |

|

64 |

|

Director,

SBFG and State Bank |

|

2018 |

| Timothy

J. Stolly |

|

66 |

|

Director,

SBFG and State Bank |

|

2010 |

YOUR

BOARD RECOMMENDS THAT SHAREHOLDERS

VOTE

FOR THE ELECTION OF ALL OF THE BOARD’S NOMINEES

The

following directors will continue to serve after the Annual Meeting for the terms indicated:

| Name |

|

Age |

|

Position(s)

Held |

|

Director

Since |

|

Term

Expires |

| Timothy

L. Claxton |

|

59 |

|

Director,

SBFG and State Bank |

|

2021 |

|

2026 |

| Gaylyn

J. Finn |

|

75 |

|

Director,

SBFG and State Bank |

|

2010 |

|

2026 |

| Richard

L. Hardgrove |

|

85 |

|

Lead

Independent Director, SBFG and State Bank |

|

2004 |

|

2025 |

| Rita

A. Kissner |

|

78 |

|

Director,

SBFG and State Bank |

|

2004 |

|

2026 |

| Mark

A. Klein |

|

69 |

|

Director,

Chairman, President and Chief Executive Officer, SBFG and State Bank |

|

2010 |

|

2025 |

| William

G. Martin |

|

57 |

|

Director,

SBFG and State Bank |

|

2014 |

|

2025 |

There

are no family relationships among any of the directors, nominees for election as directors and executive officers of the Company.

The

following gives certain information, as of the Record Date, concerning each nominee for election as a director of the Company and each

director whose term will continue after the Annual Meeting. The following also provides an overview of certain specific skills that qualify

each of our current directors and director nominees to serve as a director or to be nominated for re-election as a director. Unless otherwise

indicated, each person has held his or her principal occupation for more than five years.

Mr.

Carter has over 34 years of experience in the utility industry while serving in executive leadership positions for over 23 years.

He has recently retired from the position of President and Chief Executive Officer of the Paulding Putnam Electric Cooperative, an electric

utility serving Ohio and Indiana, a position which he had held since 2005. Prior to that role, Mr. Carter served as Director of Finance

and Administration for a utility for 12 years. Mr. Carter also serves as a Director of Buckeye Power Inc., an electric generation cooperative

that has assets of $2 billion, and formerly served on its executive and audit committees. He also serves as a director of United Utility

Supply, a materials supply company. Mr. Carter is an active member of his community, currently serving on the Paulding County Economic

Development board and as President on the Paulding Community Improvement Corporation (CIC) Mr. Carter also formerly served as a board

member and past President of the United Way of Paulding County and also served on the board of the Regional Growth Partnership, Toledo,

OH. Prior to his appointment to the Company and the State Bank Boards, he served on State Bank’s Paulding County Advisory Board.

Mr. Carter was appointed to the Boards of Directors of the Company and State Bank in 2013. He currently is the Chairman of the Compensation

Committee and also serves on the Audit Committee and State Bank’s Executive Loan Committee. He is also the board liasion to the

Paulding County Advisory Board.

Mr.

Claxton has extensive experience in business acquisitions, banking, estate planning and administration, loan documentation and mortgage

foreclosure. He is a partner at Burt Blee, a law firm in Fort Wayne, Indiana. He has practiced law for 32 years and focuses his practice

in the areas of real estate, business, banking and estate planning and administration. He is actively involved in the Fort Wayne community,

including serving as Secretary and a Director of Stavreti Scholarship, Inc., and as an active member of the Volunteer Lawyers Program.

Mr. Claxton was appointed as a director of the Company and State bank in August 2021, after previously serving on State Bank’s

Fort Wayne Advisory Board. He currently serves on the Governance and Nominating Committee, the Board’s Loan Review Committee and

the Trust and Investment Review Committee. Mr. Claxton is also the board liaison to the Fort Wayne Advisory Board.

Mr.

Finn brings to the Board an extensive financial and risk management background. He served as Treasurer and Associate Vice President

for Finance for Bowling Green State University until 2008. While serving at Bowling Green State University, Mr. Finn was responsible

for receipts, disbursement, financial reporting and investing functions of the university as well as the risk management function. He

is a holder of a CPA certificate (currently inactive) and previously worked for a large public accounting firm. Mr. Finn also served

as a corporate controller for seven years. He has over 36 years’ experience as a financial executive in the for-profit and non-profit

arenas. He currently serves as trustee of the Wood County Hospital while providing leadership as past Chairman in 2014 and 2015. He also

serves on the finance committee of The Cocoon Shelter, a non-profit organization. Mr. Finn’s experience in finance has qualified

him as an “audit committee financial expert” under Securities and Exchange Commission (“SEC”) guidelines. Mr.

Finn has been a director of the Company and State Bank since 2010. He currently is the Chairman of the Audit Committee and also serves

on the Board’s Loan Review Committee. He is also the board liaison to the Bowling Green and Fulton County Advisory Boards.

Mr.

Hardgrove brings an extensive background in finance and financial institution management. He has over 50 years of banking experience,

during which he served as the CEO of three different banks with assets of $500 million to $5 billion, as well as serving 16 years as

the CEO of a bank holding company. As CEO of financial institutions, he led these financial institutions through a number of successful

mergers. Mr. Hardgrove also formerly served as the Deputy Superintendent of Banks for the State of Ohio. He has served as a bank director

for 42 years. Mr. Hardgrove currently serves as Lead Independent Director of the Company and State Bank. Mr. Hardgrove has been a director

of the Company and State Bank since 2004. He is a member of the Compensation Committee and the Governance and Nominating Committee. He

is also the board liaison to the Columbus Advisory Board.

Mr.

Helberg has extensive knowledge and experience in real estate law. He is Of Counsel specializing in real estate related matters

at the law firm of Liebenthal Levine Ltd in Toledo, OH. He has also served as the Legal Counsel and Principal of a commercial real

estate development and investment company since 1984. Mr. Helberg has significant board service experience having served on the boards

of directors of numerous for-profit and non-profit organizations. Prior to his appointment to the Board of the Company and State Bank,

Mr. Helberg served on State Bank’s Toledo Advisory Board. He currently is a member of the American Bar Association. Mr. Helberg

is a past Director of the Toledo Hospital Foundation Board and Sylvania Township Zoning Board of Appeals. Mr. Helberg formerly served

on the Board of Directors of two mid-west Ohio banks. Mr. Helberg was appointed as a director of the Company and State Bank in February

2019 and is the Chairman of the Board’s Loan Review Committee and is also a member of the Audit and Trust Committees. He is also

board liaison to the Toledo Advisory Board.

Ms.

Kissner has broad knowledge of finance and leadership in local government. Her diverse professional background includes having served

as Mayor of Defiance, a mid-sized Northwest Ohio town, as well as finance director and auditor. She exercised her leadership skills as

the former Main Street Director of the Defiance Development and Visitors Bureau, and she also currently serves as a trustee and past

Board Chair of Defiance College. Ms. Kissner has been a director of the Company and State Bank since 2004. Ms. Kissner currently serves

as Chairperson of the Trust and Investment Review Committee and is also a member of the Audit Committee and Compensation Committees.

She is also board liaison to the Defiance County Advisory Board.

Mr.

Klein brings extensive experience in the financial institution industry. He was appointed Chairman, President and CEO of the Board

of Directors of SB Financial in 2015. Previously, he served as President and CEO of SB Financial since 2010 and State Bank since

2006. Mr. Klein is a graduate of Defiance College in Defiance, Ohio with a Bachelor of Science Degree in Finance. He is a graduate

of the University of Wisconsin – Madison Graduate School of Banking, and received his Master of Business Administration (MBA) degree

from Bowling Green State University. Mr. Klein recently attained a Certificate of Management Excellence (CME) at Harvard Business

School. Prior to joining the Company and State Bank, he was Senior Vice President Private Banking of Sky Bank, Toledo, Ohio from 2004

to January 2006, and Vice President and Team Leader of Sky Bank, Toledo, Ohio from 2000 to 2004. From 1994 to 1999, he was Executive

Vice President and Senior Lender at a $450 million Sky Bank affiliate. Mr. Klein has served as the past Chair of the ProMedica Defiance

Regional Hospital Board, past member of the Defiance City Schools Board of Education for 20 years while serving as its president for

four terms, served on the State of Ohio Banking Commission and as a member of The Defiance College Board of Trustees. Mr. Klein

has also served on the Federal Reserve Bank of Cleveland’s Fourth District, Community Depository Institutions Advisory Council

(CDIAC). Mr. Klein is active in his community including board membership in the local Community Improvement Corporation (CIC) and as

its VP. He is also a past member of the Defiance Area Foundation and Defiance City School Foundation.

Mr.

Martin has an extensive background in finance and leadership in northwest Ohio. With over 35 years’ experience in finance

and accounting, he started his career at Arthur Young (now Ernst & Young) in Toledo, OH where he passed the Ohio CPA Exam in

1993 (now non practicing). He then held the position of VP Controller with a large furniture manufacturer. Mr. Martin

is currently President of the Spangler Candy Company, a 117 year old family-owned privately held company in Bryan, OH where he has been

employed for the past 23 years. Mr. Martin also serves as a Director of Spangler Candy Company. In the local community, Mr.

Martin has significant community involvement as a Member of the Bryan Area Foundation (former Chairman 2016-2018), past Treasurer of

the Williams County Family YMCA, and serves on various committees at Bryan St. Patrick Catholic Church. Prior to his appointment

to the Company and State Bank Boards, he served on State Bank’s Williams County Advisory Board. Mr. Martin was appointed as a director

of SBFG and State Bank in 2014. Mr. Martin currently serves on the Company’s Governance and Compensation Committees and is

also Chairman of the State Bank’s Executive Loan Committee. He is also the board liaison to the Williams County Advisory

Board.

Mr.

Stolly brings to the Board over 43 years of experience in the insurance industry, as well a strong sales, services and management

background. He currently serves as Past President of Stolly Insurance Agency Inc., a regional independent insurance agency

instituted in 1904. Mr. Stolly has significant community involvement. He currently is President of the Lima Interfaith

Senior Housing board, and previously served as past president of The Lima Allen County Chamber of Commerce, Allen County Council

on Aging, Lima Noon Optimists, Shawnee Country Club and also served on the advisory board of directors for Bluffton University,

Ohio Northern University, Safeco Insurance Company and Motorists Insurance Company. He also served as a board of director

member for the Ohio Insurance Association Prior to his appointment to the Company and State Bank Boards, he served on State

Bank’s Lima Advisory Board. Mr. Stolly has been a director of the Company and State Bank since 2010. He currently is

Chairman of the Board’s Governance and Nominating Committee and also serves on the Trust and Investment and Executive Loan Committees.

He is also the board liaison to the Lima Advisory Board.

CORPORATE

GOVERNANCE

Director

Independence

The

Board has reviewed, considered and discussed each director’s relationships, both direct and indirect, with the Company and its

subsidiaries, including those described under the heading “TRANSACTIONS WITH RELATED PERSONS” beginning on page 34

of this proxy statement. As part of its review, the Board has considered and discussed the compensation and other payments, if any, each

director has, both directly and indirectly, received from or made to the Company and its subsidiaries in order to determine whether such

director qualifies as independent based on the definition of an “independent director” set forth in Rule 5605(a)(2) of the

Marketplace Rules of The NASDAQ Stock Market (“NASDAQ”).

The

Board has affirmatively determined that the Board has at least a majority of independent directors, and that each of the following individuals

who currently serve as directors, or who served as a director of the Company during the 2023 fiscal year, has and had no financial or

personal relationships, either directly or indirectly, with the Company or its subsidiaries (other than compensation as a director of

the Company and its subsidiaries, banking relationships in the ordinary course of business with the Company’s banking subsidiaries

and ownership of the Company’s Common Shares as described in this proxy statement) and thus qualifies as an “independent

director” under NASDAQ Marketplace Rule 5605(a)(2): George W. Carter, Timothy L. Claxton, Gaylyn J. Finn, Richard L. Hardgrove,

Tom R. Helberg, Rita A. Kissner, William G. Martin and Timothy J. Stolly. The Board has determined that Mark A. Klein does not qualify

as an independent director because he currently serves as an executive officer of the Company and certain of its subsidiaries.

Director

Qualifications and Review of Director Nominees

To

fulfill its responsibility to recruit and recommend to the full Board nominees for election as Directors, the Governance and Nominating

Committee reviews the composition of the Board to determine the qualifications and areas of expertise needed to further enhance the composition

of the Board, and works to identify and attract candidates with those qualifications. The Governance and Nominating Committee has adopted

a written policy regarding qualifications of directors. Pursuant to this policy, individuals who are nominated for election to the Board

must possess certain minimum personal and professional qualities, including, without limitation, personal integrity and ethical character;

demonstrated achievement in business, professional, governmental, communal, scientific or educational fields; sound judgment borne of

management or policy-making experience; and a general appreciation regarding major issues facing public companies of a size and operational

scope similar to the Company. The policy also requires the Governance and Nominating Committee to consider the contributions that a candidate

can be expected to make to the collective functioning of the Board based upon the totality of the candidate’s credentials, experience

and expertise, the composition of the Board at the time, and other relevant circumstances.

The

Governance and Nominating Committee considers candidates for the Board from any reasonable source, including shareholder recommendations.

The Governance and Nominating Committee does not evaluate candidates differently based on who has made the recommendation or the source

of the recommendation. The Governance and Nominating Committee has the authority under its charter to hire and pay a fee to consultants

or search firms to assist in the process of identifying and evaluating candidates. No such consultants or search firms have been used

to date and, accordingly, no fees have been paid to consultants or search firms.

The

Company does not have a written policy that requires the consideration of diversity in identifying nominees for election to the Board.

However, the Governance and Nominating Committee’s policy regarding qualifications of directors provides that the Company will

seek to promote through the nominations process appropriate diversity on the Board of professional background, experience, expertise,

perspective, age, gender, ethnicity and country of citizenship.

The

Board believes that each nominee and current Board member brings a strong and unique background and set of skills to the Board, giving

the Board as a whole competence and experience in a wide variety of areas, including corporate governance and board service, executive

management, banking, insurance, accounting and finance, legal, real estate, marketing and government.

Board

Leadership Structure and Role in Risk Oversight

In

April of 2015, the Board of Directors elected to combine the roles of Chief Executive Officer and Chairman and appointed Mark A. Klein

as Chairman of the Board. This decision was based upon a variety of factors, including the composition of the Board, which is comprised

of all independent directors other than Mr. Klein, and Mr. Klein’s demonstrated leadership qualities and extensive knowledge and

experience with respect to the banking industry in general and the Company’s operations in particular. Based on the foregoing,

the Board of Directors determined that Mr. Klein was in the best position to fill the strategic role of Chairman of the Board, and the

Board of Directors continues to believe this to be the case.

To

also provide independent leadership for the Board, the Board appointed Richard L. Hardgrove to serve as Lead Independent Director upon

Mr. Klein’s appointment as Chairman in April of 2015. The Lead Independent Director’s duties include acting as a liaison

between the Board and management, approving the agenda for each Board meeting, leading the annual evaluation of the Chairman and CEO

and acting as the chairman for executive sessions of the Board. Because the Board is comprised of other strong independent directors

and conducts regular executive sessions, which are led by the Lead Independent Director, the Board believes that its current leadership

structure is appropriate.

The

Board of Directors is responsible for consideration and oversight of risks facing the Company and is responsible for ensuring that material

risks are identified and managed appropriately. Several oversight functions are delegated to committees of the Board with such committees

regularly reporting to the full Board the results of their respective oversight activities. For example, the Audit & Risk Management

Committee meets periodically with management in order to review the Company’s major financial risk exposures and the steps management

has taken to monitor and control such exposures. As part of this process, the Audit & Risk Management Committee reviews management’s

risk-assessment process and reports its findings to the full Board. Also, the Compensation Committee periodically reviews the most important

enterprise risks to ensure that compensation programs do not encourage excessive risk-taking. Additional review or reporting on

enterprise risks is conducted as needed or as requested by the Board or Board committees.

Nominations

of Directors

Shareholders

may recommend director candidates for consideration to the Governance and Nominating Committee by writing to Richard L. Hardgrove, Lead

Independent Director of the Company, or Mark A. Klein, Chairman, President and Chief Executive Officer of the Company. To be considered,

recommendations must be received at the Company’s principal office located at 401 Clinton Street, Defiance, Ohio 43512, no later

than September 30th of the year preceding the Annual Meeting and must state the qualifications of the proposed candidate.

Shareholders

may also nominate an individual for election as a director of the Company by following the procedures set forth in the Regulations. Pursuant

to the Regulations, all shareholder nominations must be made in writing and delivered or mailed (by first class mail, postage prepaid)

to Keeta J. Diller, Secretary of the Company at the Company’s principal office located at 401 Clinton Street, Defiance, Ohio 43512.

To nominate an individual as a director for an annual meeting, the nomination must be received by the Secretary of the Company on or

before the later of (a) the February 1st immediately preceding the date of the annual meetings or (b) the 60th day prior to the first

anniversary of the most recent annual meeting at which directors were elected. However, if the annual meeting is not held on or before

the 31st day following the first anniversary of the most recent annual meeting at which directors were elected, nominations must be received

by the Secretary of the Company within a reasonable time prior to the date of the annual meeting. Nominations for a special meeting of

shareholders at which directors are to be elected must be received by the Secretary of the Company no later than the close of business

on the 7th day following the day on which the notice of the special meeting was mailed to shareholders. In any event, each nomination

must contain the following information: (a) the name, age and business or residence address of each proposed nominee; (b) the principal

occupation or employment of each proposed nominee; (c) the number of Common Shares owned beneficially and of record by each proposed

nominee and the length of time the proposed nominee has owned such shares; and (d) any other information required to be disclosed with

respect to a nominee for election as a director under the proxy rules promulgated by the SEC under the Securities Exchange Act of 1934,

as amended (the “Exchange Act”).

Effective

September 1, 2023, SEC Rule 14a-19 requires the use of a universal proxy card in contested director elections. Under this “universal

proxy rule,” a shareholder intending to engage in a director election contest with respect to an annual meeting of shareholders

must give the Company notice of its intent to solicit proxies by providing the name(s) of the shareholder’s nominee(s) and certain

other information at least 60 calendar days prior to the anniversary of the previous year’s annual meeting date (except that, if the Company

did not hold an annual meeting during the previous year, or if the date of the meeting has changed

by more than 30 calendar days from the previous year, then notice must be provided by the later of 60 calendar days prior to the date

of the annual meeting or the 10th calendar day following the day on which public announcement of the date of the annual meeting is first

made by the Company).

Board

Diversity

On August 6, 2021, the SEC approved amendments to the Listing Rules

of NASDAQ related to board diversity. New Listing Rule 5605(f) (the “Diverse Board Representation Rule”) will require each

NASDAQ-listed company, subject to certain exceptions, to have, or explain why it does not have, at least two members of its board of directors

who are diverse, including (1) at least one diverse director who self-identifies as female, and (2) at least one diverse director who

self-identifies as an underrepresented minority or LGBTQ+. Under the Diverse Board Representation Rule, a smaller reporting company will

be required to have, or to explain why it does not have, at least two members of its board of directors who are diverse including at least

one diverse director who self-identifies as female. Under the NASDAQ rule, a director will be considered “diverse” if the

individual self-identifies in one or more of the following categories: Female, Underrepresented

Minority, or LGBTQ+. “Female” means an individual who self-identifies her gender as a woman, without regard to the individual’s

designated sex at birth. An “underrepresented minority” means an individual who self-identifies as one or more of the

following: Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander,

or Two or More Races or Ethnicities. We are not required to fully comply with the Diverse Board Representation Rule until December 31,

2026.

In addition, new Listing Rule 5606 (the “Board Diversity Disclosure

Rule”) requires each NASDAQ-listed company, subject to certain exceptions, to provide statistical information about the company’s

current Board of Directors, in a uniform format, related to each director’s self-identified gender, race, and self-identification

as LGBTQ+. The Company provided information on the self-identified gender and demographic background attributes of the nine then members

of the Board in the section captioned“CORPORATE GOVERNANCE – Board Diversity” of Company’s proxy statement for

its 2023 Annual Meeting of Shareholders. The following summarizes the self-identified gender and demographic background attributes of

the members of the Board effective as of February 23, 2024.

| BOARD

DIVERSITY (as of February 23,

2024) |

| Total

Number of Directors |

|

9 |

| |

|

Female |

|

Male |

|

Non-Binary |

|

Did

Not Disclose Gender |

| Part

I: Gender Identity |

| Directors |

|

1 |

|

8 |

|

0 |

|

0 |

| Part

II: Demographic Background |

| African

American or Black |

|

0 |

|

0 |

|

0 |

|

0 |

| Alaskan

Native or Native American |

|

0 |

|

0 |

|

0 |

|

0 |

| Asian |

|

0 |

|

0 |

|

0 |

|

0 |

| Hispanic

or Latinx |

|

0 |

|

0 |

|

0 |

|

0 |

| Native

Hawaiian or Pacific Islander |

|

0 |

|

0 |

|

0 |

|

0 |

| White |

|

1 |

|

8 |

|

0 |

|

0 |

| Two

or More Races or Ethnicities |

|

0 |

|

0 |

|

0 |

|

0 |

| LGBTQ+ |

|

0 |

|

0 |

|

0 |

|

0 |

| Did

Not Disclose Demographic Background |

|

0 |

|

0 |

|

0 |

|

0 |

Communications

with the Board

Shareholders

may initiate communication with the directors of the Board. Any shareholder wishing to do so may write to the Board of Directors or to

specified individual directors at the Company’s principal business address, 401 Clinton Street, Defiance, OH 43512. Any shareholder

communication so addressed will be delivered to the director or a member of the group of directors to whom it is addressed or to the

Lead Independent Director and/or Chairman if addressed to the Board of Directors. In addition, communication via the Company’s

website at www.YourSBFinancial.com may be used. There is no screening process in respect to shareholder communications. All shareholder

communications received by an officer of SB Financial for the attention of the Board of Directors or specified individual directors are

forwarded to the appropriate members of the Board.

MEETINGS

AND COMMITTEES OF THE BOARD

Each

member of the Board is expected to devote sufficient time, energy and attention to ensure diligent performance of his or her duties and

to attend all Board, committee and shareholder meetings. The Board met 14 times during 2023, of which 12 were regularly scheduled meetings.

Each director attended 75% or more of the aggregate of the number of meetings held by the Board and the number of meetings held by the

Board committees on which he or she served during 2023. The Board has four standing committees: Audit & Risk Management, Compensation,

Governance and Nominating, and Loan Review. In accordance with the NASDAQ Marketplace Rules, the independent directors meet in executive

session as appropriate matters for their consideration arise. The Company encourages all incumbent directors and director nominees to

attend each Annual Meeting. All of the incumbent directors and director nominees attended the Company’s last Annual Meeting held

on April 20, 2023.

The

Board’s standing committees of independent directors facilitate and assist the Board in the execution of its responsibilities.

Each of these committees operates under a written charter, which is available on the Company’s website at www.YourSBFinancial.com

by first clicking “Corporate Overview”, and then “Governance Documents.”

| Director |

|

Audit

& Risk

Management

Committee

Member |

|

Compensation

Committee

Member |

|

Governance

and

Nominating

Committee

Member |

|

Loan

Review

Committee

Member |

| George

W. Carter |

|

X |

|

X

(Chair) |

|

|

|

|

| Timothy

L. Claxton |

|

|

|

|

|

X |

|

X |

| Gaylyn

J. Finn |

|

X

(Chair) |

|

|

|

|

|

X

|

| Richard

L. Hardgrove (Lead Independent Director) |

|

|

|

X |

|

X

|

|

|

| Tom

R. Helberg |

|

X |

|

|

|

|

|

X

(Chair) |

| Rita

A. Kissner |

|

X

|

|

X |

|

|

|

|

| Mark

A. Klein |

|

|

|

|

|

|

|

|

| William

G. Martin |

|

|

|

X |

|

X |

|

|

| Timothy

J. Stolly |

|

|

|

|

|

X

(Chair) |

|

|

| |

|

|

|

|

|

|

|

|

| Number

of meetings held – 2023 |

|

4 |

|

3 |

|

3 |

|

4 |

Audit & Risk Management Committee

The

function of the Audit & Risk Management Committee is to assist the Board in its oversight of:

| ● | the

accounting and financial reporting principles and policies and the internal accounting and

disclosure controls and procedures of the Company and its subsidiaries; |

| ● | the

Company’s internal audit function; |

| ● | the

certification of the Company’s quarterly and annual financial statements and disclosures; |

| ● | the

Company’s consolidated financial statements and the independent audit thereof; and |

| ● | The

Corporation’s enterprise-wide risk management function, including assisting the Board

of Directors in its oversight of the guidelines, policies and processes for monitoring and

mitigating risks. |

The

Audit & Risk Management Committee is also directly responsible for:

| ● | (Audit)

the appointment, compensation, retention and oversight of the work of the independent registered

public accounting firm engaged by the Company for the purpose of preparing or issuing an

audit report or performing other audit, review or attestation services. The independent registered

public accounting firm reports directly to the Audit & Risk Management Committee. The

Audit & Risk Management Committee evaluates the independence of the independent registered

public accounting firm on an ongoing basis. Additionally, the Audit & Risk Management

Committee reviews and pre-approves all audit services and permitted non-audit services provided

by the independent registered public accounting firm to the Company or any of its subsidiaries

and ensures that the independent registered public accounting firm is not engaged to perform

the specific non-audit services prohibited by law, rule or regulation. The Audit & Risk

Management Committee is also responsible for establishing procedures for the receipt, retention

and treatment of complaints received by the Company regarding accounting, internal accounting

controls or auditing matters, including the confidential, anonymous submission by employees

of the Company of concerns regarding questionable accounting or auditing matters. |

| ● | (Risk)

assisting the Board of Directors in overseeing the Company’s risk management function

and associated guidelines, policies and processes for monitoring and mitigating risk relevant

to the Company and its operations. Management is responsible for designing, implementing

and maintaining an effective risk management program. The Committee is responsible for ensuring

that management implements, maintains and adheres to an appropriate enterprise-wide risk

management program, which may include the development of specific guidelines and policies,

to identify, assess, monitor, control, mitigate and report the Company’s risks including

credit risk, compliance risk, interest rate risk, operational risk, liquidity risk, market

risk, information technology risk (including cyber-security, information security and third

party vendor risks), strategic risk (including capital management), and reputational risk.

|

The

Board has determined that each member of the Audit & Risk Management Committee is able to read and understand financial statements,

including the Company’s balance sheets, income statements and cash flow statements, and is qualified to discharge his or her duties

to the Company and its subsidiaries. In addition, the Board has determined that Gaylyn J. Finn qualifies as an “audit committee

financial expert” for purposes of Item 407(d)(5) of Regulation S-K promulgated by the SEC by virtue of his service as the Treasurer

and Associate Vice President for Finance of Bowling Green State University prior to his retirement and his CPA certification (currently

inactive).

Compensation

Committee

The

function of the Compensation Committee is to review and recommend to the Board the salary, bonus and other compensation to be paid to,

and the other benefits to be received by, the Company’s executive officers, including the named executive officers listed in the

Summary Compensation Table on page 19 of this proxy statement (the “NEOs”). In addition, the Compensation Committee evaluates

and makes recommendations regarding the compensation of the directors, including their compensation for services on Board committees.

The Compensation Committee also administers the Company’s equity incentive plans. A full listing of the Compensation Committee’s

duties and responsibilities is set forth in the Compensation Committee’s charter, a copy of which is available on the Company’s

website at www.YourSBFinancial.com by first clicking clicking “Corporate Overview”, and then “Governance Documents.”

Governance

and Nominating Committee

The

function of the Governance and Nominating Committee is to assist the Board in identifying qualified individuals to become directors of

the Company and its subsidiaries, determining the composition of the boards of directors and their committees, monitoring a process to

assess the effectiveness of the boards of directors and their committees and developing and implementing the Company’s corporate

governance guidelines. The Governance and Nominating Committee also evaluates the performance of the current members of the boards of

directors of the Company and its subsidiaries on an annual basis. Members of the boards of directors participate in director education

programs throughout the year. Education activities may include participation in conferences, seminars, or webinars conducted from time

to time by national or state associations or industry experts. The Governance and Nominating Committee also selects, evaluates and annually

renews advisory boards’ composition and its members.

The

Governance and Nominating Committee oversees risks relating to the Company’s environmental, social, and governance (“ESG”)

practices and is responsible for assisting the Board in overseeing the Company’s practices and reporting with respect to ESG matters.

Loan

Review Committee

The

function of the Loan Review Committee is to assist the Board in fulfilling its oversight responsibilities of credit quality at State

Bank. The Loan Review Committee is comprised of independent directors who are not involved in the loan approval process at State Bank,

except when full Board approval is required due to the nature or size of a particular credit being presented.

COMPENSATION

OF EXECUTIVE OFFICERS

Summary

The

following discusses our executive compensation program for our executive officers, including the NEOs listed below and describes the

process followed by the Compensation Committee for making pay decisions, as well as its rationale for specific compensation related decisions

with respect to the compensation of our NEOs and other executive officers in 2023.

The

Company has no direct employees. All officers and other employees performing services for the Company are employees of The State Bank

and Trust Company (“State Bank” or the “Bank”). The Compensation Committee is a committee of the Board of Directors,

composed solely of independent directors, and is responsible for developing the Bank’s executive compensation principles, policies

and programs and approving the compensation to be paid to the Chief Executive Officer, Chief Financial Officer and each of the other

executive officers of the Company and the Bank. The Compensation Committee consults with Mark A. Klein, Chairman, President and Chief

Executive Officer, concerning executive officer compensation, however, he does not participate in the deliberations regarding his compensation

as Chairman, President and Chief Executive Officer.

Below,

we summarize the Company’s compensation components and objectives.

| Component |

|

Objective |

| Base salary |

|

Attract and retain individuals who are capable of adding value to the Company |

| Short-term incentives (cash) |

|

Motivate individuals to achieve predefined goals and objectives that are highly correlated with the success of the Company |

Long-term incentives

(equity) |

|

Reward long-term performance that seeks to align the interests of the executive(s) with those of our stockholders |

Supplemental

benefits

(e.g. SERP, supplemental disability, deferred compensation) |

|

Provide market-driven benefits that seek to retain high-quality executives in a competitive environment |

The

total compensation package for executive officers of the Company and the Bank includes: base salary, short-term incentives (cash), long-term

incentives (equity) and supplemental benefits such as Supplemental Executive Retirement Plan (“SERP”) and supplemental disability

benefits. The long-term incentive opportunities may consist of equity incentives under the Company’s 2017 Equity Incentive plan

(the “2017 Plan”). Executive officers also receive other employee benefits, such as health and life insurance, that are generally

available to all employees. Generally, the executive officers of the Bank, with the exception of the President and CEO, are employed

“at will” without severance agreements or employment contracts. The Company believes that its compensation levels and structure,

as well as the Company’s culture and intangibles, alleviate the need for the Company to utilize employment agreements with executive

officers other than its President and CEO. However, the Company has entered into Change of Control Agreements with other executive officers

that provide them with protection in the form of severance payments in the case of a termination of employment in connection with a change

of control of the Company. For additional information, see “AGREEMENTS WITH EXECUTIVE OFFICERS - CHANGE IN CONTROL AGREEMENTS”

beginning on page 21 of this proxy statement.

Since

2013, the Company has held a “say-on-pay” advisory shareholder vote on the compensation of the Company’s NEOs at the

Annual Meeting each year. These “say-on-pay” proposals have been approved by a significant majority of the Common Shares

voted at each of the last nine Annual Meetings. At the 2023 Annual Meeting, 99.19% of the Common Shares voted on the “say-on-pay”

proposal (including abstentions but excluding broker non-votes) were voted in favor of the non-binding advisory vote on executive compensation.

While

the advisory vote was only one of several factors that influenced the Company’s executive compensation decisions and policies for

2023, the Compensation Committee viewed the results of this advisory vote as a continued indication that shareholders are generally supportive

of the Company’s compensation philosophy and policies. Based on the results of the 2023 “say-on-pay” vote, no specific

component of the executive compensation program was altered from fiscal year 2022. The Compensation Committee and the Company’s

Board of Directors believe that the Company’s executive compensation has been appropriately tailored to its business strategies,

aligns pay with performance, and reflects best practices regarding executive compensation. The Compensation Committee will continue to

consider shareholder sentiments about the Company’s core principles and objectives when determining executive compensation going

forward.

Compensation

Philosophy

The

Compensation Committee believes that the most effective executive compensation program is one that is designed to reward the achievement

of specific, long-term and strategic goals set by the Company, and which aligns executives’ interests with those of the shareholders

by rewarding for performance above these established goals, with the ultimate objective of improving shareholder value.

In

general, for short- and long-term incentive plans, the Company targets the 50th percentile (median) of its peer group when

performance expectations are met, and targets the upper quartile (75th percentile) when performance expectations are exceeded.

The

Compensation Committee evaluates both performance and compensation to ensure that the Company maintains its ability to attract and retain

quality employees in key positions. The Compensation Committee attempts to ensure that the compensation provided to key employees of

the Company and its subsidiaries, including the NEOs, remains competitive relative to the compensation paid to similarly situated employees

at comparable companies. The Compensation Committee further believes that such compensation should include both cash and equity-based

compensation that rewards performance as measured against pre-established goals.

Engagement

of Independent Compensation Consultant

The

Compensation Committee has the sole authority to engage the services of any compensation consultant or advisor. It is the policy of

the Compensation Committee to conduct a periodic, independent review of the Company’s compensation programs to verify the

reasonableness of its compensation programs for executives, directors and key officers as compared to peer groups and ensure

compliance with all applicable federal and state laws, rules and regulations. The independent reviews are conducted by a firm or

individual who does not provide other services or products to the Company. In addition, the independent firm must not have any other

personal or business relationships with any Board member or any officer of the Company. The Compensation Committee considers all

relevant factors, including those set forth in Rule 10C-1(b)(4)(i) through (vi) under the Exchange Act, in determining that the work

performed by its compensation consultants does not raise a conflict of interest.

Since

2011, the Compensation Committee has periodically engaged the services of Blanchard Consulting Group (“BCG”), a nationally

recognized independent financial institution compensation consulting company. BCG was engaged to evaluate board compensation and executive

compensation in 2022. The 2022 executive study focused on all aspects of executive total compensation, including base salaries, cash

incentives/bonuses, equity incentives and grants, other compensation and perquisites, and executive benefits and retirement programs.

The information and analyses provided by BCG in 2022 was used by the Compensation Committee in making its executive compensation decisions

for the 2023 fiscal year. It is the Company’s intent to conduct these studies on a biennial basis, with the next board and executive

compensation analysis to be conducted in 2024.

As

part of the 2022 executive total compensation review, BCG utilized a peer group of nineteen (19) publicly traded bank holding companies.

The peer group was developed jointly by BCG and the Company. The Company’s peer group was comprised of public bank holding companies

with similar attributes to the Company, such as: asset size, revenue, geography, and a similar business model. The peer group focused

on banks with assets between $1.0 billion and $3.5 billion as of 2022 fiscal year-end (2022Y) and located in Indiana, Kentucky, Michigan,

Missouri, Ohio, Pennsylvania, and Wisconsin. The peer group median asset size ($1.7 billion as of 2022Y) is slightly larger than the

Company ($1.3 billion as of 2022Y), but historically this has been intentional to account for the significant additional off-balance

sheet assets under care at the Bank (wealth management and real estate mortgage) totallying over $3.2 billion. The Company’s current

asset size remains approximately $1.3 billion. The BCG study on executive compensation contained peer group information on total compensation,

but also included additional banking industry survey data and banking industry trend information. The industry survey and trend information

was derived from BCG databases and surveys that focus almost exclusively within the banking marketplace.

Peer

Group Bank Holding Companies

The peer

group bank holding companies utilized in the 2022 executive total compensation review included the bank holding companies listed below.

Changes to the peer group from 2021 to 2022 consisted of removing County Bancorp, Inc., Kentucky Bancshares, Inc., and MutualFirst Financial,

Inc. due to acquisitions. These three peers were replaced with PSB Holdings, Inc., Richmond Mutual Bancorporation, Inc., and CSB Bancorp,

Inc. The three new peers were chosen based on having similar attributes to the Company.

| Company | |

Location |

| Civista Bancshares, Inc. | |

Sandusky, OH |

| Macatawa Bank Corporation | |

Holland, MI |

| ACNB Corporation | |

Gettysburg, PA |

| Southern Missouri Bancorp, Inc. | |

Poplar Bluff, MO |

| Farmers & Merchants Bancorp, Inc. | |

Archbold, OH |

| Citizens & Northern Corporation | |

Wellsboro, PA |

| Citizens Financial Services, Inc. | |

Mansfield, PA |

| Norwood Financial Corp. | |

Honesdale, PA |

| LCNB Corp. | |

Lebonon, OH |

| First Savings Financial Group, Inc. | |

Jeffersonville, IN |

| Finward Bancorp (formerly NorthWest Indiana

Bancorp) | |

Munster, IN |

| Limestone Bancorp, Inc. | |

Louisville, KY |

| AmeriServ Financial, Inc. | |

Johnstown, PA |

| Middlefield Banc Corp. | |

Middlefield, OH |

| First Keystone Corporation | |

Berwick, PA |

| PSB Holdings, Inc. | |

Wausau, WI |

| Richmond Mutual Bancorporation, Inc. | |

Richmond, IN |

| Ohio Valley Banc Corp. | |

Gallipolis, OH |

| CSB Bancorp, Inc. | |

Millersburg, OH |

In

its review of executive compensation, the Compensation Committee reviewed the following data provided by BCG:

| ● | Total

cash compensation = Base salary + Annual cash incentives / bonus; |

| ● | Direct

compensation = Total cash compensation + Three-year average equity awards (equity granted

in years 2019-2022 by the 19 peer bank holding companies); and |

| ● | Total

compensation = Direct compensation + Other compensation + Retirement Benefits / Perquisites |

The

Committee’s evaluation of the peer group comparison and BCG’s assessment of our compensation practices and levels concluded:

| ● | The

Company’s financial performance varied compared to the peer group; however, most performance

metrics (ROAA, ROAE, NPAs/assets, tangible equity ratio, core EPS growth, and three year

total return) were near or above the peer group 50th percentile; |

| ● | The

Company has adequate and appropriate compensation tools available to attract, motivate and

retain high-quality, skilled executives and to provide a mix of short- and long-term compensation

opportunities; |

| ● | “Total

cash compensation” of the Company’s top three executive proxy officers was considered

generally competitive compared to peers when the Compensation Committee factored in the individual

officers, their performance, and the Company’s performance; |

| ● | For

“Direct compensation,” the Company was generally near median levels of the peer

group; and |

| ● | “Total

compensation” remains competitive to peer and supports that the Company has competitive

executive benefits. |

Individual

Executive Position Responsibilities & Expectations

The

Compensation Committee establishes subjective performance objectives for each executive officer on an annual basis. The performance objectives

are tailored to the particular executive officer’s area of responsibility within the Company and the Bank. Whether these performance

objectives are achieved is one of the factors considered by the Compensation Committee when establishing annual base salaries for the

following fiscal year. Annual increases are at the discretion exclusively of the Compensation Committee. For fiscal year 2023, the Company’s

executive officers were evaluated on the performance criteria set forth below:

Mark

A. Klein – Act as the Chairman, President and Chief Executive Officer of the Company and the Bank, providing leadership and

motivation to achieve Board approved goals and objectives. Be a spokesperson for the Company to shareholders, customers, employees, and

the media. Ensure the integrity of corporate records and various regulatory reports while supervising compliance with all applicable

laws and regulations. Ensure that proper internal controls are in place and followed to protect the integrity of financial reporting.

Support shareholder relations by acting as a primary Company contact. Communicate to the Board the progress toward goals and objectives,

compliance issues, policy exceptions, and operational issues and risks.

Anthony

V. Cosentino – Act as the Chief Financial Officer of the Company and the Bank, assuring the integrity and accuracy of

corporate financial records and various regulatory reports. Ensure that proper internal controls are in place and followed to

protect the integrity of financial reporting. Prepare the budget and advise the executive management team and the Board of Directors

on progress toward budget goals. Support shareholder relations by acting as a primary Company contact. Participate as a member of

the Bank’s executive management team to develop direction and goals and to assist in communicating and supporting

management’s priorities.

David

A. Homoelle – Act as the Regional President of the Bank’s Columbus Market and the Residential Real Estate Executive overseeing

the entire operations of the Columbus market area. Provide leadership of the Bank’s residential real estate department to ensure

compliance with all applicable laws and regulations. Ensure the proper maintenance and control of customer and bank records to ensure

the integrity of those records. Manage the growth of the residential real estate department to meet budgeted goals. Participate as a

member of the Bank’s executive management team to develop direction and goals and to assist in communicating and supporting management’s

priorities.

2023

Executive Compensation Components

Annual

Base Salaries

The

determination of the base salaries of the executive officers of the Company is based upon an overall evaluation of a number of factors,

including a subjective evaluation of individual performance, contributions to the Company and its subsidiaries, and analysis of how the

Company’s and its subsidiaries’ compensation of its executive officers compares to compensation of individuals holding comparable

positions with companies of similar asset size and complexity of operations.

During

its review of each executive’s base salary, the Compensation Committee primarily considers:

| ● | market

data provided by independent outside consultants, such as BCG (peer group and banking industry

survey data); |

| ● | tenure,

experience, executive role and specific job duties being performed; |

| ● | internal

review of the executive’s compensation, both individually and relative to other officers;

and |

| ● | the

individual performance of the executive. |

The

following table sets forth the amounts of the base salaries paid to our NEOs during the 2023 and 2022 fiscal years.

| NEO

Name | |

2023

Base Salary | | |

2022

Base Salary | | |

%

of

Increase | |

| Mark A. Klein | |

$ | 476,377 | | |

$ | 458,055 | | |

| 4.00 | % |

| Anthony V. Cosentino | |

$ | 254,692 | | |

$ | 244,896 | | |

| 4.00 | % |

| David A. Homoelle | |

$ | 236,385 | | |

$ | 229,500 | | |

| 3.00 | % |

Base

salary increases for both 2023 and 2022 became effective on July 1st of each year.

Non-Equity

Incentive Compensation

The

Incentive Compensation Plan is a company-wide performance-based incentive compensation program which is intended to link incentive compensation

directly to the Company’s and individual’s performance and, thereby, to shareholder value. The following were some of the

2023 organization-wide objectives supported by the plan:

| ● | build

a high-performance financial company; |

| ● | ensure

sound operations, policies and procedures; and |

| ● | build

on the value proposition strength within each business unit. |

The

following table sets forth the range of potential payouts under the 2023 Incentive Compensation Plan for the NEOs. When determining the

incentive plan opportunity levels, the Compensation Committee evaluated competitive market data (peer group and banking industry data

for banks between $1 billion and $3 billion in asset size as provided by the 2023 BCG executive compensation analysis) along with the

experience level, duties, and responsibilities expected of each NEO position. The overall 2023 non-equity incentive plan earning opportunities

as a percent of salary were unchanged from 2022. The Company and Compensation Committee determined that they remained competitive and

appropriate for 2023. The Plan has a minimum after tax net income ($6.5 million in 2023) “circuit breaker” [below which no

incentive payouts will be made] and requires employees to be employed in “good standing” in order to receive a payout.

Non-Equity

Incentive Compensation Plan Opportunity Levels for 2023 Fiscal Year and Actual Payouts Made

| | |

Payouts

Under Non-Equity Incentive Plan

(as a % of Base Salary) | | |

2023

Actual Payouts

(as a % of | |

| Executive

Officer | |

Threshold | | |

Target | | |

Maximum | | |

salary1) | |

| Mark A. Klein | |

| 15.0 | % | |

| 30.0 | % | |

| 60.0 | % | |

| 11.41 | % |

| Anthony V. Cosentino | |

| 12.5 | % | |

| 25.0 | % | |

| 50.0 | % | |

| 8.39 | % |

| David A. Homoelle | |

| 12.5 | % | |

| 25.0 | % | |

| 50.0 | % | |

| 12.20 | % |

| 1 | 2023

salary as reported in the Summary Compensation Table. |

The

2023 non-equity incentive plan goals and weightings remained largely unchanged from 2022, except that the goal of Return on Average Common

Equity was added for Mr. Klein and Mr. Cosentino. The 10 percent weighting in this category was achieved by lowering the weighting in

several other categories. The performance criteria are reviewed annually, and the Company believes they remain the most appropriate measures

of annual performance based on the Company’s strategic goals.

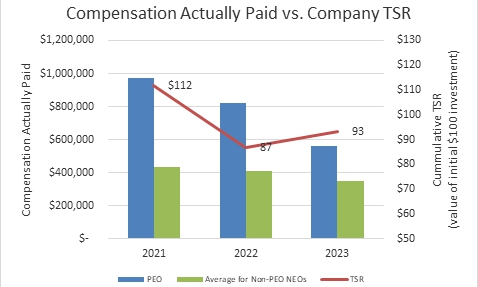

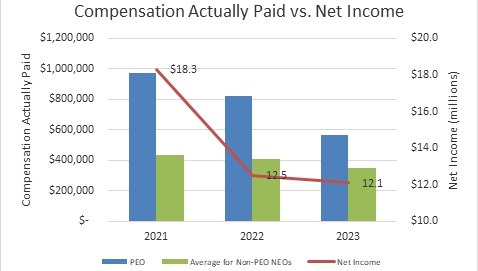

| Mark