MARKET MOVEMENTS:

-- Brent crude oil is 1.4% lower at $84.61 a barrel.

-- European benchmark gas falls 4.5% to EUR 43 a megawatt

hour.

-- Gold futures are up 0.2% at $1,858.40 a troy ounce.

-- Three Month copper is 0.7% lower at $8,862 a metric ton.

-- Wheat futures are 0.9% lower at $7.03 a bushel.

TOP STORY:

China Sets Conservative Growth Target as Challenges Loom

China unveiled its lowest growth target in more than a

quarter-century as Beijing faces challenges in the domestic and

global economy following its emergence from three years of strict

Covid-19 measures.

China's target of around 5% growth this year in gross domestic

product, announced on Sunday by Premier Li Keqiang at the start of

the country's annual legislative session, suggests that officials

are less concerned about raw economic expansion as they turn their

attention to other priorities.

At this week's legislative meetings, leader Xi Jinping is

expected to further consolidate his grip over the realms of

security, finance and technology, reshuffling key posts to further

dilute the government's role in policy-making at the expense of the

Communist Party, The Wall Street Journal has reported.

OTHER STORIES:

EVs Boost Chip Demand Despite Semiconductor Makers' Woes

Chip sales that have declined across many customer segments are

still enjoying one area of rising demand: cars.

Growing sales of electric vehicles--which tend to use more

semiconductors than their gas-powered counterparts--coupled with

greater automation in all vehicles, have kept producers of chips

for cars busy. The long-term outlook for the market appears robust,

Tesla Inc. suggested this past week, as Chief Executive Elon Musk

detailed plans for his car company to scale up to 20 million

vehicles a year by 2030, from around 1.3 million in 2022.

"We're consuming about 700,000 12-inch wafer equivalents,"

Tesla's supply-chain vice president Karn Budhiraj said Wednesday,

referring to the material individual chips are made of. "We're

going to need 8 million wafers," he added, once the company reaches

its 20-million-car production target. Tesla also indicated it was

working on ways to use fewer chips per vehicle and didn't

anticipate chip-making capacity as an impediment, given how that

industry was expanding.

--

Energy Industry Wrestles Over Going Green Too Fast

While the race to develop cleaner energy intensified over the

past year, an uneasy consensus emerged on a parallel track: At

least in the short term, the world needs more oil and gas, too.

The dueling-and sometimes conflicting-imperatives are expected

to be core topics in Houston starting Monday when oil executives,

climate hawks and government officials gather at the industry's

premier annual energy summit.

For an industry accustomed to extreme cycles of boom and bust,

the current environment is less binary and more complex than usual.

Even as the biggest companies post record profits, huge questions

linger.

--

A New York Town Once Thrived on Fossil Fuel. Now, Wind Energy Is

Giving a Lift.

This former oil town almost 300 miles from the coast is emerging

as one of the early winners in the push to develop offshore wind in

the Atlantic Ocean.

The hulking steel components of wind turbines slated to rise out

of the ocean east of Long Island are being welded at the Ljungström

factory, which for 100 years has sold parts to coal-fired power

plants. Plant managers here said their pivot to wind has meant

hiring 150 more people and could reopen a facility that has been

dormant for several years.

The renewed economic activity has brought new jobs and

perspective to some here in Wellsville, a town of 7,000 people

about 80 miles south of Rochester that blossomed in the 20th

century serving the fossil-fuel economy. As the nation strives to

meet a goal of halving greenhouse gas emissions--including enough

offshore wind to power 10 million homes by 2030--the U.S. could see

more places with historical ties to traditional energy markets try

their hand in renewables.

MARKET TALKS:

Metals Mixed as Markets Look to Powell Comments, Payrolls

Data

0824 GMT - Metals markets are mixed with investors awaiting

macro data signals to help gauge Federal Reserve policy.

Three-month copper is up 0.2% to $8,940 a metric ton while aluminum

is down 0.5% to $2,383 a metric ton. Gold, meanwhile, is 0.4%

higher at $1,862 a troy ounce. "Investors are spooked by the

hawkish Fed's 'higher for longer' interest rate projections," says

Dave Whitcomb, head of research at Peak Trading Research. Bond

markets are pricing in a 33% chance of a 50-basis-point hike from

the Fed at its next meeting, he says in a note. "That's good for

the dollar, bad for commodities," Whitcomb says, adding that the

next key dollar events will be [Fed Chair Jerome] Powell's comments

Tuesday and nonfarm payroll data Friday. (yusuf.khan@wsj.com)

--

Oil Slips as China Sets Modest Growth Target

0827 GMT - Oil falls after China set its lowest growth target in

more than a quarter-century and investors awaited comments from Fed

Chair Jerome Powell later this week. Brent crude, the international

oil benchmark, is down 0.4% at $85.52 a barrel while WTI declined

0.3% to $79.43 a barrel. China said Sunday it was aiming for 5% GDP

growth this year, a modest target compared to previous years,

suggesting officials are cautious about the nation's emergence from

Covid-19 lockdowns. Separately, Powell is set to speak to U.S.

lawmakers Tuesday and Wednesday. The focus will be on any

indication the Fed chief makes about interest rates and inflation.

(william.horner@wsj.com)

--

Copper Falls on Concerns Over China Demand

0338 GMT - Copper prices are lower in the morning Asian session,

on concerns over China demand, driven by the country unveiling a

growth target of 5% for 2023, its lowest in more than a

quarter-century. While this target isn't a surprise, it could feel

disappointing to market participants, Citi Research analysts say in

a research report. The growth target, toward the lower end of

expectations, implies that policy makers aren't willing to

overstimulate the economy, the analysts add. The three-month LME

copper contract is down 0.6% at $8,929.00 a ton.

(ronnie.harui@wsj.com)

Write to Yusuf Khan at yusuf.khan@wsj.com

(END) Dow Jones Newswires

March 06, 2023 06:01 ET (11:01 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

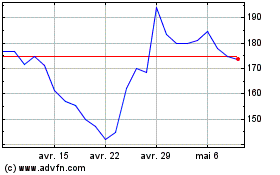

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024