NEW YORK (Agefi-Dow Jones)--Amazon et Rivian négocient la fin de

leur partenariat exclusif dans les fourgons électriques à la suite

des commandes passées par le géant du commerce électronique pour

2023, selon des personnes proches du dossier.

Dans le cadre d'un accord conclu en 2019, Rivian est tenu de vendre

tous les fourgons qu'il produit à Amazon. Ces derniers mois, le

distributeur a informé Rivian qu'il n'achèterait qu'environ 10.000

de ces véhicules cette année, ce qui correspondait au bas de la

fourchette prévu dans le contrat initial, selon les personnes

interrogées.

En réaction, Rivian cherche à s'affranchir de l'accord

d'exclusivité pour pouvoir vendre librement sa production à

d'autres acheteurs. Des pourparlers entre les deux sociétés sont

toujours en cours.

Une porte-parole d'Amazon a déclaré que l'entreprise s'engageait

toujours à acheter 100.000 fourgons à Rivian d'ici ç 2030, comme le

prévoyait l'accord initial. "Rivian reste un partenaire important

pour Amazon et nous sommes enthousiastes pour l'avenir", a-t-elle

indiqué.

Une porte-parole de Rivian a affirmé de son côté que la "relation

avec Amazon a toujours été positive. Nous continuons à travailler

en étroite collaboration et nous naviguons dans un climat

économique évolutif, comme beaucoup d'autres entreprises".

L'action Rivian chute de 3%, à 13,71 dollars, mardi à Wall Street,

après avoir touché un nouveau plus bas historique en séance.

-Sean McLain et Dana Mattioli, The Wall Street Journal (Version

française Jérôme Batteau) ed : TVA

Agefi-Dow Jones The financial newswire

-0-

Amazon.com Inc. and Rivian Automotive Inc. are in talks to scrap

the exclusivity part of their electric-van deal, allowing the auto

maker to sell to others, after the technology giant's order for

2023, according to people familiar with the matter.

Under terms of a 2019 agreement, Rivian is required to sell all of

the vans it makes to Amazon. In recent months, Amazon notified

Rivian that it wanted to buy about 10,000 vans this year, which was

at the low end of a range it previously provided the auto maker,

the people said.

In response, Rivian sought to remove the exclusivity terms, the

people said. Talks are ongoing, they said.

An Amazon spokeswoman said the company remains committed to buying

100,000 vans from Rivian by 2030, which were the terms outlined in

the original agreement. "Rivian remains an important partner for

Amazon, and we're excited about the future," she said.

A Rivian spokeswoman said: "Our relationship with Amazon has always

been a positive one. We continue to work closely together and are

navigating a changing economic climate, similar to many

companies."

Executives at both companies have touted the deal, which gave

Rivian an anchor customer and Amazon a key component of its pledge

to slash carbon emissions. Amazon is Rivian's largest shareholder,

with a 17% stake in the company, according to FactSet, and Amazon

is on Rivian's board of directors.

Amazon has initiated cost-saving measures over the past year amid a

slowdown in e-commerce sales, following a surge during the

pandemic. The online retailer has said it is pausing construction

on its second headquarters in the D.C. area and laying off more

than 18,000 workers, one of the largest reductions among technology

companies.

For Rivian, the Amazon contract has provided steady demand for one

of the three vehicles the auto maker builds at its Normal, Ill.,

factory. If Amazon agrees to end the exclusivity arrangement,

Rivian would need to find new commercial customers for the

vans.

The Amazon deal has been viewed favorably by investors as an

important stabilizing factor for the startup auto maker and an

endorsement of its technology.

"Amazon represents such a large customer, or such a large pool of

demand for us," said Rivian Chief Executive RJ Scaringe in late

2021, soon after the company's initial public offering.

Amazon and Rivian worked together closely on the development of the

electric van. A change in the Amazon relationship would mark the

latest challenge for Rivian, which is under pressure to cut costs

and boost factory output. The company also makes the R1T pickup

truck and the R1S SUV for retail customers.

Last month, Rivian's shares fell after the company said it aimed to

make 50,000 vehicles this year, below the estimates of Wall Street

analysts.

Rivian is among the more prominent electric-vehicle startups to

emerge in recent years, following the rise of EV leader Tesla Inc.

Like other young EV companies, Rivian has been strained by rising

costs and supply-chain disruptions. The company's shares have

dropped about 90% since their post-IPO highs in late 2021.

The Irvine, Calif.-based EV maker burned through $6.6 billion in

2022, after starting the year with more than $18 billion -- much of

it raised in the well-received IPO in November 2021. During an

earnings call last month, Rivian executives said they have enough

cash to last through 2025.

Last week, Rivian said it would raise $1.3 billion through the sale

of green convertible bonds. Shares tumbled about 15% the following

day.

To conserve cash, Rivian has conducted two rounds of layoffs and

pushed back plans for future business lines, such as its

more-affordable R2 line of vehicles. Mr. Scaringe has said the

workforce cuts are a response to rising commodity costs, a changing

economy and tightening capital markets.

He has emphasized that the EV maker needs to focus on vehicles and

projects that are critical in the near term for helping it turn a

profit. Several top executives departed in recent months, including

the head of supply chain and the vice president overseeing body

engineering.

Write to Sean McLain at sean.mclain@wsj.com, Dana Mattioli at

dana.mattioli@wsj.com and Nora Eckert at nora.eckert@wsj.com

(END) Dow Jones Newswires

March 13, 2023 14:23 ET (18:23 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

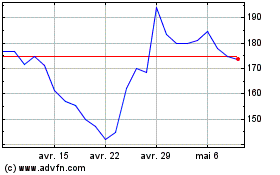

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024