Down 55% From All-Time Highs, Is Ford Stock a Good Buy Right Now?

29 Mai 2023 - 1:23PM

Finscreener.org

In the turbulent stock market

seas, sell-offs can be intimidating. Yet, they often present

opportunities to buy quality companies that have demonstrated their

capacity to weather even the fiercest storms. Consider, for

instance, the storied automaker Ford Motor

Company (NYSE:

F), whose stock is

currently down 55% from its all-time high.

In January 2022, FordU+02019s

market capitalization exceeded $100 billion for the first time in

its history. Investors were buoyed by the companyU+02019s renewed

focus on electric vehicles (EVs), which CEO Jim Farley placed at

the heart of his turnaround strategy. But as we forge into 2023,

FordU+02019s stock has seen a steep decline from that

peak.

Ford aims to improve profit margins

The company flagged unexpectedly

high costs throughout 2022 due to inflation and supply chain

disruptions, culminating in a net loss of $2 billion for the year.

However, Farley was forthright during the companyU+02019s Q4

earnings release: "We should have done much better last year," he

conceded. Ford also acknowledged letting "$2 billion in profits

slip through its fingers" due to controllable factors.

Regardless, Ford isnU+02019t

turning down the volume on its ambitions. Instead, the automaker is

sticking to its 2023 guidance, projecting between $9 billion and

$11 billion in adjusted EBIT and approximately $6 billion in

adjusted free cash flow.

FordU+02019s goal is to achieve

an 8% EBIT margin on its EV unit and reach a production rate of two

million EVs by 2026, a significant increase from the projected

600,000 by the end of this year.

This plan has faced criticism for

its aggressive nature.

Still, Ford seems undeterred,

sticking to its vision while laying out a detailed roadmap of

profit expectations for its critical business units. CFO John

Lawler was frank in acknowledging past shortfalls: "WeU+02019ve

talked about this for years. YouU+02019re not going to believe us

until we start

delivering it… we have to prove

it." The companyU+02019s new commitments will thus be crucial in

proving to Wall Street that its ambitious goals are more than just

lofty promises.

FordU+02019s "Model E" EV

business is projected to incur a $3 billion loss this year, but

profits from its traditional "Blue" and "Pro" fleet businesses

should provide a buffer. Meanwhile, the companyU+02019s traditional

car business reported earnings of $2.6 billion in Q1, and its fleet

operations pulled in $1.4 billion.

Moving forward, Ford aims to

streamline operations and boost profits from traditional products

to low double-digit EBIT margins, a substantial improvement from

7.2% in 2022. The company

also plans to increase the capacity for its internal combustion

vehicles by over 160,000 units in the next ten months.

As part of its forward-looking

strategy, Ford also aims to leverage software and subscription

revenue models. For example, the companyU+02019s BlueCruise

hands-free highway driving system could generate $200 million in

revenue, based on an expected take rate of 20% from an estimated

half a million vehicles equipped with the technology in

2024.

Ford and Tesla forge an EV partnership

Adding another string to its bow,

Ford recently announced new supply deals for lithium products to

support its ambitious plans to boost electric vehicle production in

the coming years.

These collaborations include a

"strategic partnership" with Albemarle

(NYSE:

ALBE) to supply more than

100,000 metric tons of lithium hydroxide – enough for approximately

3 million EV batteries – from 2026 to 2030.

They will also collaborate to

develop battery-recycling solutions, a critical element of

sustainable EV production. Other agreements with

Compass Minerals International (NYSE:

CMP), EnergySource

Minerals, and Canadian miner Nemaska Lithium will further ensure

FordU+02019s access to vital lithium resources.

In another surprising turn of

events, Ford announced a partnership with its competitor

Tesla (NASDAQ: TSLA)

on charging initiatives for its current and future electric

vehicles. This partnership, confirmed by Ford CEO Jim Farley and

Tesla CEO Elon Musk, will allow current Ford owners to access more

than 12,000 Tesla Superchargers across the U.S. and Canada starting

next year, using an adapter.

Furthermore, FordU+02019s

upcoming generation of EVs – expected by mid-decade –will feature

TeslaU+02019s charging plug. This integration will allow Ford

vehicle owners to charge at Tesla Superchargers without an adapter,

marking Ford as one of the first automakers to directly tap into

TeslaU+02019s extensive charging network.

Though Tesla continues to

dominate the EV sector by a significant margin, Ford ranked second

in fully electric vehicle sales in the U.S. last year, with 61,575

electric vehicles sold. This collaboration with Tesla signifies

FordU+02019s commitment to the EV sector and its readiness to adapt

and innovate to compete more effectively.

So, is Ford stock a good buy?

Given the companyU+02019s

significant investments in EVs, its improving profits, its

strategic partnerships for crucial minerals, and its willingness to

work with competitors to achieve greater access to essential

infrastructure, the future for Ford appears promising.

Investing in a company during a

downturn may feel counterintuitive, but FordU+02019s ongoing

initiatives indicate that it is a company preparing for growth. Its

strong focus on EVs, backed by important supply deals and strategic

partnerships, suggests a company that is not merely

riding

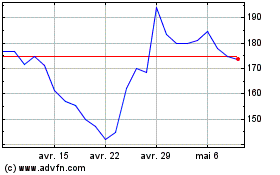

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024