Advance Auto Parts, Inc. (NYSE: AAP), a leading automotive

aftermarket parts provider in North America, that serves both

professional installer and do-it-yourself customers, announced its

financial results for the fourth quarter and full year ended

December 28, 2024.

"During 2024, we initiated transformative actions to reposition

Advance for long-term success and value creation,” said Shane

O'Kelly, president and chief executive officer. "We strengthened

our focus on the blended-box by divesting non-core assets, closing

non-strategic stores and right-sizing our organization. Our supply

chain and merchandising teams are accelerating efforts to provide

faster access to thousands of parts across our network. From a team

perspective, we deployed additional resources to support our

frontline team members and our customers. Additionally, we

augmented our leadership team with talented executives that bring

knowledge of core retail fundamentals."

"We ended 2024 with a healthy balance sheet and strong liquidity

to navigate our turnaround. The team is acutely focused on

execution and driving stronger accountability. We remain committed

to delivering an improved operating performance in 2025 and making

progress toward our FY27 goal of achieving an adjusted operating

margin of approximately 7%."

Fourth Quarter 2024 Results (1,2,3)

Fourth quarter 2024 net sales totaled $2.0 billion, a decrease

of 0.9% compared with the prior year. Comparable store sales for

the fourth quarter 2024 decreased 1.0%. Comparable store sales does

not include store closing sales at more than 500 corporate

locations which will be closing under our restructuring plan.

The company's fourth quarter 2024 gross profit was $347.1

million or 17.4% of net sales. Adjusted fourth quarter 2024 gross

profit was $778.6 million or 39.0% of net sales, compared with

$819.6 million or 40.7% of net sales in the prior year quarter. The

deleverage was primarily driven by atypical items and headwinds in

the period that are not included in non-GAAP adjustments. These

include (1) end of year inventory adjustments associated with an

annual review of vendor balances and inventory associated with DCs

closed during the year and (2) margin headwind associated with

liquidation sales at closing store and DC locations. We estimate

these items collectively impacted fourth quarter 2024 gross margin

by approximately 280 basis points.

The company's fourth quarter 2024 SG&A was $1.2 billion, or

58.5% of net sales. Adjusted fourth quarter 2024 SG&A was

$878.1 million or 44.0% of net sales compared with $850.7 million

or 42.2% of net sales in the prior year quarter. This was primarily

driven by higher labor-related expenses compared with the prior

year.

The company's fourth quarter operating loss was $820.0 million,

or (41.1)% of net sales. Adjusted fourth quarter 2024 operating

loss was $99.4 million or (5.0)% of net sales, compared with a loss

of $31.0 million or (1.5)% of net sales in the prior year quarter.

Our fourth quarter 2024 adjusted operating margin was negatively

impacted by 280 basis points of atypical items and headwinds in the

period that are not included in non-GAAP adjustments.

The company's effective tax rate in the fourth quarter of 2024

was 26.2%. The company's diluted loss per share was $10.16.

Adjusted fourth quarter diluted loss per share was $1.18 compared

with adjusted diluted loss per share of $0.45 in the prior year

quarter. Atypical items and headwinds in the period that are not

included in non-GAAP adjustments, accounted for approximately $0.68

of loss per share in the fourth quarter.

_____________________________

(1) All comparisons are based on the same

time period in the prior year. The company calculates comparable

store sales based on the change in store or branch sales starting

once a location has been open for approximately one year and by

including e-commerce sales and excluding sales fulfilled by

distribution centers to independently owned Carquest locations.

Acquired stores are included in the company's comparable store

sales one year after acquisition. The company includes sales from

relocated stores in comparable store sales from the original date

of opening. Closed stores and stores in process of closing under

the restructuring plan are not included in the comparable store

sales calculation.

Full Year 2024 Results (1,2,3)

Full year 2024, net sales totaled $9.1 billion, a decrease of

1.2% from 2023. Comparable store sales for full year 2024 decreased

0.7%. Comparable store sales does not include store closing sales

at more than 500 corporate locations which will be closing under

our restructuring plan.

The company's full year 2024 gross profit was $3.4 billion, or

37.5% of net sales. Adjusted full year 2024 gross profit was $3.8

billion or 42.2% of net sales, compared with $3.9 billion or 41.9%

of net sales in the prior year. The gross margin improvement was

primarily driven by lapping the one-time impact in the change for

inventory reserves in the prior year offset by strategic pricing

investments, atypical items and headwinds in the period that are

not included in non-GAAP adjustments. These atypical items included

end of year inventory adjustments, liquidation sales at closing

store and DC locations, lost revenue related to hurricanes and

systems outages. We estimate these items collectively impacted full

year 2024 gross margin by approximately 90 basis points.

The company's full year 2024 SG&A was $4.1 billion, or 45.3%

of net sales. Adjusted full year 2024 SG&A was $3.8 billion, or

41.8% of net sales, compared with $3.8 billion, or 41.3% of net

sales, in the prior year. The deleverage was primarily driven by

the lower sales volume compared with the prior year. Full year 2024

SG&A also includes atypical items that are not included in

non-GAAP adjustments. These include a gain on sale of asset offset

by nonrecurring team member assistance expenses and other charges.

In aggregate, we estimate these items drove 30 basis points of

favorability for the full year.

The company's full year 2024 operating loss was $713.3 million,

or (7.8)% of net sales. Adjusted full year 2024 operating income

was $35.2 million or 0.4% of net sales, compared with adjusted

operating income of $56.3 million or 0.6% of net sales in the prior

year. Our full year 2024 adjusted operating margin was negatively

impacted by 60 basis points of atypical items and headwinds in the

period that are not included in non-GAAP adjustments.

The company's effective tax rate for full year 2024 was 23.6%.

The company's full year 2024 diluted loss per share was $9.80.

Adjusted full year 2024 diluted loss per share was $0.29 compared

with adjusted diluted loss per share of $0.28 in the prior year

quarter. Atypical items and headwinds in the period that are not

included in non-GAAP adjustments accounted for approximately $0.64

of loss per share for the full year.

Net cash provided by operating activities was $140.5 million for

the full year 2024 versus $141.8 million for the prior year. The

decrease was primarily driven by lower net income and deferred

income taxes offset by higher working capital. Free cash flow for

the full year 2024 was an outflow of $40.3 million, compared with

an outflow of $83.9 million in the prior year.

Capital Allocation

On February 11, 2025, the company declared a regular cash

dividend of $0.25 per share to be paid on April 25, 2025 to all

common stockholders of record as of April 11, 2025.

__________________________

(1) Adjusted Operating Income Margin is a

non-GAAP measure. For a better understanding of the company’s

non-GAAP adjustments, refer to the reconciliation of non-GAAP

financial measures in the accompanying financial tables.

(2) All comparisons are based on

continuing operations for the same time period in the prior year,

unless otherwise specified. The company calculates comparable store

sales based on the change in store or branch sales starting once a

location has been open for approximately one year and by including

e-commerce sales and excluding sales fulfilled by distribution

centers to independently owned Carquest locations. Acquired stores

are included in the company's comparable store sales one year after

acquisition. The company includes sales from relocated stores in

comparable store sales from the original date of opening. Closed

stores and stores in process of closing under the restructuring

plan are not included in the comparable store sales

calculation.

(3) On August 22, 2024, the company

entered into a definitive purchase agreement to sell its Worldpac

Inc. business (“Worldpac”), which reflects a strategic shift in its

business. The sale was completed on November 1, 2024. As a result,

the company has classified the results of operations and cash flows

of Worldpac as discontinued operations in its condensed

consolidated statements of operations and condensed consolidated

statements of cash flows for all periods presented.

Strategic Priorities and Financial Objectives (FY25 through

FY27)

The company is executing a strategic plan to improve business

performance with a focus on core retail improvements. This plan is

anchored on three pillars outlined below to put the company on the

path to deliver consistent profitable growth.

- Merchandising excellence

- Strategic sourcing to improve first costs and bring parts to

market faster.

- Assortment management to enhance availability of parts.

- Pricing and promotions management to improve gross margin.

- Supply chain

- Consolidation of distribution centers to operate 12 large

facilities by end-2026.

- Opening of 60 market hub locations by mid-2027.

- Optimization of transportation routes and freight to lower

costs and improve productivity.

- Store operations

- Standardization of store operating model.

- Improving labor productivity.

- Accelerate pace of new store openings.

Full Year 2025 Guidance (53 weeks)

As of February 26,

2025

($ in millions, except per share data)

Low

High

Net sales from continuing operations

(1)

$8,400

$8,600

Comparable store sales (52 weeks) (2)

0.5%

1.5%

New store growth

30 new stores

Adjusted operating income margin from

continuing operations (4)

2.00%

3.00%

Adjusted diluted EPS from continuing

operations (3,4)

$1.50

$2.50

Capital expenditures

Approx. $300

Free cash flow (4)

$(85)

$(25)

(1) Includes approximately $100 to $120

million of net sales in the 53rd week.

(2) The company calculates comparable

store sales based on the change in store or branch sales starting

once a location has been open for approximately one year and by

including e-commerce sales and excluding sales fulfilled by

distribution centers to independently owned Carquest locations.

Acquired stores are included in the company's comparable store

sales one year after acquisition. The company includes sales from

relocated stores in comparable store sales from the original date

of opening. Closed stores and stores in process of closing under

the restructuring plan are not included in the comparable store

sales calculation.

(3) Includes approximately $0.40 related

to interest income for full year 2025 and approximately $0.05

contribution from the 53rd week.

(4) Adjusted operating income margin from

continuing operations, Adjusted diluted EPS from continuing

operations and Free cash flow are non-GAAP measures. For a better

understanding of the company's non-GAAP adjustments, refer to the

reconciliation of non-GAAP financial measures in the accompanying

financial tables. The company is not able to provide a

reconciliation of these forward-looking non-GAAP measures because

it is unable to predict with reasonable accuracy the value of

certain adjustments and as a result, the comparable GAAP measures

are unavailable without unreasonable efforts.

First Quarter 2025 Expectations

We are providing select first quarter 2025 expectations, which

include the impact of transitory costs associated with closure of

stores and DC locations.

($ in millions)

As of February 26,

2025

Net sales from continuing operations

Approx. $ 2,500

Comparable store sales

Decline approx. 2%

Adjusted operating income margin from

continuing operations

Approx. (2.00)%

Full Year 2027 Objectives (1)

Our full year 2027 financial objectives are unchanged

Net sales ($ in millions)

Approx. $9,000

Comparable store sales

Positive low-single-digit %

New store growth

50 to 70 new stores

Adjusted operating income margin (1)

Approx. 7.00%

Leverage ratio (Adj. debt/ Adj. EBITDAR)

(1)

Approx. 2.5x

(1) Adjusted operating income margin is

based on performance of Advance continuing operations. Adjusted

operating income margin from continuing operations and Adjusted

Debt to Adjusted EBITDAR ratio (“leverage ratio”) are non-GAAP

measures. For a better understanding of the company’s non-GAAP

adjustments, refer to the reconciliation of non-GAAP financial

measures in the accompanying financial tables. The company is not

able to provide a reconciliation of these forward-looking non-GAAP

measures because it is unable to predict with reasonable accuracy

the value of certain adjustments and as a result, the comparable

GAAP measures are unavailable without unreasonable efforts.

Investor Conference Call

The company will detail its results for the fourth quarter and

full year 2024 via a webcast scheduled to begin at 8 a.m. Eastern

Time on Wednesday, February 26, 2025. The webcast will be

accessible via the Investor Relations page of the company's website

(ir.AdvanceAutoParts.com).

To join by phone, please pre-register online for dial-in and

passcode information. Upon registering, participants will receive a

confirmation with call details and a registrant ID. While

registration is open through the live call, the company suggests

registering a minimum 10 minutes before the start of the call. A

replay of the conference call will be available on the company's

Investor Relations website for one year.

About Advance Auto Parts

Advance Auto Parts, Inc. is a leading automotive aftermarket

parts provider that serves both professional installer and

do-it-yourself customers. As of December 28, 2024, Advance operated

4,788 stores primarily within the United States, with additional

locations in Canada, Puerto Rico and the U.S. Virgin Islands. The

company also served 934 independently owned Carquest branded stores

across these locations in addition to Mexico and various Caribbean

islands. Additional information about Advance, including employment

opportunities, customer services, and online shopping for parts,

accessories and other offerings can be found at

www.AdvanceAutoParts.com.

Forward-Looking Statements

Certain statements herein are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements are usually identifiable by

words such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “forecast, “guidance,” “intend,” “likely,” “may,” “plan,”

“position,” “possible,” “potential,” “probable,” “project,”

“should,” “strategy,” “target,” “will,” or similar language. All

statements other than statements of historical fact are

forward-looking statements, including, but not limited to,

statements about the Company’s strategic initiatives, restructuring

and asset optimization plans, financial objectives, operational

plans and objectives, statements about the sale of the Company’s

Worldpac business, including statements regarding the benefits of

the sale and use of proceeds therefrom, statements regarding

expectations for economic conditions, future business and financial

performance, as well as statements regarding underlying assumptions

related thereto. Forward-looking statements reflect the Company’s

views based on historical results, current information and

assumptions related to future developments. Except as may be

required by law, the Company undertakes no obligation to update any

forward-looking statements made herein. Forward-looking statements

are subject to a number of risks and uncertainties that could cause

actual results to differ materially from those projected or implied

by the forward-looking statements. They include, among others, the

Company’s ability to hire, train and retain qualified employees,

the timing and implementation of strategic initiatives, risks

associated with the Company’s restructuring and asset optimization

plans, deterioration of general macroeconomic conditions,

geopolitical factors including increased tariffs and trade

restrictions, the highly competitive nature of the industry, demand

for the Company’s products and services, risks relating to the

impairment of assets, including intangible assets such as goodwill,

access to financing on favorable terms, complexities in the

Company’s inventory and supply chain and challenges with

transforming and growing its business. Please refer to “Item 1A.

Risk Factors” of the company’s most recent Annual Report on Form

10-K filed with the Securities and Exchange Commission (“SEC”), as

updated by the company’s subsequent filings with the SEC, for a

description of these and other risks and uncertainties that could

cause actual results to differ materially from those projected or

implied by the forward-looking statements.

Advance Auto Parts, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(in thousands), (unaudited)

Assets

December 28, 2024 (1)

December 30, 2023 (1)

Current assets:

Cash and cash equivalents

$

1,869,417

$

488,049

Receivables, net

544,040

609,528

Inventories

3,612,081

3,893,569

Other current assets

118,002

180,402

Current assets held for sale

—

1,205,473

Total current assets

6,143,540

6,377,021

Property and equipment, net

1,334,338

1,555,985

Operating lease right-of-use assets

2,242,602

2,347,073

Goodwill

598,217

601,159

Other intangible assets, net

405,751

419,161

Other noncurrent assets

73,661

85,988

Noncurrent assets held for sale

—

889,939

Total assets

$

10,798,109

$

12,276,326

Liabilities and

Stockholders’ Equity

Current liabilities:

Accounts payable

$

3,407,889

$

3,526,079

Accrued expenses

784,635

616,067

Other current liabilities

472,833

396,408

Current liabilities held for sale

—

768,851

Total current liabilities

4,665,357

5,307,405

Long-term debt

1,789,161

1,786,361

Non-current operating lease

liabilities

1,897,165

2,039,908

Deferred income taxes

192,671

355,635

Other long-term liabilities

83,813

83,538

Noncurrent liabilities held for sale

—

183,751

Total liabilities

8,628,167

9,756,598

Total stockholders’ equity

2,169,942

2,519,728

Total liabilities and stockholders’

equity

$

10,798,109

$

12,276,326

(1)

This condensed consolidated balance sheet

has been prepared on a basis consistent with the company's

previously prepared balance sheets filed with the Securities and

Exchange Commission ("SEC"), but does not include the footnotes

required by accounting principles generally accepted in the United

States of America (“GAAP”).

Advance Auto Parts, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Operations

(in thousands, except per share

data), (unaudited)

Twelve Weeks Ended

Twelve Weeks Ended

Fifty-Two Weeks Ended

Fifty-Two Weeks Ended

December 28, 2024 (1)

December 30, 2023 (1)

December 28, 2024 (1)

December 30, 2023 (1)

Net sales

$

1,996,025

$

2,014,405

$

9,094,327

$

9,209,075

Cost of sales

1,648,908

1,194,776

5,685,807

5,348,966

Gross profit

347,117

819,629

3,408,520

3,860,109

Selling, general and administrative

expenses, exclusive of restructuring and related expenses

879,021

851,676

3,812,924

3,805,235

Restructuring and related expenses

288,098

10,308

308,902

15,987

Selling, general and administrative

expenses

1,167,119

861,984

4,121,826

3,821,222

Operating (loss) income

(820,002

)

(42,355

)

(713,306

)

38,887

Other, net:

Interest expense

(18,906

)

(18,041

)

(81,033

)

(87,989

)

Other income, net

13,471

1,692

26,241

1,924

Total other, net

(5,435

)

(16,349

)

(54,792

)

(86,065

)

Loss before provision for income taxes

(825,437

)

(58,704

)

(768,098

)

(47,178

)

Provision for income taxes

(215,906

)

(23,514

)

(181,143

)

(17,154

)

Net loss from continuing operations

(609,531

)

(35,190

)

(586,955

)

(30,024

)

Net income from discontinued

operations

194,754

62

251,167

59,759

Net (loss) income

$

(414,777

)

$

(35,128

)

$

(335,788

)

$

29,735

Basic loss per common share from

continuing operations

$

(10.20

)

$

(0.59

)

$

(9.84

)

$

(0.51

)

Basic earnings per common share from

discontinued operations

3.26

—

4.21

1.01

Basic (loss) earnings per common share

$

(6.94

)

$

(0.59

)

$

(5.63

)

$

0.50

Basic weighted-average common shares

outstanding

59,743

59,504

59,647

59,432

Diluted loss per common share from

continuing operations

$

(10.16

)

$

(0.59

)

$

(9.80

)

$

(0.50

)

Diluted earnings per common share from

discontinued operations

3.24

—

4.19

1.00

Diluted (loss) earnings per common

share

$

(6.92

)

$

(0.59

)

$

(5.61

)

$

0.50

Diluted weighted-average common shares

outstanding

59,978

59,675

59,902

59,608

(1)

These preliminary condensed consolidated

statements of operations have been prepared on a basis consistent

with the company's previously prepared statements of operations

filed with the SEC, but do not include the footnotes required by

GAAP.

Advance Auto Parts, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows

(in thousands), (unaudited)

Fifty-Two Weeks Ended

December 28, 2024 (1)

December 30, 2023 (1)

Cash flows from operating

activities:

Net (loss) income

$

(335,788

)

$

29,735

Net income from discontinued

operations

251,167

59,759

Net (loss) income from continuing

operations

(586,955

)

(30,024

)

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

291,980

269,430

Share-based compensation

42,193

40,905

Write-down on receivables

34,176

—

Loss on sale and impairment of long-lived

assets

157,957

857

Provision for deferred income taxes

(203,276

)

(37,175

)

Other, net

3,968

3,267

Net change in:

Receivables, net

28,952

(114,745

)

Inventories

270,403

(64,146

)

Accounts payable

(110,112

)

57,518

Accrued expenses

126,588

94,698

Other assets and liabilities, net

84,630

(78,797

)

Net cash provided by operating activities

from continuing operations

140,504

141,788

Net cash (used in) provided by operating

activities from discontinued operations

(55,871

)

145,587

Net cash provided by operating

activities

84,633

287,375

Cash flows from investing

activities:

Purchases of property and equipment

(180,800

)

(225,672

)

Proceeds from sales of property and

equipment

13,394

6,922

Net cash used in investing activities from

continuing operations

(167,406

)

(218,750

)

Net cash provided by (used in) investing

activities from discontinued operations

1,522,160

(16,739

)

Net cash provided by (used in) investing

activities

1,354,754

(235,489

)

Cash flows from financing

activities:

Borrowings under credit facilities

—

4,805,000

Payments on credit facilities

—

(4,990,000

)

Proceeds from issuance of senior unsecured

notes, net

—

599,571

Dividends paid

(59,855

)

(209,293

)

Purchase of noncontrolling interests

(9,101

)

—

Repurchases of common stock

(6,501

)

(14,518

)

Other, net

447

(1,493

)

Net cash (used in) provided by financing

activities

(75,010

)

189,267

Effect of exchange rate changes on

cash

1,569

(8,487

)

Net increase in cash and cash

equivalents

1,365,946

232,666

Cash and cash equivalents, beginning of

period

503,471

270,805

Cash and cash equivalents, end of

period

$

1,869,417

$

503,471

Summary of cash and cash

equivalents:

Cash and cash equivalents of continuing

operations, end of period

$

1,869,417

$

488,049

Cash and cash equivalents of discontinued

operations, end of period

—

15,422

Cash and cash equivalents, end of

period

$

1,869,417

$

503,471

Advance Auto Parts, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows (continued)

(in thousands), (unaudited)

Fifty-Two Weeks Ended

December 28, 2024 (1)

December 30, 2023 (1)

Supplemental cash flow

information:

Interest paid

$

75,740

$

73,844

Income tax payments

$

37,037

$

98,792

Non-cash transactions:

Accrued purchases of property and

equipment

$

14,841

$

5,287

Transfer of property and equipment from

(to) assets related to discontinued operations to (from) continuing

operations

$

7,262

$

(1,666

)

(1)

This condensed consolidated statement of

cash flows has been prepared on a basis consistent with the

company's previously prepared statements of operations filed with

the SEC, but does not include the footnotes required by GAAP.

Reconciliation of Non-GAAP Financial

Measures

The company's financial results include certain financial

measures not derived in accordance with accounting principles

generally accepted in the United States of America (“GAAP”).

Non-GAAP financial measures, including Adjusted Net income,

Adjusted EPS, Adjusted SG&A Margin, and Adjusted Operating

Income, should not be used as a substitute for GAAP financial

measures, or considered in isolation, for the purpose of analyzing

our operating performance, financial position or cash flows.

2024 Restructuring Plan

On November 13, 2024, the company’s Board of Directors approved

a restructuring and asset optimization plan (“2024 Restructuring

Plan”) designed to improve the Company’s profitability and growth

potential and streamline its operations. This plan anticipates

closure of approximately 500 stores, approximately 200 independent

locations and four distribution centers by mid-2025, as well as

headcount reductions.

Other Restructuring Initiatives

In November 2023, the company announced a strategic and

operational plan which would result in $150.0 million of savings,

of which $50.0 million would be reinvested into frontline team

members. In addition to a reduction in workforce, this plan

streamlines the company’s supply chain by configuring a

multi-echelon supply chain by leveraging current asset and

operating fewer, more productive distribution centers that focus on

replenishment and move more parts closer to the customer. In

achieving this plan, the company is in process of converting

certain distribution centers and stores into market hubs. In

addition to providing replenishment to near-by stores, market hubs

support retail operations. In addition to the distribution network

optimization, other restructuring expenses included Worldpac post

transaction-related expenses and other expenses defined below.

The company has presented these non-GAAP financial measures as

the company believes that the presentation of the financial results

that exclude (1) transformation expenses under the company’s

turnaround plan, (2) other significant expenses and (3)

nonrecurring tax expense are useful and indicative of the company's

base operations because the expenses vary from period to period in

terms of size, nature and significance. These measures assist in

comparing the company’s current operating results with past periods

and with the operational performance of other companies in the

industry. The disclosure of these measures allows investors to

evaluate the company’s performance using the same measures

management uses in developing internal budgets and forecasts and in

evaluating management’s compensation. Included below is a

description of the expenses the company has determined are not

normal, recurring cash operating expenses necessary to operate the

company’s business and the rationale for why providing these

measures is useful to investors as a supplement to the GAAP

measures.

Transformation Expenses — Expenses incurred in connection with

the Company's turnaround plans and specific transformative

activities related to asset optimization that the Company does not

view to be normal cash operating expenses. These expenses primarily

include:

- Restructuring and other related expenses — Expenses relating to

strategic initiatives, including severance expense, retention

bonuses offered to store-level employees to help facilitate the

closing of stores, incremental reserves related to the

collectibility of receivables resulting from contract terminations

with certain independents associated with the 2024 Restructuring

Plan and third-party professionals assisting in the development and

execution of the strategic initiatives.

- Inventory write-down — Expenses relating to the incremental

write-down of inventory to net realizable value due to liquidation

sales and streamlining inventory assortment due to store and

distribution center closures associated with the 2024 Restructuring

Plan.

- Impairment and write-down of long-lived assets - Expenses

relating to the impairment of operating lease ROU assets and

property and equipment, incremental depreciation as a result of

accelerating long-lived assets over a shorter useful life, and

incremental lease abandonment expenses as a result of accelerating

ROU asset amortization for leases the Company expects to exit

before the end of the contractual term, net of gains on lease

terminations, in connection with the 2024 Restructuring Plan and

Other Restructuring Plan.

- Distribution network optimization — Expenses primarily relating

to the conversion of the stores and distribution centers to market

hubs, including temporary labor, incremental depreciation as a

result of accelerating long-lived assets over a shorter useful

life, nonrecurring professional service fees and team member

severance.

Other Expenses — Expenses incurred by the Company that are not

viewed as normal cash operating expenses and vary from period to

period in terms of size, nature, and significance. These expenses

primarily include:

- Other professional service fees — Expenses relating to

nonrecurring services rendered by third-party vendors engaged to

perform a strategic business review, including the Company’s

transformation initiatives.

- Worldpac post transaction-related expenses — Expenses primarily

relating to non-recurring separation activities provided by

third-party professionals subsequent to the sale of Worldpac.

- Executive turnover — Expenses associated with the hiring search

for leadership positions and compensation.

- Material weakness remediation — Incremental expenses associated

with the remediation of the Company’s previously-disclosed material

weaknesses in internal control over financial reporting.

- Cybersecurity incident— Expenses related to the response and

remediation of a cybersecurity incident.

Nonrecurring Tax Expense — Income tax incurred by the Company

from the book to tax basis difference in the Worldpac Canada stock

directly resulting from the sale of Worldpac.

The following tables include reconciliations of this information

to the most comparable GAAP measures:

Reconciliation of Adjusted Net Income

and Adjusted EPS:

Twelve Weeks Ended

Fifty-Two Weeks Ended

(in thousands, except per share data)

December 28, 2024

December 30, 2023

December 28, 2024

December 30, 2023

Net loss from continuing operations

(GAAP)

$

(609,531

)

$

(35,190

)

$

(586,955

)

$

(30,024

)

Cost of sales adjustments:

Transformation expenses:

Inventory write-down

431,529

—

431,529

—

Selling, general and administrative

adjustments:

Transformation expenses:

Restructuring and other related expenses

(1)

60,682

7,516

60,682

7,835

Impairment and write-down of long-lived

assets (2)

204,156

—

204,156

—

Distribution network optimization (3)

5,769

—

19,713

—

Other expenses:

Other professional service fees

10,233

—

15,533

—

Worldpac post transaction-related

expenses

7,258

—

7,258

—

Executive turnover

—

2,792

1,561

8,152

Material weakness remediation

930

1,009

4,579

1,438

Cybersecurity incident

—

—

3,491

—

Other income adjustments:

TSA services

(2,537

)

—

(2,537

)

—

Provision for income taxes on adjustments

(4)

(179,505

)

(2,829

)

(186,491

)

(4,356

)

Nonrecurring tax expense (5)

—

—

10,000

—

Adjusted net loss (Non-GAAP)

$

(71,016

)

$

(26,702

)

$

(17,481

)

$

(16,955

)

Diluted loss per share from continuing

operations (GAAP)

$

(10.16

)

$

(0.59

)

$

(9.80

)

$

(0.50

)

Adjustments, net of tax

8.98

0.14

9.51

0.22

Adjusted loss per share from continuing

operations (Non-GAAP)

$

(1.18

)

$

(0.45

)

$

(0.29

)

$

(0.28

)

(1) Restructuring and other related

expenses included transactional expenses due to incremental

receivable reserves resulting from contract terminations with

certain independents as part of the 2024 Restructuring Plan of

$24.7 million, severance and other labor related costs of $15.2

million as part of the 2024 Restructuring Plan, and nonrecurring

services rendered by third-party vendors assisting with the 2024

Restructuring Plan of $20.8 million.

(2) During the fifty-two weeks ended

December 28, 2024, the Company recorded impairment charges for ROU

assets and property and equipment of $171.4 million and incremental

accelerated depreciation and amortization for property and

equipment and ROU assets of $32.7 million. December 28, 2024

(3) Distribution network optimization

includes incremental depreciation as a result of accelerating

long-lived assets over a shorter useful life of $5.0 million.

(4) The income tax impact of non-GAAP

adjustments is calculated using the estimated tax rate in effect

for the respective non-GAAP adjustments.

(5) Income tax incurred by the Company

from the book to tax basis difference in the Worldpac Canada stock

directly resulting from the sale of Worldpac.

Reconciliation of Gross

Profit

Twelve Weeks Ended

Fifty-Two Weeks Ended

(in thousands)

December 28, 2024

December 30, 2023

December 28, 2024

December 30, 2023

Gross Profit (GAAP)

$

347,117

$

819,629

$

3,408,520

$

3,860,109

Gross Profit adjustments

431,529

—

431,529

—

Adjusted Gross Profit (Non-GAAP)

$

778,646

$

819,629

$

3,840,049

$

3,860,109

Reconciliation of Adjusted Selling,

General and Administrative Expenses

Twelve Weeks Ended

Fifty-Two Weeks Ended

(in thousands)

December 28, 2024

December 30, 2023

December 28, 2024

December 30, 2023

SG&A (GAAP)

$

1,167,119

$

861,984

$

4,121,826

$

3,821,222

SG&A adjustments

289,028

11,317

316,973

17,425

Adjusted SG&A (Non-GAAP)

$

878,091

$

850,667

$

3,804,853

$

3,803,797

Reconciliation of Adjusted Operating

Income:

Twelve Weeks Ended

Fifty-Two Weeks Ended

(in thousands)

December 28, 2024

December 30, 2023

December 28, 2024

December 30, 2023

Operating (loss) income (GAAP)

$

(820,002

)

$

(42,355

)

$

(713,306

)

$

38,887

COGS adjustments

431,529

—

431,529

—

SG&A adjustments

289,028

11,317

316,973

17,425

Adjusted operating (loss) income

(Non-GAAP)

$

(99,445

)

$

(31,038

)

$

35,196

$

56,312

NOTE: Adjusted gross profit, Adjusted

gross margin (calculated by dividing Adjusted gross profit by Net

sales), Adjusted SG&A, Adjusted SG&A as a percentage of Net

sales, Adjusted operating income and Adjusted operating income

margin (calculated by dividing Adjusted operating income by Net

sales) are non-GAAP measures. Management believes these non-GAAP

measures are important metrics in assessing the overall performance

of the business and utilizes these metrics in its ongoing

reporting. On that basis, management believes it is useful to

provide these metrics to investors and prospective investors to

evaluate the company’s operating performance across periods

adjusting for these items (refer to the reconciliations of non-GAAP

adjustments above). These non-GAAP measures might not be calculated

in the same manner as, and thus might not be comparable to,

similarly titled measures reported by other companies. Non-GAAP

measures should not be used by investors or third parties as the

sole basis for formulating investment decisions, as they may

exclude a number of important cash and non-cash recurring

items.

Reconciliation of Free Cash

Flow:

Fifty-Two Weeks Ended

(in thousands)

December 28, 2024

December 30, 2023

Cash flows from operating activities

$

140,504

$

141,788

Purchases of property and equipment

(180,800

)

(225,672

)

Free cash flow

$

(40,296

)

$

(83,884

)

Adjusted Debt to

Adjusted EBITDAR Ratio: (1)

Four Quarters Ended

(in thousands, except adjusted debt to

adjusted EBITDAR ratio)

December 28, 2024

December 30, 2023

Total GAAP debt

$

1,789,161

$

1,786,361

Add: Operating lease liabilities

2,358,693

2,423,183

Adjusted debt

$

4,147,854

$

4,209,544

GAAP Net income

$

(586,955

)

$

(30,024

)

Depreciation and amortization

291,980

269,430

Interest expense

81,033

87,989

Other income, net

(26,242

)

(1,924

)

Provision for income taxes

(181,143

)

(17,154

)

Rent expense

587,845

533,693

Share-based compensation

44,596

45,647

Other nonrecurring charges (2)

27,179

12,419

Transformation related charges (3)

742,458

29,719

Adjusted EBITDAR

$

980,751

$

929,795

Adjusted debt to adjusted EBITDAR

ratio

4.2

4.5

(1)

The four quarters ended December 30, 2023

reflect the corrected results, which include the correction of

non-material errors the company discovered in previously reported

results.

(2)

The adjustments to the four quarters ended

December 28, 2024 include expenses associated with the company's

material weakness remediation efforts and executive search charges

and the adjustments to the four quarters ended December 30, 2023

represent charges incurred resulting from the early redemption of

the company's 2023 senior unsecured notes.

(3)

Transformation related charges include

transformation plans designed to improve the company’s

profitability and growth potential and streamline its operations.

These charges primarily relate to inventory write-down charges and

impairments on long-lived assets.

NOTE: Management believes its Adjusted Debt to Adjusted

EBITDAR ratio (“leverage ratio”) is a key financial metric for debt

securities, as reviewed by rating agencies, and believes its debt

levels are best analyzed using this measure. The company’s goal is

to maintain an investment grade rating. The company's credit rating

directly impacts the interest rates on borrowings under its

existing credit facility and could impact the company's ability to

obtain additional funding. If the company was unable to maintain

its investment grade rating, this could negatively impact future

performance and limit growth opportunities. Similar measures are

utilized in the calculation of the financial covenants and ratios

contained in the company's financing arrangements. The leverage

ratio calculated by the company is a non-GAAP measure and should

not be considered a substitute for debt to net earnings, net

earnings or debt as determined in accordance with GAAP. The company

adjusts the calculation to remove rent expense and to add back the

company’s existing operating lease liabilities related to their

right-of-use assets to provide a more meaningful comparison with

the company’s peers and to account for differences in debt

structures and leasing arrangements. The company’s calculation of

its leverage ratio might not be calculated in the same manner as,

and thus might not be comparable to similarly titled measures by

other companies.

Store Information:

During the fifty-two weeks ended December 28, 2024, 42 stores

were opened and 40 were closed, resulting in a total of 4,788

stores as of December 28, 2024, compared with a total of 4,786

stores as of December 30, 2023.

The below table summarizes the changes in the number of

company-operated stores during the twelve and fifty-two weeks ended

December 28, 2024:

Twelve Weeks Ended

AAP

CARQUEST

Total

October 5, 2024

4,492

289

4,781

New

18

—

18

Closed

(5

)

(6

)

(11

)

Converted

2

(2

)

—

December 28, 2024

4,507

281

4,788

Fifty-Two Weeks Ended

AAP

CARQUEST

Total

December 30, 2023

4,484

302

4,786

New

41

1

42

Closed

(22

)

(18

)

(40

)

Converted

4

(4

)

—

December 28, 2024

4,507

281

4,788

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225874494/en/

Investor Relations Contact: Lavesh Hemnani T: (919)

227-5466 E: invrelations@advance-auto.com

Media Contact: Nicole Ducouer T: (984) 389-7207 E:

AAPcommunications@advance-auto.com

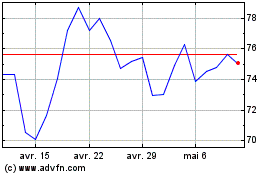

Advance Auto Parts (NYSE:AAP)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Advance Auto Parts (NYSE:AAP)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025