Current Report Filing (8-k)

02 Mai 2022 - 10:37PM

Edgar (US Regulatory)

0000001800

false

Common Shares, Without Par Value

ABT

0000001800

2022-04-29

2022-04-29

0000001800

us-gaap:CommonStockMember

exch:XCHI

2022-04-29

2022-04-29

0000001800

us-gaap:CommonStockMember

exch:XNYS

2022-04-29

2022-04-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

| Common Shares, Without Par Value |

|

ABT |

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

April 29, 2022

Date of Report (Date of earliest event reported)

ABBOTT LABORATORIES

(Exact name of registrant as specified in

charter)

| Illinois |

|

1-2189 |

|

36-0698440 |

| (State or other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

100 Abbott Park Road

Abbott Park, Illinois 60064-6400

(Address of principal executive offices)(Zip

Code)

Registrant’s telephone number, including

area code: (224) 667-6100

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of

the Act:

| Title of Each Class |

Trading

Symbol(s) |

Name of Each Exchange

on

Which Registered |

| Common

Shares, Without Par Value |

ABT |

New

York Stock Exchange

Chicago

Stock Exchange, Inc. |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.07 — Submission of Matters to a Vote of Security Holders.

Abbott held its Annual Meeting of Shareholders on April 29, 2022. The

following is a summary of the matters voted on at that meeting.

| (1) | The shareholders elected Abbott’s entire Board of Directors. The persons elected to Abbott’s Board of Directors and the

number of shares cast for, the number of shares withheld, and the number of broker non-votes, with respect to each of these persons, were

as follows: |

| Name | |

Votes For | | |

Votes Withheld | | |

Broker Non-Votes | |

| Robert J. Alpern, M.D. | |

| 1,300,318,741 | | |

| 50,116,071 | | |

| 186,229,036 | |

| Sally E. Blount, Ph.D. | |

| 1,322,633,909 | | |

| 27,800,903 | | |

| 186,229,036 | |

| Robert B. Ford | |

| 1,265,246,918 | | |

| 85,187,894 | | |

| 186,229,036 | |

| Paola Gonzalez | |

| 1,344,735,483 | | |

| 5,699,329 | | |

| 186,229,036 | |

| Michelle A. Kumbier | |

| 1,328,758,586 | | |

| 21,676,226 | | |

| 186,229,036 | |

| Darren W. McDew | |

| 1,333,987,306 | | |

| 16,447,506 | | |

| 186,229,036 | |

| Nancy McKinstry | |

| 1,037,568,700 | | |

| 312,866,112 | | |

| 186,229,036 | |

| William A. Osborn | |

| 1,243,331,162 | | |

| 107,103,650 | | |

| 186,229,036 | |

| Michael F. Roman | |

| 1,321,772,019 | | |

| 28,662,793 | | |

| 186,229,036 | |

| Daniel J. Starks | |

| 1,343,614,722 | | |

| 6,820,090 | | |

| 186,229,036 | |

| John G. Stratton | |

| 1,247,765,004 | | |

| 102,669,808 | | |

| 186,229,036 | |

| Glenn F. Tilton | |

| 1,288,825,816 | | |

| 61,608,996 | | |

| 186,229,036 | |

| (2) | The shareholders ratified the appointment of Ernst & Young LLP as Abbott’s auditors. The number of shares cast in favor

of the ratification of Ernst & Young LLP, the number against, the number abstaining, and the number of broker non-votes were as follows: |

| For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

| 1,523,487,443 |

|

9,931,288 |

|

3,245,117 |

|

0 |

| (3) | The shareholders approved the compensation of Abbott’s named executive officers listed in the proxy statement for the Annual

Meeting, with 91.27 percent of the votes cast voting “For” the proposal. The shareholder vote is advisory and non-binding.

The number of shares cast in favor of approval, the number against, the number abstaining, and the number of broker non-votes were as

follows: |

| For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

| 1,232,623,436 |

|

110,410,371 |

|

7,401,005 |

|

186,229,036 |

| (4) | The shareholders rejected a shareholder proposal to lower the ownership threshold for calling special meetings of shareholders, with

47.15 percent of the votes cast voting “For” the proposal. The number of shares cast in favor of the shareholder proposal,

the number against, the number abstaining, and the number of broker non-votes were as follows: |

| For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

| 636,741,987 |

|

707,817,833 |

|

5,874,992 |

|

186,229,036 |

| (5) | The shareholders rejected a shareholder proposal requesting that Abbott’s Board of Directors adopt a policy that the Board Chairman

be an independent director, with 27.75 percent of the votes cast voting “For” the proposal. The number of shares cast in favor

of the shareholder proposal, the number against, the number abstaining, and the number of broker non-votes were as follows: |

| For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

| 374,824,445 |

|

971,036,526 |

|

4,573,841 |

|

186,229,036 |

| (6) | The shareholders rejected a shareholder proposal that Abbott’s Board of Directors adopt a policy on Rule 10b5-1 plans with certain

restrictions and disclosure requirements, with 48.76 percent of the votes cast voting “For” the proposal. The number of shares

cast in favor of the shareholder proposal, the number against, the number abstaining, and the number of broker non-votes were as follows: |

| For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

| 658,539,820 |

|

684,198,068 |

|

7,696,924 |

|

186,229,036 |

| (7) | The shareholders rejected a shareholder proposal that Abbott’s Board of Directors prepare a report, to be updated annually,

disclosing Abbott’s lobbying policies, procedures, and expenditures, with 34.52 percent of the votes cast voting “For”

the proposal. The number of shares cast in favor of the shareholder proposal, the number against, the number abstaining, and the number

of broker non-votes were as follows: |

| For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

| 466,227,363 |

|

877,646,614 |

|

6,560,835 |

|

186,229,036 |

| (8) | The shareholders rejected a shareholder proposal that Abbott’s Board of Directors prepare a report on the public health costs

and financial market impacts of Abbott’s standards and programs regarding antimicrobial resistance, with 11.51 percent of the votes

cast voting “For” the proposal. The number of shares cast in favor of the shareholder proposal, the number against, the number abstaining,

and the number of broker non-votes were as follows: |

| For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

| 155,376,554 |

|

1,187,364,353 |

|

7,693,905 |

|

186,229,036 |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ABBOTT LABORATORIES |

| |

| Date: May 2, 2022 |

By: |

/s/ Robert E. Funck, Jr. |

| |

|

Robert E. Funck, Jr. |

| |

|

Executive Vice President, Finance and Chief Financial Officer |

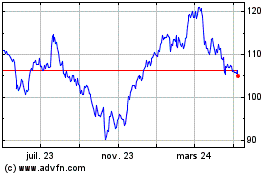

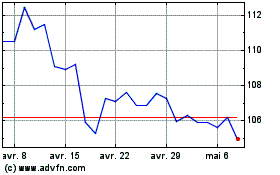

Abbott Laboratories (NYSE:ABT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Abbott Laboratories (NYSE:ABT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024