ADM Boosts Late-Summer Biodiesel Imports, Neste Trims Renewable Diesel -- OPIS

09 Novembre 2022 - 5:05PM

Dow Jones News

While the last full month of summer featured a pullback in U.S.

renewable diesel imports, biodiesel shipments climbed during the

month mostly on the back of increased deliveries from industry

leader Archer Daniels Midland, according to recently updated Energy

Information Administration figures.

Altogether, biodiesel imports to the U.S. during August amounted

to 15.582 million gal, climbing 37.9% from the month before as well

as 29% year to year, with ADM imports accounting for nearly 70% of

all August shipments, OPIS analysis of EIA's latest company-level

import data revealed.

Of the August biodiesel import total, ADM delivered 10.878

million gal of the fuel -- or 37% more than the month before and

51.5% more than the company imported a year ago -- all of it

originating out of Canada.

The breakdown of ADM shipments had the company taking 3.528

million biodiesel gal to International Falls, Minn., during August,

along with a 2.982 million gal delivery to Houston, a 2.73 million

gal shipment into Newark, N.J., and a 1.512 million gal load into

Blaine, Wash. ADM also moved 126,000 gal of biodiesel from Canada

to Eastport, Idaho, in August.

Global energy-commodity trader Vitol was the other company that

significantly increased month-to-month biodiesel imports to the

U.S., totaling 3.486 million gal from Canada in a string of

shipments delivered to Port Huron, Mich., and Buffalo-Niagara

Falls, N.Y. That had Vitol importing more than four times the

biodiesel it did the month before while also more than doubling its

year-ago import level.

On the other hand, sometimes prolific importer GreenAmerica

Biofuels cut its biodiesel imports to the U.S. to just one 546,000

gal August shipment that landed in Buffalo-Niagara Falls. That is

down almost 76% from its July shipments and about half the volume

it imported a year ago.

Shell's Shell US Trading Company imported 420,000 gal of

biodiesel from Canada to the U.S. in August, about 17% less than

the month before and a little more than one-sixth the imports

reported the same time last year. Shell's August imports included

210,000 gal into Blaine, 84,000 gal each into Buffalo Niagara and

Champlain-Rouses Point, N.Y., followed by 42,000 gal delivered into

Detroit.

Biodiesel imports by Targray Markets continued to represent a

smattering of shipments from Canada, with a total of 252,000 gal

divided equally between deliveries to Portal, N.D. and Sweetgrass,

Mont. That is down about 47.5% from month to month.

While overall biodiesel imports rebounded over the last full

month of summer, information rounded up by EIA indicated a 29% cut

in renewable diesel imports as Finnish renewable diesel producer

Neste sent 17.682 million gal from Singapore to West Coast ports in

August. Neste imports brought 8.61 million gal to storage in Los

Angeles and 7.644 million gal to the San Francisco area, with the

company rounding out its August deliveries by dropping 1.428

million gal in Portland, Ore.

Compared to August 2021, the monthly renewable diesel import

total dropped nearly 29.5% year to year.

EIA import product codes for August also indicated Asia-origin

shipments of unspecified "other renewable fuels" by Phillips 66

delivered to San Francisco totaling 504,000 gal, with the largest

slug being 420,000 gal coming from Japan. A pair of Phillips 66

renewable fuels shipments together totaling 84,000 gal also arrived

from Malaysia and Singapore during the month.

Ethanol imports reawakened in August, with the 18.69 million gal

delivered into Selby, Calif., from Brazil by the Shell-Cosan

joint-venture Raizen North America. That ethanol delivery

represented the first EIA-recorded fuel ethanol imports since May.

The resurgence in August ethanol imports also jumped it almost 56%

compared to the same month in 2021.

The latest update to U.S. Department of Commerce figures

indicate that biodiesel imports continued to expand into September,

with the agency estimating about 19.69 million gal arrived from

foreign sources. At the same time, the tap on fuel-ethanol imports

may have tightened again, with the agency pegging only a negligible

September volume coming from Brazil.

--Reporting by Spencer Kelly, skelly@opisnet.com; Editing by

Michael Kelly, mkelly@opisnet.com

(END) Dow Jones Newswires

November 09, 2022 10:50 ET (15:50 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

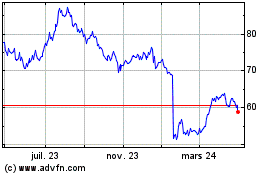

Archer Daniels Midland (NYSE:ADM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

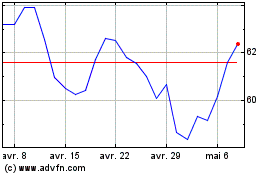

Archer Daniels Midland (NYSE:ADM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024