Statement of Changes in Beneficial Ownership (4)

03 Janvier 2022 - 2:19PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

CONSIDINE TERRY |

2. Issuer Name and Ticker or Trading Symbol

Apartment Income REIT Corp.

[

AIRC

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

CEO |

|

(Last)

(First)

(Middle)

4582 S. ULSTER STREET, SUITE 1700 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

12/29/2021 |

|

(Street)

DENVER, CO 80237

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock (1) | 12/29/2021 | | S | | 20000 | D | $54.3066 (2) | 49577 | D | |

| Class A Common Stock | 12/30/2021 | | S | | 20000 | D | $54.6411 (3) | 29577 | D | |

| Class A Common Stock | 12/31/2021 | | S | | 15001 | D | $54.9626 (4) | 14576 (5)(6)(7) | D | |

| Class A Common Stock | 12/30/2021 | | S | | 17500 | D | $54.5324 (8) | 17224 | I | See Footnote (9) |

| Class A Common Stock | 12/31/2021 | | S | | 17224 | D | $54.9685 (10) | 0 | I | See Footnote (9) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Taking into account the transactions reported on this form, Mr. Considine has an overall equity stake in the company of 6,480,985 shares, partnership units, and options, the details of which are more fully described in footnotes 5, 6, 7, and 8 below. |

| (2) | This price is a weighted average price. The price at which the shares were actually sold ranged from $53.86 to $54.81. The reporting person has provided to the issuer and will provide to any security holder or the staff of the Securities and Exchange Commission, upon request, information regarding the number of shares sold at each price within the range. |

| (3) | This price is a weighted average price. The price at which the shares were actually sold ranged from $54.39 to $54.90. The reporting person has provided to the issuer and will provide to any security holder or the staff of the Securities and Exchange Commission, upon request, information regarding the number of shares sold at each price within the range. |

| (4) | This price is a weighted average price. The price at which the shares were actually sold ranged from $54.73 to $55.19. The reporting person has provided to the issuer and will provide to any security holder or the staff of the Securities and Exchange Commission, upon request, information regarding the number of shares sold at each price within the range. |

| (5) | The reporting person holds 14,576 shares directly and 16,000 in a trust for which the reporting person disclaims beneficial ownership. In addition, the reporting person holds 2,160,007 common partnership units and equivalents in Apartment Income REIT, L.P. ("OP Units"). The 2,160,007 OP Units include 270,452 OP Units held directly by the reporting person, 179,735 OP Units held by an entity in which the reporting person has sole voting and investment power, 1,591,672 OP Units held by Titahotwo Limited Partnership RLLLP ("Titahotwo"), an entity for which the reporting person serves as the general partner and holds a 0.5% interest, and 118,148 OP Units held by the reporting person's spouse, for which the reporting person disclaims beneficial ownership except to the extent of his pecuniary interest therein. In addition, the reporting person holds 114,768 LTIP Units (which are the equivalent of OP Units) and 413,231 LTIP II Units. |

| (6) | In addition to the 14,576 shares held directly, the reporting person holds 3,011,846 unvested partnership units, the vesting of which are subject to certain performance criteria. Upon conclusion of the performance period and depending on the results thereof, the reporting person may vest in all, some or none of the performance-based partnership units. |

| (7) | In addition, as part of his overall equity stake, the reporting person holds 750,557 stock options, which are vested and exercisable. |

| (8) | This price is a weighted average price. The price at which the shares were actually sold ranged from $54.41 to $54.64. The reporting person has provided to the issuer and will provide to any security holder or the staff of the Securities and Exchange Commission, upon request, information regarding the number of shares sold at each price within the range. |

| (9) | Held by the reporting person's spouse, for which the reporting person disclaims beneficial ownership except to the extent of his pecuniary interest therein. |

| (10) | This price is a weighted average price. The price at which the shares were actually sold ranged from $54.71 to $55.17. The reporting person has provided to the issuer and will provide to any security holder or the staff of the Securities and Exchange Commission, upon request, information regarding the number of shares sold at each price within the range. |

Remarks:

The purposes of the dispositions reported this week were to repay bank debt incurred primarily with respect to (i) taxes and tax planning due to non-cash income recognized in 2020 and 2021 and (ii) funding continuing charitable commitments. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

CONSIDINE TERRY

4582 S. ULSTER STREET

SUITE 1700

DENVER, CO 80237 | X |

| CEO |

|

Signatures

|

| Terry Considine | | 12/31/2021 |

| **Signature of Reporting Person | Date |

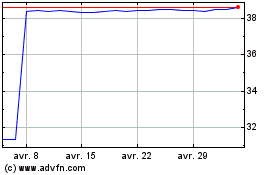

Apartment Income REIT (NYSE:AIRC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

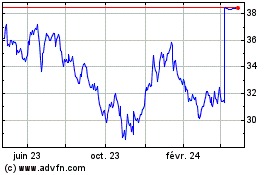

Apartment Income REIT (NYSE:AIRC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024