Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

22 Avril 2022 - 12:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2022

Commission File Number: 001-35129

Arcos Dorados Holdings Inc.

(Exact name of registrant as specified in its

charter)

Dr. Luis Bonavita 1294, Office 501

Montevideo, Uruguay, 11300 WTC Free Zone

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

ARCOS DORADOS HOLDINGS INC.

TABLE OF CONTENTS

| ITEM |

|

| 1. |

Press Release dated April 21, 2022 titled “Arcos Dorados Announces Pricing of its 6.125% Sustainability-Linked Senior Notes Due 2029” |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Arcos Dorados Holdings Inc. |

| |

|

|

| |

|

|

| |

|

|

By: |

/s/ Juan David Bastidas |

| |

|

|

|

Name: |

Juan David Bastidas |

| |

|

|

|

Title: |

Chief Legal Counsel |

Date: April 22, 2022

Item 1

FOR IMMEDIATE RELEASE

|

|

ARCOS DORADOS ANNOUNCES PRICING OF ITS 6.125%

SUSTAINABILITY-LINKED SENIOR NOTES DUE 2029

Montevideo, Uruguay, April 21, 2022 –

Arcos Dorados Holdings Inc. (NYSE: ARCO) (“Arcos Dorados” or the “Company”) today announced the pricing of U.S.$350,000,000

aggregate principal amount of 6.125% Sustainability-Linked Senior Notes due 2029 (the “New Notes”) to be issued by its subsidiary

Arcos Dorados B.V. (the “Issuer”). The New Notes will be issued at a price of 99.991%. The New Notes mature on May 27, 2029

and will be guaranteed on a senior unsecured basis by the Company and certain of the Company’s subsidiaries. The Notes include Sustainability

Performance Targets associated with the Company’s commitments to reduce greenhouse gas emissions by 36% in its restaurants and offices

and by 31% in its supply chain by 2030. The New Notes were offered in a private placement to qualified institutional buyers in accordance

with Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and outside the United States to non-U.S.

persons in accordance with Regulation S under the Securities Act. The settlement of the New Notes offering is expected to take place on

April 27, 2022, subject to customary closing conditions.

The proceeds from the Notes offering will be used

by the Issuer: (i) to fund the tender offers conducted by the Company to purchase for cash (a) any and all of its U.S.$201,763,000 properly

tendered (and not validly withdrawn) outstanding 6.625% senior notes due 2023, and (b) up to U.S.$150,000,000 aggregate principal amount

of its properly tendered (and not validly withdrawn) outstanding 5.875% senior notes due 2027; and (ii) for general corporate purposes.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy these securities, nor will there be any sale of these securities, in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any state

or jurisdiction. The Notes and related guarantees have not been registered under the Securities Act, or any applicable state securities

laws, and will be offered only to qualified institutional buyers pursuant to Rule 144A promulgated under the Securities Act and outside

the United States to non-U.S. persons in accordance with Regulation S under the Securities Act. Unless so registered, the Notes and related

guarantees may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Securities

Act and any applicable state securities laws.

|

Investor Relations Contact

Dan Schleiniger

VP of Investor Relations

Arcos Dorados

daniel.schleiniger@ar.mcd.com

|

|

Media Contact

David Grinberg

VP of Corporate Communications

Arcos Dorados

david.grinberg@mcd.com.uy

|

| Follow us on: |

|

|

|

About Arcos Dorados

Arcos Dorados is the world’s largest independent

McDonald’s franchisee, operating the largest quick service restaurant chain in Latin America and the Caribbean. It has the exclusive

right to own, operate and grant franchises of McDonald’s restaurants in 20 Latin American and Caribbean countries and territories

with more than 2,250 restaurants, operated by the Company or by its sub-franchisees, that together employ over 90 thousand people (as

of 12/31/2021). The Company is also committed to the development of the communities in which it operates, to providing young people their

first formal job opportunities and to utilize its Recipe for the Future to achieve a positive

environmental impact. Arcos Dorados is listed for trading on the New York Stock Exchange (NYSE: ARCO). To learn more about the Company,

please visit the Investors section of our website: www.arcosdorados.com/ir.

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often are proceeded by words such

as “believes,” “expects,” “may,” “anticipates,” “plans,” “intends,”

“assumes,” “will” or similar expressions. The forward-looking statements contained herein include statements about

the Company’s Notes offering and its intended use of proceeds therefrom. These expectations may or may not be realized. Some of

these expectations may be based upon assumptions or judgments that prove to be incorrect. In addition, Arcos Dorados’ business and

operations involve numerous risks and uncertainties, many of which are beyond the control of Arcos Dorados, which could result in Arcos

Dorados’ expectations not being realized or otherwise materially affect the financial condition, results of operations and cash

flows of Arcos Dorados. Some of the factors that could cause future results to materially differ from recent results or those projected

in forward-looking statements are described in Arcos Dorados’ filings with the United States Securities and Exchange Commission.

The forward-looking statements are made only as

of the date hereof, and Arcos Dorados does not undertake any obligation to (and expressly disclaims any obligation to) update any forward-looking

statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence of unanticipated

events. In light of the risks and uncertainties described above, and the potential for variation of actual results from the assumptions

on which certain of such forward-looking statements are based, investors should keep in mind that the results, events or developments

disclosed in any forward-looking statement made in this document may not occur, and that actual results may vary materially from those

described herein, including those described as anticipated, expected, targeted, projected or otherwise.

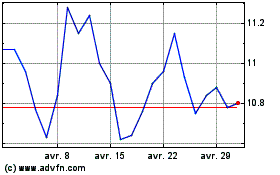

Arcos Dorados (NYSE:ARCO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

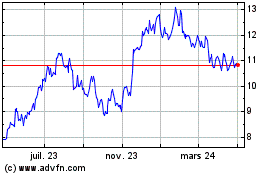

Arcos Dorados (NYSE:ARCO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024