Core & Main Announces Upsizing of Secondary Offering

08 Janvier 2024 - 6:06PM

Business Wire

Core & Main Inc. (NYSE: CNM), a leader in advancing reliable

infrastructure with local service, nationwide, today announced the

upsize of the previously announced underwritten secondary public

offering by certain selling stockholders. The size of the offering

increased from the previously announced 15 million shares to an

aggregate of 17 million shares of its Class A common stock.

The selling stockholders have granted the underwriters a 30-day

option to purchase up to an additional 2.55 million shares of Class

A common stock. Core & Main is not offering any shares of Class

A common stock in the offering and will not receive any proceeds

from the offering. The offering is expected to close on January 10,

2024, subject to customary closing conditions.

As previously announced, concurrent with the completion of the

offering, Core & Main expects to repurchase and redeem, as the

case may be, from the selling stockholders 3.13 million shares of

its Class A common stock and 1.87 million partnership interests of

the Company’s subsidiary Core & Main Holdings, LP (together

with a corresponding number of shares of Class B common stock of

Core & Main) at the same per share price to be paid by the

underwriters to the selling stockholders in the offering. The

closing of the repurchase is subject to the closing of the

offering. The closing of the offering is not conditioned upon the

closing of the repurchase.

J.P. Morgan and Citigroup are acting as joint lead book-running

managers for the offering. The underwriters may offer the shares of

Class A common stock from time to time for sale in one or more

transactions on the NYSE, in the over-the-counter market, through

negotiated transactions or otherwise, at market prices prevailing

at the time of sale, at prices related to prevailing market prices

or at negotiated prices.

A shelf registration statement (including a prospectus) relating

to these securities has been filed with the SEC and is effective.

Before investing, interested parties should read the shelf

registration statement and other documents filed with the SEC for

information about Core & Main and this offering. You may get

these documents for free by visiting EDGAR on the SEC website at

sec.gov. Alternatively, a copy may be obtained from J.P. Morgan,

c/o Broadridge Financial Solutions, 1155 Long Island Avenue,

Edgewood, New York 11717 (Tel: 1-866-803-9204), or by emailing:

prospectus-eg_fi@jpmchase.com or Citigroup, c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717

(Tel: 800-831-9146).

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy securities, nor shall there be any

sale of these securities in any state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction. Any offers, solicitations or offers to buy, or any

sales of securities will be made in accordance with the

registration requirements of the Securities Act of 1933, as

amended.

About Core & Main

Based in St. Louis, Core & Main is a leader in advancing

reliable infrastructure™ with local service, nationwide®. As a

leading specialized distributor with a focus on water, wastewater,

storm drainage and fire protection products, and related services,

Core & Main provides solutions to municipalities, private water

companies and professional contractors across municipal,

non-residential and residential end markets, nationwide. With

approximately 320 locations across the U.S., the company provides

its customers local expertise backed by a national supply chain.

Core & Main’s 4,500 associates are committed to helping their

communities thrive with safe and reliable infrastructure.

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements that constitute

“forward-looking statements,” including with respect to the

proposed offering and repurchase. No assurance can be given that

the offering discussed above will be completed on the terms

described, or at all. Forward-looking statements are subject to

numerous conditions, many of which are beyond the control of Core

& Main, including those set forth in the Risk Factors section

of the registration statement for the offering and the preliminary

prospectus supplement included therein, as filed with the SEC.

Copies are available on the SEC’s website at www.sec.gov.

Core & Main undertakes no obligation to update these

statements for revisions or changes after the date of this press

release, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240108215246/en/

Investor Relations: Robyn Bradbury, 314-995-9116

InvestorRelations@CoreandMain.com

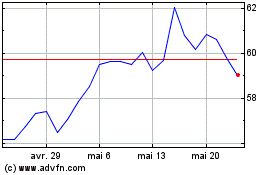

Core and Main (NYSE:CNM)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Core and Main (NYSE:CNM)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024