Eagle Point Credit Company Inc. Announces 25% Increase in Common Stock Distributions for Third Quarter 2021

13 Mai 2021 - 10:15PM

Business Wire

Eagle Point Credit Company Inc. (the “Company”) (NYSE:ECC, ECCB,

ECCW, ECCX, ECCY) today is pleased to announce the declaration of

distributions on shares of the Company’s common stock.

The Company has declared three separate distributions of $0.10

per share on its common stock, an increase of 25% from its previous

monthly distribution rate of $0.08 per share, payable on each of

July 30, 2021, August 31, 2021 and September 30, 2021 to

stockholders of record as of July 12, 2021, August 11, 2021 and

September 10, 2021, respectively. The following schedule applies to

the distributions:

Record Date

Payable Date

Amount per common share

July 12, 2021

July 30, 2021

$0.10

August 11, 2021

August 31, 2021

$0.10

September 10, 2021

September 30, 2021

$0.10

Distributions on common stock are generally paid from net

investment income (regular interest and dividends) and may also

include capital gains and/or a return of capital. The specific tax

characteristics of the distributions will be reported to the

Company’s stockholders on Form 1099 after the end of the 2021

calendar year.

“We are pleased to be able to increase our monthly distribution

by 25% to $0.10 per common share,” said Thomas Majewski, Chief

Executive Officer. “This increase underscores management’s

confidence in the Company’s future prospects.”

The Company is also pleased to announce the declaration of

distributions on shares of the Company’s 7.75% Series B Term

Preferred Stock due 2026 (the “Series B Term Preferred Stock”). The

Company has declared a distribution of $0.161459 per share on its

Series B Term Preferred Stock payable on each of July 30, 2021,

August 31, 2021 and September 30, 2021. The following schedule

applies to the distributions:

Record Date

Payable Date

Amount per share of Series B Term

Preferred Stock

July 12, 2021

July 30, 2021

$0.161459

August 11, 2021

August 31, 2021

$0.161459

September 10, 2021

September 30, 2021

$0.161459

The distributions on the Series B Term Preferred Stock reflect

an annual distribution rate of 7.75% of the $25 liquidation

preference per share of the Series B Term Preferred Stock.

ABOUT EAGLE POINT CREDIT COMPANY

The Company is a non-diversified, closed-end management

investment company. The Company’s primary investment objective is

to generate high current income, with a secondary objective to

generate capital appreciation, primarily through investment in

equity and junior debt tranches of collateralized loan obligations.

The Company is externally managed and advised by Eagle Point Credit

Management LLC.

The Company makes certain unaudited portfolio information

available each month on its website in addition to making certain

other unaudited financial information available on its website

(www.eaglepointcreditcompany.com). This information includes (1) an

estimated range of the Company’s net investment income (“NII”) and

realized capital gains or losses per share of common stock for each

calendar quarter end, generally made available within the first

fifteen days after the applicable calendar month end, (2) an

estimated range of the Company’s net asset value (“NAV”) per share

of common stock for the prior month end and certain additional

portfolio-level information, generally made available within the

first fifteen days after the applicable calendar month end, and (3)

during the latter part of each month, an updated estimate of NAV,

if applicable, and, with respect to each calendar quarter end, an

updated estimate of the Company’s NII and realized capital gains or

losses per share for the applicable quarter, if available.

FORWARD-LOOKING STATEMENTS

This press release may contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Statements other than statements of historical facts

included in this press release may constitute forward-looking

statements and are not guarantees of future performance or results

and involve a number of risks and uncertainties. Actual results may

differ materially from those in the forward-looking statements as a

result of a number of factors, including those described in the

Company’s filings with the U.S. Securities and Exchange Commission.

The Company undertakes no duty to update any forward-looking

statement made herein. All forward-looking statements speak only as

of the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210513005940/en/

Investor and Media Relations: ICR 203-340-8510

IR@EaglePointCredit.com www.eaglepointcreditcompany.com

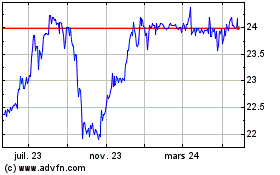

Eagle Point Credit (NYSE:ECCW)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

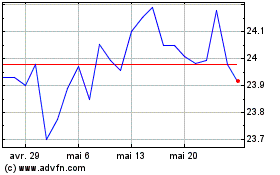

Eagle Point Credit (NYSE:ECCW)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024