FCPT Announces Acquisition of 19 Bloomin’ Brands Restaurant Properties for $66.4 Million

27 Août 2024 - 12:16AM

Business Wire

Four Corners Property Trust (NYSE:FCPT), a real estate

investment trust primarily engaged in the ownership and acquisition

of high-quality, net-leased restaurant and retail properties

(“FCPT” or the “Company”), is pleased to announce the acquisition

of 19 Bloomin’ Brands restaurant properties comprising of 20 total

restaurants (10 Outback Steakhouse restaurants and 10 Carrabba’s

Italian Grill restaurants, including one dual-tenant property with

both concepts) for a purchase price of $66.4 million. The 19

properties are located across 10 states (AZ, FL, GA, KY, LA, NC,

NV, PA, SC, and TN). The sites are in strong retail corridors with

high traffic and attractive demographics. The properties are under

two long-term master leases of ten restaurants each and leased to

corporate Bloomin’ Brands entities. The transaction was priced at

cap rate in range with previous FCPT transactions.

As of the closing date, Bloomin’ Brands is now FCPT’s third

largest tenant, comprising approximately 3.3% of the Company’s cash

rent. In addition, Outback Steakhouse and Carrabba’s Italian Grill

restaurants are FCPT’s sixth and thirteenth largest brands by cash

rent, respectively. Lastly, as a result of this transaction, Darden

Restaurants will now comprise less than 50% of the Company’s cash

rent. FCPT has published a Capital Raising and Acquisitions Update

presentation with further details on this transaction and the

Company’s brand diversification, available on FCPT’s website.

Bill Lenehan stated: “We are very pleased with the large

addition of Bloomin’ Brands restaurants to our portfolio. FCPT

continues to find opportunities that accretively grow our portfolio

while adhering to our high-quality underwriting. We’re particularly

glad to see another large public company operator rise to our #3

tenant behind Darden and Brinker as this transaction furthers our

diversification efforts while maintaining the strength of our

portfolio.”

About FCPT

FCPT, headquartered in Mill Valley, CA, is a real estate

investment trust primarily engaged in the ownership, acquisition

and leasing of restaurant and retail properties. The Company seeks

to grow its portfolio by acquiring additional real estate to lease,

on a net basis, for use in the restaurant and retail industries.

Additional information about FCPT can be found on the website at

www.fcpt.com.

Category: Acquisition

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240826086097/en/

Four Corners Property Trust: Bill Lenehan, 415-965-8031 CEO

Patrick Wernig, 415-965-8038 CFO

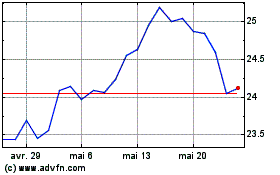

Four Corners Property (NYSE:FCPT)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

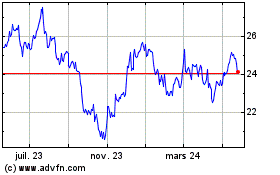

Four Corners Property (NYSE:FCPT)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024