Regulatory News:

TechnipFMC plc (NYSE: FTI) (the “Company”) announced today the

results as of 5:00 p.m., New York City time, on May 3, 2022 (the

“Early Tender Time”) of its previously announced tender offer (the

“Tender Offer”) to purchase, subject to certain terms and

conditions, its 6.500% Senior Notes due 2026 (the “Notes”) and the

related solicitation of consents (the “Consents”) of holders with

respect to the Notes (the “Consent Solicitation”) to certain

proposed amendments (the “Proposed Amendments”) to the indenture

governing the Notes. The Proposed Amendments will, among other

things, eliminate substantially all of the restrictive covenants

and certain events of default triggers in the indenture.

The Company further announced that it has increased the maximum

aggregate principal amount of Notes to be accepted in the Tender

Offer (the “Maximum Tender Amount”) from $320,000,000 to

$430,187,000. The terms and conditions of the Tender Offer and the

Consent Solicitation, as set forth in an Offer to Purchase and

Consent Solicitation (the “Statement”), dated April 20, 2022,

otherwise remain unchanged.

As of the Early Tender Time, $430,187,000 aggregate principal

amount of the Notes had been validly tendered and not validly

withdrawn. The Company intends to accept all such Notes without

proration. The settlement date for the Notes accepted for purchase

is expected to occur on May 4, 2022 (the "Early Settlement Date").

Holders of Notes validly tendered at or prior to the Early Tender

Time, not validly withdrawn and accepted for purchase in accordance

with the terms of the Tender Offer will receive on the Early

Settlement Date, for each $1,000 principal amount of such Notes,

the “Total Consideration” of $1,050, which includes an “Early

Tender Premium” of $30.00. In addition to the Total Consideration,

such Holders are also receiving, in respect of such Notes, accrued

and unpaid interest from February 1, 2022, the last interest

payment date for the Notes to, but not including, the Early

Settlement Date.

Pursuant to the Consent Solicitation, the Company obtained the

requisite consents required to approve the Proposed Amendments. The

Company intends to execute a supplemental indenture to the

indenture governing the Notes to give effect to the Proposed

Amendments. Upon such execution, the Proposed Amendments will be

effective.

Because the aggregate principal amount of the Notes that has

been accepted for purchase is equal to the Maximum Tender Amount,

no further Notes will be accepted in the Tender Offer.

The Company has engaged BofA Securities, Inc. and Citigroup

Global Markets Inc. to act as the dealer managers for the Tender

Offer and solicitation agents for the Consent Solicitation. The

Information Agent for the Tender Offer and the Consent Solicitation

is Global Bondholder Services Corporation. Copies of the Statement

and related offering materials are available by contacting the

Information Agent at (855) 654-2014 (toll-free) or (212) 430-3774.

Questions regarding the Tender Offer and the Consent Solicitation

should be directed to BofA Securities, Inc. at (888) 292-0070

(toll-free) or (980) 387-5602 (collect) or debt_advisory@bofa.com

and Citigroup Global Markets, Inc. at (800) 558-3745 (toll-free) or

(212) 723-6106 (collect).

This press release is not an offer to purchase or a solicitation

of an offer to sell any securities. The Tender Offer and the

Consent Solicitation are being made solely pursuant to the terms of

the Statement. The Company may amend, extend or terminate the

Tender Offer in its sole discretion. The Tender Offer and the

Consent Solicitation is not being made to holders of Notes in any

jurisdiction in which the making or acceptance thereof would not be

in compliance with the securities or other laws of such

jurisdiction.

Forward-Looking Statements

This release contains forward-looking statements. The words

“expect,” “believe,” “estimated,” and other similar expressions are

intended to identify forward-looking statements, which are

generally not historical in nature. Such forward-looking statements

involve significant risks, uncertainties and assumptions that could

cause actual results to differ materially from our historical

experience and our present expectations or projections. For

information regarding known material factors that could cause

actual results to differ from projected results, please see our

risk factors set forth in our filings with the United States

Securities and Exchange Commission, which include our Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current

Reports on Form 8-K. We caution you not to place undue reliance on

any forward-looking statements, which speak only as of the date

hereof. We undertake no obligation to publicly update or revise any

of our forward-looking statements after the date they are made,

whether as a result of new information, future events or otherwise,

except to the extent required by law.

United Kingdom

The communication of this press release and any other documents

or materials relating to the Tender Offer and the Consent

Solicitation is not being made and such documents and/or materials

have not been approved by an authorized person for the purposes of

section 21 of the Financial Services and Markets Act 2000 (“FSMA”).

Accordingly, such documents and/or materials are not being

distributed to, and must not be passed on to, the general public in

the United Kingdom. The communication of such documents and/or

materials is exempt from the restriction on financial promotions

under section 21 of the FSMA on the basis that it is only directed

at and may be communicated to (1) those persons who are existing

members or creditors of the Company or other persons within Article

43 of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005, and (2) to any other persons to whom these

documents and/or materials may lawfully be communicated.

European Economic Area (EEA)

In any European Economic Area (EEA) Member State (the “Relevant

State”), this press release is only addressed to and is only

directed at qualified investors in that Relevant State within the

meaning of Regulation (EU) 2017/1129 of the European Parliament and

of the Council of 14 June 2017, as amended (the “Prospectus

Regulation”). Each person in a Relevant State who receives any

communication in respect of the Tender Offer and the Consent

Solicitation contemplated in this press release will be deemed to

have represented, warranted and agreed to and with each Dealer

Manager and Solicitation Agent and the Company that it is a

qualified investor within the meaning of Article 2(e) of the

Prospectus Regulation.

About TechnipFMC

TechnipFMC is a leading technology provider to the traditional

and new energy industries, delivering fully integrated projects,

products, and services.

With our proprietary technologies and comprehensive solutions,

we are transforming our clients’ project economics, helping them

unlock new possibilities to develop energy resources while reducing

carbon intensity and supporting their energy transition

ambitions.

Organized in two business segments — Subsea and Surface

Technologies — we will continue to advance the industry with our

pioneering integrated ecosystems (such as iEPCI™, iFEED™ and

iComplete™), technology leadership and digital innovation.

Each of our approximately 20,000 employees is driven by a

commitment to our clients’ success, and a culture of strong

execution, purposeful innovation, and challenging industry

conventions.

TechnipFMC uses its website as a channel of distribution of

material company information. To learn more about how we are

driving change in the industry, go to www.TechnipFMC.com and follow

us on Twitter @TechnipFMC.

Category: UK regulatory

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220503006385/en/

Investor relations Matt Seinsheimer Vice President,

Investor Relations Tel: +1 281 260 3665 Email: Matt Seinsheimer

James Davis Senior Manager, Investor Relations Tel: +1 281 260 3665

Email: James Davis Media relations Nicola Cameron Vice

President, Corporate Communications Tel: +44 1383 742297 Email:

Nicola Cameron Catie Tuley Director, Public Relations Tel: +1 713

876 7296 Email: Catie Tuley

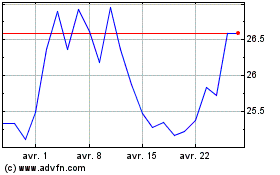

TechnipFMC (NYSE:FTI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

TechnipFMC (NYSE:FTI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024