TechnipFMC (NYSE: FTI) (“TechnipFMC” or the “Company”) announced

today that its Board of Directors has authorized a new share

repurchase program under which the Company may repurchase up to

$400 million of its outstanding ordinary shares. The program

represents 14 percent of the Company's outstanding shares at

yesterday’s closing price.

Doug Pferdehirt, TechnipFMC’s Chair and CEO, stated, “The rapid

improvement in our capital structure has enabled us to accelerate

our plan for shareholder distributions. We firmly believe that our

shares are undervalued today, and this share repurchase program

underscores our confidence in the long-term outlook for our

Company. In addition, we are reaffirming our intent to initiate a

quarterly dividend in the second half of 2023.”

The share repurchase program is in accordance with the

authorization granted by TechnipFMC’s shareholders on May 20,

2021.

The Company expects to make share repurchases from time to time

subject to the Company’s capital plan, general economic and market

conditions, and other factors. Shares purchased under the

repurchase program will be made through open market purchases,

privately negotiated transactions, Rule 10b5-1 plans, and any other

means in accordance with applicable securities laws. The repurchase

program does not obligate the Company to acquire any particular

amount of ordinary shares. The program may also be suspended or

discontinued at any time at the Company’s discretion.

About TechnipFMC

TechnipFMC is a leading technology provider to the traditional

and new energy industries, delivering fully integrated projects,

products, and services.

With our proprietary technologies and comprehensive solutions,

we are transforming our clients’ project economics, helping them

unlock new possibilities to develop energy resources while reducing

carbon intensity and supporting their energy transition

ambitions.

Organized in two business segments – Subsea and Surface

Technologies – we will continue to advance the industry with our

pioneering integrated ecosystems (such as iEPCI™, iFEED™ and

iComplete™), technology leadership and digital innovation.

Each of our approximately 20,000 employees is driven by a

commitment to our clients’ success, and a culture of strong

execution, purposeful innovation, and challenging industry

conventions.

TechnipFMC uses its website as a channel of distribution of

material company information. To learn more about how we are

driving change in the industry, go to www.TechnipFMC.com

and follow us on Twitter @TechnipFMC.

Forward-Looking Statements

This press release contains “forward-looking statements” as

defined in Section 27A of the United States Securities Act of 1933,

as amended, and Section 21E of the United States Securities

Exchange Act of 1934, as amended. Forward-looking statements are

often identified by words such as “guidance,” “confident,”

“believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,”

“should,” “would,” “could,” “may,” “will,” “likely,” “predicated,”

“estimate,” “outlook” and similar expressions, including the

negative thereof. The absence of these words, however, does not

mean that the statements are not forward-looking. These

forward-looking statements are based on our current expectations,

beliefs, and assumptions concerning future developments and

business conditions and their potential effect on us. While

management believes these forward-looking statements are reasonable

as and when made, there can be no assurance that future

developments affecting us will be those that we anticipate. All of

our forward-looking statements involve risks and uncertainties

(some of which are significant or beyond our control) and

assumptions that could cause actual results to differ materially

from our historical experience and our present expectations or

projections, including unpredictable trends in the demand for and

price of crude oil and natural gas; competition and unanticipated

changes relating to competitive factors in our industry, including

ongoing industry consolidation; the COVID-19 pandemic and its

impact on the demand for our products and services; our inability

to develop, implement and protect new technologies and services;

the cumulative loss of major contracts, customers or alliances;

disruptions in the political, regulatory, economic and social

conditions of the countries in which we conduct business; the

refusal of DTC to act as depository and clearing agencies for our

shares; the United Kingdom’s withdrawal from the European Union;

the impact of our existing and future indebtedness and the

restrictions on our operations by terms of the agreements governing

our existing indebtedness; the risks caused by our acquisition and

divestiture activities; the risks caused by fixed-price contracts;

any delays and cost overruns of new capital asset construction

projects for vessels and manufacturing facilities; our failure to

deliver our backlog; our reliance on subcontractors, suppliers and

our joint venture partners; a failure or breach of our IT

infrastructure or that of our subcontractors, suppliers or joint

venture partners, including as a result of cyber-attacks; the risks

of pirates endangering our maritime employees and assets; potential

liabilities inherent in the industries in which we operate or have

operated; our failure to comply with numerous laws and regulations,

including those related to environmental protection, health and

safety, labor and employment, import/export controls, currency

exchange, bribery and corruption, taxation, privacy, data

protection and data security; the additional restrictions on

dividend payouts or share repurchases as an English public limited

company; uninsured claims and litigation against us, including

intellectual property litigation; tax laws, treaties and

regulations and any unfavorable findings by relevant tax

authorities; the uncertainties related to the anticipated benefits

or our future liabilities in connection with the spin-off of

Technip Energies (the “Spin-off”); any negative changes in Technip

Energies’ results of operations, cash flows and financial position,

which impact the value of our remaining investment therein;

potential departure of our key managers and employees; adverse

seasonal and weather conditions and unfavorable currency exchange

rate and risk in connection with our defined benefit pension plan

commitments and other risks as discussed in Part I, Item 1A, “Risk

Factors” of our Annual Report on Form 10-K for the fiscal year

ended December 31, 2021 and Part II, Item 1A, “Risk Factors” of our

subsequently filed Quarterly Reports on Form 10-Q. We caution you

not to place undue reliance on any forward-looking statements,

which speak only as of the date hereof. We undertake no obligation

to publicly update or revise any of our forward-looking statements

after the date they are made, whether as a result of new

information, future events or otherwise, except to the extent

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220727005613/en/

Investor relations

Matt Seinsheimer Vice President, Investor Relations Tel: +1 281

260 3665 Email: Matt Seinsheimer

James Davis Senior Manager, Investor Relations Tel: +1 281 260

3665 Email: James Davis

Media relations

Nicola Cameron Vice President, Corporate Communications Tel: +44

1383 742297 Email: Nicola Cameron

Catie Tuley Director, Public Relations Tel: +1 281 591 5405

Email: Catie Tuley

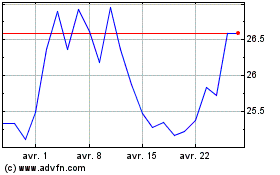

TechnipFMC (NYSE:FTI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

TechnipFMC (NYSE:FTI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024