Hess Midstream LP Announces Secondary Public Offering of Class A Shares

18 Septembre 2024 - 10:17PM

Business Wire

Hess Midstream LP (NYSE: HESM) (“HESM”) today announced the

commencement of an underwritten public offering of an aggregate of

10,000,000 Class A shares representing limited partner interests in

HESM by an affiliate of Global Infrastructure Partners (the

“Selling Shareholder”). The Selling Shareholder intends to grant

the underwriters a 30-day option to purchase up to 1,500,000

additional Class A shares. HESM will not receive any proceeds from

the sale of Class A shares in the offering.

Citigroup is acting as the bookrunning manager of the offering.

The underwriter intends to offer the Class A shares from time to

time for sale in one or more transactions on the New York Stock

Exchange, in the over-the-counter market or through negotiated

transactions at market prices or at negotiated prices.

The offering of these securities is being made only by means of

the prospectus supplement and accompanying base prospectus as filed

with the Securities and Exchange Commission (the “SEC”). Copies of

the preliminary prospectus supplement and accompanying base

prospectus relating to the offering may be obtained free of charge

on the SEC’s website at www.sec.gov under HESM’s name or from

Citigroup as follows:

Citigroup c/o Broadridge Financial Solutions

1155 Long Island Avenue Edgewood, NY 11717 Telephone:

800-831-9146

The Class A shares are being offered and will be sold pursuant

to an effective shelf registration statement that was previously

filed with the SEC. This press release shall not constitute an

offer to sell or a solicitation of an offer to buy the securities

described above, nor shall there be any sale of these securities in

any state or jurisdiction in which such an offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such state or jurisdiction. The offering

is being made only by means of a prospectus and related prospectus

supplement meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

About Hess Midstream LP

HESM is a fee-based, growth-oriented midstream company that

owns, operates, develops and acquires a diverse set of midstream

assets to provide services to Hess Corporation and third-party

customers. HESM owns oil, gas and produced water handling assets

that are primarily located in the Bakken and Three Forks Shale

plays in the Williston Basin area of North Dakota.

Forward Looking Statements

This press release contains “forward-looking statements” within

the meaning of U.S. federal securities laws. Words such as

“anticipate,” “estimate,” “expect,” “forecast,” “guidance,”

“could,” “may,” “should,” “would,” “believe,” “intend,” “project,”

“plan,” “predict,” “will,” “target” and similar expressions

identify forward-looking statements, which are not historical in

nature. Forward-looking statements are subject to certain known and

unknown risks and uncertainties that could cause actual results to

differ materially from our historical experience and our current

projections or expectations of future results expressed or implied

by these forward-looking statements. You should keep in mind the

risk factors and other cautionary statements in the filings made by

HESM with the SEC, which are available to the public. HESM

undertakes no obligation to, and does not intend to, update these

forward-looking statements to reflect events or circumstances

occurring after this press release. You are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240918881521/en/

Investors: Jennifer Gordon (212) 536-8244

Media: Lorrie Hecker (212) 536-8250

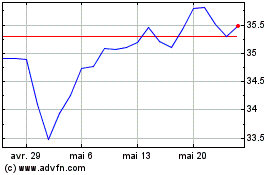

Hess Midstream (NYSE:HESM)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Hess Midstream (NYSE:HESM)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024