Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 Août 2024 - 9:57PM

Edgar (US Regulatory)

INVESTMENT PORTFOLIO (unaudited)

|

|

|

| As of June 30, 2024 |

|

Highland Global Allocation Fund |

|

|

|

|

|

|

|

|

|

| Shares |

|

|

|

|

Value ($) |

|

| |

U.S. Equity — 47.4% |

|

| |

Communication Services — 21.9% |

|

| |

169,531 |

|

|

MidWave Wireless, Inc. (fka Terrestar Corp.) (a)(b)(c)(d)(e) |

|

|

55,167,083 |

|

| |

189,945 |

|

|

Telesat (e)(f) |

|

|

1,728,499 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

56,895,582 |

|

|

|

|

|

|

|

|

|

|

| |

Energy — 1.7% |

|

| |

357,484 |

|

|

Talos Energy, Inc. (e) |

|

|

4,343,431 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,343,431 |

|

|

|

|

|

|

|

|

|

|

| |

Financials — 0.4% |

|

| |

100,000 |

|

|

TXSE Group, Inc. (a)(b)(e) |

|

|

1,000,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,000,000 |

|

|

|

|

|

|

|

|

|

|

| |

Healthcare — 0.4% |

|

| |

232,800 |

|

|

Heron Therapeutics, Inc. (e)(f) |

|

|

814,800 |

|

| |

17,200 |

|

|

Patterson (f) |

|

|

414,864 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,229,664 |

|

|

|

|

|

|

|

|

|

|

| |

Materials — 1.4% |

|

| |

730,484 |

|

|

MPM Holdings, Inc. (d)(e) |

|

|

3,652,420 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,652,420 |

|

|

|

|

|

|

|

|

|

|

| |

Real Estate — 21.6% |

|

| |

56,000 |

|

|

Alexandria Real Estate Equities, REIT (f) |

|

|

6,550,320 |

|

| |

8,055 |

|

|

City Office, REIT (f) |

|

|

40,114 |

|

| |

1,147,062 |

|

|

GAF REIT (a)(b)(c)(e) |

|

|

12,936,945 |

|

| |

573,554 |

|

|

NexPoint Diversified Real Estate Trust, REIT (c)(f) |

|

|

3,171,754 |

|

| |

901,385 |

|

|

NexPoint Real Estate Finance, Inc., REIT (c)(f) |

|

|

12,367,007 |

|

| |

180,761 |

|

|

NexPoint Residential Trust, Inc., REIT (c)(f) |

|

|

7,141,867 |

|

| |

417,500 |

|

|

Seritage Growth Properties (e)(f) |

|

|

1,949,725 |

|

| |

280,000 |

|

|

United Development Funding IV, REIT, REIT (a)(b) |

|

|

173,320 |

|

| |

875,255 |

|

|

Whitestone, REIT, Class B (f) |

|

|

11,649,644 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

55,980,696 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Equity

(Cost $128,109,960) |

|

|

123,101,793 |

|

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount ($) |

|

|

|

| |

U.S. Senior Loans (g) — 14.1% |

|

| |

Communication Services — 9.4% |

|

| |

24,528,643 |

|

|

MidWave Wireless, Inc. (fka Terrestar Corp.) Term Loan A, 1st Lien, cash/0% PIK 02/27/28

(a)(b)(c) |

|

|

24,474,680 |

|

|

|

|

|

|

|

|

|

|

| |

Real Estate — 4.7% |

|

|

|

|

| |

5,000,000 |

|

|

NexPoint SFR Operating Partnership L.P., 05/24/27 (a)(b)(c) |

|

|

4,850,000 |

|

| |

8,500,000 |

|

|

NHT Operating Partnership LLC Convertible Promissory Note, 02/22/27 (a)(b)(c) |

|

|

7,348,250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,198,250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Senior Loans

(Cost $38,020,784) |

|

|

36,672,930 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares |

|

|

|

|

|

|

| |

Non-U.S. Equity — 9.8% |

|

| |

Communication Services — 0.0% |

|

| |

77,866 |

|

|

Grupo Clarin, Class B (e)(h) |

|

|

117,839 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares |

|

|

|

|

Value ($) |

|

| |

Non-U.S. Equity (continued) |

|

| |

Consumer Discretionary — 1.9% |

|

| |

3,000 |

|

|

MercadoLibre, Inc. (e)(f)(h) |

|

|

4,930,200 |

|

|

|

|

|

|

|

|

|

|

| |

Energy — 3.3% |

|

|

|

|

| |

65,800 |

|

|

Targa Resources (f)(h) |

|

|

8,473,724 |

|

| |

121 |

|

|

Transocean (e)(f)(h) |

|

|

648 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,474,372 |

|

|

|

|

|

|

|

|

|

|

| |

Financials — 0.1% |

|

|

|

|

| |

24,300 |

|

|

Grupo Supervielle ADR (f)(h) |

|

|

164,754 |

|

| |

3,995 |

|

|

StoneCo, Class A (e)(f)(h) |

|

|

47,900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

212,654 |

|

|

|

|

|

|

|

|

|

|

| |

Healthcare — 0.0% |

|

|

|

|

| |

10,445 |

|

|

HLS Therapeutics Inc. (e)(h) |

|

|

25,590 |

|

|

|

|

|

|

|

|

|

|

| |

Industrials — 0.4% |

|

|

|

|

| |

60,593 |

|

|

GL Events (h) |

|

|

1,082,197 |

|

|

|

|

|

|

|

|

|

|

| |

Utilities — 4.1% |

|

| |

202,250 |

|

|

Central Puerto ADR (f)(h) |

|

|

1,834,407 |

|

| |

67,700 |

|

|

Pampa Energia ADR (e)(f)(h) |

|

|

2,996,402 |

|

| |

66,500 |

|

|

Vistra Corp. (f)(h) |

|

|

5,717,670 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,548,479 |

|

|

|

|

|

|

|

|

|

|

|

Total Non-U.S. Equity

(Cost $13,858,406) |

|

|

25,391,331 |

|

|

|

|

|

|

|

| |

U.S. Master Limited Partnerships — 9.2% |

|

| |

Energy — 9.2% |

|

| |

1,127,440 |

|

|

Energy Transfer L.P. (f) |

|

|

18,287,077 |

|

| |

139,050 |

|

|

Western Midstream Partners L.P. (f) |

|

|

5,524,457 |

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Master Limited Partnerships

(Cost $21,741,958) |

|

|

23,811,534 |

|

|

|

|

|

|

|

| |

U.S. LLC Interest — 8.9% |

|

| |

Real Estate — 8.9% |

|

| |

349 |

|

|

GAF REIT Sub II, LLC (a)(b)(c)(e) |

|

|

8,460,993 |

|

| |

156,528 |

|

|

GAF REIT Sub III, LLC (a)(b)(c)(e) |

|

|

11,146,971 |

|

| |

3,789,008 |

|

|

SFR WLIF III, LLC (a)(b)(c) |

|

|

3,410,866 |

|

|

|

|

|

|

|

|

|

|

|

Total U.S. LLC Interest

(Cost $24,175,570) |

|

|

23,018,830 |

|

|

|

|

|

|

|

| |

U.S. Registered Investment Companies — 5.8% |

|

| |

334,005 |

|

|

Highland Opportunities and Income Fund (c)(f) |

|

|

2,087,531 |

|

| |

724,799 |

|

|

NexPoint Event Driven Fund, Class Z (c) |

|

|

11,691,004 |

|

| |

58,598 |

|

|

NexPoint Merger Arbitrage Fund, Class Z (c) |

|

|

1,154,964 |

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Registered Investment Companies

(Cost $15,676,922) |

|

|

14,933,499 |

|

|

|

|

|

|

|

INVESTMENT PORTFOLIO (unaudited)(continued)

|

|

|

| As of June 30, 2024 |

|

Highland Global Allocation Fund |

|

|

|

|

|

|

|

|

|

| Principal Amount ($) |

|

Value ($) |

|

| |

Non-U.S. Sovereign Bonds —

4.4% |

|

|

|

|

| |

90,699 |

|

|

Argentine Republic Government International Bond

1.00%, (05/15/2024) (h) |

|

|

52,152 |

|

| |

29,000,000 |

|

|

3.50%, (05/15/2024)(h)(i) |

|

|

11,357,704 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Non-U.S. Sovereign Bonds

(Cost

$16,956,867) |

|

|

11,409,856 |

|

|

|

|

|

|

|

|

|

|

| |

U.S. Preferred Stock — 3.6% |

|

|

|

|

| |

Financials — 0.8% |

|

|

|

|

| |

25,000 |

|

|

First Horizon (f)(j) |

|

|

613,750 |

|

| |

89,000 |

|

|

Western Alliance Bancorp (f)(j) |

|

|

1,606,450 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,220,200 |

|

|

|

|

|

|

|

|

|

|

| |

Healthcare — 1.5% |

|

|

|

|

| |

202,684 |

|

|

Apnimed, Series C-1 (a)(b)(e)(j) |

|

|

2,466,664 |

|

| |

108,098 |

|

|

Apnimed, Series C-2 (a)(b)(e)(j) |

|

|

1,392,302 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,858,966 |

|

|

|

|

|

|

|

|

|

|

| |

Real Estate — 1.3% |

|

|

|

|

| |

239,774 |

|

|

Braemar Hotels & Resorts, Inc. (e)(j) |

|

|

3,083,494 |

|

| |

13,831 |

|

|

NexPoint Diversified Real Estate Trust, REIT (c)(f)(j) |

|

|

202,624 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,286,118 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Preferred Stock

(Cost $7,972,655) |

|

|

9,365,284 |

|

|

|

|

|

|

|

|

|

|

| |

Non-U.S. Registered Investment Company

— 1.3% |

|

| |

10,000 |

|

|

BB Votorantim Highland Infrastructure, LLC (a)(b)(c) |

|

|

3,446,530 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Non-U.S. Registered Investment Company

(Cost

$4,574,500) |

|

|

3,446,530 |

|

|

|

|

|

|

|

|

|

|

| |

Non-U.S. Master Limited Partnership

— 0.9% |

|

|

|

|

| |

Energy — 0.9% |

|

|

|

|

| |

78,631 |

|

|

Enterprise Products Partners L.P. (f)(h) |

|

|

2,278,726 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Non-U.S. Master Limited Partnership

(Cost

$2,151,846) |

|

|

2,278,726 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Principal Amount ($) |

|

|

|

|

| |

U.S. Corporate Bonds & Notes — 0.2% |

|

|

|

|

| |

Communication Services — 0.2% |

|

|

|

|

| |

320,615 |

|

|

iHeartCommunications, Inc.

6.38%, 05/01/26 (f) |

|

|

249,627 |

|

| |

584,493 |

|

|

8.38%, 05/01/27 (f) |

|

|

216,690 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Corporate Bonds & Notes

(Cost $1,313,965) |

|

|

466,317 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount ($) |

|

Value ($) |

|

| |

U.S. Asset-Backed Security — 0.1% |

|

|

|

|

| |

250,000 |

|

|

CFCRE Commercial Mortgage Trust, Series 2017-C8,

Class D 3.00%, (05/15/2024) |

|

|

191,829 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Asset-Backed Security

(Cost $225,684) |

|

|

191,829 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Units |

|

|

|

|

|

|

| |

U.S. Rights — 0.1% |

|

|

|

|

| |

Healthcare — 0.1% |

|

|

|

|

| |

2,156,000 |

|

|

Paratek Pharmaceuticals (a)(b)(e) |

|

|

172,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Rights

(Cost $–) |

|

|

172,480 |

|

|

|

|

|

|

|

|

|

|

| |

Non-U.S. Warrants —

0.0% |

|

|

|

|

| |

Communication Services — 0.0% |

|

|

|

|

| |

1,109 |

|

|

iHeartCommunications, Inc., Expires 05/01/2039(e)(h) |

|

|

970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

970 |

|

|

|

|

|

|

|

|

|

|

| |

Industrials — 0.0% |

|

|

|

|

| |

1,260,362 |

|

|

American Airlines Group, Inc., Expires (a)(b)(e)(h) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Non-U.S. Warrants

(Cost $23,084) |

|

|

970 |

|

|

|

|

|

|

|

|

|

|

|

|

| Principal Amount ($) |

|

|

|

| |

U.S. Repurchase Agreement — 0.0% |

|

|

|

|

| |

12 |

|

|

Daiwa Capital Markets 5.350%, dated 06/28/2024 to be repurchased on 07/01/2024, repurchase

price $12 (collateralized by U.S. Government obligations, ranging in par value $0 - $1, 0.000% - 7.500%, 07/11/2024 - 07/01/2054; with total market value $12)(k)(l) |

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Repurchase Agreement

(Cost $12) |

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

Total Investments -105.8%

(Cost $274,802,213) |

|

|

274,261,921 |

|

|

|

|

|

|

|

|

|

|

INVESTMENT PORTFOLIO (unaudited)(concluded)

|

|

|

| As of June 30, 2024 |

|

Highland Global Allocation Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares |

|

|

|

|

Value ($) |

|

| |

Securities Sold Short— (3.7)% |

|

| |

U.S. Exchange-Traded Fund — (0.8)% |

|

|

|

|

|

|

(9,610) |

|

|

iShares Russell 2000 ETF |

|

|

(1,949,773 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Exchange-Traded Fund

(Proceeds $2,000,747) |

|

|

(1,949,773 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

U.S. Equity — (2.9)% |

|

| |

Communication Services — (2.6)% |

|

|

|

|

|

|

(9,952) |

|

|

Netflix, Inc. (m) |

|

|

(6,716,406 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Consumer Staples — (0.3)% |

|

|

|

|

|

|

(4,000) |

|

|

WD-40 Co. |

|

|

(878,560 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Total U.S. Equity

(Proceeds $1,665,944) |

|

|

(7,594,966 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Securities Sold Short- (3.7)%

(Proceeds $3,666,691) |

|

|

(9,544,739 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Other Assets & Liabilities, Net - (2.1)%(n) |

|

|

(5,350,268 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Assets - 100.0% |

|

|

259,366,914 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Securities with a total aggregate value of $136,447,084, or 52.6% of net assets, were classified as

Level 3 within the three-tier fair value hierarchy. Please see Notes to Investment Portfolio for an explanation of this hierarchy, as well as a list of unobservable inputs used in the valuation of these instruments. |

| (b) |

Represents fair value as determined by the Investment Adviser pursuant to the policies and procedures approved

by the Board of Trustees (the “Board”). The Board has designated the Investment Adviser as “valuation designee” for the Fund pursuant to Rule 2a-5 of the Investment Company Act of 1940, as

amended. The Investment Adviser considers fair valued securities to be securities for which market quotations are not readily available and these securities may be valued using a combination of observable and unobservable inputs. Securities with a

total aggregate value of $136,447,084, or 52.6% of net assets, were fair valued under the Fund’s valuation procedures as of June 30, 2024. Please see Notes to Investment Portfolio. |

| (c) |

Affiliated issuer. Assets with a total aggregate fair value of $169,059,069, or 65.2% of net assets, were

affiliated with the Fund as of June 30, 2024. |

| (d) |

Restricted Securities. These securities are not registered and may not be sold to the public. There are legal

and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or

in good faith under the policies and procedures established by the Board. Additional Information regarding such securities follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restricted

Security |

|

Security Type |

|

Acquisition

Date |

|

|

Cost of

Security |

|

|

Fair Value at

Period End |

|

|

Percent of

Net Assets |

|

| MidWave Wireless, Inc. (fka Terrestar Corp.) |

|

U.S. Equity |

|

|

11/14/2014 |

|

|

$ |

48,015,561 |

|

|

$ |

55,167,083 |

|

|

|

21.3 |

% |

| MPM Holdings, Inc. |

|

U.S. Equity |

|

|

5/15/2019 |

|

|

$ |

— |

|

|

$ |

3,652,420 |

|

|

|

1.4 |

% |

| (e) |

Non-income producing security. |

| (f) |

All or part of this security is pledged as collateral for short sales. The fair value of the securities pledged

as collateral was $ 92,139,725. |

| (g) |

Senior loans (also called bank loans, leveraged loans, or floating rate loans) in which the Fund invests

generally pay interest at rates which are periodically determined by reference to a base lending rate plus a spread (unless otherwise identified, all senior loans carry a variable rate of interest). These base lending rates are generally

(i) the Prime Rate offered by one or more major United States banks, (ii) the lending rate offered by one or more European banks such as the Secured Overnight Financing Rate (“SOFR”) or (iii) the Certificate of Deposit rate.

As of June 30, 2024, the SOFR 1 Month and SOFR 3 Month rates were 5.33% and 5.32%, respectively. Senior loans, while exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”), contain certain restrictions

on resale and cannot be sold publicly. Senior secured floating rate loans often require prepayments from excess cash flow or permit the borrower to repay at its election. The degree to which borrowers repay, whether as a contractual requirement or

at their election, cannot be predicted with accuracy. As a result, the actual remaining maturity maybe substantially less than the stated maturity shown. |

| (h) |

As described in the Fund’s prospectus, a company is considered to be a

non-U.S. issuer if the company’s securities principally trade on a market outside of the United States, the company derives a majority of its revenues or profits outside of the United States, the company

is not organized in the United States, or the company is significantly exposed to the economic fortunes and risks of regions outside the United States. |

| (i) |

Step Coupon Security. Coupon rate will either increase (step-up bond)

or decrease (step-down bond) at regular intervals until maturity. Interest rate shown reflects the rate currently in effect. |

| (j) |

Perpetual security with no stated maturity date. |

| (k) |

Tri-Party Repurchase Agreement. |

| (l) |

This security was purchased with cash collateral held from securities on loan. The total value of such

securities as of June 30, 2024 was $12. |

| (m) |

No dividend payable on security sold short. |

| (n) |

As of June 30, 2024, $9,541,239 in cash was segregated or on deposit with the brokers to cover investments

sold short and is included in “Other Assets & Liabilities, Net”.

|

GLOSSARY: (abbreviations that may be used in the preceding statements) (Unaudited)

Other Abbreviations:

|

|

|

| ADR |

|

American Depositary Receipt |

| LLC |

|

Limited Liability Company |

| L.P. |

|

Limited Partnership |

| PIK |

|

Payment-in-Kind |

| REIT |

|

Real Estate Investment Trust |

NOTES TO INVESTMENT PORTFOLIO (unaudited)

|

|

|

| As of June 30, 2024 |

|

Highland Global Allocation Fund |

Organization

NexPoint Funds II (the “Trust”) is a Massachusetts business trust organized on August 10, 1992. The Trust is registered under the Investment

Company Act of 1940, as amended (the “1940 Act”), as a closed-end management investment company. It comprises two portfolios (collectively the “Funds”) that are currently being offered.

This report covers information for the period ended June 30, 2024 for Highland Global Allocation Fund (the “Fund”). NexPoint Climate Tech Fund is reported separately.

Valuation of Investments

Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated NexPoint as the Fund’s valuation designee to perform the fair valuation determination for securities and other assets held by the Fund. NexPoint acting through

its “Valuation Committee,” is responsible for determining the fair value of investments for which market quotations are not readily available. The Valuation Committee is comprised of officers of NexPoint and certain of NexPoint’s

affiliated companies and determines fair value and oversees the calculation of the NAV. The Valuation Committee is subject to Board oversight and certain reporting and other requirements intended to provide the Board the information it needs to

oversee NexPoint’s fair value determinations.

The Fund’s investments are recorded at fair value. In computing the Fund’s net assets

attributable to shares, securities with readily available market quotations on the New York Stock Exchange (“NYSE”), National Association of Securities Dealers Automated Quotation (“NASDAQ”) or other nationally recognized

exchange, use the closing quotations on the respective exchange for valuation of those securities. Securities for which there are no readily available market quotations will be valued pursuant to policies established by NexPoint and approved by the

Fund’s Board. Typically, such securities will be valued at the mean between the most recently quoted bid and ask prices provided by the principal market makers. If there is more than one such principal market maker, the value shall be the

average of such means. Securities without a sale price or quotations from principal market makers on the valuation day may be priced by an independent pricing service. Generally, the Fund’s loan and bond positions are not traded on exchanges

and consequently are valued based on a mean of the bid and ask price from the third-party pricing services or broker-dealer sources that the Investment Adviser has determined to have the capability to provide appropriate pricing services.

Securities for which market quotations are not readily available, or for which the Fund has determined that the price received from a pricing service or

broker-dealer is “stale” or otherwise does not represent fair value (such as when events materially affecting the value of securities occur between the time when market price is determined and calculation of the Fund’s NAV) will be

valued by the Fund at fair value, as determined by the Board or its designee in good faith in accordance with procedures approved by the Board, taking into account factors reasonably determined to be relevant including: (i) the fundamental

analytical data relating to the investment; (ii) the nature and duration of restrictions on disposition of the securities; and (iii) an evaluation of the forces that influence the market in which these securities are purchased and sold. In

these cases, the Fund’s NAV will reflect the affected portfolio securities’ fair value as determined in the judgment of the Board or its designee instead of being determined by the market. Using a fair value pricing methodology to value

securities may result in a value that is different from a security’s most recent sale price and from the prices used by other investment companies to calculate their NAVs. Determination of fair value is uncertain because it involves subjective

judgments and estimates.

There can be no assurance that the Fund’s valuation of a security will not differ from the amount that it realizes upon the

sale of such security. Those differences could have a material impact to the Fund.

Fair Value Measurements

The Fund has performed an analysis of all existing investments and derivative instruments to determine the significance and character of inputs to their fair

value determination. The levels of fair value inputs used to measure the Fund’s investments are characterized into a fair value hierarchy. Where inputs for an asset or liability fall into more than one level in the fair value hierarchy, the

investment is classified in its entirety based on the lowest level input that is significant to that investment’s valuation. The three levels of the fair value hierarchy are described below:

Level 1 — Quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement;

NOTES TO INVESTMENT PORTFOLIO (unaudited) (continued)

|

|

|

| As of June 30, 2024 |

|

Highland Global Allocation Fund |

Level 2 — Quoted prices for similar instruments in active markets; quoted prices for identical or

similar instruments in markets that are not active, but are valued based on executed trades; broker quotations that constitute an executable price; and alternative pricing sources supported by observable inputs are classified within Level 2.

Level 2 inputs are either directly or indirectly observable for the asset in connection with market data at the measurement date; and

Level 3

— Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. In certain cases, investments classified within Level 3 may include securities for which the Fund has obtained indicative

quotes from broker-dealers that do not necessarily represent prices the broker may be willing to trade on, as such quotes can be subject to material management judgment. Unobservable inputs are those inputs that reflect the Fund’s own

assumptions that market participants would use to price the asset or liability based on the best available information.

The Investment Adviser has

established policies and procedures, as described above and approved by the Board, to ensure that valuation methodologies for investments and financial instruments that are categorized within all levels of the fair value hierarchy are fair and

consistent. A Valuation Committee has been established to provide oversight of the valuation policies, processes and procedures, and is comprised of personnel from the Investment Adviser and its affiliates. The Valuation Committee meets monthly to

review the proposed valuations for investments and financial instruments and is responsible for evaluating the overall fairness and consistent application of established policies.

The fair value of the Fund’s loans, bonds and asset-backed securities are generally based on quotes received from brokers or independent pricing

services. Loans, bonds and asset-backed securities with quotes that are based on actual trades with a sufficient level of activity on or near the measurement date are classified as Level 2 assets. Senior loans, bonds and asset-backed securities

that are priced using quotes derived from implied values, indicative bids, or a limited number of actual trades are classified as Level 3 assets because the inputs used by the brokers and pricing services to derive the values are not readily

observable.

The fair value of the Fund’s common stocks, exchange traded funds, rights and warrants that are not actively traded on national

exchanges are generally priced using quotes derived from implied values, indicative bids, or a limited amount of actual trades and are classified as Level 3 assets because the inputs used by the brokers and pricing services to derive the values

are not readily observable. Exchange-traded options are valued based on the last trade price on the primary exchange on which they trade. If an option does not trade, the mid-price, which is the mean of the

bid and ask price, is utilized to value the option. At the end of each calendar quarter, the Investment Adviser evaluates the Level 2 and 3 assets and liabilities for changes in liquidity, including but not limited to: whether a broker is

willing to execute at the quoted price, the depth and consistency of prices from third party services, and the existence of contemporaneous, observable trades in the market. Additionally, the Investment Adviser evaluates the Level 1 and 2

assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges.

Due to the inherent uncertainty of determining

the fair value of investments that do not have a readily available market value, the fair value of the Fund’s investments may fluctuate from period to period. Additionally, the fair value of investments may differ significantly from the values

that would have been used had a ready market existed for such investments and may differ materially from the values the Fund may ultimately realize. Further, such investments may be subject to legal and other restrictions on resale or otherwise less

liquid than publicly traded securities.

NOTES TO INVESTMENT PORTFOLIO (unaudited) (concluded)

|

|

|

| As of June 30, 2024 |

|

Highland Global Allocation Fund |

Affiliated Issuers

Under Section 2(a)(3) of the Investment Company Act of 1940, as amended, a portfolio company is defined as “affiliated” if a fund owns five

percent or more of its outstanding voting securities or if the portfolio company is under common control. The table below shows affiliated issuers of the Fund as of June 30, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuer |

|

Shares/

Principal

Amount ($)

September

30, 2023 |

|

|

Beginning

Value as of

September

30, 2023

$ |

|

|

Purchases

at Cost

$ |

|

|

Proceeds

from Sales

$ |

|

|

Distribution

to Return of

Capital

$ |

|

|

Net

Amortization

(Accretion)

of Premium/

(Discount)

$ |

|

|

Net

Realized

Gain (Loss)

on Sales of

Affiliated

Issuers

$ |

|

|

Change in

Unrealized

Appreciation

(Depreciation)

$ |

|

|

Ending

Value as of

June 30,

2024

$ |

|

|

Shares/

Principal

Amount ($)

June 30,

2024 |

|

|

Affiliated

Income

$ |

|

|

Cap Gain

Distributions

$ |

|

| Majority Owned, Not Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Affiliates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MidWave Wireless, Inc. (fka Terrestar Corp.) (U.S. Equity) |

|

|

169,531 |

|

|

|

59,727,467 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,560,384 |

) |

|

|

55,167,083 |

|

|

|

169,531 |

|

|

|

— |

|

|

|

— |

|

| GAF REIT (U.S. Equity) |

|

|

1,147,062 |

|

|

|

12,786,700 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

150,245 |

|

|

|

12,936,945 |

|

|

|

1,147,062 |

|

|

|

— |

|

|

|

— |

|

| NexPoint Diversified Real Estate Trust (U.S. Equity) |

|

|

556,218 |

|

|

|

4,844,659 |

|

|

|

119,926 |

|

|

|

— |

|

|

|

(330,871 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1,461,960 |

) |

|

|

3,171,754 |

|

|

|

573,554 |

|

|

|

(76,870 |

) |

|

|

— |

|

| NexPoint Real Estate Finance (U.S. Equity) |

|

|

901,385 |

|

|

|

14,746,664 |

|

|

|

— |

|

|

|

— |

|

|

|

(1,068,645 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1,311,012 |

) |

|

|

12,367,007 |

|

|

|

901,385 |

|

|

|

400,902 |

|

|

|

(49,287 |

) |

| NexPoint Residential Trust, Inc. (U.S. Equity) |

|

|

175,885 |

|

|

|

5,659,979 |

|

|

|

163,713 |

|

|

|

— |

|

|

|

89,712 |

|

|

|

— |

|

|

|

— |

|

|

|

1,228,463 |

|

|

|

7,141,867 |

|

|

|

180,761 |

|

|

|

38,975 |

|

|

|

(298,062 |

) |

| MidWave Wireless, Inc. (fka Terrestar Corp.) (U.S. Senior Loan) |

|

|

22,383,167 |

|

|

|

22,289,158 |

|

|

|

2,145,475 |

|

|

|

— |

|

|

|

— |

|

|

|

1,216 |

|

|

|

— |

|

|

|

38,831 |

|

|

|

24,474,680 |

|

|

|

24,528,643 |

|

|

|

2,167,426 |

|

|

|

— |

|

| NexPoint SFR Operating Partnership, LP (U.S. Senior Loan) |

|

|

5,000,000 |

|

|

|

4,957,500 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(107,500 |

) |

|

|

4,850,000 |

|

|

|

5,000,000 |

|

|

|

281,250 |

|

|

|

— |

|

| NHT Operating Partnership LLC Secured Promissory Note (U.S. Senior Loan) |

|

|

8,500,000 |

|

|

|

8,168,500 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(820,250 |

) |

|

|

7,348,250 |

|

|

|

8,500,000 |

|

|

|

349,326 |

|

|

|

— |

|

| GAF REIT Sub II, LLC (U.S. LLC Interest) |

|

|

349 |

|

|

|

8,561,604 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(100,611 |

) |

|

|

8,460,993 |

|

|

|

349 |

|

|

|

— |

|

|

|

— |

|

| GAF REIT Sub III, LLC (U.S. LLC Interest) |

|

|

156,528 |

|

|

|

11,047,064 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

99,907 |

|

|

|

11,146,971 |

|

|

|

156,528 |

|

|

|

— |

|

|

|

— |

|

| SFR WLIF III, LLC (U.S. LLC Interest) |

|

|

3,789,008 |

|

|

|

3,517,435 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(106,569 |

) |

|

|

3,410,866 |

|

|

|

3,789,008 |

|

|

|

292,929 |

|

|

|

— |

|

| Highland Opportunities and Income Fund (U.S. Registered Investment Company) |

|

|

334,005 |

|

|

|

2,685,400 |

|

|

|

— |

|

|

|

— |

|

|

|

(103,007 |

) |

|

|

— |

|

|

|

— |

|

|

|

(494,862 |

) |

|

|

2,087,531 |

|

|

|

334,005 |

|

|

|

51,303 |

|

|

|

— |

|

| NexPoint Event Driven Fund (U.S. Registered Investment Company) |

|

|

706,236 |

|

|

|

11,130,287 |

|

|

|

285,674 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

275,043 |

|

|

|

11,691,004 |

|

|

|

724,799 |

|

|

|

285,674 |

|

|

|

— |

|

| NexPoint Merger Arbitrage Fund (U.S. Registered Investment Company) |

|

|

57,856 |

|

|

|

1,133,394 |

|

|

|

14,545 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7,025 |

|

|

|

1,154,964 |

|

|

|

58,598 |

|

|

|

28,818 |

|

|

|

— |

|

| NexPoint Diversified Real Estate Trust (U.S. Preferred Stock) |

|

|

13,831 |

|

|

|

198,613 |

|

|

|

— |

|

|

|

— |

|

|

|

(14,263 |

) |

|

|

— |

|

|

|

— |

|

|

|

18,274 |

|

|

|

202,624 |

|

|

|

13,831 |

|

|

|

— |

|

|

|

— |

|

| BB Votorantim Highland Infrastructure LLC (Non-U.S. Registered Investment Company) |

|

|

10,000 |

|

|

|

3,607,189 |

|

|

|

— |

|

|

|

— |

|

|

|

2,717 |

|

|

|

— |

|

|

|

— |

|

|

|

(163,376 |

) |

|

|

3,446,530 |

|

|

|

10,000 |

|

|

|

— |

|

|

|

— |

|

| Other Controlled |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

43,901,061 |

|

|

|

175,061,613 |

|

|

|

2,729,333 |

|

|

|

— |

|

|

|

(1,424,357 |

) |

|

|

1,216 |

|

|

|

— |

|

|

|

(7,308,736 |

) |

|

|

169,059,069 |

|

|

|

46,088,054 |

|

|

|

3,819,733 |

|

|

|

(347,349 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

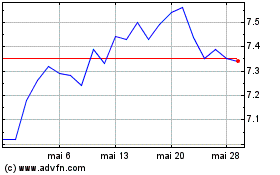

Highland Global Allocation (NYSE:HGLB)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Highland Global Allocation (NYSE:HGLB)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024