Final Impact Disclosure Guidance Released, Aimed to Scale Financing for the UN Sustainable Development Goals

23 Octobre 2024 - 10:00AM

Business Wire

Market-led initiative could drive more capital

to investments that advance sustainable development in places with

the greatest need

The Impact Disclosure Taskforce, a market-led effort co-chaired

by J.P. Morgan and Natixis Corporate & Investment Banking,

released its final voluntary Impact Disclosure Guidance,

following a public consultation period. The Impact Disclosure

Guidance helps corporate and sovereign entities provide

transparency on their efforts to reduce poverty and inequality in

communities that still lack access to basic human needs. It also

helps disseminate information to institutional investors that are

seeking investments that offer both financial and social

returns.

Drawing on existing resources, the final guidance outlines a

five-step process for corporate and sovereign entities to measure

and disclose the development impact of their business strategies or

national development plans. The guidance, whilst voluntary, is

applicable to both developed and developing country entities, as a

means to measure their impact on underserved communities at home

and abroad, and to attract impact-focused investors to fund their

efforts. Key aspects of the guidance include:

- Entity-level but context-specific: Assesses the entity’s

overall strategy in countries of focus, measuring how the entity’s

products, services, and operations are anticipated to address the

most acute development gaps in each country;

- Impact-oriented: Focuses on outputs and outcomes,

including plans to achieve outputs and the theory of change assumed

to lead to outcomes; and

- Forward-looking: Establishes targets that measure

intended impacts, as well as a commitment to monitoring and

reporting progress against targets.

With the release of the final guidance, the Impact Disclosure

Taskforce encourages:

- Investment banks and underwriters to highlight and

promote the adoption of the guidance to their corporate and

sovereign clients;

- Institutional investors to review entities adopting the

guidance for allocation from their sustainable or impact

portfolios;

- Data and analytics providers to support investors with

independent verification and analysis of the development impact

disclosures; and

- Regulators to consider interoperability of the guidance

with sustainable finance rules and disclosure regulations.

First convened in April 2023, the Impact Disclosure Taskforce is

a network of more than 80 financial institutions and industry

stakeholders whose objective is to bring more impact transparency

to financial markets. While continuing to expand its network, the

Taskforce remains a resource to stakeholders looking to implement

the voluntary Impact Disclosure Guidance. Additionally, the group

is now working on building market infrastructure to help

disseminate and analyze disclosed impact information.

Gergana Thiel, Global Co-Head of Macro Sales, J.P.

Morgan:

“Institutional investors that prioritize impact in their

investment strategies are more varied and nuanced than traditional

ESG investors. While some investors may seek impact on financial

inclusion, others on water and sanitation, and others on gender

equality; they all require better impact disclosure from entities

issuing securities. This guidance will increase the investment

opportunities across all themes, providing investors more choice to

invest in accordance with their financial and non-financial

criteria.”

John Ploeg and Armelle de Vienne, Co-Heads of ESG Research

for PGIM Fixed Income:

“Historically, ESG disclosures have focused on

financially-material ESG risks/opportunities; however, with some

asset owners increasingly looking to generate positive

environmental and social impacts with their investments, the need

for issuers to take a standardized approach to reporting impacts is

paramount for asset managers to determine appropriateness for these

clients. This guidance strikes a great balance between

standardization and giving issuers the flexibility to report on

what’s most material for them.”

Dan Grandage, Chief Sustainability Officer, Investments,

Abrdn:

“This guidance addresses a neglected global engagement issue and

provides a practical framework for companies to report on positive

impact. Making this data accessible, consistent, and comparable has

aided impact analysis and reporting in emerging market debt,

notoriously an asset class where data access has been substandard

or difficult to access. We hope it will help support the growth of

investments dedicated to contributing to the UN SDGs, an objective

abrdn is committed to via our SDG aligned fund range.”

Cédric Merle Hamon and Leisa Cardoso De Souza, Center

of Expertise and Innovation within Natixis Corporate &

Investment Banking’s Green and Sustainable Hub:

“The guidance is a new toolbox for framing a contribution to the

UN SDGs in a readable way for financiers. It provides a

step-by-step method and will nudge corporates and sovereign

entities to set forward looking targets. It also paves the way for

fruitful engagement on impact delivery and optimization, but also

remediation as it includes negative effects.”

For more information, visit

https://www.icmagroup.org/assets/documents/Sustainable-finance/Impact-Disclosure-Guidance-October-2024-181024.pdf.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023147754/en/

Media Contacts: Charlotte Powell, J.P. Morgan,

charlotte.f.powell@jpmorgan.com Ashley Frost, J.P. Morgan,

ashley.c.frost@jpmorgan.com

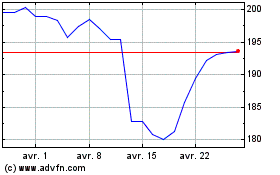

JP Morgan Chase (NYSE:JPM)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

JP Morgan Chase (NYSE:JPM)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024