April Feely promoted to Senior Vice President and Group Director

EB-5 Operations, and James M. Sozomenou promoted to Senior Vice

President and Group Director EB-5 New Business Development

Metropolitan Commercial Bank (the “Bank”) has announced the

promotions of April Feely and James M. Sozomenou as Co-Heads of

Metropolitan Commercial Bank’s EB-5 Private Client Group. In this

dual leadership role, they will continue to provide comprehensive

banking services and products tailored for stakeholders in the

United States Citizen and Immigration Services EB-5 Immigrant

Investor Program. Ms. Feely and Mr. Sozomenou will lead the team

with the support of their long-standing colleagues in serving the

needs of investors, developers, Regional Centers, government

agencies, law firms, and consulting companies specializing in EB-5

and E-2.

“April has demonstrated masterful expertise in EB-5 operations,

while James has consistently delivered exceptional results across

the entire spectrum of EB-5 stakeholders,” stated Mark R. DeFazio,

President and CEO of Metropolitan Commercial Bank. “Both of these

individuals have unquestionably earned their promotions.”

In April 2023, April Feely embarked on a new chapter in her

career by joining Metropolitan Commercial Bank. Prior to this, she

dedicated 14 years of her professional journey to Signature Bank,

where she managed client services and operations for EB-5 and E-2

clients. Before her tenure at Signature Bank, Ms. Feely contributed

her experience to HSBC for over six years. Her academic background

includes a Bachelor of Arts degree from the State University of New

York at Buffalo, located in Amherst, New York.

“I am extremely pleased to continue serving the EB-5 community

with our team and the expertise that we have brought to the table

for many years. James and I look forward to continuing what we’ve

built and expanding our relationships,” said April Feely, Senior

Vice President and Group Director of EB-5 Private Client Group

Operations at Metropolitan Commercial Bank. “The Bank has been more

than supportive in ensuring that our team’s reputation remains

stellar. We are excited for the future here at MCB.”

In April 2023, James M. Sozomenou also became a part of the

Metropolitan Commercial Bank EB-5 team. Prior to this, he dedicated

six years of his career to Signature Bank, where his

responsibilities encompassed client development and operations for

EB-5 and E-2 clients. Before his tenure at Signature Bank, Mr.

Sozomenou held senior sales positions in financial services and

technology firms. He pursued his educational path by studying

communications at Monmouth University in West Long Branch, New

Jersey, and obtaining a Certification in Broadcasting and

Communications from the Connecticut School of Broadcasting in

Hasbrouck Heights, New Jersey.

“I am truly grateful for the opportunity to lead this incredible

EB-5 team alongside April. We have been active in the EB-5 market

for some time now and I am excited to see what is yet to come,”

said James M. Sozomenou, Senior Vice President and Group Director

of EB-5 Private Client Group New Business Development at

Metropolitan Commercial Bank. “The Bank has been extremely

welcoming of our team and this unique business vertical. They are

as excited about the future of EB-5 as we are!”

About Metropolitan Commercial Bank

Metropolitan Commercial Bank (the “Bank”) is a New York City

based full-service commercial bank. The Bank provides a broad range

of business, commercial and personal banking products and services

to small businesses, private and public middle-market and corporate

enterprises and institutions, municipalities and local government

entities, and affluent individuals.

Metropolitan Commercial Bank’s Global Payments group is an

established leader in domestic and international fintech services,

including: providing digital payments settlements; providing a

gateway to payment networks; acting as a custodian of deposits;

providing merchant acquiring services; acting as a global

settlement agent, and as a leading national issuer of third-party

debit cards. The Bank continues to grow its presence as a valued,

trusted and innovative strategic partner across fintech, payments

and money services businesses worldwide.

Metropolitan Commercial Bank was ranked by Independent Community

Bankers of America among the top ten successful loan producers for

2023 by loan category and asset size for commercial banks with more

than $1 billion in assets. The Bank finished ninth in S&P

Global Market Intelligence’s annual ranking of the best-performing

community banks with assets between $3 billion and $10 billion for

2022 and eighth among top-performing community banks in the

Northeast region for 2022. The Bank is also a member of the Piper

Sandler Sm-All Stars Class of 2022 and Kroll affirmed a BBB+

(investment grade) deposit rating on January 25, 2023.

Metropolitan Commercial Bank operates banking centers and

private client offices in Manhattan and Boro Park, Brooklyn in New

York City and Great Neck on Long Island in New York State.

The Bank is a New York State chartered commercial bank, a member

of the Federal Reserve System and the Federal Deposit Insurance

Corporation, and an equal housing lender. The parent company of

Metropolitan Commercial Bank is Metropolitan Bank Holding Corp.

(NYSE: MCB).

For more information, please visit the Bank’s website at

MCBankNY.com.

Forward Looking Statement Disclaimer

This release contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Examples of forward-looking statements include but are not limited

to the Company’s future financial condition and capital ratios,

results of operations and the Company’s outlook and business.

Forward-looking statements are not historical facts. Such

statements may be identified by the use of such words as “may,”

“believe,” “expect,” “anticipate,” “plan,” “continue” or similar

terminology. These statements relate to future events or our future

financial performance and involve risks and uncertainties that may

cause our actual results, levels of activity, performance or

achievements to differ materially from those expressed or implied

by these forward-looking statements. Although we believe that the

expectations reflected in the forward-looking statements are

reasonable, we caution you not to place undue reliance on these

forward-looking statements. Factors which may cause our

forward-looking statements to be materially inaccurate include, but

are not limited to the continuing impact of the COVID-19 pandemic

on our business and results of operation, an unexpected

deterioration in our loan or securities portfolios, unexpected

increases in our expenses, different than anticipated growth and

our ability to manage our growth, unanticipated regulatory action

or changes in regulations, unexpected changes in interest rates,

inflation, an unanticipated decrease in deposits, an unanticipated

loss of key personnel or existing customers, competition from other

institutions resulting in unanticipated changes in our loan or

deposit rates, an unexpected adverse financial, regulatory or

bankruptcy event experienced by our fintech partners, unanticipated

increases in FDIC costs, changes in regulations, legislation or tax

or accounting rules, the current or anticipated impact of military

conflict, terrorism or other geopolitical events and unanticipated

adverse changes in our customers’ economic conditions or general

economic conditions, as well as those discussed under the heading

“Risk Factors” in our Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q.

Forward-looking statements speak only as of the date of this

release. We do not undertake any obligation to update or revise any

forward-looking statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231026332498/en/

212-365-6721 IR@MCBankNY.com

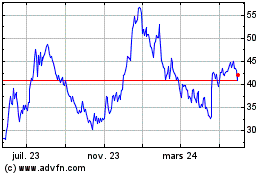

Metropolitan Bank (NYSE:MCB)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

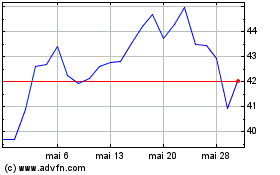

Metropolitan Bank (NYSE:MCB)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024