0000789570FALSE00007895702023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 8, 2023

MGM Resorts International

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 001-10362 | 88-0215232 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

3600 Las Vegas Boulevard South, Las Vegas, Nevada 89109

(Address of principal executive offices – Zip Code)

Registrant’s Telephone Number, Including Area Code: (702) 693-7120

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock (Par Value $0.01) | | MGM | | New York Stock Exchange | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CRF § 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CRF § 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

This current report on Form 8-K is being furnished to disclose the press release issued by the Registrant on November 8, 2023. The purpose of the press release, furnished as Exhibit 99.1, was to announce the Registrant’s results of operations for the quarter ended September 30, 2023. The information in this Form 8-K and Exhibit 99.1 attached hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

ITEM 8.01 OTHER EVENTS

On November 8, 2023, MGM Resorts International ("the Company") announced that its Board of Directors had authorized a new $2.0 billion share repurchase plan, pursuant to which the Company may, from time to time, purchase shares of its common stock. The share repurchase plan will terminate when the aggregate cost of shares repurchased under the program reaches $2.0 billion. Share repurchases may be executed through various means, including, without limitation, open market transactions, privately negotiated transactions or otherwise. Repurchases of common stock may also be made under a Rule 10b5-1 plan, which would permit common stock to be purchased when the Company might otherwise be precluded from doing so under insider trading laws. The timing, volume and nature of stock repurchases will be at the sole discretion of the Company, dependent on market conditions, applicable securities laws, and other factors, and may be suspended or discontinued at any time. The share repurchase plan does not obligate the Company to purchase any shares. The authorization for the share repurchase plan may be terminated, increased or decreased by the Company’s Board of Directors in its discretion at any time.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(a)Not applicable.

(b)Not applicable.

(c)Not applicable.

(d)Exhibits:

| | | | | | | | |

Exhibit Number | | Description |

| | |

99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| | MGM Resorts International |

| | | |

| Date: November 8, 2023 | By: | /s/ Todd Meinert |

| | | Todd Meinert |

| | | Title: Senior Vice President and Chief Accounting Officer |

Exhibit 99.1

MGM RESORTS INTERNATIONAL REPORTS THIRD QUARTER 2023 FINANCIAL AND OPERATING RESULTS

•Finalized Japan certification process by signing the Implementation Agreement for our Integrated Resort in Osaka

•Repurchased $572 million in shares during the quarter

•New $2 billion share repurchase program authorized by the Board of Directors

Las Vegas, Nevada, November 8, 2023 – MGM Resorts International (NYSE: MGM) (“MGM Resorts” or the “Company”) today reported financial results for the quarter ended September 30, 2023.

“We started the quarter with great momentum across our businesses. While we were faced with a difficult cybersecurity issue in September, our employees rose to the occasion with incredible resilience and determination. With the incident now behind us, we are a stronger company having been through the challenge,” said Bill Hornbuckle, Chief Executive Officer and President of MGM Resorts. “Going forward we have much to be optimistic about with Formula 1’s inaugural Las Vegas race next week and early next year the debut of the MGM Collection with Marriott Bonvoy followed by the Super Bowl. Beyond these catalysts, MGM China is performing exceptionally well, and we have a pipeline of development opportunities including New York and Japan alongside the growth and development of our international digital business and BetMGM.”

“We continue to view share repurchases as an attractive opportunity to return value to our shareholders,” said Jonathan Halkyard, Chief Financial Officer and Treasurer of MGM Resorts. “Year-to-date, we have repurchased approximately $1.7 billion in stock. Our buyback program totals $6.2 billion since the beginning of 2021, reducing our share count by over 30%.”

Third Quarter 2023 Financial Highlights:

Consolidated Results

•Consolidated net revenues of $4.0 billion, an increase of 16% compared to the prior year quarter, due primarily to an increase in revenue at MGM China due to the removal of COVID-19 related entry restrictions in Macau, partially offset by the decrease in revenues at our Las Vegas Strip Resorts and Regional Operations due to the dispositions of The Mirage and Gold Strike Tunica as well as the cybersecurity issue in September 2023;

•Operating income was $370 million compared to operating loss of $1.0 billion in the prior year quarter due to the increase in net revenues in the current quarter, discussed above, and a decrease in amortization expense of $1.2 billion relating to the MGM Grand Paradise gaming subconcession;

•Net income attributable to MGM Resorts was $161 million in the current quarter compared to net loss of $577 million in the prior year quarter. Net income/loss attributable to MGM Resorts was impacted by the items affecting operating income/loss above;

•Diluted income per share of $0.46 in the current quarter compared to diluted loss per share of $1.45 in the prior year quarter;

•Adjusted diluted earnings per share (“Adjusted EPS”)(1) of $0.64 in the current quarter compared to a loss of $1.39 in the prior year quarter;

•Consolidated Adjusted EBITDAR(2) of $1.1 billion;

•Net cash flow provided by (used in) operating, investing, and financing activities for the nine months ended September 30, 2023 was $2.0 billion, ($421 million), and ($4.2 billion), respectively; and

•Free Cash Flow(3) for the nine months ended September 30, 2023 of $1.4 billion.

Las Vegas Strip Resorts

•Net revenues of $2.1 billion in the current quarter compared to $2.3 billion in the prior year quarter, a decrease of 8%, due primarily to the disposition of The Mirage in December of 2022 and the cybersecurity issue in September 2023;

•Same-store net revenues (adjusted for dispositions) of $2.1 billion compared to $2.2 billion in the prior year quarter, a decrease of 2%;

•Adjusted Property EBITDAR(2) of $714 million in the current quarter compared to $846 million in the prior year quarter, a decrease of 16%;

•Same-Store Adjusted Property EBITDAR(2) of $714 million in the current quarter compared to $805 million in the prior year quarter, a decrease of 11%; and

•Adjusted Property EBITDAR margin(2) of 33.9% in the current quarter compared to 36.8% in the prior year quarter, a decrease of 287 basis points due primarily to the impact of the cybersecurity issue and an increase in payroll related expenses.

Regional Operations

•Net revenues of $925 million in the current quarter compared to $974 million in the prior year quarter, a decrease of 5%, due primarily to the disposition of Gold Strike Tunica in February 2023 and the cybersecurity issue in September 2023;

•Same-store net revenues (adjusted for dispositions) of $925 million in the current quarter compared to $919 million in the prior year quarter, an increase of 1%;

•Adjusted Property EBITDAR of $293 million in the current quarter compared to $322 million in the prior year quarter, a decrease of 9%;

•Same-Store Adjusted Property EBITDAR of $293 million in the current quarter compared to $299 million in the prior year quarter, a decrease of 2%; and

•Adjusted Property EBITDAR margin of 31.7% in the current quarter compared to 33.1% in the prior year quarter, a decrease of 136 basis points, due primarily to the impact of the cybersecurity issue and an increase in payroll related expenses.

MGM China

•Net revenues of $813 million in the current quarter compared to $87 million in the prior year quarter, an increase of 829%, and an increase of 10% compared to the third quarter of 2019. The current quarter was positively affected by the removal of COVID-19 related travel and entry restrictions and an increase in visitation;

•Adjusted Property EBITDAR of $226 million in the current quarter compared to Adjusted Property EBITDAR loss of $70 million in the prior year quarter, and an increase of 23% compared to the third quarter of 2019; and

•Adjusted Property EBITDAR margin of 27.8% in the current quarter compared to 24.9% in the third quarter of 2019.

Adjusted EPS

The following table reconciles diluted earnings per share (“EPS”) to Adjusted EPS (approximate EPS impact shown, per share; positive adjustments represent charges to income):

| | | | | | | | | | | |

| Three Months Ended September 30, | 2023 | | 2022 |

| Diluted earnings per share | $ | 0.46 | | | $ | (1.45) | |

| Property transactions, net | 0.03 | | | (0.03) | |

| Non-operating items: | | | |

| Loss related to debt and equity investments | 0.15 | | | 0.05 | |

| Foreign currency transaction loss | 0.02 | | | 0.01 | |

| Change in the fair value of foreign currency contracts | 0.03 | | | 0.05 | |

Income tax impact on net income adjustments(1) | (0.05) | | | (0.02) | |

| Adjusted EPS | $ | 0.64 | | | $ | (1.39) | |

(1)The income tax impact includes current and deferred income tax expense based upon the nature of the adjustment and the jurisdiction in which it occurs.

The prior year quarter also included a non-cash income tax benefit of $296 million to record the deferred tax impact of the extension of the exemption from the Macau 12% complementary tax to the end of the year and a non-cash income tax charge of $59 million to record the deferred tax impact of income tax regulations governing combined reporting in New Jersey that were issued during the quarter.

Las Vegas Strip Resorts

The following table shows key gaming statistics for Las Vegas Strip Resorts:

| | | | | | | | | | | | | | |

| Three Months Ended September 30, | 2023 | | 2022 | % Change |

| | (Dollars in millions) | |

| Casino revenue | $ | 546 | | | $ | 576 | | (5) | % |

| Table games drop | $ | 1,491 | | | $ | 1,604 | | (7) | % |

| Table games win | $ | 405 | | | $ | 389 | | 4 | % |

| Table games win % | 27.2 | % | | 24.3 | % | |

| Slot handle | $ | 5,698 | | | $ | 6,193 | | (8) | % |

| Slot win | $ | 531 | | | $ | 577 | | (8) | % |

| Slot win % | 9.3 | % | | 9.3 | % | |

The following table shows key hotel statistics for Las Vegas Strip Resorts:

| | | | | | | | | | | | | | |

| Three Months Ended September 30, | 2023 | | 2022 | % Change |

Room revenue (in millions) | $ | 695 | | | $ | 736 | | (6) | % |

| Occupancy | 92 | % | | 93 | % | |

| Average daily rate (ADR) | $ | 236 | | | $ | 227 | | 4 | % |

Revenue per available room (RevPAR)4 | $ | 216 | | | $ | 210 | | 3 | % |

Regional Operations

The following table shows key gaming statistics for Regional Operations:

| | | | | | | | | | | | | | |

| Three Months Ended September 30, | 2023 | | 2022 | % Change |

| | (Dollars in millions) | |

| Casino revenue | $ | 679 | | | $ | 721 | | (6)% |

| Table games drop | $ | 1,026 | | | $ | 1,152 | | (11)% |

| Table games win | $ | 209 | | | $ | 217 | | (4)% |

| Table games win % | 20.4 | % | | 18.8 | % | |

| Slot handle | $ | 6,732 | | | $ | 7,426 | | (9)% |

| Slot win | $ | 652 | | | $ | 703 | | (7)% |

| Slot win % | 9.7 | % | | 9.5 | % | |

MGM China

The following table shows key gaming statistics for MGM China:

| | | | | | | | | | | | | | |

| Three Months Ended September 30, | 2023 | | 2022 | % Change |

| | (Dollars in millions) | |

| Casino revenue | $ | 714 | | | $ | 70 | | 915% |

| Main floor table games drop | $ | 3,303 | | | $ | 352 | | 838% |

| Main floor table games win | $ | 709 | | | $ | 75 | | 839% |

| Main floor table games win % | 21.5 | % | | 21.4 | % | |

Intercompany branding license fee expense, which eliminates in consolidation, was $14 million in the current quarter and $2 million in the prior year quarter.

Corporate Expense

Corporate expense, including share-based compensation for corporate employees, increased to $122 million in the current quarter compared to $117 million in the prior year quarter, due primarily to an increase in payroll expense and costs associated with the development in Japan, partially offset by a decrease in transaction costs.

Unconsolidated Affiliates

The following table summarizes information related to the Company's share of operating income (loss) from unconsolidated affiliates:

| | | | | | | | | | | |

| Three Months Ended September 30, | 2023 | | 2022 |

| | (In thousands) |

| BetMGM | $ | 12,629 | | | $ | (23,582) | |

| Other | 9,878 | | | 6,115 | |

| | $ | 22,507 | | | $ | (17,467) | |

MGM Resorts Share Repurchases

During the third quarter of 2023, the Company repurchased approximately 13 million shares of its common stock for an aggregate amount of $572 million, pursuant to its repurchase plan. The remaining availability under the February 2023 repurchase plan was approximately $806 million as of September 30, 2023. All shares repurchased under the Company's repurchase plan have been retired.

In addition, on November 8, 2023, the Company announced that its Board of Directors had authorized a new $2 billion share repurchase plan, which is in addition to the Company’s existing February 2023 repurchase plan.

Conference Call Details

MGM Resorts will host a conference call at 5:00 p.m. Eastern Time today, which will include a brief discussion of the results followed by a question and answer session. In addition, supplemental slides will be posted prior to the start of the call on MGM's Investor Relations website at http://investors.mgmresorts.com.

The call will be accessible via the internet through http://investors.mgmresorts.com/investors/events-and-presentations/ or by calling 1-888-317-6003 for domestic callers and 1-412-317-6061 for international callers. The conference call access code is 7018423.

A replay of the call will be available through November 15, 2023. The replay may be accessed by dialing 1-877-344-7529 or 1-412-317-0088. The replay access code is 8019015.

1."Adjusted EPS" is diluted earnings or loss per share adjusted to exclude property transactions, net, net gain/loss related to equity investments for which the Company has elected the fair value option of ASC 825 and equity investments accounted for under ASC 321 for which there is a readily determinable fair value and net gain/loss related to the Company's investments in debt securities, foreign currency transaction gain/loss, and the change in the fair value of foreign currency contracts.

Adjusted EPS is a non-GAAP measure and is presented solely as a supplemental disclosure to reported GAAP measures because management believes this measure is useful in providing period-to-period comparisons of the results of the Company's continuing operations to assist investors in reviewing the Company's operating performance over time. Management believes that while certain items excluded from Adjusted EPS may be recurring in nature and should not be disregarded in evaluating the Company's earnings performance, it is useful to exclude such items when comparing current performance to prior periods because these items can vary significantly depending on specific underlying transactions or events. Also, management believes certain excluded items, and items further discussed in footnote 2 below, may not relate specifically to current operating trends or be indicative of future results. Adjusted EPS should not be construed as an alternative to GAAP earnings per share as an indicator of the Company's performance. In addition, Adjusted EPS may not be defined in the same manner by all companies and, as a result, may not be comparable to similarly titled non-GAAP financial measures of other companies. A reconciliation of Adjusted EPS to diluted earnings per share can be found under "Adjusted EPS" included in this release.

2."Adjusted EBITDAR" is earnings before interest and other non-operating income (expense), taxes, depreciation and amortization, preopening and start-up expenses, property transactions, net, gain on REIT transactions, net, rent expense related to triple-net operating leases and ground leases, and income from unconsolidated affiliates related to investments in real estate ventures.

"Adjusted Property EBITDAR" is the Company's reportable segment GAAP measure, which management utilizes as the primary profit measure for its reportable segments and underlying operating segments. Adjusted Property EBITDAR is a measure defined as earnings before interest and other non-operating income (expense), taxes, depreciation and amortization, preopening and start-up expenses, property transactions, net, gain on REIT transactions, net, rent expense related to triple-net operating leases and ground leases, income from unconsolidated affiliates related to investments in real estate ventures, and also excludes corporate expense and stock compensation expense, which are not allocated to each operating segment, and rent expense related to the master lease with MGP that eliminated in consolidation.

"Same-Store Adjusted Property EBITDAR" is Adjusted Property EBITDAR further adjusted to exclude the Adjusted Property EBITDAR of acquired operating segments from the date of acquisition through the end of the reporting period and to exclude the Adjusted Property EBITDAR of disposed operating segments from the beginning of the reporting period through the date of disposition. Accordingly, for Las Vegas Strip Resorts, the Company has excluded the Adjusted Property EBITDAR of The Cosmopolitan for periods subsequent to its acquisition on May 17, 2022 and of The Mirage for the periods prior to its disposition on December 19, 2022, as applicable. For Regional Operations, the Company has excluded the Adjusted Property EBITDAR of Gold Strike Tunica for the periods prior to its disposition on February 15, 2023, as applicable.

Same-Store Adjusted Property EBITDAR is a non-GAAP measure and is presented solely as a supplemental disclosure to reported GAAP measures because management believes this measure is useful in providing meaningful period-to-period comparisons of the results of the Company's operations for operating segments that were consolidated for the full period presented to assist users of the financial statements in reviewing operating performance over time. Same-Store Adjusted Property EBITDAR should not be viewed as a measure of overall operating performance, considered in isolation, or as an alternative to the Company's reportable segment GAAP measure or net income, or as an alternative to any other measure determined in accordance with generally accepted accounting principles, because this measure is not presented on a GAAP basis, and is provided for the limited purposes discussed herein. In addition, Same-Store Adjusted Property EBITDAR may not be defined in the same manner by all companies and, as a result, may not be comparable to similarly titled non-GAAP financial measures of other companies, and such differences may be material. A reconciliation of the Company's reportable segment Adjusted Property EBITDAR GAAP measure to Same-Store Adjusted Property EBITDAR is included in the financial schedules in this release.

Adjusted EBITDAR information is a non-GAAP measure that is a valuation metric, should not be used as an operating metric, and is presented solely as a supplemental disclosure to reported GAAP measures because management believes this measure is widely used by analysts, lenders, financial institutions, and investors as a principal basis for the valuation of gaming companies. Management believes that while items excluded from Adjusted EBITDAR may be recurring in nature and should not be disregarded in evaluation of the Company's earnings performance, it is useful to exclude such items when analyzing current results and trends. Also, management believes excluded items may not relate specifically to current trends or be indicative of future results. For example, preopening and start-up expenses will be significantly different in periods when the Company is developing and constructing a major expansion project and will depend on where the current period lies within the development cycle, as well as the size and scope of the project(s). Property transactions, net includes normal recurring disposals, gains and losses on sales of assets related to specific assets within the Company's resorts, but also includes gains or losses on sales of an entire operating resort or a group of resorts and impairment charges on entire asset groups or investments in unconsolidated affiliates, which may not be comparable period over period. In addition, management excludes rent expense related to triple-net operating leases and ground leases. Management believes excluding rent expense related to triple-net operating leases and ground leases provides useful information to analysts, lenders, financial institutions, and investors when valuing the Company, as well as comparing the Company's results to other gaming companies, without regard to differences in capital structure and leasing arrangements since the operations of other gaming companies may or may not include triple-net operating leases or ground leases. However, as discussed herein, Adjusted EBITDAR should not be viewed as a measure of overall operating performance, an indicator of the Company's performance, considered in isolation, or construed as an alternative to operating income or net income, or as an alternative to cash flows from operating activities, as a measure of liquidity, or as an alternative to any other measure determined in accordance with generally accepted accounting principles, because this measure is not presented on a GAAP basis and excludes certain expenses, including the rent expense related to triple-net operating leases and ground leases, and is provided for the limited purposes discussed herein. In addition, other companies in the gaming and hospitality industries that report Adjusted EBITDAR may calculate Adjusted EBITDAR in a different manner and such differences may be material. The Company has significant uses of cash flows, including capital expenditures, interest payments, taxes, real estate triple-net lease and ground lease payments, and debt principal repayments, which are not reflected in Adjusted EBITDAR. A reconciliation of GAAP net income to Adjusted EBITDAR is included in the financial schedules in this release.

3. "Free Cash Flow" is net cash flow provided by operating activities less capital expenditures. Free Cash Flow for the three months ended September 30, 2023 is calculated as the difference in net cash flow provided by operating activities for the nine months ended September 30, 2023 and the net cash flow provided by operating activities for the six months ended June 30, 2023 less the difference between the capital expenditures for the nine months ended September 30, 2023 and the capital expenditures for the six months ended June 30, 2023.

Free Cash Flow is a non-GAAP measure and is presented solely as a supplemental disclosure to reported GAAP measures because management believes this liquidity measure is useful in evaluating the ability of the Company's operations to generate cash for uses other than capital expenditures, and is used for decision-making purposes related to investments and returning cash to shareholders through share repurchases. Free Cash Flow should not be construed as an alternative to net cash provided by operating activities as a measure of liquidity. The Company's definition of Free Cash Flow is limited in that it does not represent residual cash flows for discretionary expenditures due to the fact that it does not deduct payments for debt service or other obligations and does not reflect the total movement of cash as detailed in the Company's consolidated statements of cash flows. In addition, Free Cash Flow may not be defined in the same manner by all companies and, as a result, may not be comparable to similarly titled non-GAAP measures of other companies. A reconciliation of GAAP net cash provided by operating activities to Free Cash Flow is included in the financial schedules in this release.

4. RevPAR is hotel revenue per available room.

* * *

About MGM Resorts International

MGM Resorts International (NYSE: MGM) is an S&P 500® global gaming and entertainment company with national and international locations featuring best-in-class hotels and casinos, state-of-the-art meetings and conference spaces, incredible live and theatrical entertainment experiences, and an extensive array of restaurant, nightlife and retail offerings. MGM Resorts creates immersive, iconic experiences through its suite of Las Vegas-inspired brands. The MGM Resorts portfolio encompasses 32 unique hotel and gaming destinations globally, including some of the most recognizable resort brands in the industry. The Company's 50/50 venture, BetMGM, LLC, offers sports betting and online gaming in North America through market-leading brands, including BetMGM and partypoker, and the Company's subsidiary, LeoVegas AB, offers sports betting and online gaming through market-leading brands in several jurisdictions throughout Europe. The Company is currently pursuing targeted expansion in Asia through the integrated resort opportunity in Japan. Through its “Focused on What Matters: Embracing Humanity and Protecting the Planet” philosophy, MGM Resorts commits to creating a more sustainable future, while striving to make a bigger difference in the lives of its employees, guests, and in the communities where it operates. The global employees of MGM Resorts are proud of their company for being recognized as one of FORTUNE® Magazine's World's Most Admired Companies®. For more information, please visit us at www.mgmresorts.com. Please also connect with us @MGMResortsIntl on Twitter as well as Facebook and Instagram.

Cautionary Statement Concerning Forward-Looking Statements

Statements in this release that are not historical facts are forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 and involve risks and/or uncertainties, including those described in the Company's public filings with the Securities and Exchange Commission. The Company has based forward-looking statements on management’s current expectations and assumptions and not on historical facts. Examples of these statements include, but are not limited to: the Company's expectations regarding any benefits expected to be received from the Company's recent transactions, including the long-term license agreement with Marriott International; future results of the Company (including the Company's ability to maintain a strong balance sheet), and its unconsolidated affiliates, including BetMGM; expectations regarding future sports and entertainment events in Las Vegas, including Formula 1, the Super Bowl, and potential relocation of the Oakland Athletics; expectations regarding the impact of macroeconomic trends on the Company's business; expectations regarding the Company's booking pace, liquidity position and the size and timing of future investments; the Company's ability to execute on its strategic plans, including the development of an integrated resort in Japan, obtaining a commercial gaming license in New York, expansion of LeoVegas and the MGM digital brand, positioning BetMGM as a leader in sports betting and iGaming; the Company's ability to return capital to shareholders (including the timing and amount of any share repurchases); and the impact of cybersecurity incidents, including the Company's September 2023 cybersecurity issue. These forward-looking statements involve a number of risks and uncertainties. Among the important factors that could cause actual results to differ materially from those indicated in such forward-looking statements include: the effects of economic conditions and market conditions in the markets in which the Company operates and competition with online gaming and sports betting operators and destination travel locations throughout the United States and the world; the design, timing and costs of expansion projects; risks relating to international operations, permits, licenses, financings, approvals and other contingencies in connection with growth in new or existing jurisdictions; disruptions in the availability of the Company's information and other systems or those of third parties on which the Company rely, through cyber-attacks, such as the Company's September 2023 cybersecurity issue, or otherwise, which could adversely impact the Company's ability to service its customers and affect its sales and the results of operations; impact to the Company's business, operations and reputation from, and expenses and uncertainties associated with a cybersecurity incident, including the Company's September 2023 cybersecurity issue and any related legal proceedings, other claims or investigations and costs of remediation, restoration, or enhancement of information technology systems; the availability of cybersecurity insurance proceeds; and additional risks and uncertainties described in the Company's Form 10-K, Form 10-Q and Form 8-K reports (including all amendments to those reports). In providing forward-looking statements, the Company is not undertaking any duty or obligation to update these statements publicly as a result of new information, future events or otherwise, except as required by law. If the Company updates one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those other forward-looking statements.

MGM RESORTS CONTACTS:

| | | | | |

| Investment Community | |

| SARAH ROGERS | |

| Senior Vice President of Corporate Finance | |

(702) 730-3942 or srogers@mgmresorts.com | |

| |

| ANDREW CHAPMAN | |

| Director of Investor Relations | |

(702) 693-8711 or achapman@mgmresorts.com | |

| |

| News Media | |

| BRIAN AHERN | |

| Director of Communications | |

| media@mgmresorts.com | |

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Revenues | | | | | | | |

| Casino | $ | 2,050,584 | | | $ | 1,407,367 | | | $ | 5,884,394 | | | $ | 4,185,411 | |

| Rooms | 827,091 | | | 827,397 | | | 2,490,902 | | | 2,159,202 | |

| Food and beverage | 698,261 | | | 722,982 | | | 2,163,628 | | | 1,893,592 | |

| Entertainment, retail and other | 385,691 | | | 447,637 | | | 1,215,980 | | | 1,264,545 | |

| Reimbursed costs | 11,556 | | | 10,689 | | | 33,782 | | | 32,519 | |

| 3,973,183 | | | 3,416,072 | | | 11,788,686 | | | 9,535,269 | |

| Expenses | | | | | | | |

| Casino | 1,056,487 | | | 653,601 | | | 3,073,122 | | | 1,950,132 | |

| Rooms | 260,905 | | | 256,128 | | | 751,319 | | | 684,670 | |

| Food and beverage | 530,145 | | | 528,966 | | | 1,579,561 | | | 1,377,749 | |

| Entertainment, retail and other | 238,403 | | | 271,177 | | | 740,403 | | | 755,110 | |

| Reimbursed costs | 11,556 | | | 10,689 | | | 33,782 | | | 32,519 | |

| General and administrative | 1,192,298 | | | 1,212,474 | | | 3,472,228 | | | 3,018,076 | |

| Corporate expense | 121,838 | | | 117,264 | | | 366,485 | | | 348,115 | |

| Preopening and start-up expenses | 68 | | | 396 | | | 356 | | | 1,372 | |

| Property transactions, net | 12,227 | | | (11,639) | | | (378,235) | | | 23,704 | |

| Gain on REIT transactions, net | — | | | — | | | — | | | (2,277,747) | |

| Depreciation and amortization | 201,827 | | | 1,405,520 | | | 608,831 | | | 2,060,413 | |

| 3,625,754 | | | 4,444,576 | | | 10,247,852 | | | 7,974,113 | |

| Income (loss) from unconsolidated affiliates | 22,507 | | | (17,467) | | | (68,681) | | | (119,888) | |

| Operating income (loss) | 369,936 | | | (1,045,971) | | | 1,472,153 | | | 1,441,268 | |

| | | | | | | |

| Non-operating income (expense) | | | | | | | |

| Interest expense, net of amounts capitalized | (111,170) | | | (125,172) | | | (353,415) | | | (457,822) | |

| Non-operating items from unconsolidated affiliates | 438 | | | (995) | | | (1,187) | | | (22,248) | |

| Other, net | (34,879) | | | (14,316) | | | 35,121 | | | (23,322) | |

| (145,611) | | | (140,483) | | | (319,481) | | | (503,392) | |

| | | | | | | |

| Income (loss) before income taxes | 224,325 | | | (1,186,454) | | | 1,152,672 | | | 937,876 | |

| Benefit (provision) for income taxes | (12,440) | | | 125,367 | | | (217,360) | | | (411,131) | |

| Net income (loss) | 211,885 | | | (1,061,087) | | | 935,312 | | | 526,745 | |

| Less: Net (income) loss attributable to noncontrolling interests | (50,768) | | | 484,257 | | | (106,592) | | | 662,346 | |

| Net income (loss) attributable to MGM Resorts International | $ | 161,117 | | | $ | (576,830) | | | $ | 828,720 | | | $ | 1,189,091 | |

| Earnings (loss) per share | | | | | | | |

| Basic | $ | 0.46 | | | $ | (1.45) | | | $ | 2.30 | | | $ | 2.81 | |

| Diluted | $ | 0.46 | | | $ | (1.45) | | | $ | 2.28 | | | $ | 2.79 | |

| Weighted average common shares outstanding | | | | | | | |

| Basic | 347,345 | | | 393,295 | | | 360,732 | | | 417,686 | |

| Diluted | 351,390 | | | 393,295 | | | 364,847 | | | 421,770 | |

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

(Unaudited)

| | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| ASSETS |

| Current assets | | | |

| Cash and cash equivalents | $ | 3,316,360 | | | $ | 5,911,893 | |

| Accounts receivable, net | 812,187 | | | 852,149 | |

| Inventories | 135,859 | | | 126,065 | |

| Income tax receivable | 159,806 | | | 73,016 | |

| Prepaid expenses and other | 834,961 | | | 583,132 | |

| Assets held for sale | — | | | 608,437 | |

| Total current assets | 5,259,173 | | | 8,154,692 | |

| | | |

| Property and equipment, net | 5,256,883 | | | 5,223,928 | |

| | | |

| Other assets | | | |

| Investments in and advances to unconsolidated affiliates | 231,998 | | | 173,039 | |

| Goodwill | 5,142,838 | | | 5,029,312 | |

| Other intangible assets, net | 1,733,379 | | | 1,551,252 | |

| Operating lease right-of-use assets, net | 24,150,291 | | | 24,530,929 | |

| Other long-term assets, net | 797,897 | | | 1,029,054 | |

| Total other assets | 32,056,403 | | | 32,313,586 | |

| | $ | 42,572,459 | | | $ | 45,692,206 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY |

| Current liabilities | | | |

| Accounts and construction payable | $ | 412,757 | | | $ | 369,817 | |

| Current portion of long-term debt | — | | | 1,286,473 | |

| Accrued interest on long-term debt | 114,714 | | | 83,451 | |

| Other accrued liabilities | 2,434,598 | | | 2,236,323 | |

| Liabilities related to assets held for sale | — | | | 539,828 | |

| Total current liabilities | 2,962,069 | | | 4,515,892 | |

| | | |

| Deferred income taxes, net | 2,990,639 | | | 2,969,443 | |

| Long-term debt, net | 6,505,517 | | | 7,432,817 | |

| Operating lease liabilities | 25,129,233 | | | 25,149,299 | |

| Other long-term obligations | 523,283 | | | 256,282 | |

| Redeemable noncontrolling interests | 32,938 | | | 158,350 | |

| Stockholders' equity | | | |

| Common stock, $.01 par value: authorized 1,000,000,000 shares, issued and outstanding 340,914,804 and 379,087,524 shares | 3,409 | | | 3,791 | |

| Capital in excess of par value | — | | | — | |

| Retained earnings | 3,962,925 | | | 4,794,239 | |

| Accumulated other comprehensive income (loss) | (617) | | | 33,499 | |

| Total MGM Resorts International stockholders' equity | 3,965,717 | | | 4,831,529 | |

| Noncontrolling interests | 463,063 | | | 378,594 | |

| Total stockholders' equity | 4,428,780 | | | 5,210,123 | |

| $ | 42,572,459 | | | $ | 45,692,206 | |

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

SUPPLEMENTAL DATA – NET REVENUES

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Las Vegas Strip Resorts | $ | 2,105,839 | | | $ | 2,301,022 | | | $ | 6,428,641 | | | $ | 6,101,090 | |

| Regional Operations | 924,957 | | | 973,935 | | | 2,796,900 | | | 2,824,433 | |

| MGM China | 812,525 | | | 87,486 | | | 2,171,072 | | | 498,873 | |

| Management and other operations | 129,862 | | | 53,629 | | | 392,073 | | | 110,873 | |

| $ | 3,973,183 | | | $ | 3,416,072 | | | $ | 11,788,686 | | | $ | 9,535,269 | |

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

SUPPLEMENTAL DATA – ADJUSTED PROPERTY EBITDAR AND ADJUSTED EBITDAR

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Las Vegas Strip Resorts | $ | 714,086 | | | $ | 846,355 | | | $ | 2,326,424 | | | $ | 2,265,256 | |

| Regional Operations | 293,257 | | | 321,984 | | | 900,199 | | | 975,113 | |

| MGM China | 226,117 | | | (70,410) | | | 604,454 | | | (148,157) | |

Unconsolidated affiliates(1) | 19,809 | | | (20,157) | | | (76,769) | | | (179,050) | |

| Management and other operations | 18,251 | | | (6,484) | | | 20,998 | | | (8,897) | |

| Stock compensation | (11,125) | | | (7,415) | | | (46,245) | | | (46,138) | |

Corporate(2) | (114,881) | | | (114,064) | | | (335,177) | | | (318,180) | |

| | $ | 1,145,514 | | | | | $ | 3,393,884 | | | |

(1) Represents the Company's share of operating income (loss) excluding investments in real estate ventures, adjusted for the effect of certain basis differences.

(2)Three months ended September 30, 2023 includes amounts related to MGM China of $9 million, global development of $15 million, and transaction costs of $1 million. Nine months ended September 30, 2023 includes amounts related to MGM China of $24 million, global development of $27 million, and transaction costs of $3 million. Three months ended September 30, 2022 includes amounts related to MGM China of $5 million, global development of $6 million, and transaction costs of $9 million. Nine months ended September 30, 2022 includes amounts related to MGM China of $13 million, global development of $14 million, and transaction costs of $40 million.

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

RECONCILIATION OF NET INCOME (LOSS) ATTRIBUTABLE TO MGM RESORTS INTERNATIONAL TO ADJUSTED EBITDAR

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Net income (loss) attributable to MGM Resorts International | $ | 161,117 | | | $ | (576,830) | | | $ | 828,720 | | | $ | 1,189,091 | |

| Plus: Net income (loss) attributable to noncontrolling interests | 50,768 | | | (484,257) | | | 106,592 | | | (662,346) | |

| Net income (loss) | 211,885 | | | (1,061,087) | | | 935,312 | | | 526,745 | |

| (Benefit) provision for income taxes | 12,440 | | | (125,367) | | | 217,360 | | | 411,131 | |

| Income (loss) before income taxes | 224,325 | | | (1,186,454) | | | 1,152,672 | | | 937,876 | |

| Non-operating (income) expense: | | | | | | | |

| Interest expense, net of amounts capitalized | 111,170 | | | 125,172 | | | 353,415 | | | 457,822 | |

| Other, net | 34,441 | | | 15,311 | | | (33,934) | | | 45,570 | |

| 145,611 | | | 140,483 | | | 319,481 | | | 503,392 | |

| Operating income (loss) | 369,936 | | | (1,045,971) | | | 1,472,153 | | | 1,441,268 | |

| Preopening and start-up expenses | 68 | | | 396 | | | 356 | | | 1,372 | |

| Property transactions, net | 12,227 | | | (11,639) | | | (378,235) | | | 23,704 | |

| Depreciation and amortization | 201,827 | | | 1,405,520 | | | 608,831 | | | 2,060,413 | |

| Gain on REIT transactions, net | — | | | — | | | — | | | (2,277,747) | |

| Triple-net operating lease and ground lease rent expense | 564,154 | | | 604,193 | | | 1,698,867 | | | 1,350,099 | |

| Income from unconsolidated affiliates related to real estate ventures | (2,698) | | | (2,690) | | | (8,088) | | | (59,162) | |

| Adjusted EBITDAR | $ | 1,145,514 | | | | | $ | 3,393,884 | | | |

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2023 | | September 30, 2023 |

| Net cash provided by operating activities | $ | 694,080 | | | $ | 1,974,839 | |

| Less: Capital expenditures | (209,756) | | | (603,053) | |

| Free Cash Flow | $ | 484,324 | | | $ | 1,371,786 | |

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

RECONCILIATIONS OF LAS VEGAS STRIP RESORTS NET REVENUES TO LAS VEGAS STRIP RESORTS SAME-STORE NET REVENUES AND LAS VEGAS STRIP RESORTS ADJUSTED PROPERTY EBITDAR TO LAS VEGAS STRIP RESORTS SAME-STORE ADJUSTED PROPERTY EBITDAR

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Las Vegas Strip Resorts net revenues | $ | 2,105,839 | | | $ | 2,301,022 | | | $ | 6,428,641 | | | $ | 6,101,090 | |

Acquisitions (1) | — | | | — | | | (939,155) | | | (465,009) | |

Dispositions (2) | — | | | (145,505) | | | — | | | (422,056) | |

| Las Vegas Strip Resorts same-store net revenues | $ | 2,105,839 | | | $ | 2,155,517 | | | $ | 5,489,486 | | | $ | 5,214,025 | |

| | | | | | | |

| Las Vegas Strip Resorts Adjusted Property EBITDAR | $ | 714,086 | | | $ | 846,355 | | | $ | 2,326,424 | | | $ | 2,265,256 | |

Acquisitions (1) | — | | | — | | | (380,264) | | | (185,250) | |

Dispositions (2) | — | | | (41,460) | | | — | | | (117,730) | |

| Las Vegas Strip Resorts Same-Store Adjusted Property EBITDAR | $ | 714,086 | | | $ | 804,895 | | | $ | 1,946,160 | | | $ | 1,962,276 | |

(1)Excludes the net revenues and Adjusted Property EBITDAR of The Cosmopolitan for the nine months ended September 30, 2023 and 2022.

(2)Excludes the net revenues and Adjusted Property EBITDAR of The Mirage for the three and nine months ended September 30, 2022.

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

RECONCILIATIONS OF REGIONAL OPERATIONS NET REVENUES TO REGIONAL OPERATIONS SAME-STORE NET REVENUES AND REGIONAL OPERATIONS ADJUSTED PROPERTY EBITDAR TO REGIONAL OPERATIONS SAME-STORE ADJUSTED PROPERTY EBITDAR

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Regional Operations net revenues | $ | 924,957 | | | $ | 973,935 | | | $ | 2,796,900 | | | $ | 2,824,433 | |

Dispositions (1) | — | | | (54,804) | | | (26,967) | | | (168,568) | |

| Regional Operations same-store net revenues | $ | 924,957 | | | $ | 919,131 | | | $ | 2,769,933 | | | $ | 2,655,865 | |

| | | | | | | |

| Regional Operations Adjusted Property EBITDAR | $ | 293,257 | | | $ | 321,984 | | | $ | 900,199 | | | $ | 975,113 | |

Dispositions (1) | — | | | (22,690) | | | (11,073) | | | (75,726) | |

| Regional Operations Same-Store Adjusted Property EBITDAR | $ | 293,257 | | | $ | 299,294 | | | $ | 889,126 | | | $ | 899,387 | |

(1)Excludes the net revenues and Adjusted Property EBITDAR of Gold Strike Tunica for the three months ended September 30, 2022 and the nine months ended September 30, 2023 and 2022.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

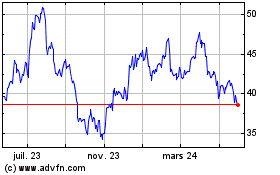

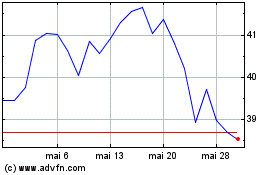

MGM Resorts (NYSE:MGM)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

MGM Resorts (NYSE:MGM)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024